- ESG risks can be material drivers of default risk and investment returns in fixed income portfolios, as well as drivers of systemic risk.

- There is no clear consensus on the financial impact of ESG risks, meaning there could be significant opportunities for investors who identify ESG risks that are material for the price of a bond.

- The nature of ESG risks is that unanimity on how to assess them is not feasible, in our view. An evidence-based approach to such assessments, ideally based on transparent and comparable data, is necessary.

ESG risks can be material drivers of investment risk – but their complexity means analysis is necessary

The potential materiality of ESG risks for fixed income investors is clear

The core focus for fixed income investors is the risk of an impairment to their coupons or return of principal. Any material risk that could affect whether an issuer fulfils these obligations – including ESG risks – will be relevant to investors’ analysis.

The potential materiality of ESG risks is widely acknowledged. There are many examples of such risks having a material impact on the pricing of a bond, or leading issuers to default. Global credit ratings agencies now incorporate ESG evaluation within their analysis1, and the UN-supported Principles for Responsible Investment has established the ESG in Credit Risk and Ratings Initiative to “enhance the transparent and systematic integration of ESG factors in credit risk analysis”2.

The limitations of ESG ratings – and why analysis by investors is crucial

Data on a wide range of ESG metrics is increasingly available from corporate and sovereign debt issuers, but disclosures remain inconsistent and global standards are still in development3. Regulators are also proposing various mandatory disclosures, but approaches diverge across different regions – most notably between the US and EU – with significant controversy over such disclosures in some quarters.

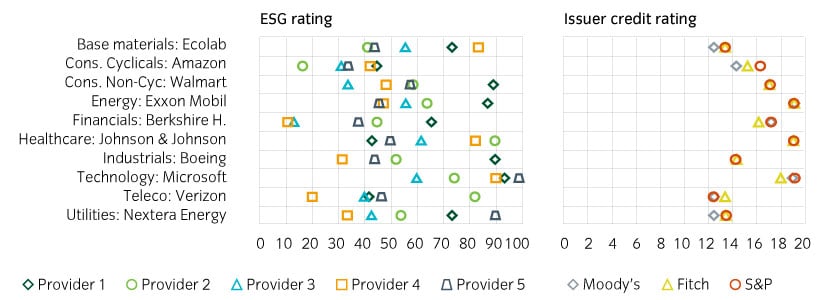

Investors can access a wide range of ESG ratings which aim to incorporate ESG metrics and highlight aspects of entities’ ESG performance, but the purposes, methodologies and underlying assumptions of ESG ratings providers vary, sometimes leading to a wide spread in ESG ratings for a single issuer. This is particularly clear when compared with credit ratings for issuers, which are typically closely correlated (see Figure 1).

Figure 1: For specific companies ESG ratings can vary widely, while credit ratings are typically very similar4

The inconsistency and variance in the availability and applicability of ESG ratings, means that it is crucial to understand exactly what the ratings are designed to highlight and how this relates to the objective of a particular fixed income portfolio. Engagement with issuers can also play a role in helping to understand the drivers behind an ESG rating. In our experience, how issuers report ESG data and metrics may not align with an ESG data provider’s methodology, leading in some cases to an ESG rating that does not reflect the reality, in our view.

|

Insight’s approach: These considerations led Insight to develop the Prime corporate and sovereign ESG risk ratings frameworks. These are based on ESG data from multiple inputs, adjusted using our in-house expertise, and they aim to more accurately and reliably reflect the risks that corporate issuers face. They aim to help our analysts and portfolio managers consider material ESG risks, informing their decision-making and engagement, and to enable tailored portfolios for clients requesting specific sustainability criteria. |

A lack of consensus on ESG risks means there are financial opportunities for investors

Investors may agree on the potential relevance and materiality of ESG risks for fixed income investments, but there is no clear consensus on the financial impact of such risks.

Investors may opt to use different ESG metrics or ESG ratings, leading them to different conclusions on ESG risks. They may also conduct their own analysis and engagements, and given the complexities of ESG risks and idiosyncrasies of different sectors or issuers, they may judge the relevance and materiality of specific risks differently.

Time horizons are also relevant. ESG risks may be more relevant for strategic credit portfolios, which typically aim to invest in fixed income assets on a long-term hold-to-maturity basis. Those impacts might range from short-term risks to a company’s creditworthiness or reputation, to longer-term concerns about commercial viability.

This is perhaps clearest when considering existing methodologies for pricing climate change risk. Whether for specific instruments, wider sectors or for an entire asset class, they tend to focus on backward-looking occurrences and probability distributions. These are unlikely to help investors effectively understand the impacts of an unprecedented, systemic phenomenon like climate change. As a result, we see significant scope for mispricing and a strong possibility of unintended outcomes when investment decisions are based on imperfect evaluation methodologies.

|

Insight’s view on thermal coal: Individual investments face pecuniary risks, while systemic risks also need to be considered. The details of our approach are explained in Insight’s position on thermal coal. |

Investors need evidence on the financial impact of ESG risks

Given the complexity of ESG risks and the different ways in which they could have a financial impact on fixed income portfolios, unanimity on how to assess them is not feasible, in our view. Global standards in development and regulatory proposals broadly focus on the disclosure of ESG metrics and data, but it will be up to investors to interpret their relevance and materiality for portfolios.

While investors’ approaches and conclusions may differ, they will need clear evidence on which to base their assessments. We therefore believe there is a need for transparent and comparable data on ESG-related issues, and more research to show how ESG risks can have an impact on default risk and/or financial returns.

- On transparency, we believe all investment strategies could benefit from more information regarding factors that affect their objectives. We therefore welcome initiatives, whether by regulators, industry bodies or other collaborative efforts, that seek to promote such transparency regarding ESG metrics and information – if they are relevant for investors’ decision making.

- On research, much of the academic research into how ESG factors influence investment performance has focused on listed equity markets rather than fixed income. This is understandable, given the transparency and simplicity of equity markets: the data is clean and each company usually has just one share class. But in fixed income markets, companies issue multiple bonds at a time with varying maturities, meaning benchmarks change far more often than those of listed equity markets. In addition, ESG data for fixed income securities can be patchy, presenting a barrier to research. However, given the significance of fixed income allocations for many investors, we believe more research to clarify the evidence around the importance of ESG risks is necessary.

|

Insight’s contribution to research: While the industry has a feeling for how ESG factors impact performance in fixed income, Insight felt it was important to commission a rigorous, independent academic study on the topic. Seeking to identify how much out or underperformance an ESG strategy would deliver would lead to spurious conclusions as the results would be dependent on the time period, market, ESG data source and method of implementation. Therefore, we asked Bayes Business School an open question to ‘assess the implications of applying ESG factors within a fixed income portfolio’. Bayes conducted detailed analysis on the benefits or otherwise of integrating ESG considerations into a European corporate bond portfolio, and explored how different ESG implementation strategies affected performance. We believe the study provides additional independent, academic support for the consideration of ESG risks in fixed income portfolios, gives investors a better understanding of the influences on performance and highlights that there are still many areas where further research would be helpful. More information is available here. |

Most read

Responsible investment, Fixed income

July 2022

Assessing the impact of ESG in Fixed income

Responsible investment

May 2022

Insight Investment's net-zero pledge

Responsible investment

May 2022

Insight's position on thermal coal

Responsible investment

December 2020