MARKET REVIEW

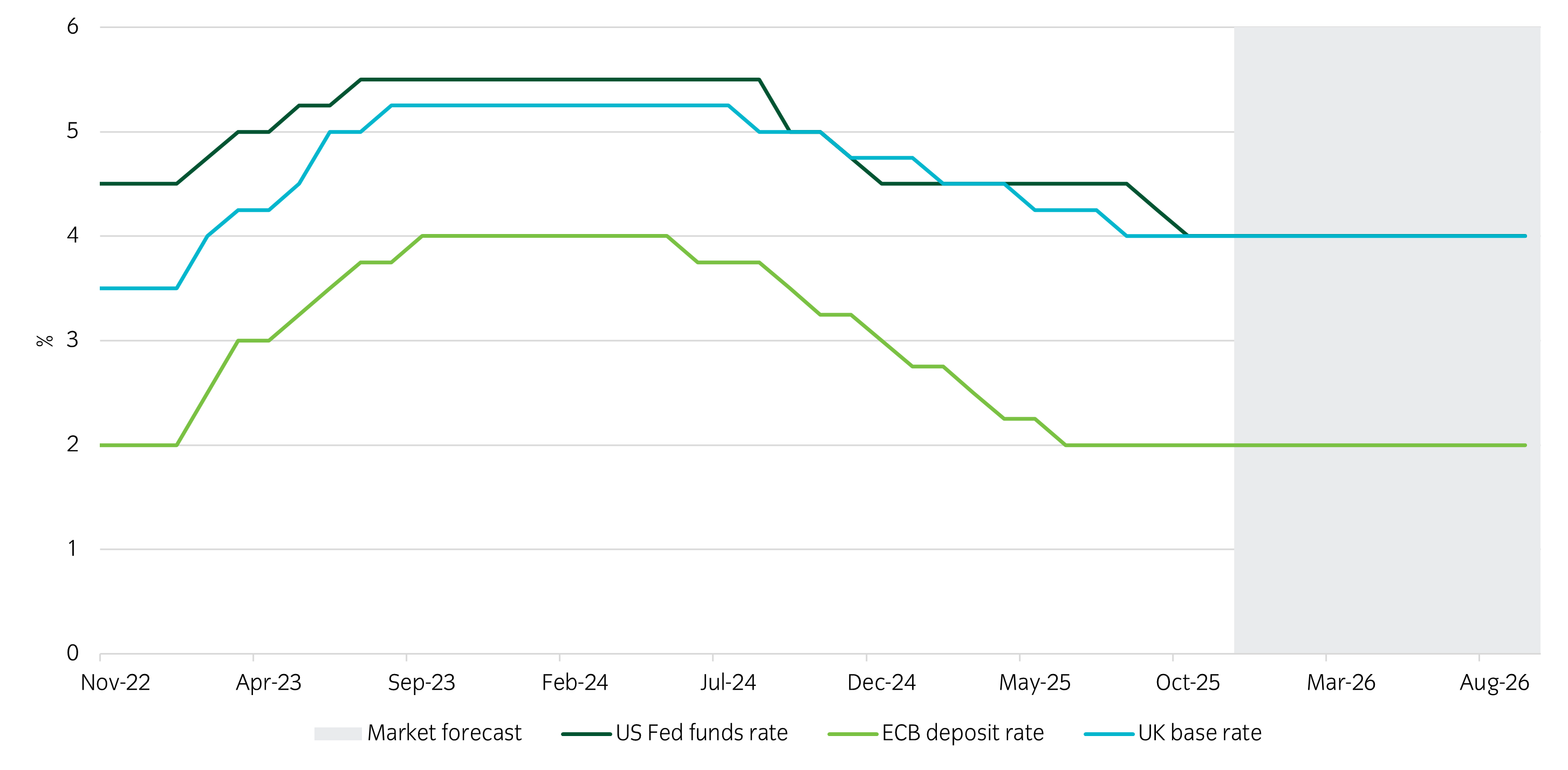

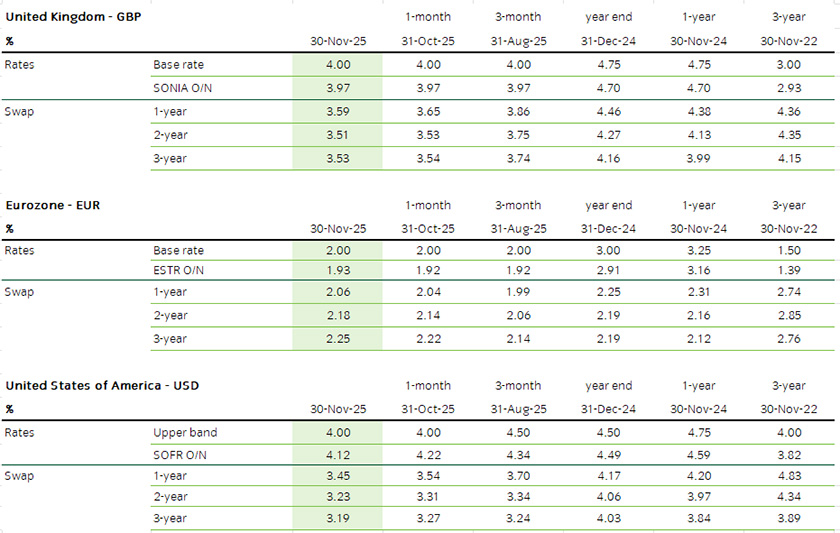

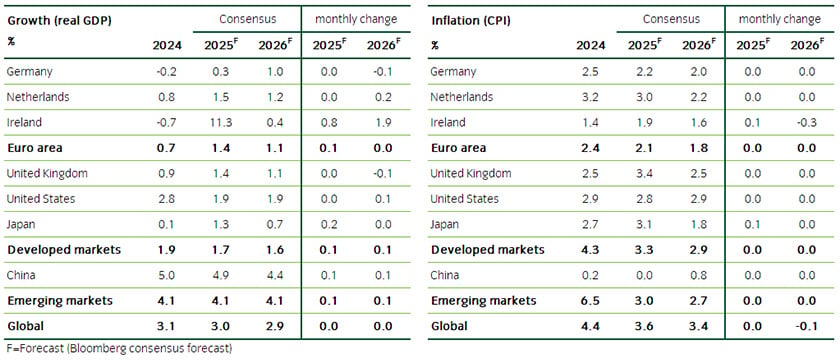

Bank of England (BoE): In a close split vote, the Bank of England’s (BoE) Monetary Policy Committee kept the base rate unchanged at 4.0% in November. Four of the nine voting members voted for a cut, double the number who did so at the previous meeting. However, the majority preferring no change prevailed. Meanwhile, inflation fell back to 3.6% at headline level and 3.4% for the core measure. Unemployment rose to 5.0% in the third quarter, the highest level since the three month period to May 2021, as the claimant count reached 29,000, the highest monthly rate of the year so far. At the same time, the rate of average earnings growth tempered slightly, to below 5%. The GfK Consumer Sentiment Barometer gave back the previous month’s gains as it fell back to -19, while retail sales registered a month-on-month decline for the first time since May. In the budget, the chancellor announced a range of measures to raise tax revenues, as was widely expected, having trailed a variety of potential strategies in the media over the previous few weeks.

European Central Bank (ECB): There was no meeting of the European Central Bank (ECB) Governing Council, so policy rates remained unchanged, with the deposit rate at 2.0%. Headline inflation for the eurozone was confirmed as 2.1% for October, while the initial estimate for labour cost growth for the third quarter showed a slight slowdown to 3.5%. A more definitive easing to 3.2% had been anticipated. At the same time, the second estimate of GDP growth for the quarter reinforced the relatively sluggish 0.2% rate of expansion. The ZEW Economic Sentiment measure for the euro area rose to 25, recovering most of the previous month’s decline. Within that, and contrary US, the indicator of the current economic situation improved. The Economic Sentiment Index for the eurozone increased to 97.0 in November, its highest level since April 2023.

US Federal Reserve (Fed): There was no Federal Open Market Committee meeting in November. The fed funds rate remains at 3.75%-4.%. The government shutdown ended in the US after 43 days when a handful of Democrat members of congress joined Republicans to break the deadlock. Economic data and forward-looking indicators continued to languish, with the Manufacturing Purchasing Managers Index (PMI) from the Institute of Supply Management falling back to 48.7, when a modest improvement had been anticipated. The New Orders component did increase slightly but remains below 50, a level exceeded only once since January. However, there was more positive news in the Service PMI measure, which increased to 52.4, more than expected. The end of the shutdown allowed for the release of a backlog on employment data, with the September non-farm payrolls expansion of 119,000 jobs being ahead of expectations. The October release was cancelled, with the next report due for release in early December. Despite the strongest report for new jobs for five months, a growth in the labour force meant the unemployment rate increased to 4.4%, the highest level for four years. The consumer price inflation data for October was not released, but in September both headline and core CPI were 3.0%. Consumer sentiment, as measured by the University of Michigan showed another modest decline in November, to 51.0, being the lowest reading since midway through 2022. Within the survey, the Current Economic Conditions Index fell sharply to 51.1, which was its lowest level since records started in 1951, and compared to the historic average of 94.5, which has not been seen since before the COVID-19 pandemic.

Figure 1: Central bank rates history and future market pricing

Source: Insight and Bloomberg. Data as at 30 November 2025.

Key interest rates and global data

Source: Insight and Bloomberg. Data as at 30 November 2025.

Insight money market funds performance

For the full list of prices for Insight’s money market funds, please click here.