- Energy prices drive up headlines

- Core CPI sectors, however, continued to slow overall

- The real economy continues to reflect moderating inflation pressures

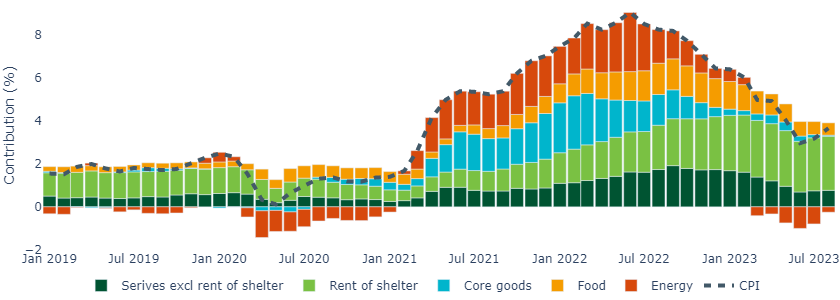

Headline CPI rose 0.6% month-on-month in August (up from 0.2% in July) driven primarily by higher energy prices (as we had flagged last month). On a year-over-year basis, CPI rose 3.7% in August, a pickup from 3.2% seen the prior month.

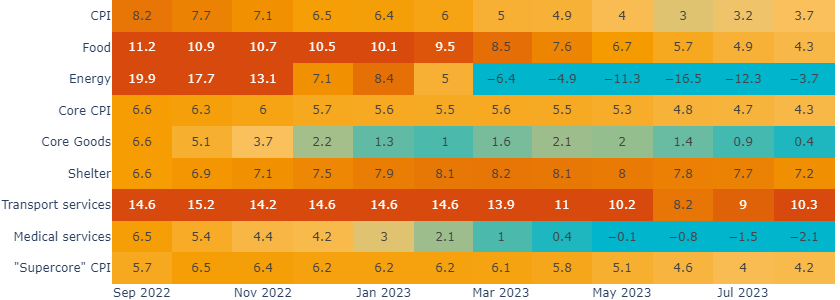

Excluding food and energy prices, however, core CPI painted a more benign picture, with the annual inflation rate slowing from 4.7% to 4.3%, the slowest level since September 2021. Meanwhile, the 3-month annualized rate fell below 3%, improving from 3.1% to 2.4%.

Energy prices drive up headline CPI prices

Energy prices were the biggest culprit behind the recent pick-up in CPI, with gasoline prices contributing half the increase to month-on-month CPI (gasoline prices rose 10.6% in August). Energy CPI overall rose 5.6% month-on-month but were still 3.6% below the levels seen last year.

WTI crude oil prices have risen 9.4% since the start of August, reaching almost $90 per barrel, with US gasoline prices up 8.8% over the same period (albeit they have been roughly flat since mid-August, which may bode well for next month’s CPI release).

Energy prices have been impacted by a combination of robust global oil demand (driven primarily by demand for global travel) and supply cut extensions from Saudi Arabia and Russia.

Figure 1: Energy exerts upward pressure on CPI

Source: Bureau of Labor Statistics, Insight calculations, September 2023

Core CPI sectors, however, continued to slow overall

Broad disinflationary trends are still evident across core goods and services. Durable goods and used cars were the largest negative contributors to the index this month. Within core services, the shelter component reached its lowest level since November 2022.

There were some blemishes, however. Non-durable goods contributed positively, and transportation services notably accelerated, particularly in private transportation categories, likely related to higher energy prices.

Figure 2: Core services sectors cooling (albeit still running hot overall)

Source: Bureau of Labor Statistics, Insight calculations, September 2023

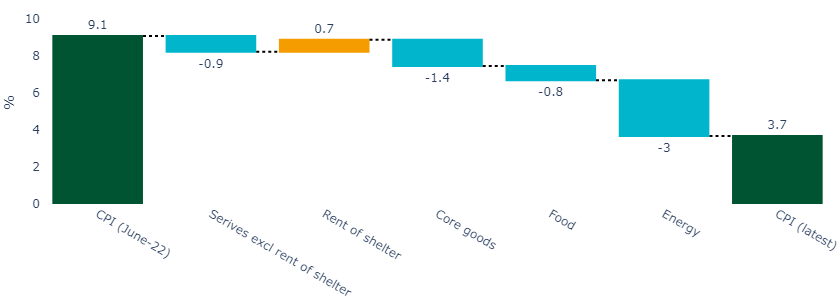

Rents is the only major category still running as strong as it was in June 2022, when nominal CPI peaked at 9.1% (Figure 3). As such, continued progress in core services sectors this month will likely be particularly comforting to the Fed.

Figure 3: Core services are still running as hot as they were, but signs are improving

Source: Bureau of Labor Statistics, Insight calculations, September 2023

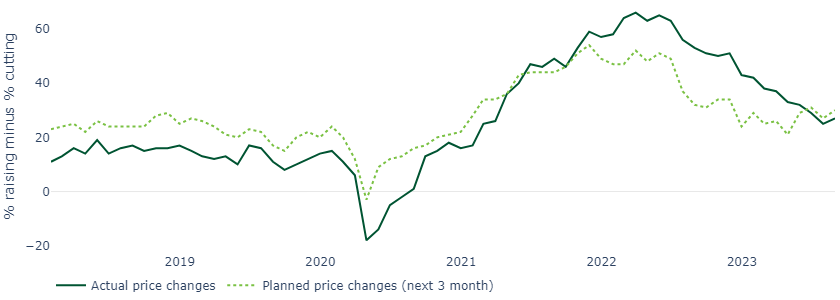

The real economy continues to reflect moderating inflation pressures

Outside of the CPI report, Tuesday’s NFIB small business survey also continued to reflect moderating price pressures. The net percent of business owners raising prices decreased to a net 25% and has been trending down (Figure 4), suggesting an improving balance between supply and demand.

Figure 4: Figure 4: NIFB small business survey indicates less appetite to raise prices

Source: National Federation of Independent Business, September 2023

The Fed’s relief over Core CPI may outweigh its concern over rising energy prices

The Fed will watch energy prices closely but will likely focus more on Core CPI in our view.

Nonetheless, the Fed may latch onto energy prices as a reason to strike a relatively hawkish tone at next week’s FOMC meeting (perhaps via its “dot plot” and economic projections) as it looks to ensure financial conditions remain relatively tight to continue making progress on core inflation.

We believe we are at or very close to the top of the hiking cycle but see one additional rate hike into year-end as a possibility.

United States

United States