For the right entry points, the high yield market is one of our key picks for this point of the cycle and beyond.

Specifically, we see considerable value in short duration high yield and fallen angels.

Contents

- Short duration and fallen angels sit on the efficient frontier within high yield

- Short duration high yield: compelling carry and price stability

- Fallen Angels — the greatest potential for capital gains

- Both short duration and fallen angels potentially offer protection against rising rates

- Both short duration and fallen angels may offer a way to play corporate deleveraging trends

- Playing short duration high yield and fallen angels — an efficient beta approach

Short duration and fallen angels sit on the efficient frontier within high yield

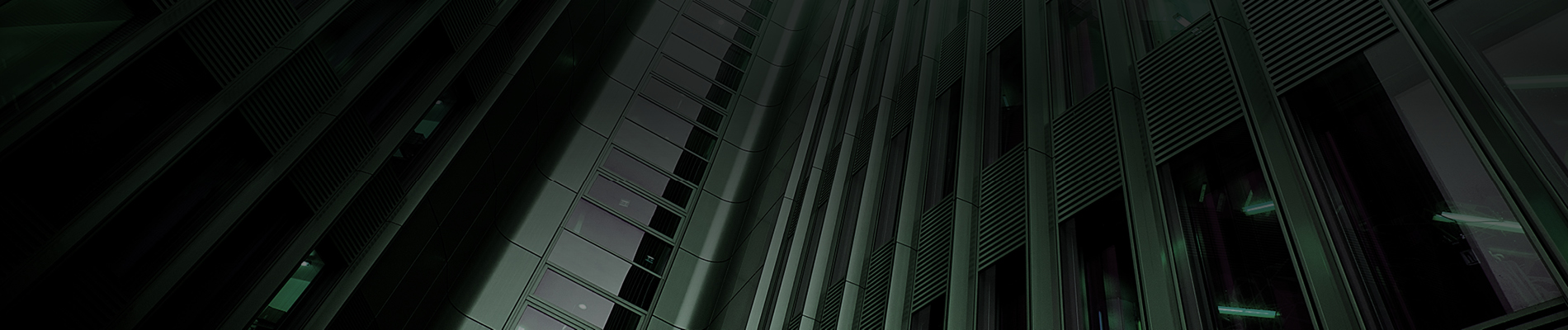

Historically, short duration high yield and fallen angels have delivered higher historical returns than other high yield segments (Figure 1). As such, those looking to allocate to high yield should, in our view, consider a combination of allocations to both strategies.

Figure 1: Short duration and fallen angels are the high yield efficient frontier (returns from October 2004 to February 2022)1

Short duration high yield: compelling carry and price stability

Short duration high yield bond investors have the most visibility into corporates’ ability to repay short-dated bonds, by analyzing their liquidity positions. Short duration bond portfolios also tend to be the most liquid, given the frequency of maturities, and prices tend to be stable given the “pull to par” effect.

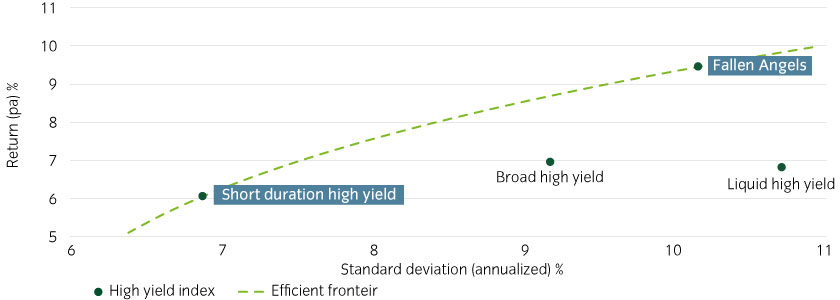

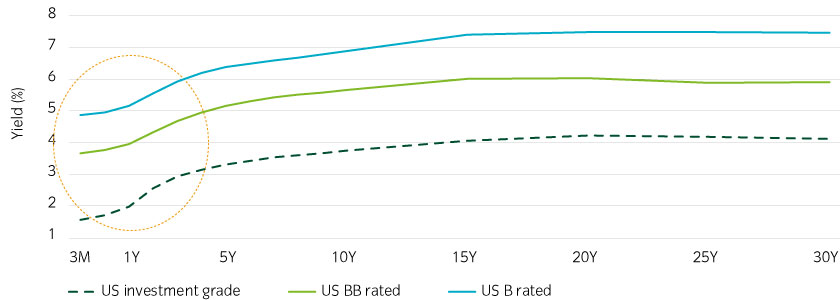

Despite this, short duration high yield bonds still tend to offer a large yield premium over investment grade bonds (Figure 2). In our view, this is because high yield companies often receive a single credit rating for their long and short-term debt, unlike investment grade issuers and this limits the number of investors able to purchase them.

Figure 2: High yield bonds have a single credit rating regardless of maturity, which can result in compelling premium at the front-end2

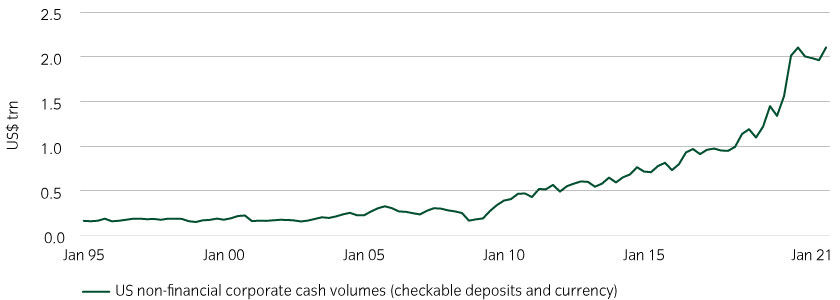

This is also despite the fact that corporate liquidity positions are currently particularly healthy, as many companies built large liquidity buffers during the beginning of the pandemic as a buffer against uncertainty (Figure 3).

Figure 3: Corporate liquidity for near-term maturities is still around record highs, good news for short duration investors3

Fallen Angels — the greatest potential for capital gains

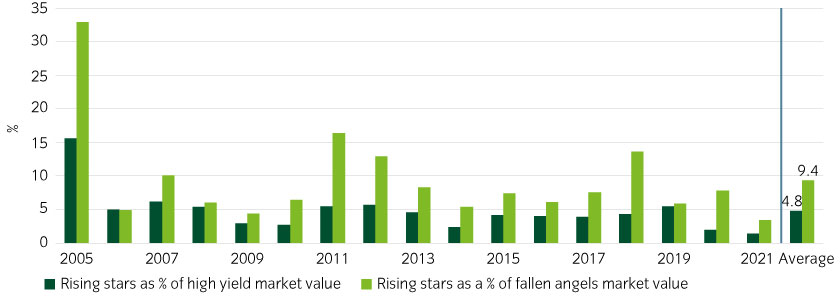

In our view, fallen angels are one of the few areas that offer compelling prospects for material capital gains at this stage of the cycle. This is because the fallen angels market has historically been twice as likely to incubate future rising stars than the broad high yield market (Figure 4). Rising stars benefit from "forced buying" from investment grade accounts during the period in which they receive an upgrade.

Figure 4: Rising stars have been almost twice as likely to come from the fallen angels market than the broad high yield market4

Furthermore, fallen angels have historically offered higher credit ratings than other high yield companies (Table 1).

Table 1: Fallen Angels have the highest credit quality within high yield5

| As of October 2021 | Broad HY | Liquid HY | Short duration HY | Fallen Angels |

|---|---|---|---|---|

| Ba exposure | 51% | 39% | 52% | 87% |

| B exposure | 37% | 50% | 36% | 10% |

| Caa and lower | 12% | 11% | 12% | 3% |

Both short duration and fallen angels potentially offer protection against rising rates

High yield bonds have historically performed well through periods of rising rates.

Over the seven periods since 2004 in which 10-year Treasury yields rose by 1% or more, short duration high yield bonds were particularly well-insulated given their low interest rate risk exposure. Fallen angels have also fared well, with gains from credit spread tightening compensating for losses from interest rate risk (Table 2).

Note that the following figures exclude the additional return from call premia, earned when callable bonds are redeemed early. We believe that this is more likely to positively impact short duration bonds than Fallen Angels (as investment grade bonds are rarely callable).

Table 2: Both short duration and fallen angels have historically performed well during the seven periods since 2004 that 10-year Treasury yields have risen by 1%6

| Short Duration HY Corp | Fallen Angels Corp | |||||

|---|---|---|---|---|---|---|

| Total return | Spread return | Rate return | Total return | Spread return | Rate return | |

| Jun 05 - Jun 06 | 6.17% | 3.30% | 2.87% | 2.25% | 4.27% | -2.02% |

| Dec 08 - Dec 09 | 50.83% | 42.61% | 8.22% | 73.08% | 75.52% | -2.44% |

| Aug 10 - Mar 11 | 9.48% | 7.97% | 1.51% | 10..25% | 13.42% | -3.18 |

| Jul 12 - Dec 13 | 14.71% | 13.84% | 0.87% | 17.45% | 21.61% | -4.15% |

| Jul 16 - Dec 16 | 5.09% | 5.17% | -0.08% | 5.48% | 10.18% | -4.70% |

| Aug 17 - Oct 18 | 4.24% | 2.16% | 2.08% | 2.40% | 5.48% | -3.07% |

| Jul 20 - Mar 21 | 8.98% | 8.90% | 0.08% | 9.93% | 15.57% | -5.64% |

| Simple average | 14.22% | 11.99% | 2.22% | 17.26% | 20.86% | -3.60% |

| ↑ Lower rate sensitivity |

↑ Greater spread compensation |

|||||

Both short duration and fallen angels may offer a way to play corporate deleveraging trends

High yield companies need to grow their equity faster than their debt to make good on their interest payments, such as by expanding their businesses, selling assets or reducing debt. This provides a natural impulse for well-run companies to deleverage.

Short duration

Deleveraging trends benefit short duration bonds by increasing the frequency of call events. When companies deleverage, they are often able to finance at more favorable terms, incentivizing them to redeem their existing issues early and issue new bonds. Investors in callable bonds in growing companies are more likely to benefit from bonds gravitating to their call price (which is typically a significant premium to par). This is most likely to benefit short duration investors able to pinpoint callable bonds with the best prospects of early redemption.

Fallen angels

Fallen angels that successfully delever will have a shot at returning to investment grade status, thus benefiting from “forced buying” from investment grade accounts as they return to mainstream indices.

Playing short duration high yield and fallen angels — an efficient beta approach

Benchmark agnostic investors can allocate to short duration high yield and do their best to pick Fallen Angels within their active credit strategies.

However, we also believe that investors should consider investing in short duration high yield and fallen angels on a standalone basis. In our view, an Efficient Beta approach may be the most compelling way of accessing these markets.

Efficient beta is neither active nor passive. It is an approach that prioritizes quantitative active management methods and a ‘basket trading’ approach leveraging the fixed income ETF ecosystem to greatly reduce transaction costs and improve liquidity.

For more on Efficient Beta strategies, see “A better way to generate beta in fixed income"

We believe investors should seriously consider high yield credit at this stage of the economic cycle, particularly through strong corporates growing into their capital structures. However, in an environment of rising rates and geopolitical uncertainty, we believe short duration high yield and fallen angels offer the most compelling prospects for price stability and capital gains.

Our key investment view for 2022 is that the “easy money” has been made in equities but certain areas of fixed income look attractive at this point in the cycle. Alex Veroude, Insight's CIO, Fixed Income, provides a 2-minute overview:

United States

United States