Contents

- Higher fixed income yields are back

- Meanwhile, the "TINA" equity story is less compelling

- Without extreme monetary stimulus, fixed income offers more certain returns

- The contractual nature of fixed income has been key to its consistency

- Fixed income has tended to be first to recover from significant corrections

- Time to start "averaging in"?

- Cashflow certainty and timing provide additional benefits from fixed income

- A multi-sector appraoch can potentially add value to a fixed income allocation

- There is no sensible alternative to fixed income?

Higher fixed income yields are back

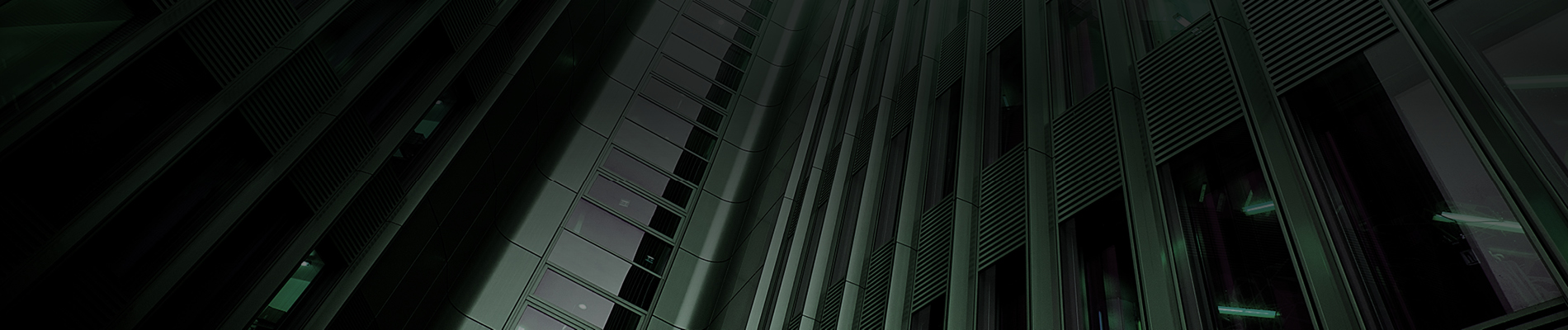

Fixed income yields more than doubled over 2022 across most market segments (Figure 1).

This does not just reflect higher credit risk, but a balance of rising “risk free” government bond yields and a wider credit spread premium (represented by the dark and light green bars, respectively).

Figure 1: Fixed income yields have generally more than doubled1

The (dark green) risk-free component across the fixed income spectrum alone now largely exceeds the total yield (including credit spread) on all the other sub-asset classes at the start of the year.

Meanwhile, the "TINA" equity story is less compelling

Since the global financial crisis of 2008, “TINA” (there is no alternative) became a key buzzword for equities. Yields were low in fixed income and the “Fed put” helped cushion downside equity risk. As a result, equity valuations rose well beyond those suggested by economic growth fundamentals alone (Figure 2).

Figure 2: In recent years equity markets rose far more than economic growth alone would suggest2

However, things changed dramatically in 2022 as the “Fed put” has disappeared for now, with the central bank forced to focus on managing sticky inflation. This has resulted in rising uncertainty and volatility. Equity markets have fallen into bear market territory3.

Without extreme monetary stimulus, fixed income offers more certain returns

Fixed income outperformed equities in the tumultuous 2000s

In our view, equity markets are significantly more vulnerable in a world transitioning away from extraordinary monetary policy. We expect corporate credit to be more resilient, given the contractual nature of returns.

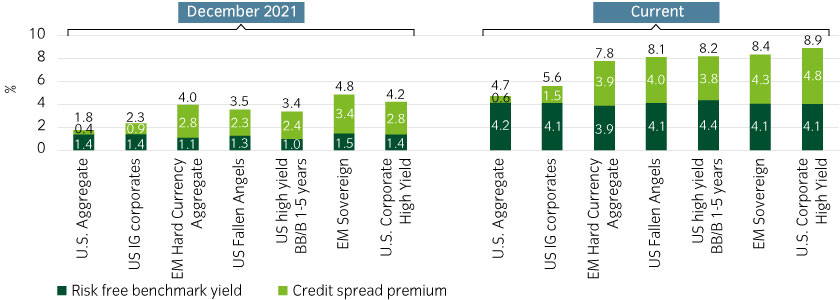

From 2010 to 2021 (a QE-heavy decade and before the recent drawdown), US equities (represented by the S&P 500 Index) returned 16.9% pa, but in the previous decade (a more tumultuous era with far less QE) they returned less than 0.5% pa (Figure 3).

Figure 3: Investment grade and high yield fared better in a less QE-driven decade4

However, investment grade markets (as represented by the as represented by the Bloomberg US Corporate High Yield Bond Index) actually delivered higher average returns in the decade with lower QE, at 6.8% versus 5.6%. Volatility was also relatively low in both periods. In our view, this indicates investment grade is a potentially dependable choice for a core fixed income allocation regardless of market conditions.

Similarly, high yield returns (as represented by the Bloomberg US Corporate High Yield Bond Index) were almost identical in both periods, again higher in the 2000s at 7.5% pa. versus 7.4% pa. Volatility, however, was somewhere between investment grade and equities, potentially making it more suitable as a direct equity replacement for those with higher risk appetite or as a more strategic or tactical allocation.

The contractual nature of fixed income has been key to its consistency

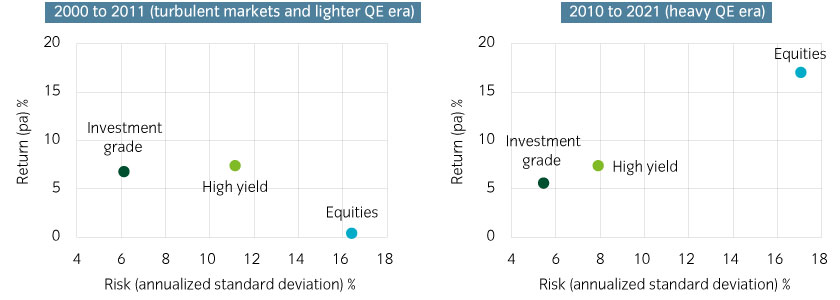

The divergence between fixed income and equity performance is largely explained by the fact that fixed income returns are contractual in nature (i.e. underpinned by legal documentation defining a coupon schedule and principal repayments).

If a credit-worthy bond is held to maturity, its returns are determined at the point of purchase, regardless of market volatility (except when early redemption options are exercised).

As such, day-to-day price fluctuations have very little influence on long-term corporate credit returns. Contractual income (i.e. coupons) has instead been the key factor, unlike in equity markets (Figure 4).

Figure 4: Income (i.e. coupons) overwhelmingly determine fixed income returns5

By contrast, large-cap equities (the most likely to pay dividends) have delivered the majority of their long-term returns through price movements. As such, uncertainty has tended to weigh more heavily on them.

Fixed income has tended to be first to recover from significant corrections

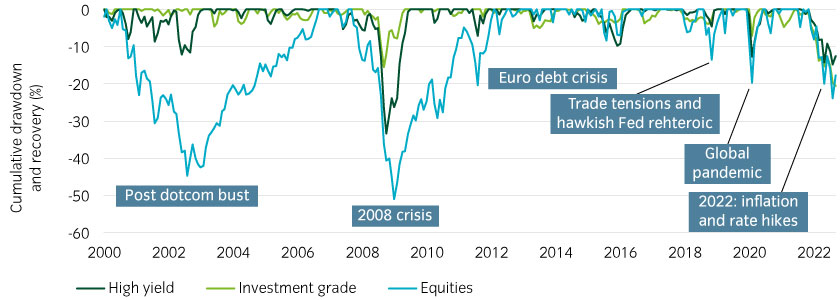

Historically, fixed income markets have recovered far quicker from drawdowns than equities. In the early 2000s, investment grade drawdowns were also particularly small by comparison (Figure 5).The “pull to par” effect as bonds reach maturity tends to cushion the impact of price falls and aid recoveries.

Figure 5: Fixed income markets have historically recovered much faster from drawdowns than equities6

Given the lack of central bank assistance, we believe the current drawdown will potentially result in a slower recovery, more reminiscent of the early 2000s or following the 2008 crisis. During both periods, corporate bond markets recovered sharply but equity markets did not.

Time to start "averaging in"?

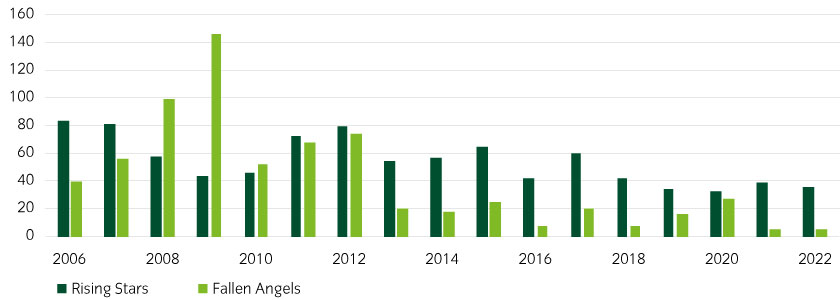

Understandably, investors may be concerned about further sell-offs in fixed income, as well as the potential for rising downgrades and defaults.

Investment grade defaults have historically been negligible, as struggling names tend to get downgraded into high yield before defaulting. As such, investment grade may be compelling for those concerned about credit risks rising.

In high yield we do expect defaults to rise toward historical averages. The good news is that on the high yield index7, the longer-term average annual default rate is only 1.5% pa, lower than ratings agency estimates that tend to be closer to 3-5%.

Meanwhile, despite rising uncertainty this year, credit rating downgrades have not risen (Figure 6), but we expect to see more of a balance between upgrades and downgrades looking ahead, we do not expect a worse outcome as long as we avoid a deep recession.

Figure 6: Downgrades have not yet meaningfully accelerated, but we expect a moderate rise8

However, we do not believe that high downgrades and defaults will spike to levels seen in deep recessions, such as 2008. We believe corporate balance sheets are starting from a strong position, and 55% of outstanding high yield bonds and 32% of outstanding investment grade bonds were issued in 2020 or 20219 and therefore fixed when yields were at historical lows. We believe current yields and credit spreads offer healthy compensation for the risks.

Nonetheless, perfectly timing market turning points is incredibly difficult. We believe cautious investors may at least wish to consider first allocating more to their core investment grade allocation while also potentially dipping their toes into high yield, to provide the optionality to “average in” to both markets should yields rise further, while avoiding the “regret risk” of being uninvested if markets were to rally instead.

Cashflow certainty and timing provide additional benefits from fixed income

As well as a potential alternative to equities, a higher yielding environment offers clear benefits to solutions-focused investors, such as pension plans.

Relatively large and predictable income streams make it easier to construct portfolios that can offer a cashflow match against liabilities, reducing the risk that investors will be subject to “forced selling” of investments to meet their obligations.

As a result, we expect to see rising institutional demand across the fixed income markets, particularly investment grade, as investors look to lock in the returns while they are available.

A multi-sector appraoch can potentially add value to a fixed income allocation

Currently, investors looking to allocate to a high credit quality portfolio may achieve a 6% yield on investment grade indices. We believe that with an active and flexible multi-sector approach to portfolio construction, up to ~7% or ~7.5% is possible.

We believe active multi-sector investors can enhance returns by embracing BBB credit as the center of gravity for an investment grade allocation, while complementing the allocation with tactical exposure to areas such as global credit, high yield, emerging market debt and structured credit.

In high yield, investors can currently achieve more than a 9% yield. If they wish to avoid the lowest quality areas and focus on BB and B rated credit, we believe they may still achieve yields in the region of ~8% to ~9%.

Within an active multi-sector approach, we believe that investors should emphasize security selection and sub-sector selection with strong underlying asset coverage and good visibility of revenues, earnings, and cashflows. There are several sub-sectors that are still recovering from the height of the pandemic (such as autos, discretionary healthcare spending or aerospace manufacturing) and “secular winners” such as companies benefiting from corporate software investment, defense spending or from the continuing transition to digital media and online retail.

For those looking to allocate to high yield, we believe an Efficient Beta approach, targeting High Yield or Fallen Angels, can help investors overcome transaction costs to deliver returns reliably, by leveraging the ETF trading infrastructure and implementing quantitative factor-based approaches to alpha.

There is no sensible alternative to fixed income?

We believe TINA is no longer an equity story. If anything, we think it now applies to fixed income, specifically investment grade and high yield credit.

Investors have waited for years for fixed income assets to offer compelling yield again. We believe now is the time to formulate a strategy to seek to harvest these yields while they are available.

United States

United States