The Milliman Top 100 Plan funding index was over 98% funded at the end of March 2021, the highest level since late 2007.

In our view, this makes a ‘hibernation strategy’ a more realistic near-term goal for a growing number of plans. This is because many plans are closed to new joiners and/or fully frozen to all future benefit accruals (a so-called ‘plan freeze’).

Hibernation as an endgame alternative to buyouts

A full plan insurance buyout is a strategy that has received a lot of attention in recent years and has the attraction of removing pension obligations completely ‘off balance sheet’. However, due to the premium level required, it remains unaffordable for most plans while transaction-related issues (such as accounting charges) can make it unattractive. It therefore often remains a longer-term ambition.

A hibernation strategy is a lower-cost ‘on-balance sheet’ alternative, which seeks to achieve a similar outcome to that adopted by insurance companies, but which avoids any ‘cost of capital’ and other expense loadings required when insuring a portfolio. We believe that many closed/frozen plans may already be sufficiently funded to implement a hibernation strategy.

How does hibernation work?

The investment strategy typically involves matching asset inflows with expected outflows, while fully hedging other valuation risks, such as interest rates. The asset strategy and required funding level can vary depending on the target credit quality, the liability hedge ratio and the cashflow matching approach.

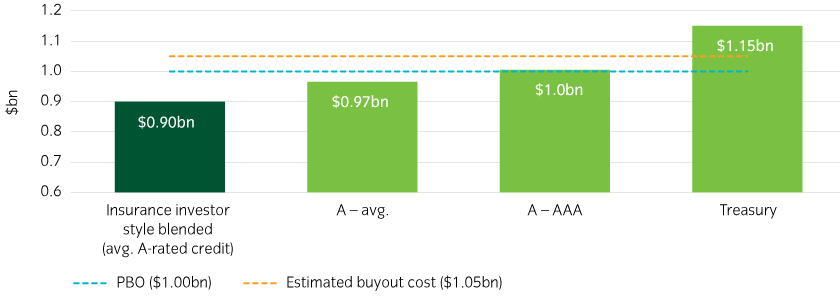

Figure 1 shows the illustrative required funding level to defease a sample set of obligations with a cashflow-matching strategy of different underlying target credit ratings. As the chart outlines, we estimate that following an ‘insurance style’ hibernation strategy would require only 90% funded status for a frozen plan, saving up to 15%1 in funding costs: i.e. 105% of required funding to execute a buyout minus ~90% for the alternative self-managed solution.

Figure 1: Illustrative cost of in-plan liability-matching solutions2

The light green bars are investment strategies consisting only of public investment grade corporate bonds and/or Treasuries. The dark green follows the typical annuity-style insurance investment strategy. It seeks to invest up to 40% in high quality private credit investments with the remaining 60% primarily in public investment grade bonds and Treasuries.

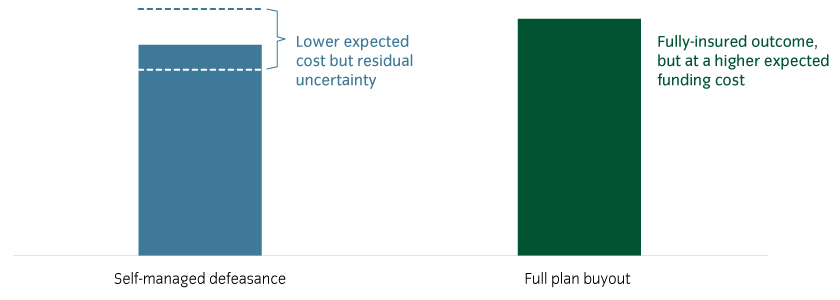

Comparing the approaches: a trade-off between cost and risk

A hibernation strategy can be an appealing alternative to a full insurance buyout, at least in the near-term to medium term, due to the potentially materially lower upfront cash funding cost. Some uncertainty, however, remains with regards to the long-term funding outcome as some funding risks may remain unhedged and/or are difficult to address, such as longevity and credit default risks.

Figure 2: The choice of end-state depends on a cost vs residual risk trade-off3

How does hibernation compare with a partial retiree buyout strategy?

A partial insurance buyout is often discussed as a step toward a target full de-risked end-state and where the key attraction is to ‘shrink’ the total pension plan obligation, leaving behind a smaller ‘more manageable’ obligation.

The approach typically involves transferring the obligations of retiree participants (i.e. in-pays) or other participant groups. Non-transferred members remain an obligation of the plan sponsor in the ‘residual plan’.

However, the challenge is that the amount of risk transfer achieved can be lower than expected compared to the cash funding required, while implementing the strategy can delay the timeframe to reach a full plan de-risking, increasing long-term de-risking costs.

We outline a hypothetical example in Table 1. In the table we show a frozen plan with a $1bn PBO , including $500bn of retiree obligations with a 90% funding ratio. The plan is considering a retiree only buyout at a ‘premium’ of 105% of PBO4 – i.e. for a total premium funding cost of $525m.

Table 1: Analysis of a hypothetical retiree buyout5

| $m | Pre-retiree buyout | Post-retiree buyout | Change |

|---|---|---|---|

| Liability (PBO) | 1,000 | 500 | -50% |

| Assets | 900 | 450 | -50% |

| Assets not transferred to the insurer ($900m minus $525m cost) | 375 | ||

| Cash top-up (required to remain 90% funded) | 75 | ||

| Risk reduction (sensitivity to 1bp discount rate move)6 | 1.3 | 0.9 | -30% |

As we can observe from Table 1:

- Although 50% of the pre-transaction assets and liabilities are transferred to the insurance company, only 30% of interest rate sensitivity and liability risk would be reduced. This is because the longer duration liabilities (and associated interest rate and longevity risk) remain in the residual plan.

- The plan is also left with $375m of residual assets before further funding: $900m of starting assets less $525m to fund the insurance premium. It would therefore require a $75m cash top-up to in order to maintain the funded status at 90% and to avoid disadvantaging remaining plan participants.

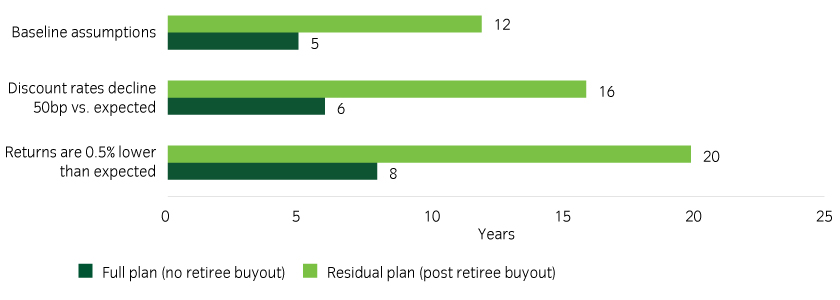

In Figure 3 we compare this to a hibernation or ‘no partial buyout’ scenario. We assume that an additional $75m is added to the $900m of plan assets under the hibernation scenario – in order to make an ‘apples to apples’ funding cost comparison. As we can observe, the time horizon for the plan to achieve a target funding ratio of 105% is considerably extended under the partial buy-out scenario.

Figure 3: Time to achieve 105% target funded ratio7.

Conclusion – what is the right end-state approach for your plan?

When planning for the endgame, plan sponsors naturally see the appeal of an ‘off-balance sheet’ solution, such as an insurance buyout. However, a self-managed ‘on balance sheet’ strategy may be more achievable. It is important to weigh the costs and benefits of each approach and to seek advice, as the financial differences and effects can be material.

Read our full paper on end-state strategies: Planning for the Endgame.

United States

United States