Natural capital explained

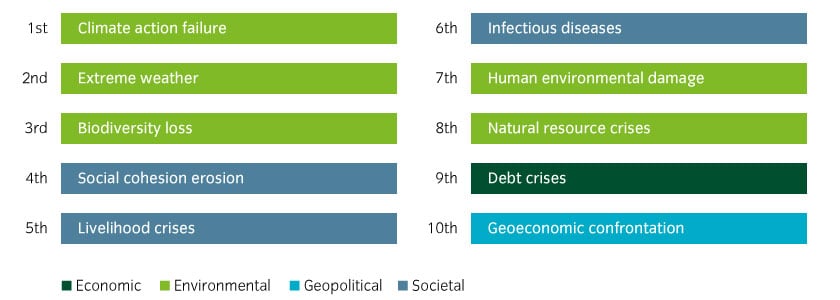

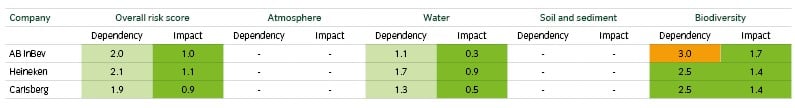

Each year, the World Economic Forum (WEF) publishes a paper entitled the Global Risk Landscape, which incorporates a survey of nearly 1,000 global experts and leaders on their perception of global risks. The latest survey results, published in early 2022, identified the three “most severe risks on a global scale over the next 10 years” as climate action failure, extreme weather, and biodiversity loss respectively (see Figure 1). Natural resource crises are also cited as one of the most severe risks on the same timeframe.

Figure 1: The most severe risks on a global scale over the next 10 years

Source: World Economic Forum Global Risks Perception Survey 2021-2022.

These risks are linked directly to the depletion of natural capital, the world’s stock of natural assets. Natural capital typically refers to four types of assets:

- biodiversity

- water

- atmosphere

- soil and sediments.

The benefits flowing from natural capital to people and businesses are known as ecosystem services. These services are fundamental necessities for human well-being and a bedrock of many aspects of the global economy.

While it is becoming commonplace for investors and asset owners to act on reducing climate change risk in their portfolios, natural capital risk has received less scrutiny. However, progress is being made. Initiatives are in progress to understand the specific implications for investors, such as the Taskforce on Nature-related Financial Disclosures (TNFD), which is developing a framework for disclosures and risk management.1

Below, we show how a framework can help with analysis of companies within a specific sector - the brewing sector - demonstrating the relevance of natural capital risk for investors and how it might be meaningfully and practically assessed.

The US$13 trillion exposure: one third of global economic value generation is highly dependent on natural capital

In 2020, PwC estimated that over US$40 trillion of economic value generation (more than half of global total GDP) is moderately or highly dependent on nature and its services2. Of this, industries highly dependent on nature – such as agriculture, fishing, mining, and tourism – account for around US$13 trillion.

Businesses do not have to be based in an area of natural capital depletion to feel the effects of this dependency. Of the 20 countries richest in biodiversity, 11 are categorised as key global exporters3. Globalisation means that many businesses will have some potential risk exposure to these biodiversity-rich regions, be that a factory or an office space or a link through their wider supply chain.

Despite the clear importance of natural capital to the global economy, many have historically ignored the – often devastating – effect that human and business activities have had on the biome and the resultant unsustainable depletion of natural capital. A key measure of the depletion of biodiversity specifically is the WWF Living Planet Index. In 2020 it recorded that biodiversity declined by 68% between 1970 and 2016 resulting from land use change, land exploitation, climate change, pollution and the introduction of foreign species.

How to assess natural capital risk

What methodology and data sources could be used?

There are challenges in effectively deciphering the natural capital risk associated with companies. There are no universally agreed metrics to assess a company’s exposure to natural capital risk and it will likely be some time until there is such agreement.

Science-based targets (SBTs), a growing focus of interest within the financial industry, offer a way forward. SBTs are measurable, actionable, time-bound objectives, anchored in scientific evidence and research that can be aligned with goals and targets set by international bodies (for ESG matters, the UN Sustainable Development Goals are one such yardstick).

In considering how to assess natural capital risk, we established an initial framework, adapting the initial steps in setting an SBT to create an assessment of natural capital risk which we believe is industry- and location-specific. The data sources used are largely freely available and recommended by the online specialist data aggregator ENCORE, which was set up to help financial institutions better understand and assess and integrate natural capital risks in their activities4. We also used data from CDP and MSCI when conducting our mitigation analysis.

What does Insight’s framework analyse?

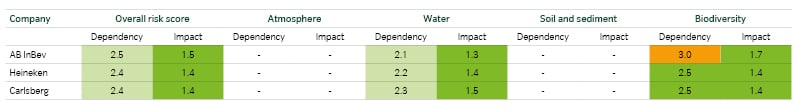

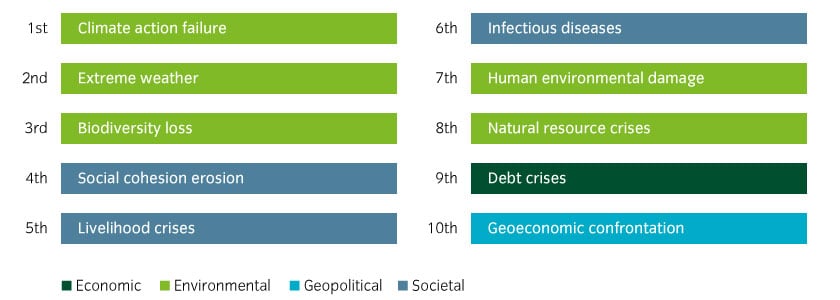

In seeking to demonstrate that natural capital risk could be meaningfully analysed, our approach aimed to rank companies’ dependency and impact on ecosystem services, depending on their locations in relation to natural capital depletion hotspots. The framework reflects three broad stages:

- Industry-level materiality assessment – We firstly formed a view on the risk facing a company's industry. We analysed natural capital dependence and impact at an industry level and identified the industries most exposed to different risk types through their value chain.

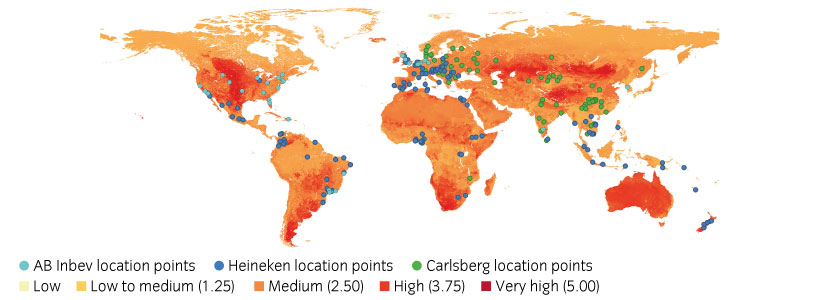

- Geospatial mapping – Next, we assessed a company’s geographic exposure to capital depletion risks by mapping the locations of company operations to capital depletion hotspots. It is important to do this as natural capital is not declining at the same rate globally and to capture the diversity of ecosystem services.

- Mitigation analysis – Finally, we adjusted any ratings based on an issuer’s risk-mitigation strategies. We recognise that companies can take steps to both minimise their damage to the environment and to reduce their risk exposure to natural capital assets depletion. It is in mitigation actions that a company can exercise the most control and where, as investors, we can wield the most influence through engagements.

Case study – assessing natural capital risk to brewing companies

Once measured, natural capital risk can be incorporated into the overall risk assessment of companies. We believe natural capital risk to be more material over long time horizons, and therefore the inclusion of natural capital risk assessment will be most pertinent in long-term buy and maintain bond mandates and those with a specific ESG focus.

We used our framework to consider the investment implications of natural capital risk for the holdings of brewing companies in buy and maintain mandates. Brewing companies present an interesting case study: Insight holds a number of long-dated bonds in this sector partly because we believe they are less vulnerable to structural changes, such as those resulting from climate change and technological shifts. Therefore, they may be perceived as being relatively ‘safe’ when viewed through the lens of long-term risk.

However, our framework showed they can bear significant natural capital risk.

We chose to illustrate the risk presented to the brewing sector by analysing three brewers for which Insight had holdings: AB InBev, Heineken, and Carlsberg.