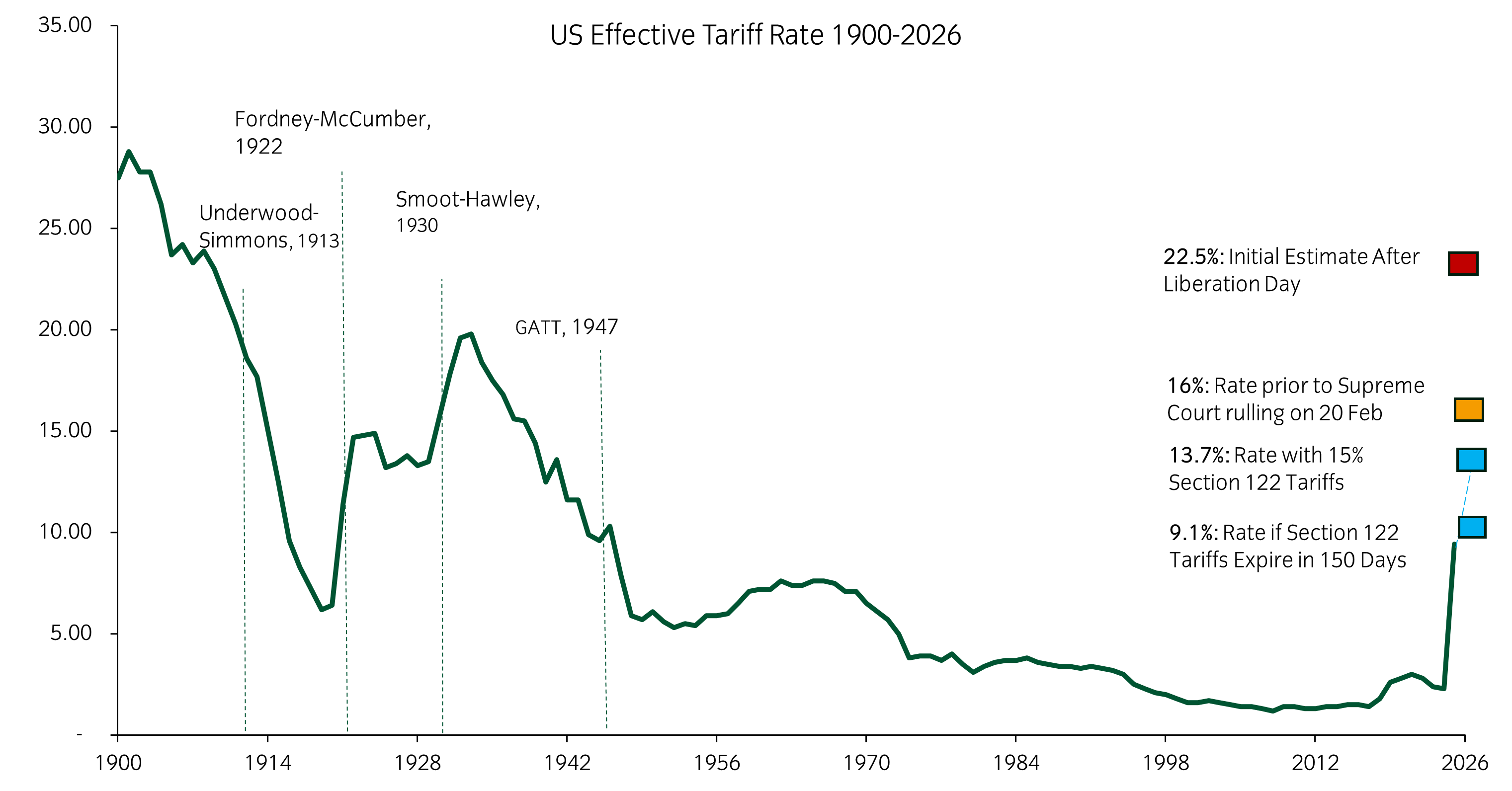

The recent US Supreme Court ruling on tariffs lowers the effective tariff rate for the end of 2026

Stephanie Chan, CFA, Portfolio Manager, said: “The US Supreme Court ruled on 20 February that President Trump exceeded his authority when he enacted global tariffs through an emergency law (IEEPA). Those tariffs are invalidated and the result is a reduction in the expected effective tariff rate imposed by the US. President Trump has already announced a blanket 15% tariff on trade partners through a different provision, Section 122. This new tariff will expire in 150 days unless it is extended by Congress. President Trump can also use other legal routes to enact tariffs, but those other routes will likely take more time and need to be targeted toward specific countries or products. Prior to the Supreme Court’s ruling, the effective tariff rate was 16%. As of 20 February, and after the 15% Section 122 tariffs, the effective tariff rate has reduced to 13.7%. All else equal, if the Section 122 tariffs expire in 150 days, then the effective tariff rate will reduce further to 9.1%. Though President Trump has other means to impose tariffs, the Supreme Court’s ruling significantly impacts the effective tariff rate going forward.”†

Source: Insight Investment, Bloomberg, The Budget Lab, Yale University as at 23 February 2026.

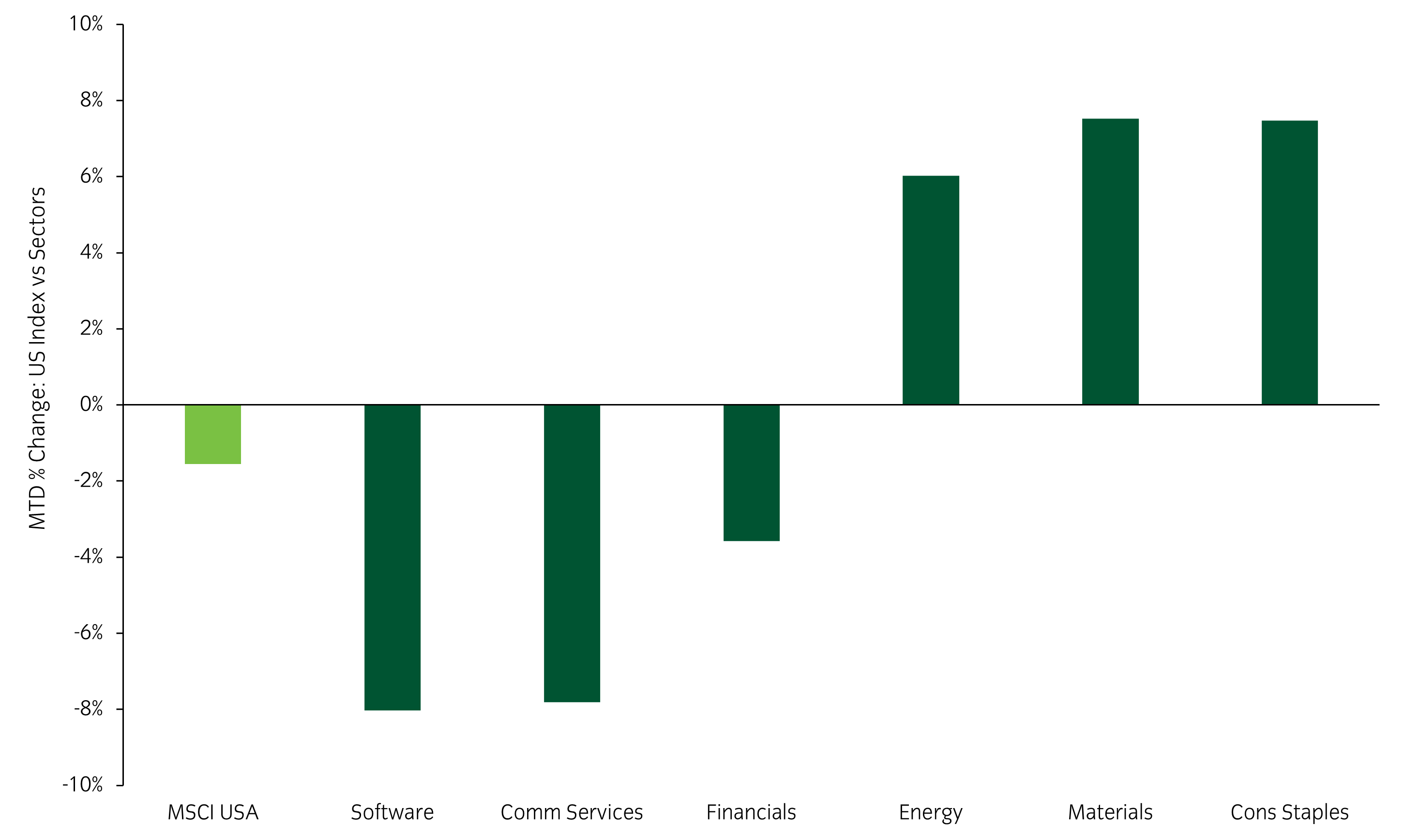

US equities: wide dispersion across sectors despite small changes at the index level

Stephanie Chan, CFA, Portfolio Manager, said: “In recent weeks and months, sectors such as software, communication services, and financials have had strong negative returns, as the market has focused in on potential industries that may be disrupted or replaced by AI tools. The moves at the index level, however, have been relatively muted, as other sectors in the index have had outsized positive returns. This marks a continued rotation within the index, away from sectors that have generally performed well since Liberation Day, but may be vulnerable to disruption by AI, to sectors that have lagged over the past year, but that may be more resilient against AI. Since the beginning of February, the MSCI USA index was down -1.6% while software was down -8.0% and materials were up 7.5%.”†

Source: Insight Investment, Bloomberg as at 16 February 2026.

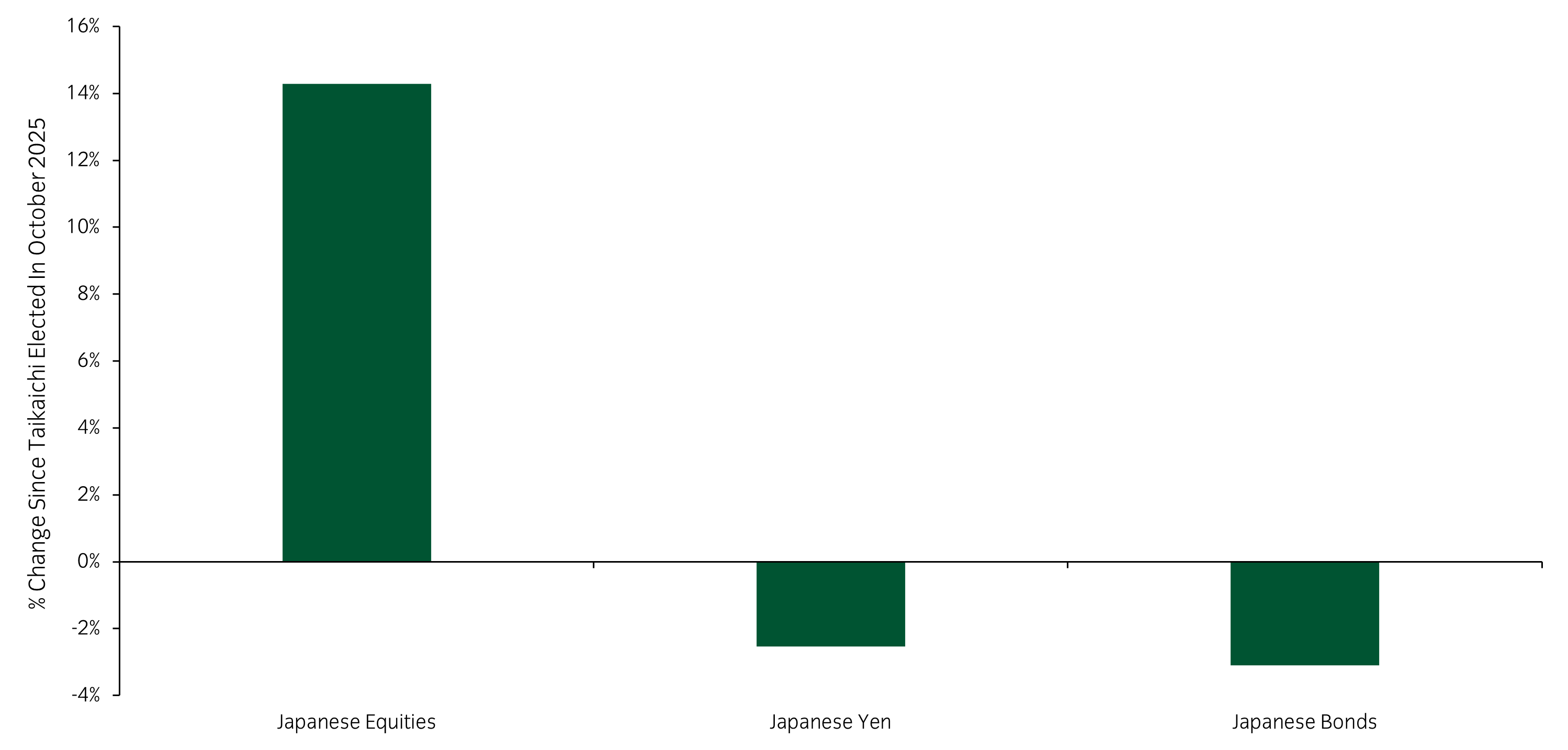

Japanese equities have rallied and Japanese bonds have fallen with Prime Minister Takaichi’s election win

Stephanie Chan, CFA, Portfolio Manager, said: “Sanae Takaichi was elected as Prime Minister of Japan in October 2025. She called a snap election just four months later and subsequently secured, along with a coalition partner, a super-majority in the House of Representatives. Takaichi pledges to spend more and to cut taxes to spur a sluggish economy. She also aims to increase defense spending and has taken a more hawkish foreign policy stance. Since Takaichi’s election in October, Japanese equities have rallied by more than 14%, with the Nikkei index rising 4% in the day following the snap election. In that same period since Takaichi’s election, Japanese bonds have fallen: the Japanese 10-year yield has increased by 0.6%, from 1.7% to 2.3%, as markets continue to expect expanding government borrowing needs.”†

Source: Insight Investment, Bloomberg as at 09 February 2026.

Gold suffered a 14% drawdown at the end of January, a move much larger than its normal volatility

Stephanie Chan, CFA, Portfolio Manager, said: “The price of gold fell by 14% between 28 January and

2 February, a move much larger than its normal range of volatility seen in recent years. Over the past year, gold had been rallying along with risk assets and as the US dollar weakened; gold was seen as a potential alternative to the US dollar as policy uncertainty remained high in the US. Furthermore, the gold price move coincided with Trump’s nomination of Kevin Warsh as the next Fed chair, and given Warsh’s historical comments, the market was concerned about a marginally more hawkish Fed and ultimately a potentially stronger US dollar. Gold suffered a drawdown along with other cyclical sectors of the market that had had relatively strong performance in January, including semiconductors, materials, and industrials.”†

Source: Insight Investment, Bloomberg as at 02 February 2026.