Headline CPI continued to make strong progress, reaching 4.0% year-on-year in May, falling from 4.9% in April, the lowest since early 2021.

On the other hand, Core CPI remained stubborn, at 5.3%, only down from 5.5% last month, and over a longer period not much lower than its 5.6% rate in January this year. Month-on-month, it was 0.4%, and remained within the narrow 0.3% to 0.6% range over the last 12 months.

While the Fed is clearly making good progress on headline CPI, cracking core CPI will be more of a challenge over the coming months.

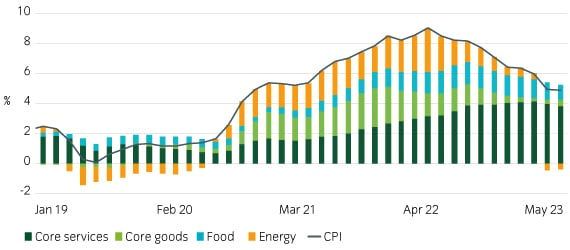

Non-core items continued to slow headline CPI

Of the non-core categories, energy was the largest negative contributor, falling deeper into negative territory given global price falls, while food inflation continued to slow modestly.

Elsewhere, core goods prices continued to pick up, but this was almost entirely due to a continuing bounce in used vehicle prices (the sector was the second-highest contributor to the index month by weight). Most other goods categories had either a flat or negative contribution, and the segment still contributed only modestly overall (Figure 1).

Figure 1: Core services continue to bring down CPI

Source: Bureau of Labor Statistics, Bloomberg, June 2023

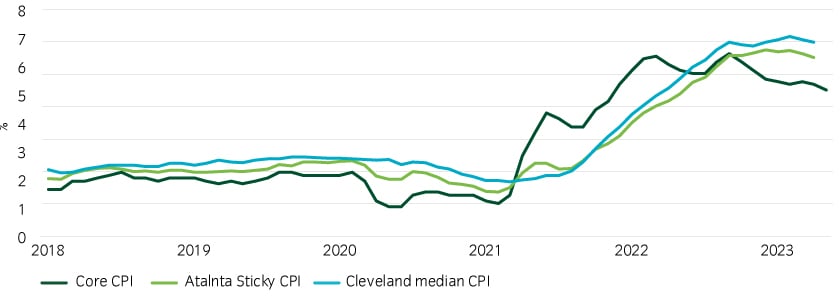

Services inflation is cresting, but may descend slowly

Core services remained the most stubborn category but continued to show progress (Figure 2).

Shelter was once again the largest weighted monthly contributor, but shelter inflation now looks passed its peak, albeit its descent is proving painfully slow. “Supercore” CPI, the Fed’s closely watched inflation measure, continued to moderate – from 5.1% to 4.6%.

Figure 2: Core services are making slow progress

Source: Bureau of Labor Statistics, Bloomberg, June 2023

Meanwhile, three of the most closely watched measures of “sticky” service sector inflation have generally stopped accelerating, and finally appear to be slowing down (Figure 3). However, it remains to be seen how fast the Fed can slow this category down given continuing strength in the labor market.

Figure 3: Sticky CPI indices are cresting

Source: Bureau of Labor Statistics, Atlanta Fed, Cleveland Fed, Bloomberg, June 2023

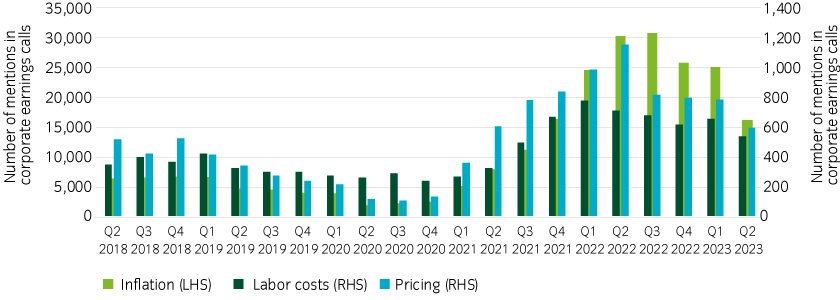

Markets are focusing less on inflation, which may be good news for inflation expectations

Signs of easing inflationary pressures can be seen by analyzing corporate earnings calls. Mentions of “inflation” and related subjects such as “labor costs” and “pricing” have decreased over the past several months (Figure 4). Inflation still clearly remains a concern, but some of the acute pressures seen last year appear to be abating.

Figure 4: Mentions of inflation in earnings calls have started to recede

Source: Bloomberg, June 2023

Base effects bode well for headline CPI, but cracking core CPI will be the main challenge

Last June, headline CPI peaked at 9%, meaning next month we will see a peak impact from “base effects”. Next month’s headline CPI may print close to ~3% (assuming no major rebound from volatile categories such as energy), almost in striking distance of the Fed’s 2% target.

However, Core CPI has less of a tailwind from base effects and may still trend close to 5% based on current momentum, although we expect used car inflation may slow down, easing pressure on the Core CPI index.

Ultimately, although signs are improving, the Fed still needs to see some more progress in the sticker services categories before fully declaring victory over inflation.

United States

United States