Single-A credits can potentially be riskier investments than their triple or double B counterparts during a growing or recovering economy.

Watch the ratings cycle - don't 'buy high' and 'sell low'

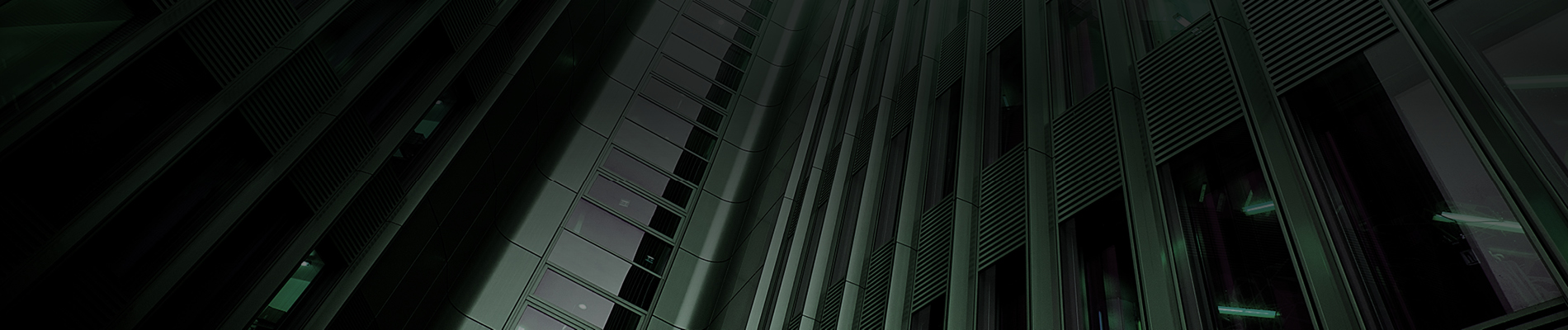

As we edge potentially closer to the end of pandemic-related economic restrictions in the US, the corporate ‘ratings cycle’ is coming back into play (Figure 1).

Figure 1: The ratings cycle1

A-rated corporates in unregulated industries are often at the ‘top’ of the ratings cycle (making them less attractive) and BBB/BB corporates can often be at the ‘bottom’ of theirs.

A-rated companies are incentivized to increase leverage

A-rated (and even high BBB) companies are often pressured into increasing leverage by their shareholders. Consider, for example, activist investor Carl Icahn’s infamous proclamation in 2013 that “Apple is not a bank” and should return its cash pile to shareholders.

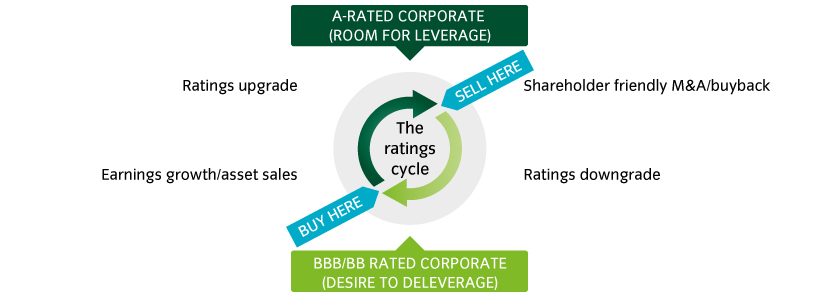

Even though existing bondholders are disadvantaged, increasing leverage can optimize a company’s weighted average cost of capital. Today, the average credit spread (cost) resulting from a downgrade from A to BBB is only ~50bp, around its lowest levels in over a decade (Figure 2).

Figure 2: A-rated companies face little spread penalty for a downgrade to BBB2

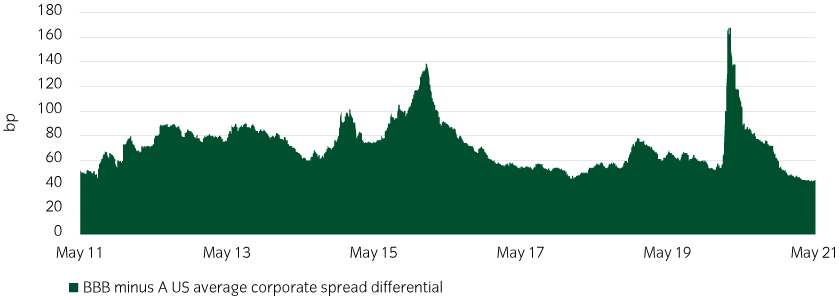

Additionally, from a corporate finance perspective, the all-in yield differential between A-rated and B-rated credit has also fallen (Figure 3). Given the fall in rates over the last year, a downgrade from A to BBB may still mean lower borrowing costs today than a year ago.

Figure 3: The all-in yield differential between A and BBB credit has also narrowed3

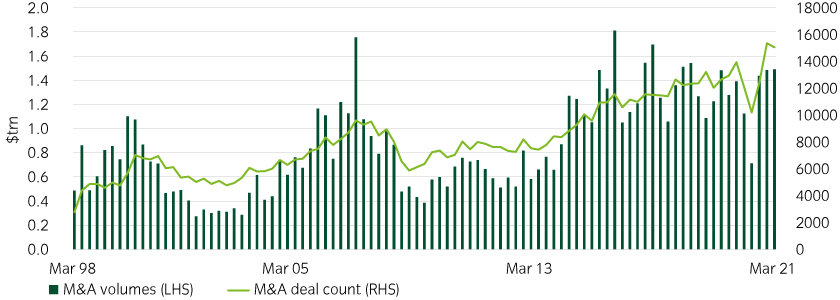

A-rated companies are showing some signs of leveraging up accordingly

Net issuance is set to fall over 2021. Refinancing needs are relatively low as many companies are flush with liquidity, having raised high levels of debt in 2020 to ensure they had enough cash on hand to ride out the crisis (see Credit Insights: Technical Tailwinds). As a result, M&A is emerging as one of the remaining major drivers of new issuance in 2021 (Figure 4). Many stronger companies, for example, are considering opportunities to purchase competitors that fared less well during the pandemic.

Figure 4: M&A is on the rise4

We are already seeing signs that M&A driven by A-rated corporates is on the rise. Examples of key deals that have already occurred include Oracle5, which sold $15bn of bonds in March to refinance debt and pay shareholders, receiving a two-notch downgrade from A3 to Baa2 by Moody’s given “aggressive use of debt to finance large shareholder returns.”

Verizon5 (an A- / high BBB issuer) sold $25bn of bonds to finance spectrum purchases in the largest deal of the year so far—in our view all but giving up on its aspirations of fully returning to single-A.

We expect this trend to continue as corporates emerge from the pandemic in better shape to consider growth by acquisition.

BBB or BB companies are incentivized to reduce leverage

Unlike A-rated companies, equity holders often push lower rated BBB or BB companies to reduce leverage, often by selling assets, raising new equity or simply by growing earnings.

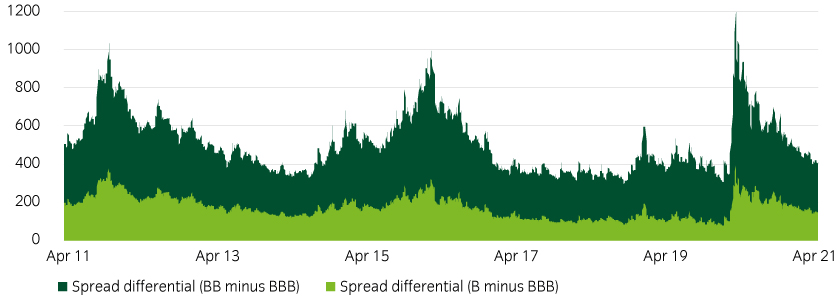

This is because there is still a notable cliff between BBB and BB corporate bonds at ~160bp and another ~200bp for a downgrade to B (Figure 5). The high yield market is smaller, and less liquid, than its investment grade counterpart. High yield is also not included in the Aggregate index and faces less favorable insurance capital requirements. High yield companies sometimes need to include covenants to raise bonds (albeit standards have declined in recent years).

Figure 5: The penalty for a downgrade to high yield is material6

For example, AT&T5 (BBB) agreed to spin off its media operations in a deal with Discovery. General Electric (BBB) is selling assets, such as its air leasing business, and introduced plans to buy back debt to placate its equity investors concerned about its giant debt load.

Kraft Heinz5(a BBB/BB ‘crossover’ credit) sold Planters, Corn Nuts, and the rest of its nuts business to Hormel for $3.4bn to reduce debt, to the media enthusiasm of equity investors such as Warren Buffett and Michael Burry (of ‘Big Short’ fame)7.

US equity issuance doubled to over $300bn in 2020, a record, as companies moved to manage cash shortfalls and contain balance sheet leverage8.

Issuers gravitating to BBB is the 'new normal'

We have seen the fastest economic cycle in history play out, from the depths of recession to the advanced stages of recovery in a single year.

The accompanying credit cycle has been equally rapid. Corporates have gone from raising defensive cash holdings at the height of the crisis to thinking about making the most of the recovery.

That leaves issuers at a fork in the ratings cycle. Higher-rated companies will potentially work more for equity holders while lower-rated firms will work more for bondholders.

We increasingly expect both will gravitate toward mid-to-high BBB ratings – a sweet spot for funding costs and balance sheet strength.

Managing A and BBB/BB debt as the economy recovers

Be mindful of A-rated companies and seek out mid-to-low BBBs and rising stars

At present, we favor mid- to low-rated BBB credit as the current sweet spot for credit allocations. For investors such as pension funds, that require a higher average quality, we suggest potentially blending Treasuries with BBB-rated credit to arrive at a weighted average of A.

We still see some selective value in A-rated debt, but are focused in areas still impacted by the pandemic, where we believe best-in-class players offer defensive attributes. We see value within sectors where higher ratings are often particularly desirable given the nature of business models, such as banks, insurance companies, utilities, municipalities and hospitals.

We also see selective value in crossover and high yield names, particularly improving credit stories – such as ‘rising star’ candidates or those that have recently completed M&A activity and are now on a de-leveraging path.

Prudent sector rotation and in-depth security selection remains essential, particularly as there will always be exceptions to the wider trend. For example, AA-rated Exxon recently decided to hold oil production at a two-decade low as part of a plan to address activist investor pressure around debt, dividends and sustainability. Elsewhere, Synnex, a ‘crossover’ BB IT supply chain vendor, announced plans to issue $4bn to help acquire Tech Data.

Investors need to understand the potential attractiveness of M&A or buybacks to management teams, as well as the company’s attractiveness as a takeover target.

In general, however, we believe gravitating toward BBB is the ‘new normal’ for corporate credits, particularly in the industrial sectors.

United States

United States