The Fed raised the Fed Funds rate by 25bp, as expected, to a range of 5% to 5.25%. This is the tenth consecutive hike. The Fed signalled a pause is likely to follow, meaning this could be the end of the hiking cycle.

In the FOMC’s statement, the central bank removed the phrase "The Committee anticipates that some additional policy firming" may be appropriate, indicating that it will likely pause its rate hikes.

It continued to refer to uncertainty around the ongoing instability in regional banks as having an additional tightening impact on credit conditions. When additionally asked about the uncertainty surrounding the impending debt ceiling standoff in Congress, Chair Powell stated it was discussed as a risk to the outlook, but not an important factor in its policy decision.

The Fed may have tightened enough, at least for now, to cool the economy

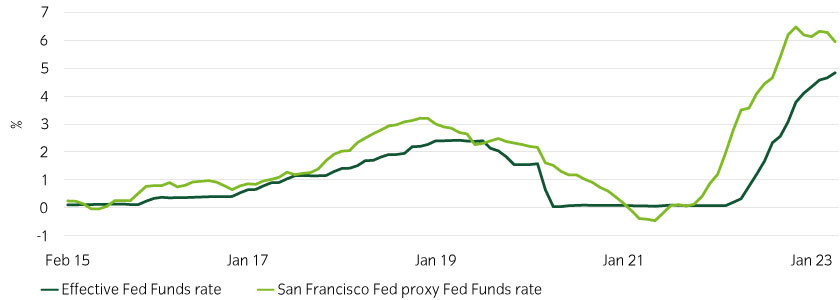

The impact of the Fed’s shrinking balance sheet has likely also contributed to the tightening of monetary conditions. According to a proxy Fed Funds rate indicator maintained by the Federal Reserve Bank of San Francisco, the broader stance of the monetary policy is markedly tighter than what the Effective Fed Funds rate suggests (Figure 1).

Source: San Francisco Fed, 30 April 2023: https://www.frbsf.org/economic-research/indicators-data/proxy-funds-rate/

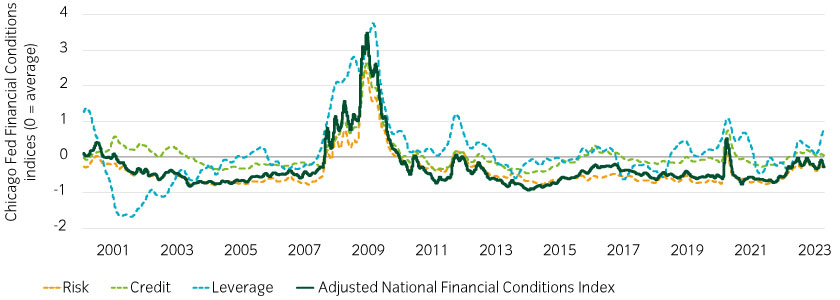

However, financial conditions justify a continued tight policy

Powell continued to play down the prospect of rate cuts this year, despite the market’s insistence on pricing them in. As of May 3, Fed Funds futures pricing implied an almost 65% probability that the Fed will perform 75bp of rate cuts or more by year end (Table 1).

| Total rate cuts from today | Market-implied probability by year-end 2023 |

| 0% | 1% |

| -25bp | 7% |

| -50bp | 28% |

| -75bp | 42% |

| -100bp | 20% |

| -125bp | 2% |

Source: Bloomberg, May 2023

Source: Federal Reserve Bank of Chicago, May 2023: https://www.chicagofed.org/research/data/nfci/current-data

Uncertainty supports a pause; financial conditions support holding rates high

Rate cuts seem unlikely to us this year, barring a major retreat in inflation, which we see as unlikely as favorable base effects dissipate this summer.

Although the overall job market conditions still are fairly robust, the data in the past few months point to a loosening of the labor market. Meanwhile, we expect the path to lower inflation to be protracted and bumpy. Hence, we believe these factors justify maintaining a tight policy stance.

On the flip side, the magnitude of the Fed’s hikes and uncertainty around regional banks justifies a cautious approach over any potential further rate hikes.

This could be the apex of the Fed’s hiking cycle, but we expect rates to stay on hold for some time.

United States

United States