The Federal reserve kept the fex funds rate on hold at 5.25% to 5.5%, as recently telegraphed by many FOMC members.

Notably, the committee continued to project another rate hike by the end of the year, and it significantly raised its economic growth forecasts. Chair Powell stated the central bank will "proceed carefully".

|

The Fed is still projecting one more hike this year, but emphasizes “caution”

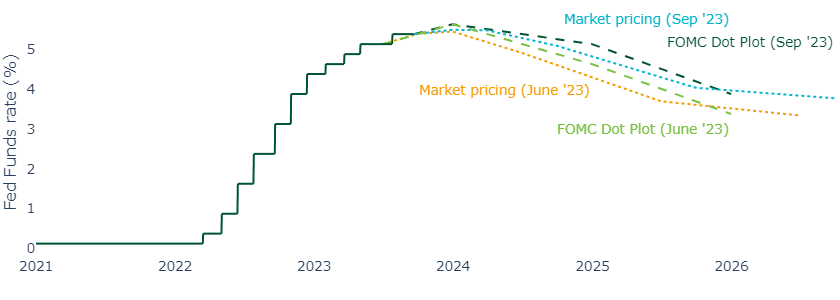

The Fed continued to project one further hike before the end of the year, and adjusted the “dot plot” to reflect a slower pace of rate cuts than it did in at its June meeting, reflecting alignment with the most recent market pricing, which has similarly shifted over the last quarter (Figure 1).

Figure 1: Market expectations have now converged with the Fed’s expectations

Source: Federal Reserve, Bloomberg, Insight, September 2023

We see this convergence as encouraging for the Fed, indicating that the market increasingly sees Fed guidance as credible, which will likely help the central bank keep financial conditions in check.

The FOMC significantly raised its growth projections. It revised its 2023 forecast up from 1% to 2.1% and its 2024 outlook from 1.1% to 1.5%. It reduced its 2023 unemployment rate forecast from 4.1% to 3.8% and 4.5% to 4.1% for 2024. It left its inflation forecast largely unchanged.

Chair Powell cited robust consumer spending and strength in the labor market (albeit he acknowledged some signs of loosening conditions). He emphasized that the Committee will “proceed cautiously”, noting the Fed has “covered a lot of ground” and acknowledged near-term economic headwinds from industrial action in the auto sector, rising oil prices and looming government shutdown.

The US and its global peers appear close to peak rates

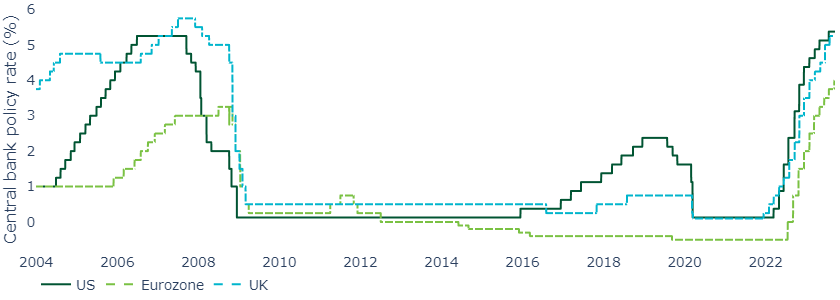

The Fed has not been the only central bank in focus over the last month. Other central banks also appear to be reaching the end of their respective hiking cycles (Figure 2).

Figure 2: The Fed has moved in line with its global peers, but may start diverging

Source: Federal Reserve, European Central Bank, Bank of England, Insight, September 2023

So far, the Fed’s hiking cycle has been closely aligned with its developed market peers. However, we suspect that the Fed may be biased to cut rates slower than other central banks over the coming years, given potentially higher economic sensitivity to higher interest rates outside the US, partly relating to the fact that 30-year fixed rate mortgages are a rarity in other countries.

Nonetheless, the Fed’s policy is having a tightening impact on housing

We believe the Fed is justified in taking a pause. Its hikes are being felt in interest rate sensitive sectors of the real economy.

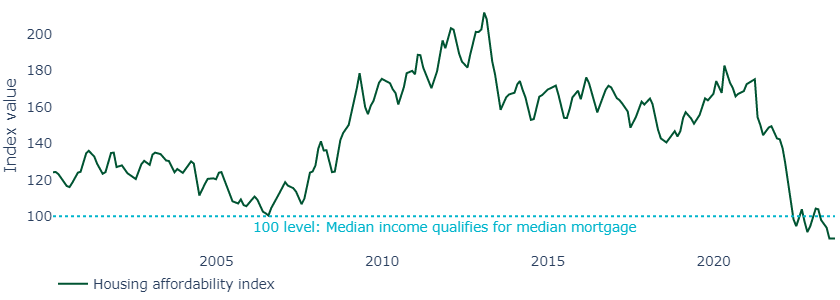

Although many are locked into fixed rate mortgages, conditions for new buyers are strained, largely due to 30-year fixed mortgage rates, which rose above 7% in mid-August for the first time since 2000, from a low of 2.7% during the pandemic.

As a result, home affordability is at its lowest level since at least 1989. Further, the first time since 2006, the median income does not qualify for the median property for sale (Figure 3).

Figure 3: The Fed’s policy has strained housing affordability

Source: National Association of Realtors, September 2023

The Fed may be done, if not we expect it will be in November

We believe that the prospect of a hike in November is finely balanced. Either way, we do not expect any further hikes after that meeting.

Nonetheless, the Fed has underlined the fact that policy will likely be in restrictive territory for some time yet as it will take time for core inflation to sustainably move closer to its 2% objective.

United States

United States