Latest views

New World Disorder

15 May 2024

At a time of heightened geopolitical risk, the world’s leading superpower will be heading to the polls to choose a new president. It is hard to remember a time of greater division, and the two candidates will have very different approaches to the world’s problems.

The Politics of ESG

7 May 2024

Sustainability is often viewed as extraneous to a business. However, managing the impact of externalities is a precondition for any business.

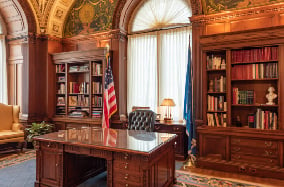

US Election 2024: An early look

3 May 2024

An early look at implications of the US Presidential election.

Archive

The AI awakening: Productivity and the future of work

1 May 2024

Erik Brynjolfsson, one of the most-cited authors on the economics of information, examines the potential effects that artificial intelligence may produce on economies, living standards and society.

The unexpected resilience of global housing markets

19 March 2024

Global housing markets have held up better than expected through the rate hiking cycle. We think this strength could mean a slower rate cutting cycle than markets expect.

The scientific scrutiny of sustainability

11 March 2024

Alex Edmans, Professor of Finance at London Business School, explains how confirmation bias can be a challenge when it comes to sustainability and investment.

China: potential growth – lower for longer

14 February 2024

We continue to have a bearish view for Chinese growth over the medium term relative to current market expectations.

Asset returns post rate peaks

30 January 2024

Markets are pricing in the end of the rate cycle, and if they are correct then asset prices have historically performed well in the period between the last hike and the first cut.

Ireland

Ireland