- Another month, another failed French government. President Macron’s centrist experiment appears to be reaching an end.

- Legislative elections are the likely next step, but weak and divided government remains most probable in any case.

- Fiscal deterioration is likely to continue. There are no likely positive outcomes for French assets unless a potential RN government gets strategic.

It is only 40 days since our last note on French politics, but the latest French Prime Minister Sebastien Lecornu and his government have lasted much less time than that. France has now caught up with Italy in numbers of governments since the end of World War II, at 45 each.

The proximate causes for this latest collapse were the failure of Lecornu to reach agreement with the centre-left Socialists to support his government (on Saturday), and then the centre-right Republicans first agreeing to continue support but then reversing that decision when Lecornu announced his choice of cabinet ministers (on Sunday).

It would be easy to assign blame for this solely on Lecornu’s inability to manage political negotiations with any deftness, but that would miss the bigger picture. The next French presidential elections are due in 18 months at most, in April 2027, and parties and individual politicians are positioning themselves for that.

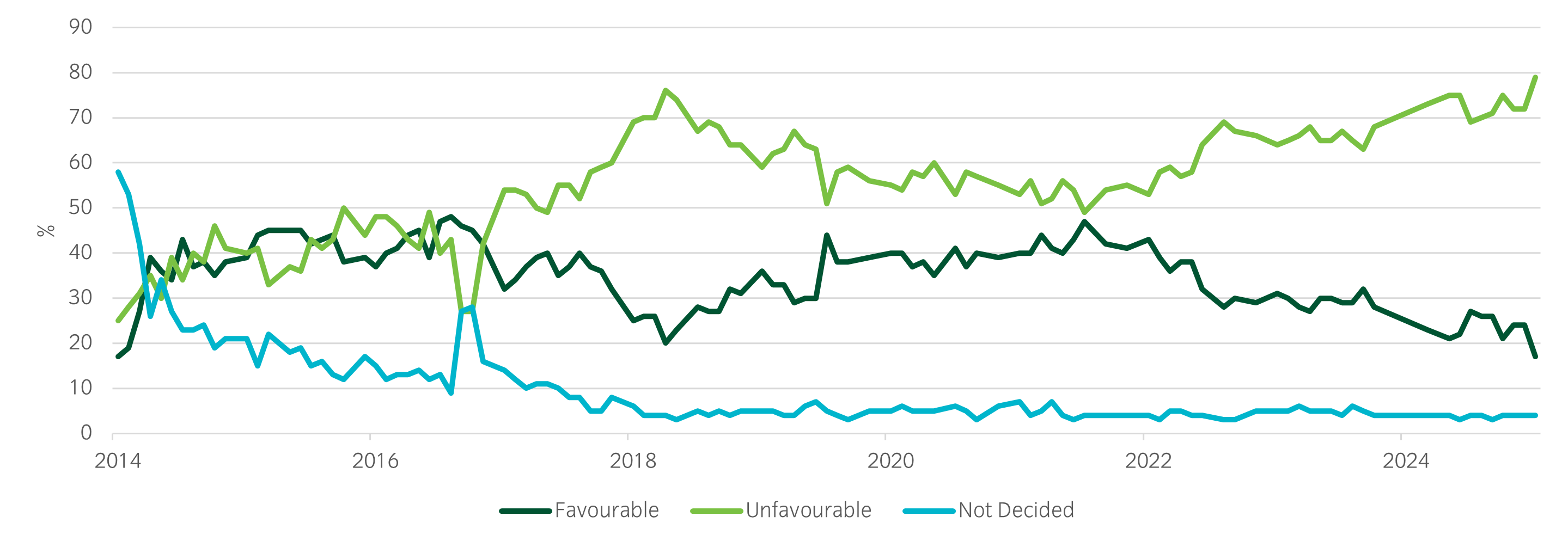

President Macron’s approval ratings are dire and worsening (see Figure 1). No politician with aspirations for the future wants to be associated with this, which is why the Socialists and Republicans both ultimately decided against supporting the government, and it is why even previously loyal Macron allies and former prime ministers with presidential ambitions of their own such as Édouard Philippe and Gabriel Attal would not accept ministerial posts.

President Macron’s grand political experiment of building a bulwark against extremist forces of both left and right is coming to an end. The centre is crumbling.

Figure 1: Favourability ratings for Emmanuel Macron have lurched lower through 2025

Source: Macrobond – France, Political Polls, Ipsos MMI, Favorable Ratings, Emmanuel Macron.

Latest poll: September 2025.

What next?

While President Macron has given Lecornu until Wednesday evening to see if anything can be cobbled together in the interests of passing a budget, such an outcome appears to be a forlorn hope. This will leave Macron with a similar set of undesirable choices that he faced after former Prime Minister François Bayrou’s exit, less the option that has just failed. It now seems unlikely that a new centrist prime minister would be able to build a majority sufficient to pass a sensible budget, but if Macron wants to prioritise retaining the 2023 pension reforms until the end of his term, this is still possible.

Such a government, or more likely series of governments, would be very weak indeed and would achieve little other than retaining the status quo. This is broadly what is priced in to markets now, with the prospect of increasing risk as 2027 gets closer. If a new budget can’t be drafted and agreed (and it appears increasingly unlikely that it can), then the previous budget would be carried forward once again, with tax rates and spending unchanged.

Perhaps more likely, but very unwelcome to Macron, would be the appointment of a left-wing prime minister, perhaps Bernard Cazeneuve or Lucie Castets. Although the broad left-wing alliance has the most seats in the current assembly, it still does not have a majority and would need to entice Macron’s centrist Ensemble to make a stable coalition. Ensemble has previously refused to support a government that includes the far-left La France Insoumise (LFI), but such a coalition would lack a majority without either of them. So a left-wing prime minister would also preside over a minority government, but one that could perhaps gain external support on key bills such as a budget from Ensemble in the interest of national stability, as long as a currently lacking spirit of compromise holds.

This would certainly result in a worse fiscal outcome than planned by any of the recent PMs, but not necessarily worse than the existing budget. Most of the fiscal consolidation would come from wealth taxes. Markets would likely start to worry more about this, however, as well as the possibility of such a government getting external support from the far-right Rassemblement National (RN) to revoke the pension reforms which really would blow a hole in the fiscal outlook. So this outcome may be bad for French assets in the short term, but with little prospect of improvement in the medium term, there is a case for underweight positions to be retained.

Barring unlikely possibilities, such as appointing a technocrat prime minister (Christine Lagarde is currently employed elsewhere), an RN prime minister (RN leader Jordan Bardella has ruled this out in the current parliament), or a referendum to change the electoral system (De Gaulle tried this and failed in 1969), then that leaves fresh legislative elections as the most likely outcome. The first round would have to be 20 to 40 days after the dissolution, so most likely November, with the second round a week later. Published opinion polls in France are relatively rare outside of election seasons and are frankly not that great a guide to seat allocations anyway due to the complex electoral system, but there were a cluster in early September (see Table 1).

Table 1: Recent opinion polls (September 2025) for the next French legislative election

| Ensemble | RN and allies | NFP coalition | LR | Others | |

| Previous election | 21% | 33% | 28% | 7% | 11% |

| Recent polling (by polling company) | |||||

| Ifop1 | 14% | 34% | 24% | 12% | 16% |

| Harris Interactive2 | 16% | 33% | 26% | 10% | 15% |

| Cluster173 | 14% | 29% | 25% | 13% | 19% |

The only conclusion that one might draw with confidence from these polls is that Ensemble is likely to do worse than last time, and Les Républicains (LR) are likely to do better. I would assume that the broad left-wing Nouveau Front Populaire (NFP) does hold together as a coalition (perhaps part of the reason why the Socialists stayed out of Lecornu’s government), and also that the pact to keep RN out of power is even weaker (as a result of President Macron refusing to appoint a left-wing prime minister after they gained the most seats in 2024).

So the election conclusions and implications from our previous note hold: the most likely outcome is a new hung parliament, then an RN victory, then an NFP victory. The only change is the possibility of an RN victory; in particular, if it requires some external support from the Republicans, there is a chance that presumed Prime Minister Bardella tries to demonstrate sensible government and some limited fiscal consolidation with an eye to the 2027 elections – and, quite probably, a promise to revoke the pension reforms after 2027 should they win. If there is an outright victor, then addressing the budget would become a key priority.

While all electoral outcomes have the potential for French asset underperformance, it appears to be more likely in the case of an RN or NFP victory. Some investors may deem it appropriate to take at least partial profits if RN win.