We assess and identify, and take responsibility for managing, factors we deem to be financially material (including, but not limited to, sustainability and governance factors) whilst also reflecting client sustainability preferences. Financially material sustainability risks can be ‘direct’ in that they are identifiable, can be more straightforward to quantify, and typically occur over the nearer term, such as pollution fines or product safety issues. They can also be ‘indirect’ and may have multiple pathways to financial relevance; quantification is more complex as they typically stem from broader issues that impact the whole economy over the long term. Examples are extreme heat and water scarcity.

For clients who wish to apply specific criteria to their mandates to help deliver sustainability outcomes, we have developed sustainable investing strategies to enable them to do so.

“Insight focuses on helping our clients achieve their goals in line with their priorities. Our investment teams look to take account of anything that could be financially material.

“We pride ourselves on our ability to fulfil our clients’ specific needs with tailored portfolios that reflect their preferences, including sustainability goals. However, for every client mandate, we believe that it is crucial to have a robust evidence base to support better investment decision-making that helps our clients to achieve their desired outcomes. This is foundational to a responsible approach.”

Our latest 2025 report details our responsible investment and stewardship activity.

1

Seeking to understand how Insight applies its stewardship approach in practice?

2

Looking for evidence of the impact of Insight’s responsible investment approach?

3

Interested to learn more about 2024 enhancements to our approach?

Insight’s long-established approach to integrating environmental, social and governance (ESG) issues in fixed income research and decision-making aims to support the long-term potential of our portfolios.

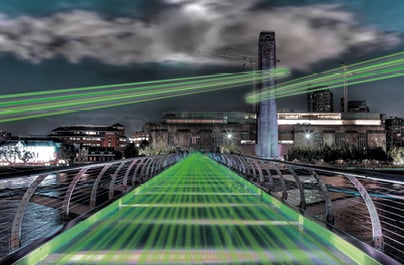

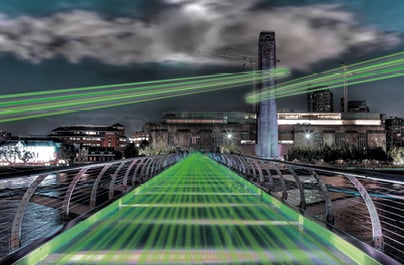

Whether your goals are purely financial, or you also want to achieve sustainability outcomes, a fixed income portfolio can help achieve both. Watch our video to find out more.

2006

Founding signatory to PRI1

134

Number of ESG-focused engagements in 20242

>3,100

Issuers covered by Insight’s Prime corporate ESG ratings3

6

Responsible Horizons strategies for investors with financial and sustainability goals4

A responsible investment leader

-

- Insight introduced proprietary ESG ratings for corporates to address the gaps in third-party data, especially for smaller, high-yield and emerging market debt issuers

-

- We introduced a comprehensive ranking of how fixed income corporate credit issuers manage their climate change-related risks and opportunities. The Prime climate risk ratings cover a range of key climate-related issues, including physical and transition risks..

- Growth in the impact (use of proceeds) bond market led us to develop a proprietary impact bond analysis framework, to help our analysts discern whether an impact bond meets our expectations for sustainability characteristics.

- In response to client demand, we introduced our first pooled fund with sustainability and ESG objectives, building on our years of expertise analysing and engaging with corporates on sustainability issues.

-

- We introduced our country sustainability risk index. This aims to help us better understand the ESG risks at the country level across our portfolios.

-

- Insight enhanced our proprietary ESG ratings, introducing customised metrics to make the data as pertinent as possible to our analysis and offering high coverage of global benchmarks.

-

- We substantially expanded our responsible investment policy, to spell out in detail the six principles that guide our business and investment approach.

- We introduced sovereign ESG impact ratings, helping us understand how countries are aligned with the UN Sustainable Development Goals, enabling us to build portfolios for clients seeking sovereign debt portfolios with sustainability objectives.

-

- We joined the UN Global Compact, confirming Insight’s commitment to supporting its 10 principles on human rights, labour, the environment and anti-corruption.

- We became a signatory to the Net Zero Asset Managers initiative, committing to reach net zero emissions by 2050 at the latest. To support our journey towards net zero, we will either actively engage with our highest emitters, or ensure they are on a net zero pathway.

-

- We introduced a thematic engagement programme, prioritising climate change, water management, and diversity and inclusion as themes on which to engage with issuers.

- We introduced a counterparty engagement programme, with the objective of achieving a greater level of impact in our engagements with entities in their capacity as counterparties. We are taking a thematic approach focused on areas including environmental factors, remuneration, diversity and cyber.

-

- We launched a research prize for green finance with the University of Oxford. The Greening Finance Prize celebrates, showcases and rewards world-leading research which contributes to the goal of greening the global financial system.

Information on ESG factors and related risks is offered by a wide range of providers but there are significant gaps. We seek to deepen our understanding of such issues through our own analysis, engagement and using our proprietary Prime ESG ratings. For clients with net-zero goals, we also seek to categorise corporate issuers according to their net-zero alignment.

There is variation in ESG data from different providers. For many smaller issuers, particularly emerging market or high-yield companies, the availability of relevant non-financial data lags information from larger issuers.

For these reasons, we developed the Prime corporate ESG ratings, with customised metrics to make the data as pertinent as possible to our analysis.

Insight’s Prime corporate Insight ESG ratings are generated by following a risk-centric approach with high coverage of global benchmarks.

To read more on our ratings and how we use them, please click here.

In 2017, we introduced our Prime climate risk ratings, which now over 18,200 issuers according to how they manage climate change-related risks.

We believe it to be the investment industry’s first comprehensive ranking of how fixed income corporate credit issuers manage their climate change-related risks and opportunities, and how they are positioning themselves for the transition to a low-carbon economy. The index is designed to be used to assess risks and opportunities related to climate change.

Please click here for more details, including:

- how Insight uses the index

- the methodology underlying it, and

- details of key findings.

Climate change is unique in terms of its complexity, uncertainty and scope for material value destruction and opportunities for value creation. It also divides people and societies, both culturally and intellectually.

Beyond merely considering climate risks as part of their core investment approach, some of our clients are looking to pursue net-zero targets. To help our clients invest in line with their net-zero goals, Insight created ratings to categorise corporate issuers according to the extent of their commitment to and alignment with achieving net zero by 2050.

To read more on our net-zero ratings for corporates, please click here

Our responsible investment policies

For a full range of definitions for responsible investment terms, including investment strategies, please see our responsible investment glossary.

Latest perspectives

Responsible investment

June 2025

Insight’s Climate Change Report 2025

Responsible investment, Fixed income

February 2025

Understanding methane: risks and opportunities for fixed income investors

Responsible investment, Fixed income

January 2025