Contents

- World of opportunity - do not restrict potential returns

- US economic "exceptionalism" may be good for global fixed income

- A global strategy provides a platform to target opportunities in emerging markets

- Global active managers can exploit a world of inefficiencies

- Global fixed income does not mean ignoring the US

World of opportunity - do not restrict potential returns

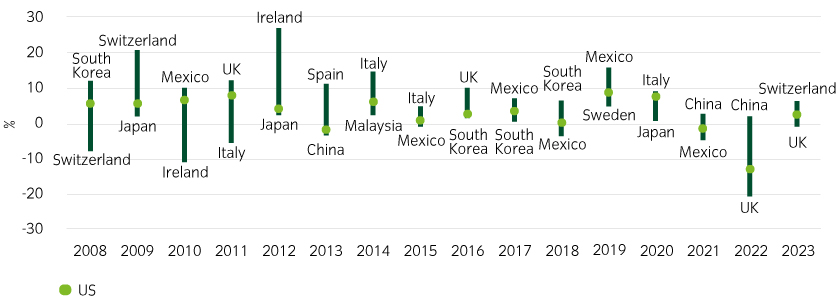

US fixed income underperformed most other markets in 2022, and to date in 2023 (Figure 1). This was despite the global stock of negative-yielding debt (none of which was US) plunging from $14trn to close to zero over the year, pressuring those prices down1.

Figure 1: US fixed income has seldom outperformed the rest of the world

Source: Bloomberg Global Aggregate Bond Index, April 2023. Includes top 20 countries by market weight based on current universe. Past performance is not indicative of future results.

Even in relatively strong years for US markets, it has seldom been the top performer. We believe global diversification is beneficial.

US economic "exceptionalism" may be good for global fixed income

We believe non-US fixed income may continue to outperform.

The US economy is looking strong compared to the rest of the developed world and the US consumer is less interest-rate sensitive. This implies more persistent inflation and higher rates at home.

US economy looks relatively strong – but this may come with inflation pressure

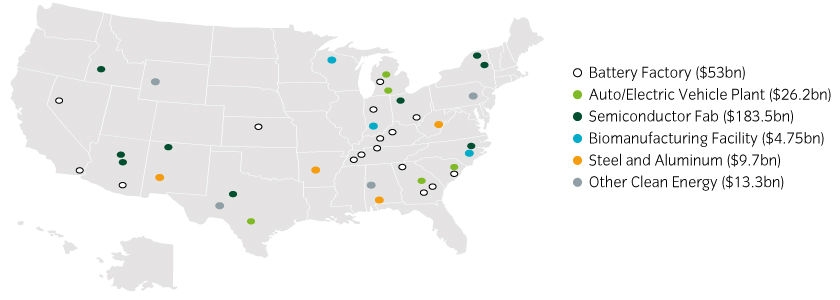

US manufacturing is on the rise, particularly along the Eastern seaboard states (Figure 2). Companies are responding to incentives from the administration’s $1.5trn spending agenda, which includes the Inflation Reduction Act, CHIPS Act and other spending initiatives.

Figure 2: US manufacturing is on the rise, which potential bodes well for relative economic growth

Source: Reshoring initiative, ZETA, SIA and Alliance for Automotive Innovation.

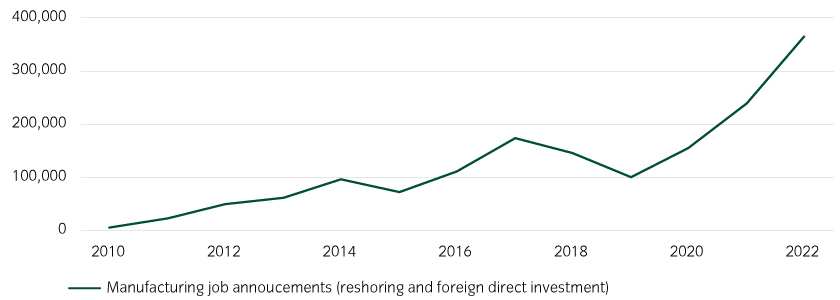

Companies are also reshoring supply chains from China. Within the Western world, the US is proving more attractive than Europe due to more stable energy market dynamics (Figure 3). The US economy has added one million jobs year-to-date, and we believe this will create an additional labor market impulse.

Figure 3: US companies and non-US companies are expanding production in the US

Source: Reshoring Initiative, December 2022: https://reshorenow.org/content/pdf/2022_Data_Report.pdf

Importantly, Chinese manufacturing has been a major disinflationary force over the last three decades. Its partial reversal, and the potential growth impulse imply Stateside inflationary pressures.

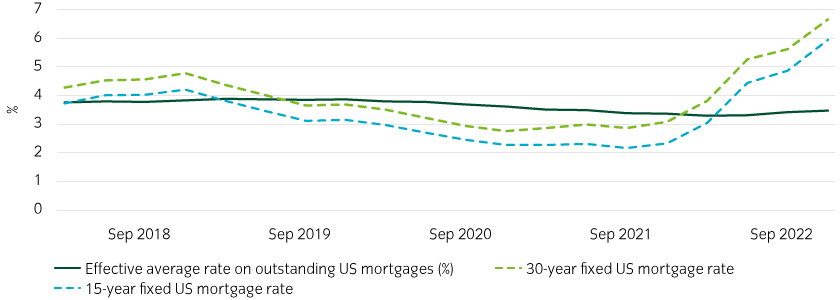

US housing market is less interest-rate sensitive, implying tighter rates for longer

The US is the only country in the world where 30-year fixed rate mortgages are dominant products2. Adjustable-rate mortgages (ARMs) account for less than 15% of the market3. US mortgages financed before 2022 are immune to rising rates, reducing the transmission of monetary policy (Figure 4).

Figure 4: US consumers are potentially the most insulated globally against rising rates

Source: Bureau of Economic Analysis, Freddie Mac, March 2023

Other mortgage markets work more like US ARMS (temporary fixed rate legs before a variable rate kicks in) because long-term fixed rate debt sits poorly with banks’ classic business models.

Mortgage markets in Canada, the UK, Ireland, Spain, Korea, Australia and New Zealand are particularly rate sensitive, with France, Germany, the Netherlands, Switzerland and Japan, are a bit less so4.

The US mortgage market structure was shaped by the Great Depression. In 1934, Congress created the Federal Housing Association (FHA) to insure fixed rate mortgage repayments and in the 1970s authorized Fannie Mae and Freddie Mac to buy and repackage fixed rate mortgages into mortgage-backed securities, creating the Agency MBS market (unique to the US), now ~$8trn in size.

A global strategy provides a platform to target opportunities in emerging markets

Emerging markets (EM) were rattled by the Russia-Ukraine war, China growing at less than 4%, and US dollar strength in 2022, but probably fared better than you might think.

Local currency sovereigns returned -8.8%, outperforming the US aggregate index and many developed markets. Latin American local currency government bond returns were even positive at +3.72%5. We believe the outlook is improving.

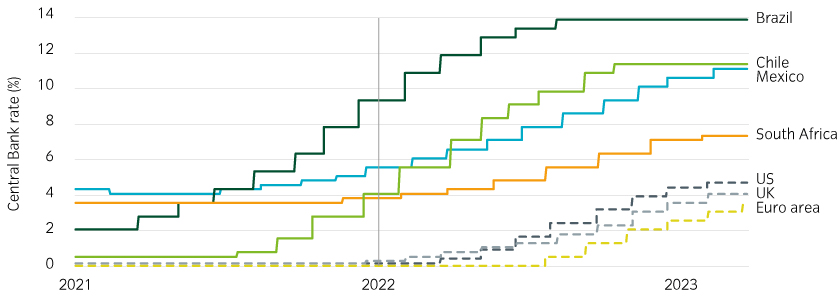

This is largely because EM central banks had already started raising rates in 2021, ahead of the Fed and others (Figure 5), building a buffer.

Figure 5: Emerging markets were ahead of the curve on rate hikes

Source: Bloomberg, December 2022

Inflation pressures are receding faster in EM, particularly in Central and Eastern Europe, Latin America, and Asia. As such we believe rate hikes are largely in the rear-view mirror.

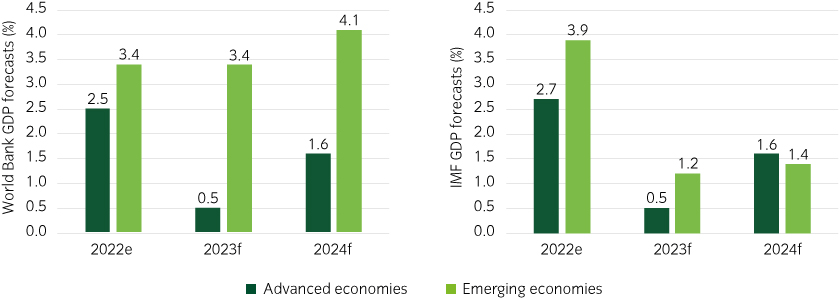

While inflationary pressures ease, the growth outlook is not (Figure 6). As the “reshoring” occurs in the US, we expect “nearshoring” in countries like Mexico, India, Thailand and Vietnam, particularly as many companies have “China plus one” strategies.

Figure 6: Potentially robust EM growth bodes well for real yield opportunities as foreign capital flows in

Source: IMF, World Bank, March 2023. Any projections or forecasts contained herein are based upon certain assumptions considered reasonable. Projections are speculative in nature and some or all of the assumptions underlying the projections may not materialize or vary significantly from the actual results. Accordingly, the projections are only an estimate.

A combination of receding inflation and solid growth bodes well for real yields, which we believe are particularly attractive across EM, and seldom positive in the developed world.

Further, in the event of another shock, EM would have room to cut rates more aggressively than developed market central banks.

Global active managers can exploit a world of inefficiencies

Overweight positions in different countries opportunistically can pay off

US and euro investment grade credit spreads generally track each other closely, but occasionally relative value can shift, such as after Russia’s invasion of Ukraine (Figure 7).

Figure 7: Relative value between countries can shift, providing opportunities

Source: Bloomberg, May 2023

This created opportunities to overweight euro credits versus US dollar credit (either through physical bonds or CDS) to profit from the differential narrowing or target names with little exposure to Ukraine or energy markets that had sold off.

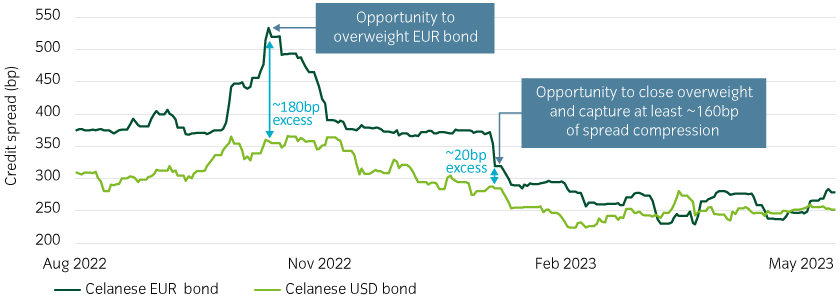

Relative value can even be found within the same issuer’s bonds

US issuers do not just issue in US dollars. Their debt in other currencies can trade at different levels for no fundamental reason. This opens the door for skilled active investors to overweight one bond and underweight the other (Figure 8).

Figure 8: Even a single issuer’s bonds can be better priced in other currencies

Source: Bloomberg, March 2023

Global fixed income does not mean ignoring the US

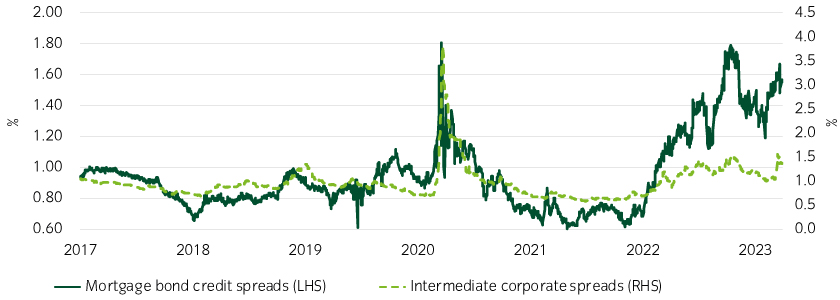

US fixed income accounts for approximately a third of the global aggregate index. The US market also offers opportunities not available overseas, such as the agency MBS market (Figure 9). Global fixed income also includes US companies with debt issued overseas.

Figure 9: Mortgage spreads (unlike corporates) are close to their 2020 levels

Source: Bloomberg, March 2023

Fixed income is fashionable for the first time in years. A global strategy is more diversified, targeting the full range of income and relative value opportunities.

We believe managers with a truly global expertise across the US, developed and emerging markets (in bonds and derivatives) offer investors the best potential for extracting the markets’ potential.

United States

United States