Executive summary

Many plans made considerable investment and funding gains over the last year. Now is the time to seek to secure them by protecting your plan from the risk of equity drawdowns.

We believe that investors can achieve a low-cost but reliable downside equity hedging approach using an intelligent and dynamically managed strategy.

It could be the time to consider such an intelligent hedging approach as:

- Equity valuations are currently near all-time highs, which has historically led to higher drawdowns and volatility, as well as lower future returns

- The extreme monetary accommodation that helped push valuations to these highs is being normalized

- Equity drawdowns can hit decumulating plans particularly hard, as timing of returns becomes crucial to meeting obligations

____________________________________________________________

Contents

Three reasons to hedge downside equity risks

“An ounce of prevention is worth a pound of cure” – Benjamin Franklin.

1) Central banks have helped push equity valuations to record highs

In recent years, the extraordinary equity bull market has supported asset growth allowing many pension plans to erase their funding deficits.

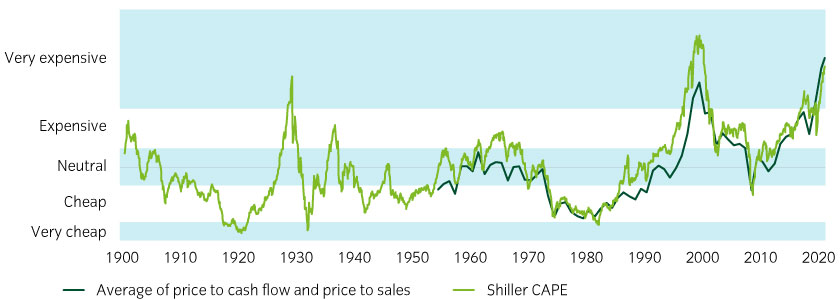

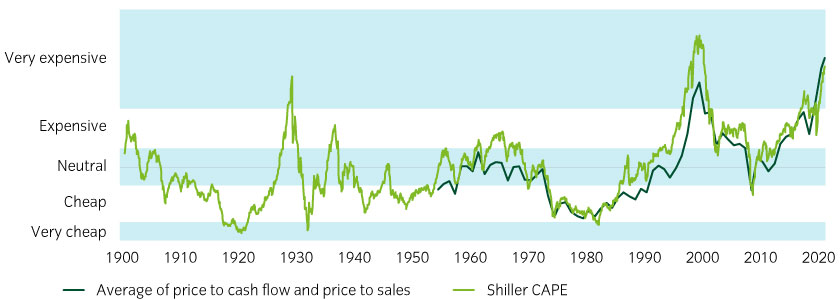

However, equity valuations are now at or around their highest levels ever, at over two standard deviations above the long-term average, based on price-to-cashflow, price-to-sales and the Shiller CAPE index (Figure 1).

Figure 1: Equities are very expensive relative to history1

Equity performance has substantially outpaced growth in the real economy, sustained by very low central bank policy rates and quantitative easing (QE). However, monetary policy stimulus is set to reverse course, potentially creating a significant adjustment in prices.

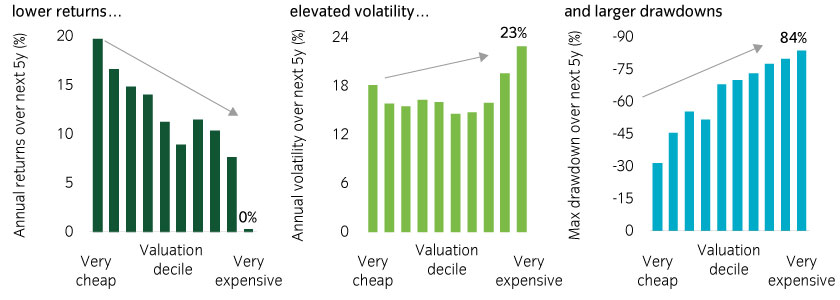

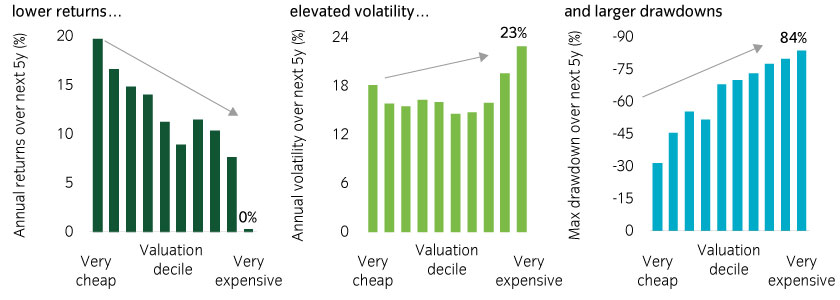

2) High valuations have historically meant lower returns, higher volatility, and larger drawdowns

When equity valuations have historically reached extreme levels like these, typically, volatility has risen, drawdowns have been more common and future 5-year returns have fallen (Figure 2).

Figure 2: Very expensive valuations often indicate volatility ahead and lower future returns2

3) Drawdowns are far more painful in the "decumulation" stage

Many pension plans have moved from accumulation to decumulation. As outflows from pension obligations exceed income from investments and contributions, they are cashflow negative, and the asset base is shrinking.

In this situation, the timing of returns becomes very important.

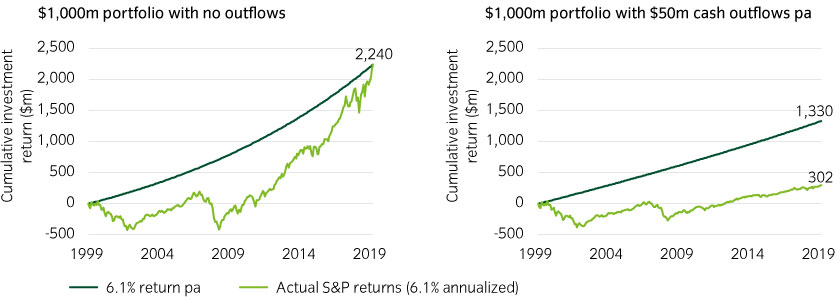

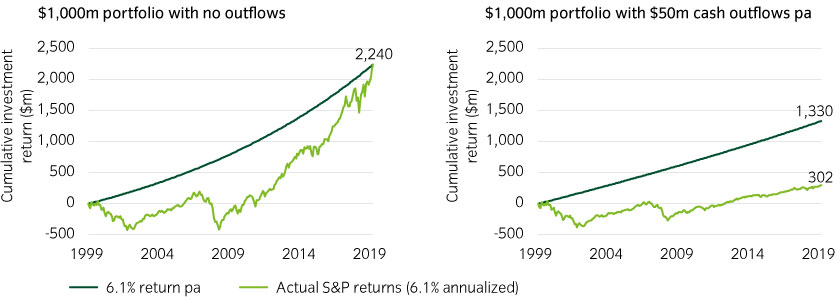

Consider a hypothetical $1bn portfolio invested in the S&P 500 Index in 2000 and held for twenty years. During this time, the S&P 500 delivered poor returns early on (a result of the dot-com bust and the 2008 crisis), followed by spectacular returns after 2008.

For the whole of that period, an investor would have earned an average return of 6.1% pa, for a cumulative profit of $2.2bn. If the investor withdrew $50m each year, a 6.1% pa return would have only created a $1.3bn profit (40% less), assuming the returns were delivered consistently each year.

However, because returns were weaker in the early period, using the actual path of S&P 500 Index returns, profits would have been much lower, at just $302m, or ~78% less than in the average return scenario (Figure 3).

Figure 3: Decumulation amplifies the effect of equity drawdowns3

____________________________________________________________

Option strategies can aim to deliver a reliable hedge and there are ways to manage costs

Put option strategies can offer full risk protection with a high degree of precision and certainty even through stressed market conditions.

However, it can come with high costs that detract from investment returns, which is particularly problematic for plans in decumulation and for those that are underfunded. However, there are ways to reduce the cost of hedging, while partially trading off on effectiveness.

Investors can reduce costs of an option strategy by opting for a partial hedge instead of a full hedge, such as with an out-of-the-money (OTM) put option or a ‘put spread’ strategy (see Appendix).

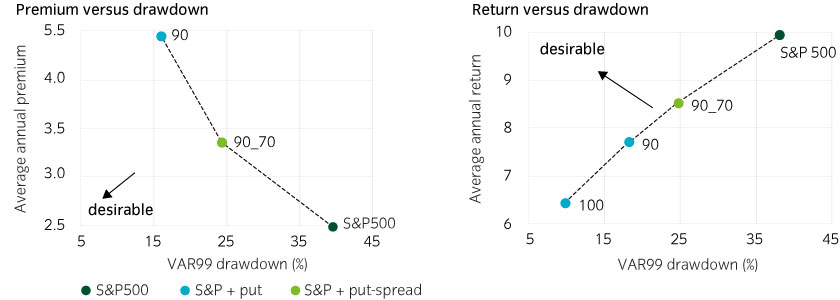

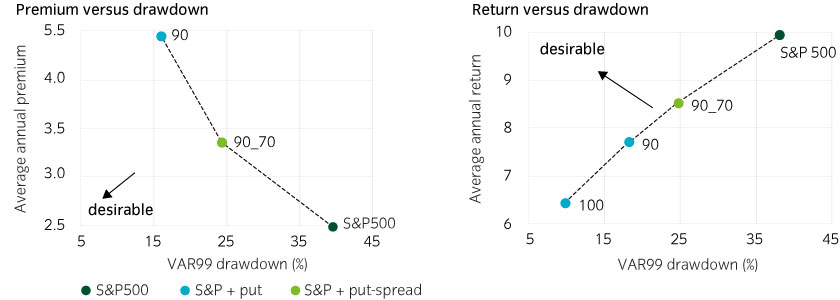

Historically, out-of-the-money puts and put spread strategies have lower hedging costs, but they have still caused a drag on returns (Figure 4). The left chart shows the upfront premium cost of protection against historical drawdowns (Var99). The right chart depicts the historical long-term annual returns, also plotted against historical drawdowns.

Figure 4: Put and put spread strategies have reduced drawdowns but led to a significant drag on returns4

The key question is whether there is an approach that can help reduce the cost of the upfront premium (and drag on returns that this represents) while at the same time providing reliable downside protection.

____________________________________________________________

An intelligent hedge: potential reliability at a lower cost

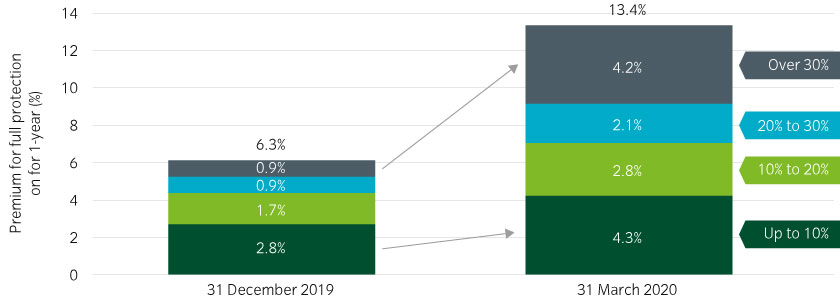

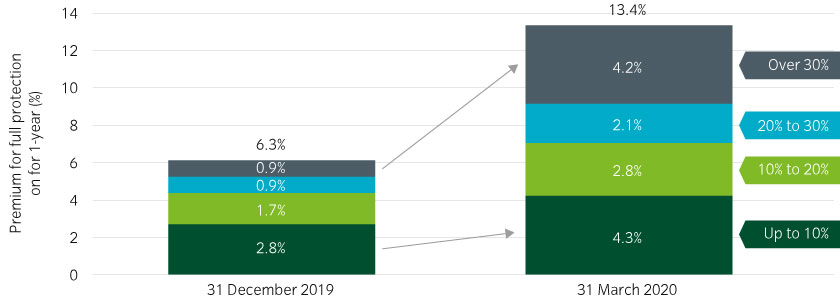

We believe that investors can reduce the costs of hedging strategies significantly as the cost of option strategies varies considerably over time (Figure 5).

Figure 5: The cost of a 90% put spread varies significantly over time5

Hedging costs rise steeply during crises as buying put options during these periods is the equivalent of buying home insurance when your house is on fire.

Crucially, however, when markets become more volatile, the prices of different option contracts tend not to move together in a definable relationship. The price of different hedges changes at different rates, reflecting investor demand for protection.

For example, as the pandemic hit in March 2020, the cost of protecting against the first 10% of a drawdown rose by 50%, while the cost of protecting against drawdowns from 30% to 100% rose by 360% (Figure 6).

Figure 6: During the pandemic, hedging costs at different levels rose at vastly different rates6

____________________________________________________________

Intelligent dynamic hedging strategies examined

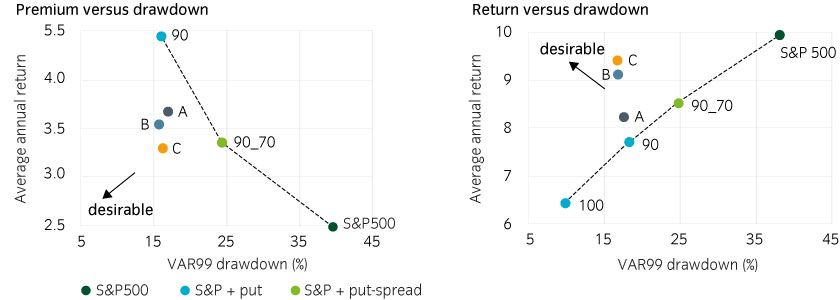

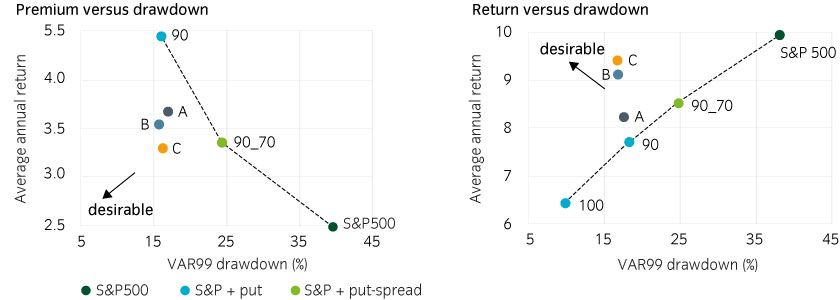

Consider the following dynamic hedging strategies:

A: dynamically switching between a put and a put spread based upon the pricing of put options.

B: investing in put options struck at a level determined by the pricing of call options.

C: dynamic switching between puts and put spreads, and dynamically adjusting the strikes based upon the pricing of call options.

We believe these three illustrative strategies can reduce hedging costs and drawdown risks, preserving much of the long-term returns achieved by equity markets in recent years (Figure 7).

Figure 7: Intelligent hedging strategies can potentially reduce hedging costs while maintaining effectiveness7

These strategies can reduce the cost of hedging markedly without impacting the quality of the protection achieved.

____________________________________________________________

We believe you can successfully protect your portfolio from downside risks in decumulation while keeping the costs in check

Equity performance over recent years has served investors such as pension plans well. However, given where equity valuations are now, the threat of drawdowns is particularly acute for plans in decumulation and it is now crucial to carefully consider protecting downside risks.

While investors are right to be concerned about the potential costs of high-certainty hedging strategies such as options, we believe investors can protect their plans through an intelligent hedging strategy that keeps costs in check without impacting the quality of the protection.

We would be delighted to discuss how intelligent hedging strategies can help you as you seek to protect your portfolio and maximize the certainty of achieving your desired outcome.

____________________________________________________________

Why Insight for equity protection strategies?

Insight is a global leader in liability-driven investment and fixed income, with a global platform, a broad toolkit and history of innovation.

We aim to design solutions to manage all aspects of risk, across multiple asset classes including rates, equity, credit, inflation, currency and equities, in the form of full, dynamic or tail risk hedging strategies.

We manage over $1.1trn in assets under management8. Our investment teams are located in New York, San Francisco, Boston and London.

United States

United States