Deals with the UK and China suggest the US is beginning to de-escalate its trade war – but tariffs are still likely to have a meaningful impact on growth and inflation. We consider these dynamics and how it changes the outlook for the global economy.

De-escalation deals

The UK/US trade framework agreement: announced 8 May 2025

The framework agreement, announced on the anniversary of VE Day, was a public relations success for both the US and UK governments. The Trump administration needed to show positive results from its tariffs policy, while the Labour government in the UK received applause, even from some opposition members, for striking a deal with the US after eight years of post-Brexit Conservative governments failed to do so.

Key details of the agreement include:

- The 10% baseline tariff will remain, consistent with the view that it is primarily for raising revenue and not up for negotiation.

- The 25% tariffs on steel and aluminum will be scrapped entirely, providing a lifeline for the struggling UK steel industry.

- A quota of 100,000 cars will be subject to a low tariff rate of 10%, close to the number of cars exported to the US last year.

- In return, there are reciprocal tariff-free quotas for 13,000 tons of beef, benefiting US organic beef farmers, as there will be no reduction in food safety standards.

- The UK will scrap tariffs on US ethanol and implement economic security measures controlling exports of sensitive technologies or critical minerals.

Further negotiations over the next year will address changes to the UK digital services tax and Online Safety Act, as well as further opening the UK market to US agriculture and chemicals.

The China/US de-escalation agreement: announced 12 May 2025

The US-China agreement is far from a comprehensive deal, as it only temporary (for 90 days), then reverts to the status quo that most other countries enjoy following the 9 April tariff suspension. Currently, Chinese exporters to the US face a 30% tariff (comprising a 10% baseline tariff and a 20% punitive tariff for fentanyl, which could be reduced if fentanyl flows decrease), while US exporters to China face a 10% tariff. Additionally, Chinese export controls on critical minerals are temporarily eased.

Over the next 90 days, further negotiations are expected to address various aspects of the relationship. However, it is difficult to avoid the conclusion that China has gained more from this round, which may incentivize them to maintain a tough stance. This level of de-escalation from the US was surprising, as it contradicts the idea of thwarting China’s economic rise. Unlike the UK deal, there remains a possibility that tariffs on China could rise again after 12 August.

Nevertheless, even if temporary, the 115% decline in bilateral tariff rates will be sufficient to restart transpacific trade. As a result, US consumers may face higher prices rather than empty shelves.

Revisiting the impact on growth

The 9 April announcements introduced significantly higher tariffs on China while lowering tariffs for much of the rest of the world. This resulted in a slight increase in the overall effective tariff rate to around 25%-27%. However, the de-escalation last weekend has brought the overall effective tariff rate back down to approximately 15%-17%.

Although this rate is still considerably higher than the average rate of around 2.5% in 2024, the impact will be less severe than it would have been last week. The higher tariff rate will still cause a supply shock, leading to weaker growth globally and higher inflation in the US.

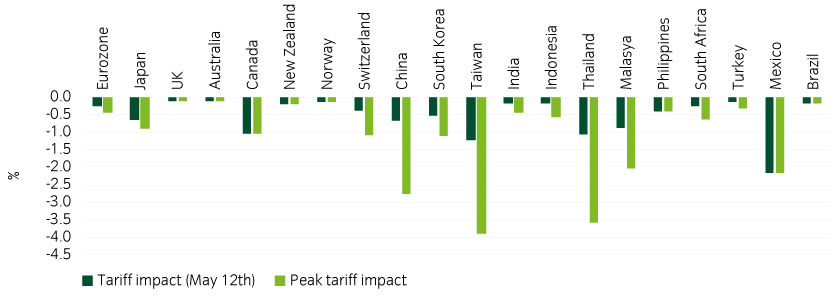

We can reassess the direct trade impact on countries by comparing the current tariff levels to the peak tariffs for each country (see Figure 1). It’s important to note that the US-UK deal has had minimal impact on the UK overall. The peak effective tariffs for Canada and Mexico were higher than shown here before exemptions were agreed upon, reflecting the highest point since 2 April.

Figure 1: Impact of tariff announcements YTD (Exposure US % GDP x tariff change)1

The impact of uncertainty through the confidence channel is inherently difficult to forecast due to the unpredictable nature of market sentiment. While confidence may be improving, particularly in the financial markets, it is challenging to argue that overall uncertainty is significantly decreasing. We estimate the overall impact on GDP relative to baseline forecasts in Table 1 but acknowledge that forecasting uncertainty is extremely high.

Table 1: Estimated total impact on GDP relative to baseline forecasts2

| Estimated impact on GDP | |

| US |

-1.0% |

| China |

-1.2% |

| EU |

-0.6% |

| Japan |

-1.0% |

| UK |

-0.5% |

Impact on US inflation

The impact of tariffs on the US is complex. While higher tariffs clearly increase import costs in the short term, margin compression may partially mitigate the pass-through to consumer prices. On the other hand, weaker growth will have a dampening effect on inflation, though not as quickly.

With tariffs on China being somewhat higher than those on other countries, there will be some substitution effects as importers shift to non-Chinese products. This will reduce the inflation impact over time, although this process will be slower at a tariff rate of 30% than it would have been at 145%.

The Yale Budget Lab estimates a 1.7% increase in price levels from the 2025 tariffs to date, declining to 1.4% over the longer run due to substitution effects. These numbers were previously at 2.9% and 1.7%, respectively, prior to the 12 May. The UBS scenarios from 2 April, which assumed no significant margin compression, showed similar figures. Bloomberg Economics also projects an impact on core PCE of 0.9%, rising to 1.4% if tariffs on pharmaceuticals and semiconductors come into force as expected.

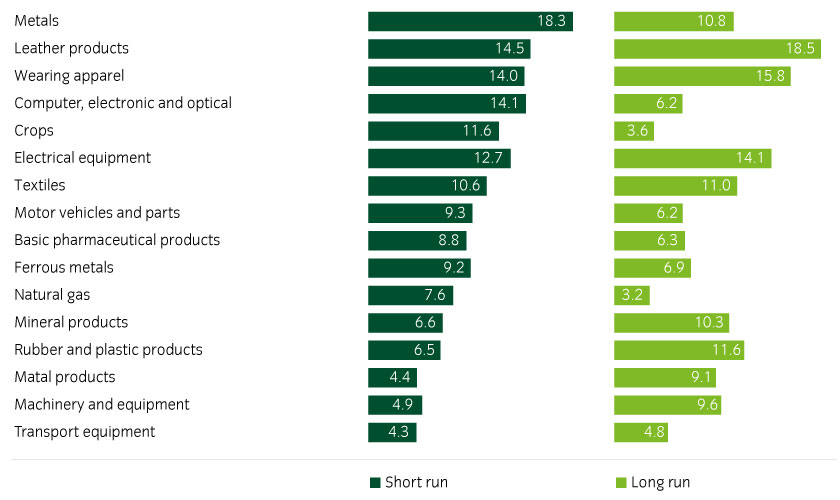

Yale breaks down the effects on different products, showing that clothing and textiles, machinery (particularly electrical equipment), metals, and motor vehicles are all facing significantly higher price levels (see Figure 2).

Figure 2: Yale Budget Lab price effects from 2025 tariffs through 12 May, % change to price level3

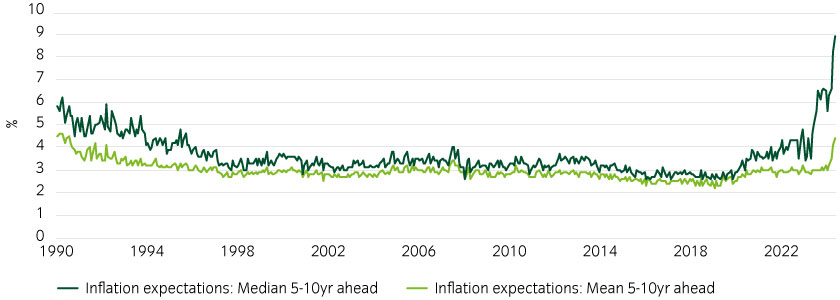

Consumer expectations on inflation are currently surging, surpassing levels seen during the high inflation periods of recent years, even for longer-term expectations (see Figure 3). This suggests that inflation expectations are becoming de-anchored, which ought to be very concerning to the Federal reserve.

Figure 3: University of Michigan expected inflation rate4

It is reasonable to expect some pass-through into US prices, based on recent corporate earnings updates. Initially, this could result in a 0.9% to 1.3% increase in the inflation rate, which will likely decrease over time as substitution effects come into play. This increase will be at least partially offset by lower energy and services prices, which are expected to rise gradually.

For the rest of the world, the negative impact on growth will be a dominant driver of inflation. Falling oil prices, due to lower global demand, will see the fastest pass-through. Additionally, a weaker US dollar will amplify this effect for some economies. There is also potential for downward pressure on goods prices as a result of redirected trade flows if China attempts to dump excess production on the rest of the world.

Implications for markets

- Risk assets are not clearly pricing in the likely slowdown in growth, and the policy response so far has been insufficient to counter the negative headwinds facing the global economy. To see a significant change in the outlook, we need one of the following:

- Significant Fed cuts: This is unlikely before unemployment rises, given the current inflation outlook and expectations.

- A significant change in tariff policy: Although the easing in tensions between the US and China is welcome, reducing the overall effective tariff rate back to pre-trade-war levels seems very unlikely before significant economic pain, given the current level of ideology in the White House.

- Offsetting fiscal impulse: This could include tax cuts, subsidies, or other support for affected industries. This seems the most likely scenario, so keep an eye on budget bills going through Congress.

- Significant Fed cuts: This is unlikely before unemployment rises, given the current inflation outlook and expectations.

- In the meantime, we see downside risks to equities and credit as the economic impact feeds through over the summer.

- With growth slowing, we expect wider deficits, with steeper yield curves, particularly in the US. The Fed will likely be slow to react due to inflation risks until unemployment picks up, but should then accelerate the easing cycle, causing US rates to underperform initially but potentially catch up later.

- Risks of capital reallocation may see the US dollar struggling to maintain its lofty valuation, and we could potentially be at the start of a long-term bear market for the dollar. In the shorter term, a cautious Fed and higher yields relative to the rest of the world are likely to provide some support.