Why consider an overlay manager?

Many asset owners face structural challenges when trying to adjust portfolio positions swiftly. The sheer scale of their holdings can constrain flexibility, and changes often require coordination with external managers, slowing the process considerably. Even those with in-house investment teams may lack the trading infrastructure or market access necessary to ensure best execution.

This can be particularly frustrating when market movements present time-sensitive opportunities. Similarly, even a well-constructed strategic asset allocation may occasionally benefit from additional protection. In such moments, partnering with an overlay manager can offer valuable agility and support, helping asset owners respond effectively and stay aligned with their long-term objectives.

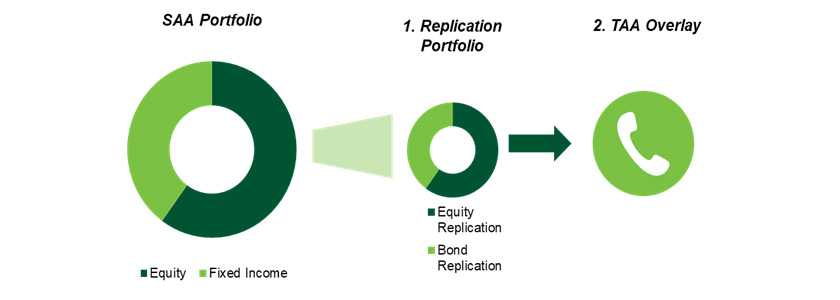

Capital efficiency and synthetic replication

One of the key advantages of an overlay solution is its capital efficiency. While implementing an overlay typically requires the client to liquidate a portion of their portfolio, the overlay manager can mitigate potential ‘cash drag’ by synthetically replicating the original exposure using instruments such as futures or total return swaps (TRS).

This synthetic replication – often referred to as the ‘replication portfolio’ – must be backed by a cash reserve to meet collateral requirements. The size of this reserve depends on factors including leverage limits and the collateral management framework. The remaining cash can then be redeployed as capital for the Tactical Asset Allocation (TAA) overlay.

Figure 1: Example of a client directed TAA overlay1

To illustrate this, consider a strategic asset allocation (SAA) comprising 60% MSCI All World Equity and 40% US Aggregate Bonds. This exposure can be efficiently replicated using instruments such as TRS or futures. If a client allocates US$100 million of capital, approximately US$30 million would typically be reserved as collateral to support the synthetic replication. The remaining US$70 million could then be deployed to implement derivative-based TAA adjustments.

In this example, the overlay manager maintains a synthetic version of the client’s SAA, ensuring it stays within agreed tracking error parameters. How the remaining capital is deployed depends on the client’s preferences and governance framework. The TAA overlay can be implemented in two primary ways:

- Client-directed overlay: The client retains full discretion, issuing specific instructions to the overlay manager regarding trades. This typically involves collaborative discussions around liquidity, execution, and the most suitable instruments to achieve the desired exposures.

- Collaborative design: The overlay manager works in partnership with the client to shape the TAA strategy. The objectives may vary depending on the underlying SAA, ranging from enhancing returns to providing downside protection during periods of market stress.

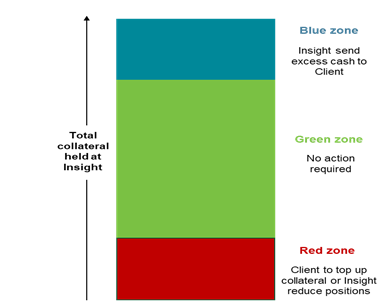

Collateral management: key to overlay mandates

Regardless of the implementation approach, a core responsibility of the overlay manager is to manage the derivative positions along with the associated collateral and margin movements. This function is central to any overlay mandate – and one where Insight brings deep expertise built over many years.

Collateral requirements fluctuate based on the performance of the derivative positions. For example, in a long equity total TRS, collateral must be posted as markets decline and is received as markets rise. To ensure transparency and operational efficiency, the client and overlay manager must agree on a framework for managing the collateral pool.

This framework typically includes two types of triggers for re-sizing the collateral pool:

- Time-based triggers: Scheduled reviews or resets, such as an annual rebalancing of the collateral reserve.

- Market-based triggers: These are responsive to market movements and the performance of derivative positions. If the collateral pool declines to a level where maintaining certain overlay positions becomes untenable, the client may need to inject additional capital. Conversely, if the pool grows beyond what is required, excess capital can be returned to the client by the overlay manager.

These arrangements are typically established at the outset of the mandate and involve calibrating margin thresholds based on the size and scope of the overall strategy.

Figure 2: Managing a collateral ‘waterfall’ framework1

Cash management: making your capital work for you

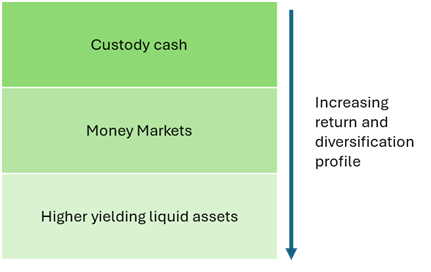

When capital is used as collateral, there are several options beyond simply holding cash in a custody account. It is essential that collateral is invested in highly liquid and readily accessible assets. To support this, Insight can invest collateral in a variety of separate or pooled strategies. These solutions typically provide higher yields than uninvested custody cash.

Figure 3: Making your cash work for you1

Extensive market access and best execution

A well-equipped overlay manager should provide clients with extensive market access to support best execution. As a specialist derivatives manager with decades of experience, Insight has cultivated deep relationships with clearing houses and counterparties, underpinned by robust IT, trading, and risk infrastructure designed to deliver institutional-grade execution.

Collateral management is a cornerstone of overlay strategies. Insight’s systems enable intra-day margin assessments, allowing for timely and precise management of collateral flows. Insight’s extensive use of derivatives means we have developed what we believe are industry leading processes.

Some overlay mandates include instructions to execute trades when specific market levels are reached. To support this, Insight has developed proprietary monitoring systems that enable market-based triggers across any instrument with live pricing feeds. These systems provide early alerts and a transparent view of proximity to trigger thresholds, allowing portfolio managers to anticipate and plan the most effective course of action. Insight also has a dedicated derivatives legal team to assist clients with documentation setup and provide ongoing support.

Additional services Insight can offer

As noted earlier, overlay mandates can take many forms. Even when clients retain full discretion over TAA decisions, Insight can add value by offering market perspectives and drawing on over two decades of TAA expertise. When evaluating potential TAA adjustments, Insight can support clients with proprietary tools developed through its own TAA processes, including:

- Derivative-based index replication tools

- Market technical screeners and back-testing platforms

- Relative value dashboards

- Index option strategy screeners with back-testing capabilities

Once a TAA trade is identified, Insight can provide detailed pre-trade assessments, covering:

- Liquidity analysis

- Review of alternative instruments for efficient implementation

- Evaluation of margin implications

- Indicative trading cost estimates

With deep experience in asset allocation and TAA, Insight is well-positioned to help design overlay strategies tailored to each client’s objectives. For many, the goal of a TAA overlay is to introduce a defensive layer – whether to mitigate moderate equity market drawdowns or to protect against more severe dislocations. Insight follows a structured four-stage process to develop bespoke overlays aligned with client needs. Please contact us for more information on this.