Liquidity may pose underappreciated risks for institutional investors. We think implementing customized strategies to manage it are becoming increasingly essential.

Liquidity – the most underappreciated risk for institutions?

Liquidity risk is emerging as a critical challenge for institutional investors amid shifting demographics, market volatility, and political uncertainty.

Cashflow obligations are rising

Pension plans’ transition from accumulation to decumulation is accelerating. Nearly half of US plans are paying out more than 7% of assets annually in benefits, with net outflows nearing $200bn1. Endowments are also confronting growing liquidity pressures as they balance long-term investment horizons with near-term funding needs.

Selling assets to meet cashflows can be painful

Without cash in hand at the right time, institutions are forced to sell assets to meet their liquidity needs. This can incur painful transaction costs, of up to 190bp in stressed markets or an entire 30% for illiquid private assets (Figure 2). We have observed endowments increasingly resort to selling private assets and issuing debt to manage cashflow and maintain operational continuity.

Figure 1: Transaction costs can be prohibitive for those forced to sell assets to meet obligations1

Even when equities (typically among the most liquid assets) can be sold, poorly timed forced sales can significantly undermine a portfolio’s long-term growth potential. For example, if we consider a $1bn investment in the S&P 500 Index in 1999. If it were forced to sell just $50m per year (excluding trading costs), it would have crystallized painful losses for the first decade, leaving it with less capital to then participate in the stronger returns that were generated from 2011 onward (Figure 2).

Figure 2: Forced selling at the wrong time can impair asset growth2

Investors are increasingly considering liquidity solutions

In response to these challenges, many institutions are reassessing their asset allocation strategies, particularly if they have significant exposure to private assets. This reflects a broader shift to shorter portfolio durations and more robust liquidity profiles.

We believe this underscores the importance of proactive liquidity management – ensuring obligations are met without compromising investment discipline and enhancing portfolio resilience amid policy or market uncertainty.

Turning liquidity from a risk to a strategic advantage

We believe that incorporating a dedicated liquidity strategy can address the potential downsides of liquidity risks and unlock new opportunities within an overall portfolio.

We believe that effective liquidity management includes the following strategies:

1) Maturing contractual assets that offer regular cash inflows

Assets with contractual cashflows, such as high-quality bonds, can offer a predictable schedule of cashflows that an investor can align to their most certain cash requirements.

These assets naturally generate cash inflows. If the assets are purchased with the intent to hold to maturity, they do not need to be sold, with default risk replacing volatility as the primary risk to manage. When constructing portfolios, Insight’s large team of credit analysts aim to screen for bonds with low default probabilities and robust structural protections. We also believe in semi-actively managing assets on a relative-value “switching basis” with the aim of enhancing risk-adjusted returns over time.

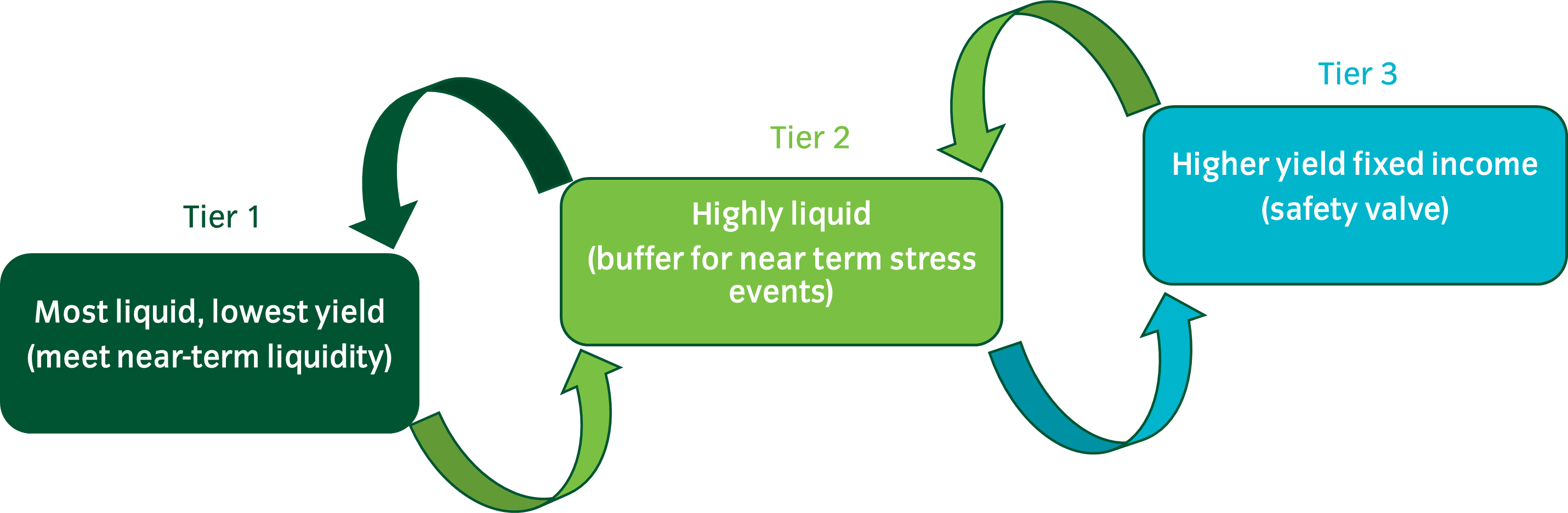

2) Tiered portfolios of assets that can be sold quickly

For less predictable liquidity demands – such as variation margin calls or lump-sum outflows – investors can maintain dedicated liquidity portfolios comprising low-volatility, short-duration assets that can be readily sold to meet cash needs. Tiering portfolios into a “waterfall” structure balance return generation with drawdown risk.

Investors can hold their most liquid assets in the “lower” tiers to meet day-to-day working capital or regular cash requirements. They would expect to sell “upper” tier assets (which can act as a safety valve) less frequently, as such they can be slightly less liquid and higher yielding.

The size of each tier should reflect the likelihood of needing to sell assets from higher tiers, as well as the additional yield and volatility they offer – helping to minimize the risk of drawing on principal when liquidity needs to be raised from these tiers.

Figure 3: We believe tiering assets may be an efficient way to meet expected and unexpected cash needs3

Lower “tier 1” assets may include an enhanced cash strategy or ultra short duration asset backed securities. Multi-sector credit, intermediate or longer-dated asset-backed securities or even high yield credit (particularly if managed systematically using a highly liquid credit portfolio trading portfolio) may be appropriate for the higher tiers.

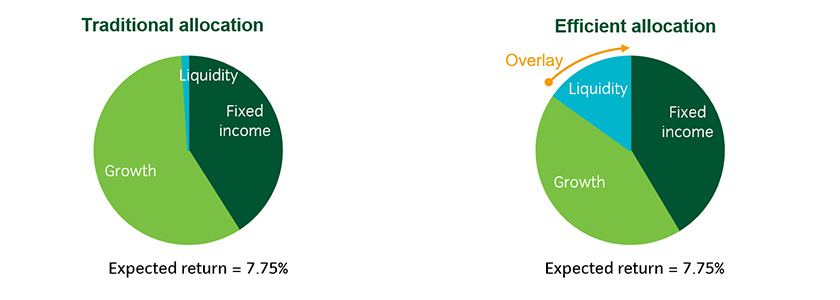

3) Overlay strategies can aim to raise liquidity in a capital-efficient way

Derivative strategies can allow investors to raise cash in a capital efficient manner without losing market exposure, by allowing investors to sell physical assets and replace the exposure synthetically.

Figure 4: Overlay strategies can potentially enhance portfolio liquidity4

Investors can consider tools such as futures swaps to closely replicate Treasury, credit or public equity exposures. Replicating alternative asset exposures may be harder to achieve with a high degree of precision, however, so investors would need to accept a higher tracking error.

Turning liquidity into a source of strength

In a world where the rules are constantly changing, in our view, liquidity is not just a defensive tool it is a strategic asset.

In our view, an investor that does not need to worry about selling assets to meet obligations may be able to accept greater liquidity risks across the rest of their portfolio. A liquidity solution can buy breathing room for assets like high yield debt, equities, alternatives and private debt the opportunity to deliver returns over the fullness of time, with less risk that they will need to be unexpectedly liquidated.

Insight’s commitment to clients

Insight is committed to partnership with our clients. We work closely with every client to understand their unique cashflows, regulatory constraints, and investment policies. From there, we build customized liquidity solutions, integrating short-term fixed income, overlay strategies, and cashflow matching techniques that align asset maturities with projected outflows.

Insight has $853.4bn in assets under management including over $180bn in liquidity solutions under management5. Insight has $668.4bn in OTC derivative exposure, offering scale, expertise, and innovation to help clients meet their objectives.