Public pension plans are entering a transformative period. As funding levels improve, they face a “contribution cliff” – a sharp reduction in required contributions and persistent negative net cashflows. Plans must adapt to new liquidity realities. Purpose-built, liability-aware fixed income portfolios may be a solution.

Public pension plans have traditionally relied on contributions for the liquidity to support regular benefit payments and expenses. However, these contributions are declining, so plans must adapt to new liquidity realities.

At the same time, plans’ allocations to illiquid assets are rising, and the traditional relationship between equities and bonds is shifting. These changes present both challenges and opportunities for the stakeholders of public DB plans.

The new reality: Liquidity, illiquidity, and correlation breakdown

The contribution cliff is looming

Full funding is a milestone worth celebrating, but it brings new complexities. When amortization payments end, plans still need liquidity to pay benefits and administrative expenses. They must therefore regularly liquidate assets to meet obligations – sometimes in less-than-ideal market conditions.

Figure 1: Projected benefits are set to significantly exceed contributions1

Illiquid allocations have expanded

Public plans have allocated more to private equity, private credit, infrastructure, and real estate to potentially enhance returns and diversify portfolios. In many cases, private assets now comprise ~30% or more of total portfolios2. While these investments may offer attractive long-term potential, they also introduce new risks:

- Limited liquidity: Illiquids cannot be efficiently sold to meet benefit payments. When liquidity is needed, selling illiquid assets in secondary markets can result in significant haircuts – often 20% or more of NAV3 – making them a costly source of cash.

- Unpredictable cashflows: Capital calls and distributions are often irregular and difficult to forecast. In recent years, distributions have consistently fallen short of initial expectations, further intensifying liquidity pressures.

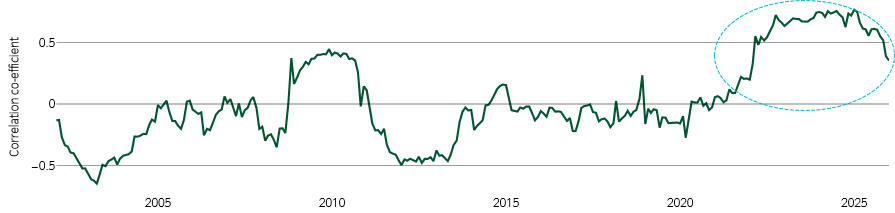

The equity-bond relationship is changing

Post-2008, the negative correlation between equities and bonds often provided a natural hedge: when stocks fell, bonds typically rose, cushioning portfolio losses. The inflationary pressures of the post-COVID era have seen this relationship weaken or even reverse. The result? Traditional diversification strategies are less effective, and the risk that both equities and bonds decline together is now a real concern.

Figure 2: Plans may need more than traditional diversification to meet their growing cashflow needs4

As such, in periods of market stress, plans may be forced to sell a narrower selection of liquid assets at depressed prices, amplifying sequencing risk and potentially triggering a downward spiral in funded status.

Sequencing of returns, explainedThe order in which a plan realizes investment returns (sequencing of returns) impacts the realized monetary performance when outflows are paid from the portfolio. For defined benefit plans seeking to grow assets to deliver fixed participant benefits, this risk can materially impact the likelihood of achieving the objective. Consider a $1bn investment in the S&P 500 Index at the end of 1999. Over the following 24 years, the return of the index was equivalent to a 7.7% pa return. If the investor were forced to sell just $50m per year (excluding trading costs), it would have crystallized painful losses for the first decade, leaving it with less capital to then participate in the stronger returns that were generated from 2011 onward (Figure 3). Such forced selling would mean the investment only generated 16% of the returns that would be earned if no selling had occurred. Figure 3: Forced selling at the wrong time can impair asset growth5 |

Reaching the summit: Pathways to overcome the cliff

Natural cashflow, aiming for maximum certainty of returns, and risk management

Fixed income portfolios constructed using liability-aware and cashflow-matching principles can be engineered to seek to deliver steady, predictable cashflows through regular coupon payments and principal returned at maturity to deliver a reliable stream of income to directly support benefit payments, administrative expenses and other cash needs. This may help to ensure plans maintain liquidity even as their allocations to illiquid assets grow. By holding bonds to maturity, investors effectively lock in the yield at purchase, ensuring a high degree of certainty in their return stream (absent default) and minimizing exposure to interim market volatility.

Cashflow-matching strategies and liquidity waterfalls (potentially complemented by overlay solutions) can deliver a range of benefits.

- Reliable liquidity: Asset cashflows are aligned with liability needs, reducing reliance on forced asset sales.

- Sequencing risk mitigation: Predictable potential income helps shield plans from the adverse effects of poor early market returns.

- Cost and funded status stability: Lower volatility in asset values and cashflows supports consistent contribution requirements and long-term funding objectives.

- Support for illiquid allocations: A robust liquid portfolio may enable confident investment in illiquids, knowing benefit payments are secure even if private markets freeze or capital calls spike.

- Enhanced risk and return management: Incorporating capital-efficient beta exposure or downside protection through synthetic strategies can preserve market exposure and strengthen resilience during periods of volatility and liquidity stress.

Multi-sector and multi-geography construction

Today’s customized fixed income portfolios are not one-size-fits-all. They can be thoughtfully constructed across multiple sectors – including government, corporate, structured, and municipal bonds – and diversified across geographies. In our view, such a multi-dimensional approach may enhance robustness, allowing plans to tap into a broader opportunity set, enhance yield, manage sector-specific risks, and adapt to changing market conditions.

Implementation in practice – delivering for all stakeholders

Plans can reposition existing fixed income allocations to be more purpose-built, constructed to deliver specific cashflow objectives with high certainty. In our view yields remain attractive in the current environment, and any further increase in yields can allow plans to allocate more to fixed income without dramatically impacting their expected potential return.

By gradually increasing allocations as funded status improves and regularly reassessing the balance between liquid and illiquid assets these strategies may help future-proof portfolios and help reconcile the diverse objectives of key public pension stakeholders:

- Employees and pensioners may enjoy greater benefit security.

- Politicians and taxpayers may benefit from budget stability and predictable funding costs.

- Bondholders and rating agencies may see improved credit profiles and reduced volatility.

- Investment teams may gain flexibility to pursue potentially higher returns in illiquid markets, without compromising liquidity.

Conclusion

The contribution cliff, rising benefit payments and illiquidity, and the breakdown of traditional diversification demand a new approach. We believe a customized fixed income portfolio – designed to match plan liabilities and cashflow needs, constructed across sectors and geographies – may offer public pension plans a strategic solution for managing liquidity and sequencing risk, stabilizing costs and funded status, and potentially mitigating the likelihood of liquidity crunches and forced selling.