Amid strong improvements in funded status, many plan sponsors with closed and or frozen pension obligations are in a stronger position to begin considering their desired end state strategy. This article outlines three appropriate strategies and considerations of each.

The range of end state solutions

Many corporate defined benefit plans have seen a strong pick-up in funded status in recent months. The Milliman Top 100 Plan funding index reached almost 93% funded at the end of February 2021, the highest level since late 2018. These are levels at which many plan sponsors can now consider when planning for the endgame, through either an ‘off-balance sheet’ solution, such as a full plan or partial insurance buyout or an ‘on-balance sheet’ self-managed defeasance strategy, also known as ‘hibernation’.

Full insurance buyout

A full insurance buyout involves paying an upfront premium to transfer all plan obligations to an insurance company. The pension plan is typically then terminated. At present, a full buyout is unrealistic for most plans, as the required premium would be unaffordable or unachievable. It is therefore often a longer-term ambition. See Additional Perspective 1 for further information.

Self-managed defeasance

A self-managed defeasance strategy is an alternative end-state approach. It typically involves matching asset inflows with expected outflows, while fully hedging other valuation risks, such as interest rates. From an investment perspective, it follows a similar approach to that adopted by insurance companies. There are many ways to construct a matching portfolio as the strategy can vary depending on target credit quality, the liability hedge ratio and the cashflow matching approach. See Additional Perspective 2 for further information.

Retiree or partial insurance buyout

Partial buyouts are also considered on the path to a target end-state and typically involve transferring the obligations of retiree participants (i.e. in-pays) or other select participant groups to an insurance company. Non-transferred members remain as an obligation of the plan sponsor in the ‘residual plan’. Retiree pools are often chosen as they are easier to price and transact and thus can attract strong interest from insurance companies. See Additional Perspective 3 for further information.

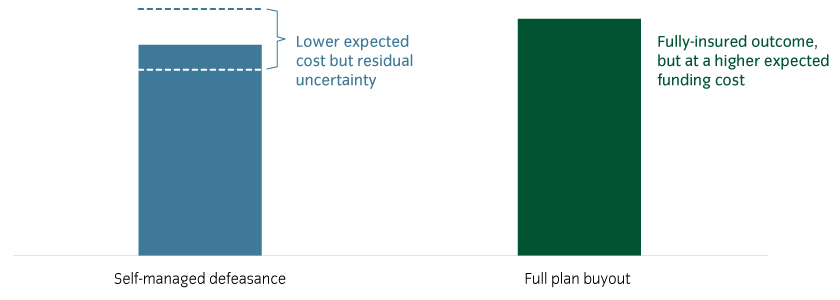

Comparing the approaches: a "cost-risk" tradeoff

Insurance buyouts can provide the ultimate measure of de-risking certainty but can often come with a material upfront cash funding cost. This is because a plan sponsor will require additional funding to pay for the insurance premium and, in the case of a partial buyout, may also need to make a voluntary cash top-up to preserve the funded status of the residual plan liabilities. Insurance buyout transactions may also have an associated non-cash accounting charge. Reputational and HR risks are a further consideration – buyouts can be high-profile transactions involving many employees.

Under a self-managed solution, the plan would continue to exist in its current form, retaining its asset and liabilities while continuing to participate in the PBGC insolvency system. The advantage of this approach relative to a buyout is that de-risking can be achieved at potentially much lower expected funding cost than an insurance buyout, in addition to avoiding any accounting settlement charges1. The funding differential can be material, particularly when credit spreads are relatively wide. The trade-off however is retaining residual uncertainty with regards to potential future costs (See Figure 1 and Table 1 below). See Additional Perspective 2 for further information.

Figure 1: The choice of end-state depends on a cost vs residual risk trade-off2

Table 1: Summary comparison between off-balance sheet and on balance sheet solutions3

| Self-managed defeasance | Buyout | |

|---|---|---|

| Cost | Lower expected cost of defeasance | Requires the payment of an insurance premium and / or additional top-up contributions |

| PGBC status | Plan remains in PGBC system | Transferred obligations will exit the PBGC system |

| Accounting treatment | No immediate recognition of actuarial losses | May incur GAAP accounting settlement charge |

| Other considerations | Plan retains use of any applicable asset surplus e.g. future accrual, IRS 420 transfers to OPEB, future acquisition, etc. | Plan may be terminated with distribution of any applicable surplus |

Path to the endgame — examining retiree buyouts

Partial buyouts are sometimes viewed as a step on the way to a full de-risking or full buyout. This approach often involves transferring all retirees or a subsection of participants, such as those with small benefits or blue- or white-collar obligations. The key attraction is to ‘shrink’ the total pension plan obligation, leaving behind a smaller ‘more manageable’ obligation.

Plan sponsors are typically motivated by the opportunity to reduce the size of the pension obligation on its balance sheet and to make progress on the path to a full de-risking. However, funding the insurance premium can mean transferring a comparatively high level of assets relative to the liability risk that is eliminated, and thus it can result in projected higher future contributions and / or delay the plan’s expected time horizon to achieve its ultimate target end-state. As such, retiree buyouts require more detailed analysis before a sponsor can conclude if a deal is advantageous in its particular situation.

An analysis of a hypothetical retiree transaction

In the hypothetical example below we show a frozen plan with a $1bn PBO4, including $500bn of retiree obligations, with a 90% funding ratio. The plan is considering a retiree buyout at a ‘premium’ of 105% of PBO – i.e. for a total premium funding cost of $525m (Table 2).

Table 2: Analysis of a hypothetical retiree buyout5

| $m | Pre-retiree buyout | Post-retiree buyout | Change |

|---|---|---|---|

| Liability (PBO) | 1,000 | 500 | -50% |

| Assets | 900 | 450 | -50% |

| Assets not transferred to the insurer ($900m minus $525m cost) | 375 | ||

| Cash top-up (required to remain 90% funded) | 75 | ||

| Risk reduction (sensitivity to 1bp discount rate move)6 | 1.3 | 0.9 | -30% |

As we can observe from Table 2:

- Required funding: the proposed deal would leave the plan with $375m of residual assets after funding the insurance premium ($900m starting assets less $525m for the retiree buyout), and would therefore require a $75m cash top-up to the residual plan in order to maintain the funded status at 90% ($375m of residual assets plus the top-up of $75m gives $450m of assets relative to $500m of residual liabilities); this top-up is necessary to avoid disadvantaging the remaining plan participants in the deal.

- Risk transfer: although 50% of the pre-transaction assets and liabilities are transferred to the insurance company, only 30% of interest rate sensitivity would be reduced in this scenario.

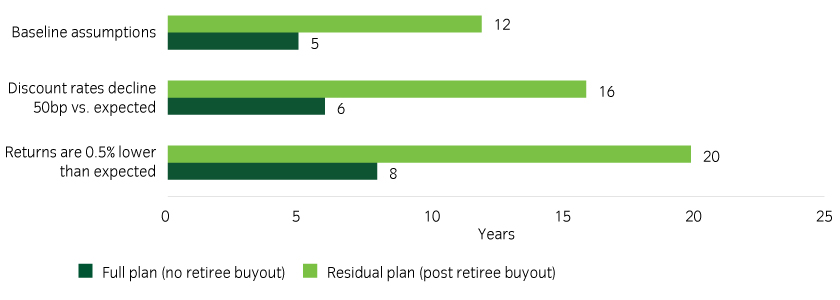

In Figure 2 we compare this to a hibernation or ‘no partial buyout’ scenario. We assume that an additional $75m is added to the $900m of plan assets under the hibernation scenario – in order to make an ‘apples with apples’ funding cost comparison. We observe that the time horizon for the plan to achieve a target funding ratio of 105% is reduced from 12 years to 5 years. In the scenario, we find the plan is also better protected against the risk of triggering minimum required contributions in future in a scenario where liability discount rates were to subsequently decline or asset returns were to be lower than expected.

Figure 2: Time to achieve 105% target funded ratio7.

Securing the end-state — key conclusions

Sponsors of closed and/or frozen pension plans will need to consider their end-state target: either ‘on-balance sheet’ or ‘off-balance sheet’. A buyout can remove risk but can be the most expensive option. By contrast, in-plan solutions can be achieved at a lower projected funding cost but with the need to manage residual risk. Partial retiree buyouts are more complex considerations. Any analysis on a transaction needs to consider the amount of liability risk transferred and the residual plan’s expected timeframe and contribution risk in meeting its long-term objective.

Additional perspectives

1) How insurance companies price buyouts

In exchange for an upfront premium, an insurance company will typically ensure it can:

- Pay the future obligation 'best estimate liability'

- Meet expenses

- Meet the incremental cost of any participant options

- Generate the required target return on its equity capital

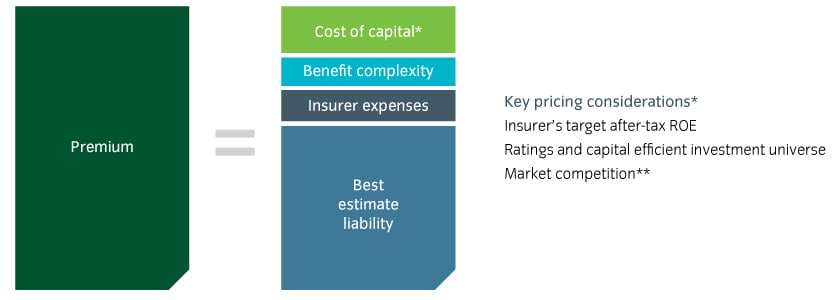

Figure 3: Buyout pricing as an insurance company8

Insurance companies price in a cost of capital spread to the premium basis, which we estimate to be ~60-80bp p.a. for retirees to up to ~100bp p.a. for non-retirees. This means that the projected return on matching assets held is higher by 60-100bp than the associated discount rate used for the premium basis.

2) Self-managed defeasance solutions

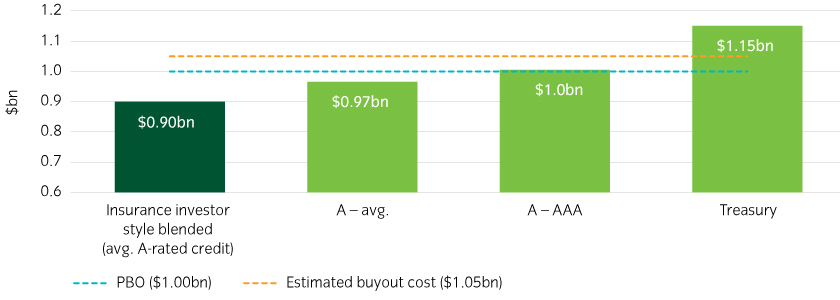

We believe self-managed solutions can be executed at a lower expected funding cost than an insurance buyout as it avoids any cost of capital. However, the trade-off is the plan sponsor retains some residual risk, which would be mitigated or hedged to the extent feasible or desirable. Figure 3 shows the required funding level to defease a sample set of obligations with a cashflow-matching strategy of different underlying target credit ratings. The light green bars are strategies consisting only of public investment grade corporate bonds and/or Treasuries. The dark green bar follows an investment strategy similar in nature to that held by a typical annuity carrier seeking to invest to match cashflow obligations and allocating up to 40% in high quality private credit investments with the remaining 60% primarily in public investment grade bonds and Treasuries.

Figure 4: Illustrative cost of in-plan liability matching solutions9

Under current market conditions, we estimate that a self-managed cashflow-matching strategy incorporating high quality private credit could save up to 15%10 in projected funding costs relative to a buyout (assuming 105% of funding required to the PBO for the buyout versus 88% for the self-managed solutions). The relative pricing change of a self-defeasance solution to the Plan PBO changes with general credit spread levels, being relatively cheaper when the general level of credit spreads available are wider compared to the AA rate inherent in the PBO liability.

3) Insurance companies prefer retiree buyouts to non-retiree buyouts

While insurance companies also price non-retiree buyouts, they tend to favor retiree buyouts. This is because these obligations have more predictable cashflows, shorter durations, lower longevity risk and do not have complex participant options as the benefits are already being paid. As such, these obligations can be easily ‘matched’ with fixed income investments including high quality private credit.

By contrast, non-retiree deals have more risk and uncertainty and are therefore see less demand from insurers. Additionally, the incremental liability pricing and capital charges (over a longer duration) typically lead to a much higher relative premium versus a typical PBO reserve, making the pricing less palatable for a plan sponsor.

United States

United States