We have seen recent fears over the possibility of a stock market bubble driven by the valuations of companies offering AI services. Some observers have drawn parallels to the dot-com bubble of the late 1990s, which burst in 2000 after internet stock prices soared on growth expectations that proved vastly overstated.

For equity investors, the risks are clear, but we believe fixed income investors can view the growth in AI capital expenditure through a different lens. In fixed income markets, we view the surge in financing for AI infrastructure as an opportunity to access attractive, low-risk debt from high quality issuers that rarely come to market – or through structures typically offering a yield premium relative to similarly rated corporate bonds.

Riding the AI infrastructure build out

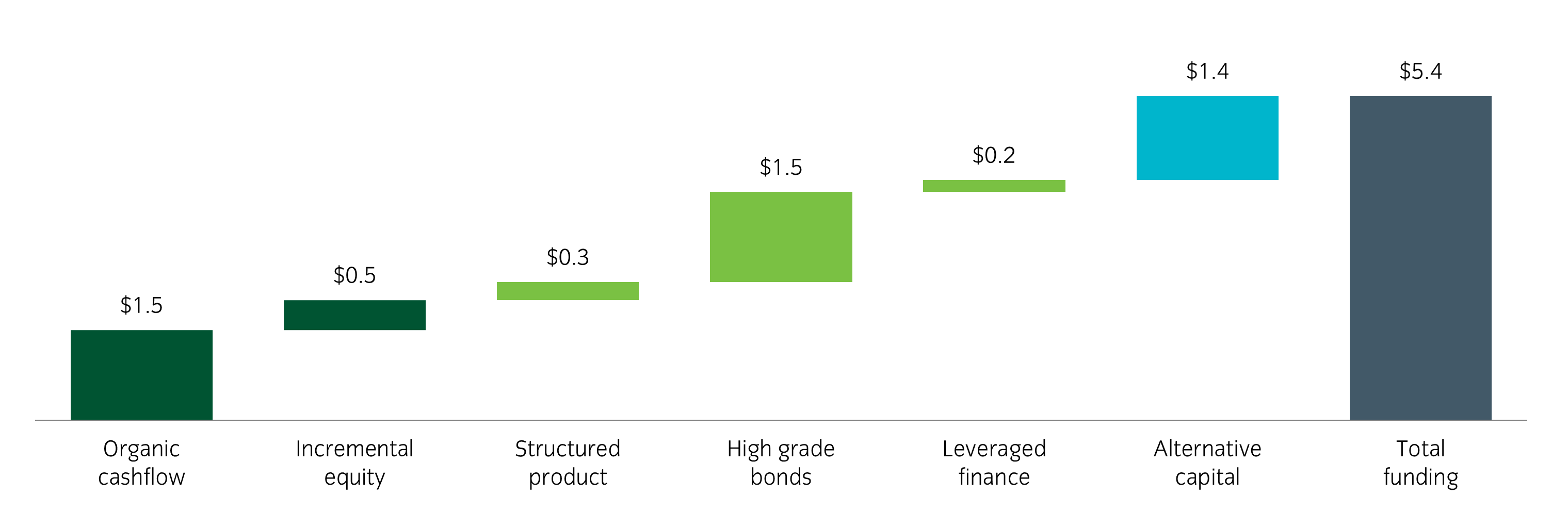

Research by JP Morgan projects that a total $5.4trn could be spent on data centres, AI infrastructure and related power supplies over the next five years1. Out of this figure JP Morgan projects that $1.5trn will be raised from high grade credit issuance. The companies raising such capital have become known as hyperscalers and include Amazon, Apple, Google, Meta, Microsoft, IBM and Oracle2.

Figure 1: How AI capex will likely be funded to 2030

Source: JP Morgan, 10 November. Data is a forecast. For illustrative purposes only

Debt investors shouldn’t fear an equity bubble

The dot-com bubble was defined by companies with weak balance sheets taking on excessive debt. In contrast, today’s AI-related capital expenditure is largely driven by firms with exceptionally strong financial foundations. Across the US, corporate balance sheets and profitability remain healthy.

The largest US technology companies are underpinned by robust, diversified revenue streams – a critical distinction from the dot-com era. So, even if AI business plans disappoint, there is little reason to fear that these companies will have difficulty repaying their debts. Many hyperscalers generate substantial cash flows from existing businesses, and their credit ratings are anchored in these revenues rather than speculative AI income.

Three questions for active credit managers

1. Can markets digest the volume of issuance?

The large volume of hyperscaler credit issuance in October 2025 is widely seen as the point at which the market became more aware of this trend. Notably US credit spreads widened that month, as markets struggled to absorb the unusually large volume of debt. In contrast, euro-denominated spreads tightened in October.

Going forward, in our view, we expect markets to become more attuned on how to process these large bouts of issuance funding AI capex. We believe issuance is likely to come in peaks and troughs in 2026.

Ultimately, although an increase in issuance may impact spreads in the short term, we don’t see it as a problem over longer time horizons. Spreads in US credit markets tightened slightly over 2025, which suggest that demand kept up with supply. With absolute yields remaining elevated, we see little reason at present for this dynamic to change anytime soon – even with this increase in AI related issuance.

2. Will spreads for hyperscalers widen?

Historically, hyperscalers have enjoyed a scarcity premium on their securities, thanks to strong profitability and limited reliance on debt financing. However, the recent shift toward large-scale issuance has eroded that premium, leading to some widening in spreads. The elevated level of issuance is likely to see these issuers trading in this new wider range going forward. From an investor perspective, concentration limits will naturally cap exposure to any single issuer, which we expect will encourage companies to tap different segments of the debt market to diversify their funding sources. Asset backed markets are one area which we are closely monitoring to take advtange of this.

3. Where can value be found?

This wave of issuance offers investors greater access to securities from highly rated companies. However, if supply becomes excessive, it could put further upward pressure on spreads. For active credit managers, a key task is assessing how future issuance may influence spreads and positioning accordingly. Each deal needs to be assessed on an individual basis to determine whether an investor is being adequately compensated – we have seen significant variations between deals in this respect.