Contents

- Euro loans offer a decade-high premium over US loans

- Euro loans have no direct exposure to Ukraine

- The credit impact of the commodity market disruption has been contained

- Euro loans offer compelling technicals and fundamentals

- Euro loans offer considerable diversification to US markets

- Loans offer value either directly or via CLOs

- Conclusion: US investors need to seriously consider euro loans and CLOs

Euro loans offer a decade-high premium over US loans

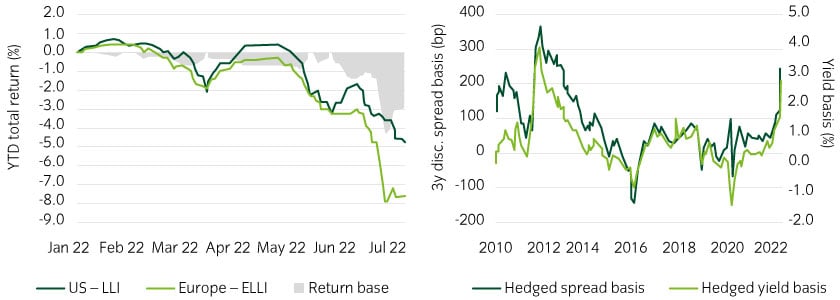

Euro loans currently offer a premium as international investors have indiscriminately fled euro assets, causing the asset class to underperform US dollar loans this year (Figure 1). As a result, European loans offer the highest spread premium relative to US loans for almost 10 years.

Figure 1: European loans are potentially oversold and currently offer a close to once-in-a-decade premium over US loans1

Table 1: European loans versus US loans2

| European loan market | US loan market | |

|---|---|---|

| Market size | $420bn | $1.2trn |

| BB spread (bp) | 592 | 365 |

| B spread (bp) | 803 | 592 |

| CLO AAA spread (bp) | 200 | 212 |

| CLO AA spread (bp) | 340 | 304 |

| CLO A spread (bp) | 450 | 404 |

Euro loans have no direct exposure to Ukraine

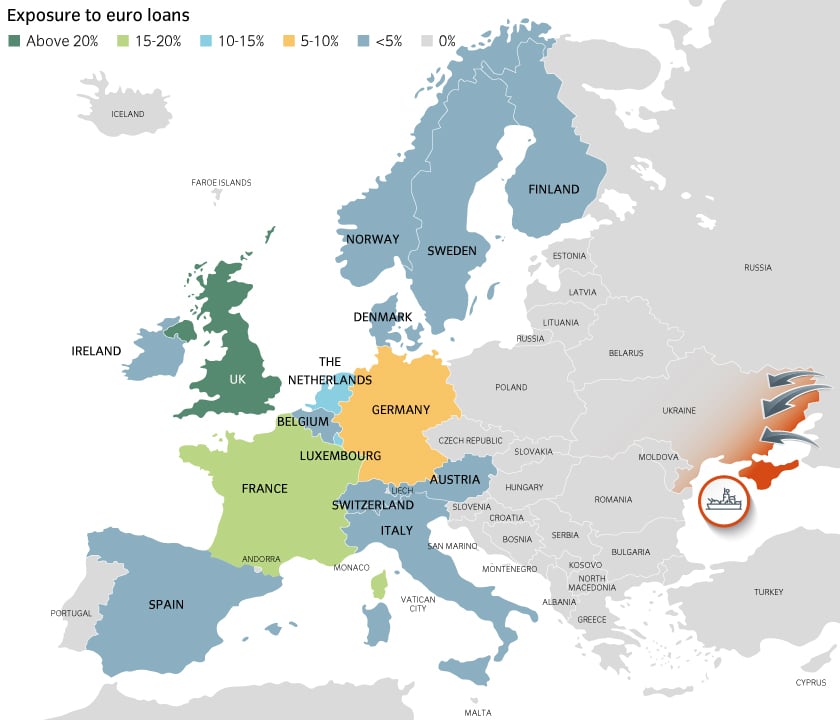

The European loan market has no exposure to Ukraine or Russia, or even any neighboring emerging markets of Eastern Europe. Issuers are exclusively from 15 Western European countries (outside US and Canada) (Figure 2).

Figure 2: Euro loans are geographically located a distance from Ukraine3

Geographically and operationally, most euro loan issuers do not have exposure to Ukraine and Russia. The main exception is the German pharmaceuticals manufacturer Stada , which has Russian operations. However, after initial weakness, the loans no longer reflect credit stress.

The credit impact of the commodity market disruption has been contained

The Russian-Ukraine war has disrupted commodity markets, forcing up European energy costs (benchmark European gas prices doubled since pre-war) and food prices have risen (as Russia and Ukraine were large exporters of grains, sunflower seeds and 30% of global wheat exports).

Rising food prices has had a limited impact outside of isolated credits, such as Dutch margarine maker Upfield5 (formerly the Flora Food Group), which fell into distress given sunflower seed costs (albeit this compounded cost pressures from its 2020 separation from Unilever and a ban on palm oil exports from Indonesia). The issuer’s euro term loan currently trades at 85% of par.

Rising energy costs have been inescapable. But the impact has most been felt most by heavy industrials, such as German chemical companies. Most others have managed the crisis and are positioned to benefit from government interventions (such as the recently announced energy price cap in the UK).

We believe that investors able to analyze each issuers’ energy consumption and energy hedges can pinpoint value opportunities on a security selection basis.

Euro loans offer compelling technicals and fundamentals

As loans offer a rare source of floating-rate cashflows in a rising-rate environment, and average prices of around 91% of par and seniority in the capital structure, we expect demand for euro loans to rise from investors that typically look to high yield bonds.

We also expect demand from CLOs to ramp up, particularly as we have observed ~70 euro CLOs in the warehouse stage and getting ready to launch.

From a fundamental perspective, the euro loan market is over 50% exposed to non-cyclical sectors such as healthcare and information technology. It has relatively low exposure to the more volatile energy and retail sectors than the US market.

Default rates are starting from a position close to zero (Figure 3). In general, we expect default rates to rise closer to 2-3%, but still relatively low on a historical basis. We believe these risks are more than adequately compensated by the spread on offer.

Figure 3: Default rates are starting from a low position6

Euro loans offer considerable diversification to US markets

The European loan market developed differently to its US counterpart. US leverage loans came to prominence after the leveraged finance boom in the 1980s and became a source of finance for issuers without access to the US high yield market.

However, the European loan market did not develop until the advent of the euro in the mid-90s. Previously, issuers relied on finance from domestic banks given the frictions of operating across countries, as the high yield market was also relatively small. The European loan and high yield markets have since developed in tandem, with a high degree of crossover between issuers in Europe.

Loans offer value either directly or via CLOs

Loans are naturally only accessible with sub-investment grade credit risk. Euro CLOs offer credit enhancement, allowing investors to access AAA to BBB (or below). Typically, they offer superior credit spreads at each level of the capital structure to loans alone.

European loans may offer some advantages over CLOs, chiefly the Term Loan B market is generally more liquid than the CLO market. Buying individual loans offers the lender more access to management and specific data to understand fundamental performance. However, for investors who value structural protections and investment grade credit quality, CLOs may be more appropriate as ~60% of euro loans are B-rated with another ~15% split BB and B rated.

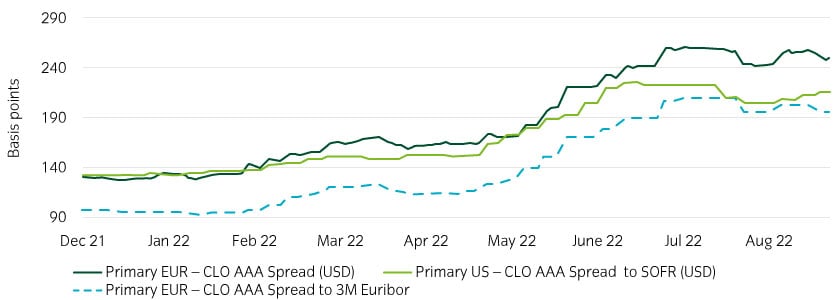

As with loans, euro CLOs offer a premium to US CLOs in US dollar terms (Figure 4).

Figure 4: Euro CLOs currently offer look compelling7

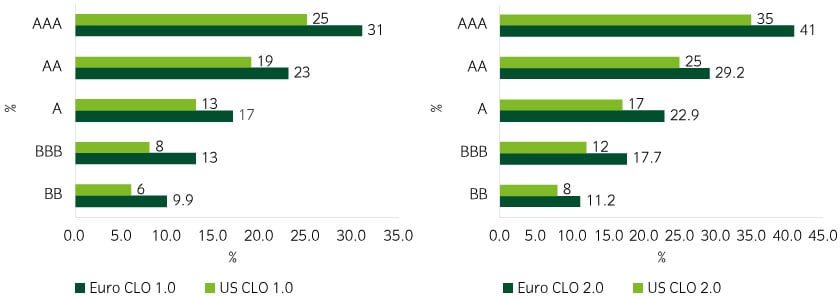

Further, credit enhancement levels on Euro CLOs tend to be higher than on US CLOs at each level of the capital structure (Figure 5).

Figure 5: European CLOs generally offer superior credit enhancement8

We will follow up with an in-depth paper looking at relative value across global CLOs.

Conclusion: US investors need to seriously consider euro loans and CLOs

We believe that euro loans offer some of the most compelling value in history over US loans, and concerns relating to the Ukraine war and associated economic fallout on euro loans are overblown. As such, we see underappreciated and compelling value for euro investors.

US investors can hedge euro interest rate and currency risks back to US dollars via the cross currency forward market (i.e., by rolling FX forward contracts) or by using cross currency basis swaps. In recent months, asset swapping euro assets to US dollars has even provided a pickup due to positive basis. This basis varies through time, depending on market conditions, and by tenor, however it has ranged from approximately 5-50bps this year.

Contributors: |

|

|

Shaheer Guirguis, CFA |

|

|

Jeremy King, CAIA |

|

United States

United States