Summary

- Plans are in pole position, but need a change of set up

- A "pit-stop" on your de-risking journey: An "intermediate" rather than full de-risking

- Evaluating high yield and convertible bonds as a step between equity and fixed income

- Taking the checkered flag

Many pension plan investors have historically ignored high yield and convertible bonds. However, as their funded statuses have improved, now might be the time to consider them as an intermediate de-risking step.

Many corporate pension plan sponsors have seen a significant uptick in funded status over the past year, and they are likely hitting de-risking glidepath triggers or refreshing asset/liability studies.

However, a wholesale asset allocation pivot from growth assets into bonds opens up the potential for “regret risk”, particularly if risk market conditions improve. Consequently, plan sponsors may wish to consider a “pit stop” (i.e. an intermediate de-risking step) into assets that retain some higher return potential of risk assets as well as the lower volatility of bonds.

Plans are in pole position, but need a change of set up

The average pension plan has reached full funding for the first time since 2008. Estimates show that funded status improved by more than 7% over fiscal year 2021 (Figure 1), driven by increases in discount rates as well as strong returns from equities and other growth assets.

While 2022 has been marked by alarming geopolitical events, inflationary pressures, and market volatility, pension funding has improved another 9%.

We believe continued interest rate increases will push more underhedged pension plans towards a fully funded position, regardless of equity market volatility.

Figure 1: The average pension plan is fully funded for the first time in years1

Red flags ahead

On the rates side, the market is already arguably fully pricing in the Fed’s hiking cycle.

On the equity side, it has been the worst start to a year since the 1930s2. Although it appears to be an ever-changing situation, a strong case can be made that the easy early-cycle equity gains have been made and the market will struggle as monetary policy tightens.

Furthermore, continued uncertainty appears inevitable, as demonstrated by alarming geopolitical events, exacerbated inflationary pressures, economic growth concerns and extreme volatility - just as the worst of the pandemic had appeared to pass.

In this volatile environment, we think the first order of business should be to reduce investment risk in order to protect these gains and mitigate future funded status volatility – this would increase the likelihood of a smoother ride on a potentially dangerous course.

A "pit-stop" on your de-risking journey: An "intermediate" rather than full de-risking

As plan sponsors move along their journey plans, we think they can consider a different approach rather than simply moving growth assets into high quality fixed income. We believe there is an opportunity to incorporate fixed income alternatives like high yield and convertibles due to their “hybrid” investment qualities and diversification benefits, particularly as liability-aware investors have historically excluded them. When pension assets are de-risked, equities are typically shifted into high quality corporate bonds and Treasuries with the idea that those types of bonds most closely mimic the required yield implied by the accounting discount rate. But why stick with a black-and-white approach when you can play in the gray, especially given the uncertainty surrounding corporate and Treasury bonds?

High yield and convertible bonds have qualities of both equities and bonds and therefore could be viewed as a logical steppingstone from riskier growth assets into safer hedging assets.

We see three potential benefits:

-

Reduce the risk profile of pension programs

-

Maintain some of the upside of growth assets

-

Reduce issuer concentration and diversify credit risks

In addition, we believe this approach decreases the regret risk associated with making significant asset allocation decisions that change the risk/return profile of the program.

We recognize that there are also risks associated with these asset classes like drawdowns, liquidity and default risks. Therefore, we evaluate them below, addressing several misconceptions, partly due to frequent comparisons to investment grade bonds instead of to equities or through the lens of a holistic portfolio risk.

Evaluating high yield and convertible bonds as a step between equity and fixed income

1) Risk-adjusted returns

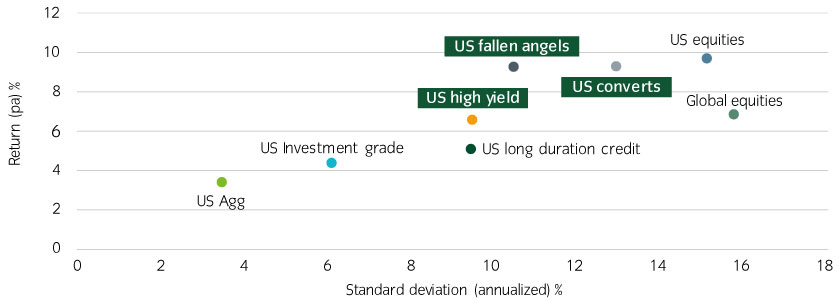

Due to lower credit quality, high yield is often labeled “junk” when compared to their investment grade brethren. However, high yield is historically less volatile than equities, which makes it a suitable investment from a total portfolio perspective.

As a hybrid security, a convertible bond has historically had both the lower downside volatility of fixed income as well as the higher return potential of equity. Hence the investment risk here also lies somewhere between equity and bonds.

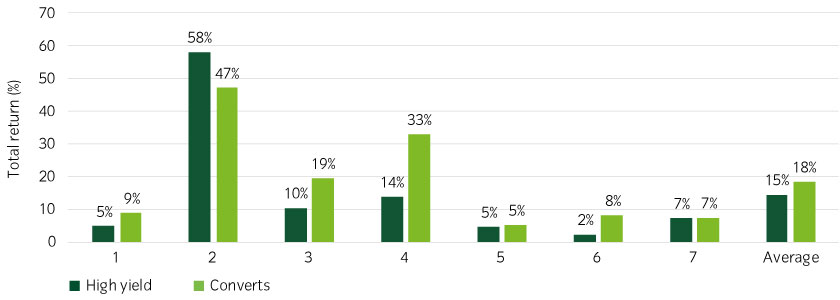

Figure 2 below shows that these instruments — including fallen angels (a subset of high yield bonds that have been downgraded from investment grade status) — have historically delivered similar returns to equities, but with volatility between bonds and equities.

Figure 2: High yield and converts can potentially provide equity-like upside for bond-like protection3

2) Interest rate risk

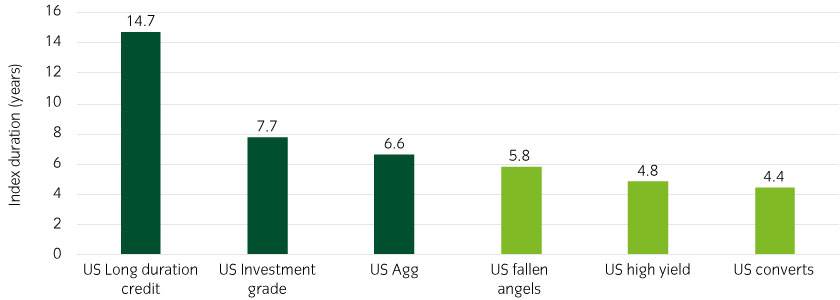

High yield bonds and convertibles have lower interest rate risks than Treasuries and investment grade bonds, which makes them inherently less sensitive to rising interest rates.

Convertibles have a very short duration so perhaps they should be compared to equities instead of bonds. While most investment professionals agree that equities (and therefore convertibles) have some sensitivity to interest rates, there is no consensus on how to measure that sensitivity, so typically the simple approach has been to ignore any possible duration.

Within high yield, fallen angels come closer to offering higher duration, which is perhaps no surprise as fallen angels are former investment grade companies (Figure 3).

Figure 3: High yield and converts have lower duration risks than mainstream fixed income4

An important consideration for this current environment is that high yield and converts have tended to deliver positive returns during rising interest rate periods. Their yields are comprised mostly of credit spread (~60% for high yield5), so when rising rates reflect a growing economy, spread tightening tends to offset losses attributable from interest rate risks (Figure 4).

Figure 4: High yield and converts have delivered positive returns during the eight rising rate periods since 20046

For pension plans, the low interest rate risk of these assets is a curse as well as a blessing. While investors will generally prefer their growth assets to have a low sensitivity to rising rates during a rate hiking cycle, pension investors want their liability-hedging assets to track with their liability discount rates to stabilize their funding ratios.

Pension sponsors requiring additional duration can focus on fallen angels within high yield, extend duration of Treasury investments, or consider using capital efficient derivative overlays in order to achieve the desired interest rate hedge.

3) Credit and default risk

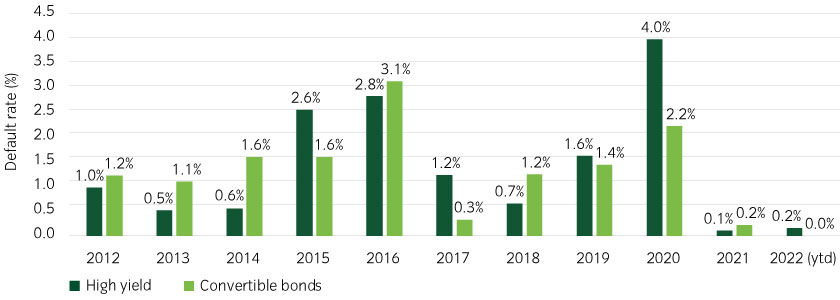

Default rates in the US high yield index have averaged 1.5% over the last 15 years, which is significantly lower than ratings agency estimates of 3% to 5% (based on a wider universe of all securities that are rated). Defaults have been similarly low across the convertible market (Figure 5).

Figure 5: High yield default rates have been lower than you may think7

Importantly, active or quantitative security selection approaches are key to further protecting portfolios from potential defaults if they creep up toward historical norms.

Liquidity risks

High yield and convertible bonds had become less liquid for over-the-counter trading since the 2008 financial crisis, as new banking sector regulations made it less attractive for market makers to hold large inventories.

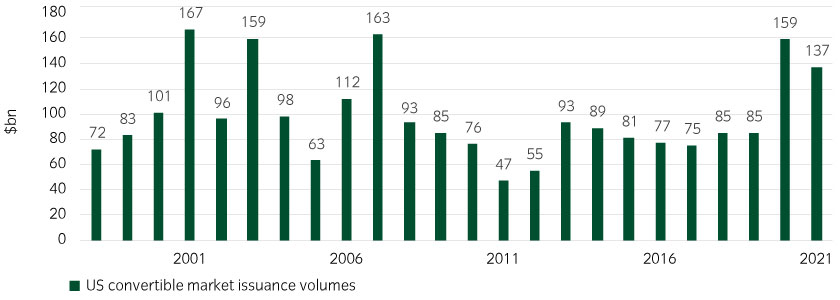

However, liquidity has been improving since both markets have been expanding. In the convertible bond market, nearly record new issuance has improved the depth and breadth of the market (Figure 6).

Figure 6: High convertibles issuance is improving overall liquidity8

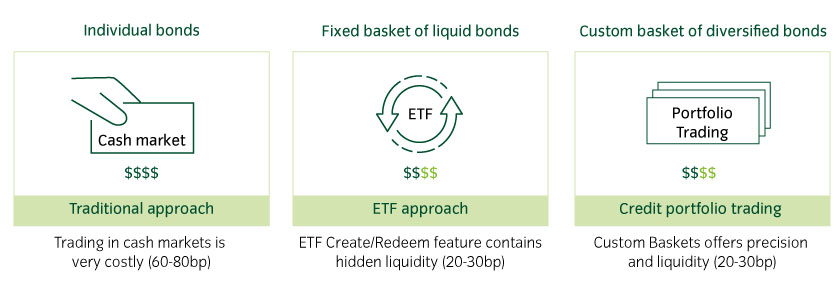

In high yield, skilled investors experienced within the fixed income ETF ecosystem have been able to unlock "hidden liquidity" within the "create and redeem" feature, similar to the programmatic trading that has been a staple of the equity market for decades.

This has opened the door to trading large, customized baskets of bonds within hours at a relatively low cost. We have seen that market makers prefer trading diversified bond baskets because they can hedge them more efficiently and cost effectively (Figure 7).

Figure 7: The ETF infrastructure offers new ways to improve high yield liquidity9

Diversification

Returns on high yield and convertibles have had low correlation with Treasuries or the US Agg index, potentially offering compelling diversification within a fixed income portfolio (Table 1).

Table 1: Correlations indicate that high yield and converts offer diversification within fixed income10

| Mainstream fixed income | Alternative fixed income | Equity | ||||||

|---|---|---|---|---|---|---|---|---|

| Correlation matrix | Treasuries | Agg | Investment grade | Long credit | High yield | Fallen angels | Converts | S&P 500 |

| Treasuries | ||||||||

| Agg | 0.7 | |||||||

| Investment grade | 0.6 | 0.8 | ||||||

| Long credit | 0.6 | 0.9 | 0.8 | |||||

| High yield | 0.2 | 0.3 | 0.6 | 0.2 | ||||

| Fallen angels | 0.2 | 0.3 | 0.7 | 0.2 | 1.0 | |||

| Converts | 0.2 | 0.2 | 0.5 | 0.2 | 0.8 | 0.8 | ||

| Equities | 0.2 | 0.1 | 0.4 | 0.1 | 0.7 | 0.7 | 0.9 | |

While both categories have had a higher correlation with equities than with bonds, we note that correlation is an infamously poor measure of the relationship between non-linear variables. Note that two variables that are perfectly correlated on the upside, but perfectly uncorrelated on the downside, would typically register a correlation of ~0.9 (not the more intuitive 0.5).

This is exactly what we see with converts, as they typically have a non-linear pay-off structure (i.e. similar to an equity protection strategy), tending to perform like equities when stocks are rallying but like bonds when stocks are falling.

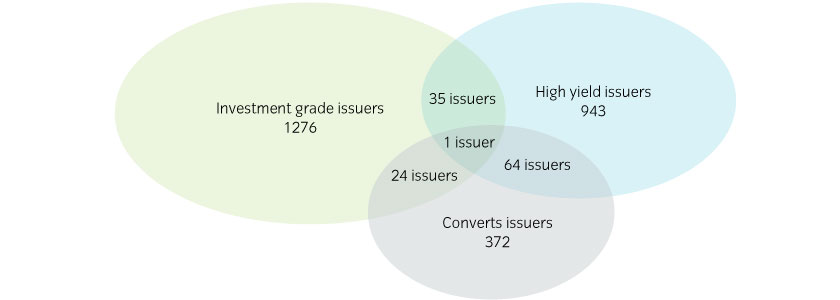

In addition to portfolio diversification, we believe that including these alternative fixed income categories also provides issuer diversification. We see that there is little overlap between issuers of investment grade, high yield and convertible bonds (Figure 8), which mitigates the issuer concentration risk that is becoming more pronounced in the high quality long corporate bond market and is a key concern for pension liability investors.

Figure 8: “Crossover” issuers across investment grade, converts and high yield are uncommon11

Taking the checkered flag

We believe that high yield and convertibles may be suitable components of a pension de-risking glidepath since they can improve a plan’s risk/return profile and add diversification benefits without undue exposure to defaults or illiquidity.

Their “hybrid” qualities reduce risk while still maintaining growth potential, which increases the likelihood that the pension plan achieves a funded status that is strong enough to provide stability in the end-state without requiring a cash infusion.

Relative to a glidepath that only increases investment grade fixed income, the benefits of this approach might be:

- More flexibility across a broader range of fixed income opportunities

- Reduced “regret risk” in this environment of high volatility

- Competitive pricing from insurers in a pension risk transfer scenario, since they often hold these types of investments in their own portfolios

In this uncertain world, with increasingly volatile capital markets, we acknowledge how difficult it can be to make big investment decisions. When we recognize that asset allocation decisions do not need to be only “black or white”, we allow ourselves to shift into compelling hybrids and alternatives that may help us cross the finish line more quickly.

Making a pit stop with high yield and convertible bonds may facilitate a smoother path to your end-state, allowing you to take that checkered flag but with potentially greater reliability.

United States

United States