Inflation may be painful, but there are some positives for corporate credit investors. We believe investors can seek to benefit from biasing towards companies with domestically focused revenues, those with strong pricing power and low commodity exposure.

- Companies are successfully passing on high costs to consumers

- Corporate debt is being "inflated away"

- Inflation has also created potentially compelling entry points for corporate credit

- US, rather than international, corporates may be best placed to weather inflation

- Playing inflation-related credit opportunities

Companies are successfully passing on high costs to consumers

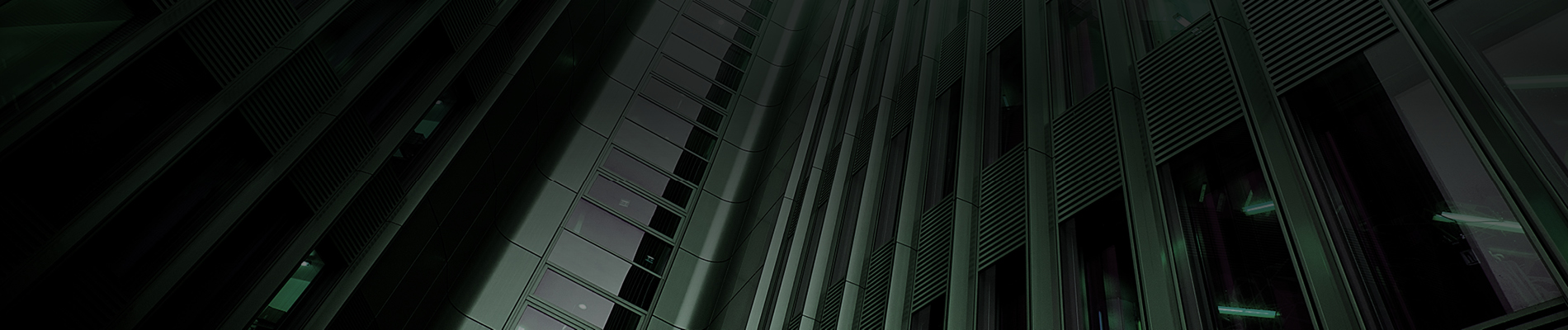

Corporates mainly experience inflation through their input costs, which is measured by producer prices for finished goods. Currently, producer price inflation (PPI) is running at its highest level since the 1970s.

However, corporate margins will potentially only be squeezed if companies fail to pass those costs onto consumers. So far, consumer price inflation (CPI) for goods has kept pace with PPI for goods (Figure 1). This indicates that, on average, corporate margins are holding up in line with price rises.

Figure 1: Companies are successfully passing their input costs onto consumers1

Corporate debt is being "inflated away"

Inflation may be helping many corporates to delever their balance sheets. Consider that ~80% corporate debt is fixed rate, and corporates tend to hedge the other 20% that are floating.

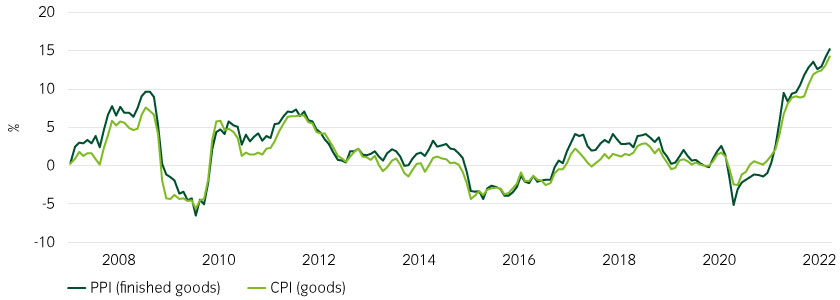

From the start of the pandemic, corporates rushed to issue debt as rates fell to record lows. As much as 44% of today’s outstanding investment grade bonds were issued since the pandemic started. For high yield, the figure is even higher at 61% (Figure 2).

Figure 2: Corporates are benefiting from raising cheaper debt at the start of the pandemic2

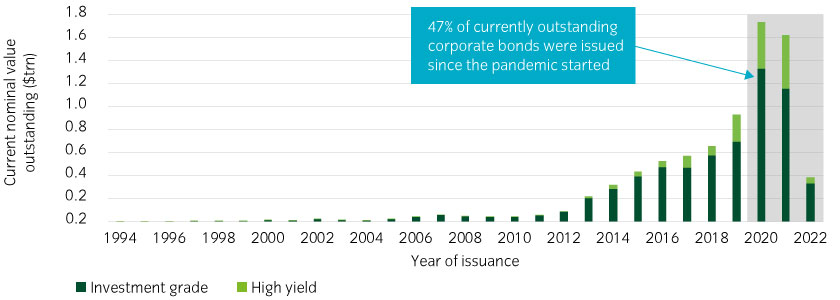

Corporates have also locked in historically low rates for longer. The average maturity of the investment grade index3 is now at its longest since the turn of the millennium (Figure 3).

Figure 3: Corporates have extended their maturities, meaning they have locked in lower rates for longer4

As such, as inflation rises, fixed rate debt loads and interest costs are falling in real terms, but real earnings are holding firm for companies that can pass on higher input prices to consumers.

In other words, corporate leverage is being ”inflated away”, helping many corporates “grow into” their capital structures. This is particularly good news for upgrade candidates, such as prospective rising stars5.

Inflation has also created potentially compelling entry points for corporate credit

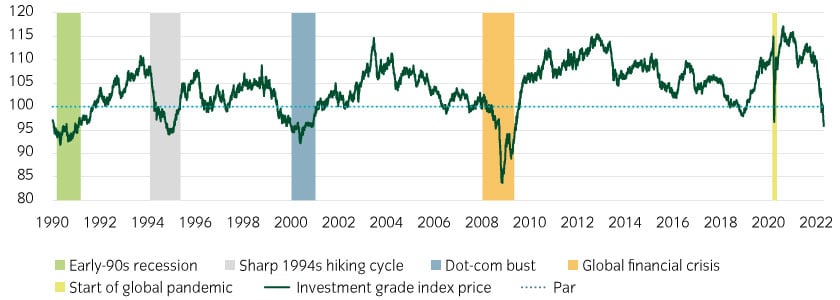

The average price of the investment grade corporate index recently fell below par to levels it has only tended to reach during crises or recessions (Figure 4).

Figure 4: The investment grade bond index is unusually below par, indicating opportunity6

Newly issued debt has notably borne the brunt. $1.3trn and $1.1trn of investment grade bonds were issued in 2020 and 2021, respectively, and the average price of those bonds has fallen to below ~90% of par. This essentially represents a saving for issuers that have raised that debt when rates and credit spreads were narrower.

For new investors, this could be a compelling entry point.

US, rather than international, corporates may be best placed to weather inflation

Nonetheless, for corporate investors concerned about inflation, we believe they may wish to implement a “home bias”, prioritizing US companies with domestically-focused revenues over those more reliant on European business.

The ability of corporates to continue passing on higher input costs depends largely on the buying power of the consumer.

In our view, the US consumer is better placed than global peers to weather inflation, due in large part to the particularly aggressive fiscal stimulus policies enacted in the US since the start of the pandemic, where (unlike other countries) incomes rose for the poorest Americans, allowing the consumer to amass $3trn of excess savings relative to pre-pandemic trends.

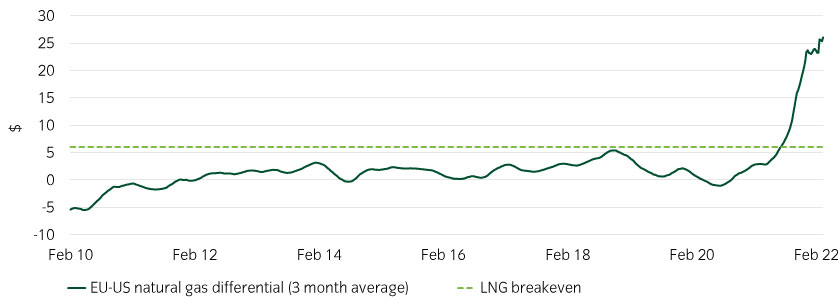

Further, Russia’s war in Ukraine has greater implications for European consumers, given the reliance on imported liquid natural gas (LNG), which has resulted in a record differential between US and European natural gas prices. This is well above the breakeven level, by which US producers profit from selling into Europe (Figure 5).

Figure 5: Natural gas prices provide a large headwind for European consumers relative to the US7

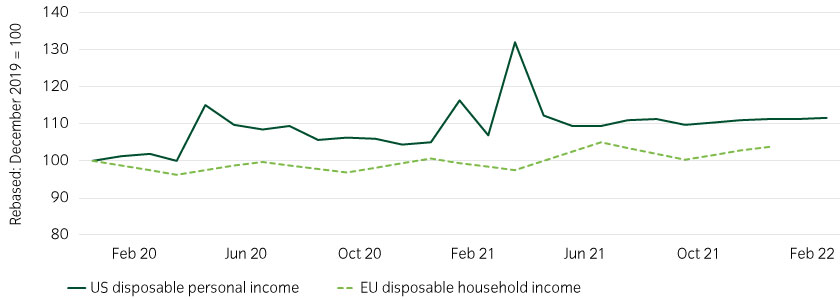

US consumer incomes also look healthier than their European counterparts at present (Figure 6), which we believe offers further support to US corporates.

Figure 6: The US consumer incomes are outpacing those in Europe8

We estimate US consumers could take on $400bn of debt and still be less levered than Q4 2019, reflecting strong consumer leverage metrics today (Figure 7).

Figure 7: US consumer balance sheets are in historically strong shape9

Playing inflation-related credit opportunities

In credit markets, we believe investors should focus on companies that have strong pricing power and less exposure to commodities. We also believe investors should skew their credit portfolios towards to the US economy.

Pricing power is key

Large, concentrated industries that sell lower-priced items (like supermarkets or soft drink manufacturers) are examples of industries with strong pricing power. It also may include services companies like software companies, over services companies like restaurants.

Focus on those benefiting, or insulated from, energy costs

Investors may wish to be cautious around energy-intensive heavy industrials and high yield companies involved in processing primary food ingredients such as soy, corn, wheat and edible oils.

We believe investors also need to be able to pick the winners and losers within energy markets through security selection. The most robust companies in our view will include oil and exploration and production (E&P) companies, which have a direct feedthrough from input costs to output prices.

Consider relative value in US versus European credit

Investors may also consider opportunities to take long positions in companies with revenues focused on the domestic US market. They also may wish to consider relative value trades long US companies versus their European counterparts. An example would be picking a choice US autos name and playing it against a European competitor as a spread differential play.

Consider selective emerging market (EM) debt entry points

In many instances, inflation is an older story in EM, and many central banks are way ahead of the Fed, having been tightening policy rates above long-term “neutral” levels for over six months. Further, energy-exporting nations have benefited from upward pressure in global commodity markets. In particular, areas like Latin America look attractive to us, as real yields are well into positive territory. Country selection is crucial, as those exposed to both higher commodity prices and a strengthening dollar could be particularly vulnerable.

Turning inflation into a positive requires care

We believe many will be able to naturally deleverage through this period of high inflation, particularly if they have pricing power and have termed out debt.

Further, as long as cyclical indicators such as consumption and business investment remain robust, we believe it can bode well for many corporates. This means potential opportunities for careful and selective credit investors. In our view, it could therefore be a good time to consider entry points into certain areas of credit.

United States

United States