Inflation fell from its 40-year high of 8.5% from last month. However, markets took little comfort, as it fell less than most all forecasters expected, sliding only to 8.3%. Core CPI also rose more than expected, to 6.2% from 6.5%.

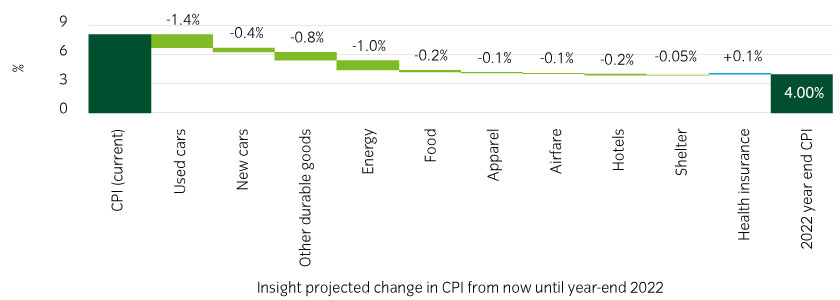

While we believe inflation has peaked, we project it will remain well above-target by year end at ~4%. However, this means that the Fed’s hiking cycle may already be priced in to a large extent, allowing diligent investors to find value opportunities.

“Flexible” categories are easing, but “sticky” components still accelerating slightly

The categories we are watching most closely, the “stickier” categories, such as rents and medical prices, accelerated slightly faster than their recent trend.

On the positive side, the “flexible” categories, particularly those sensitive to global supply chain conditions and currency volatility (such used cars and apparel) are showing signs of easing (Table 1).

Table 1: Flexible sectors are moderating but sticky sectors accelerated slightly1

| Sticky | Flexible | Non-Core | ||||||

|---|---|---|---|---|---|---|---|---|

| Health services | Owner's Equivalent Rent | Education and Commuication | Airfare | Used Cars | Apparel | Food | Energy | |

| 12 month Average | 0.3% | 0.4% | 0.1% | 2.7% | 1.8% | 0.4% | 0.7% | 2.3% |

| Feb-22 | 0.1% | 0.4% | 0.1% | 5.2% | -0.2% | 0.7% | 1.0% | 3.5% |

| Mar-22 | 0.6% | 0.4% | -0.1% | 10.7% | -3.8% | 0.6% | 1.0% | 11.0% |

| Apr-22 | 0.5% | 0.5% | 0.2% | 18.6% | -0.4% | -0.8% | 0.9% | -2.7% |

The shelter component (i.e. rental inflation) remains our largest concern. Rental CPI reached 5% year-on-year and it makes up around a third of the index. Given that rents are typically locked in for up to a year or more, we expect it to end this year at a similar level.

For 2023, we see more reasons to be optimistic, particularly as more housing supply hits the market, which will potentially ease rental conditions. However, we believe this will be a drawn-out process.

Goods inflation will reduce CPI, but services will keep it above-target

In essence, goods inflation is normalizing but services inflation is steady-to-rising. We expect this to be the key theme for the rest of the year. In our view, the former (goods) will cause inflation to slow, but the latter (services) will cause inflation to remain persistent and above-target.

We expect inflation to fall to ~4% by year-end, assuming crude oil prices do not change from their current ~$100 per barrel level. This is due to base effects as, although energy prices are 30% higher than a year ago, they are only 15% higher than they were last December.

As such, we expect autos and energy inflation to ease the most, partly also due to easing supply chain conditions. We also believe used car prices (which are still 22% up year-on-year) may have further room to fall (Figure 1).

Figure 1: Goods inflation will help inflation fall, but services will potentially keep it at ~4%2

Food prices pose the greatest risk to our projection

Although goods inflation is easing across many categories, pressure is building on food prices.

The ongoing Russia-Ukraine conflict remains the main driver, but tough global weather conditions are exacerbating the pain. Drought is making it harder for France to help ease global wheat supplies, a devastating heat wave is causing India to consider restricting crop exports and flooding has threatened food crops in Southern China.

Further, fertilizer prices (which account for a third of farmers’ total costs) have also risen sharply over the last year (Figure 2).

Figure 2: Fertilizer prices are adding to farmers’ input costs, adding to food price pressure3

Although our assumptions account for 10% inflation in food prices, the risk is that this will be too low.

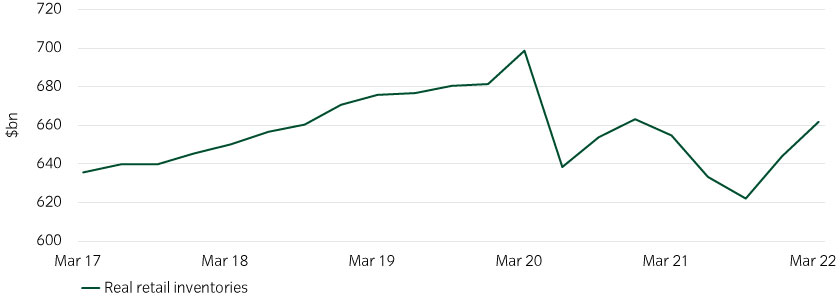

Supply chains are improving even as China locks down

Better news concerns supply chains. Although they remain lower than pre-pandemic levels, retail inventories are building (Figure 3).

Figure 3: Rising inventories is encouraging for supply chains4

A return to “normal” may be a way off, but slowing consumer demand (as a result of inflation) may help inventories normalize further, thus feeding back into further disinflationary effects on goods.

We have potentially passed “peak inflation”, but it is not “mission accomplished”

Absent falling commodity prices, it will be incredibly challenging for the Fed to bring inflation close to its 2% target over the next year. Ultimately, we believe rate hikes alone will not be enough.

In our view, the Fed will need assists from fading fiscal stimulus, supply chain improvements, housing supply increases and slowing consumer demand. The good news is that many of these scenarios are starting to transpire.

As such, we do not see this print as a reason for the Fed to change course, and the market may have now fully priced in the Fed’s hiking cycle.

Ultimately, this could be good news as it will provide opportunities for disciplined, security selection-focused investors to find compelling value opportunities within investment grade and high yield credit.

United States

United States