Congress is on a fast-approaching collision course over the debt ceiling in June. Treasury coffers will run dry if the limit is nor raised or suspended in time. Uncertainty will likely rise but market volatility may also create investment opportunities.

Our base case is a 90% probability of a last-minute agreement to raise the debt ceiling. However, the probability of a US default is arguably higher than in recent years and needs to be carefully considered.

Contents

- A quick reminder of the debt ceiling

- Today's impasse is similar to 2011

- Congress likely has until the summer

- Insight's expected scenarios

- Base case (90% probability): Resolution

- "Messy" case (8% probability): No debt ceiling raise but no default

- Disaster case (2% probability): US sovereign default

- Volatility may create opportunity

- Prepare for uncertainty and volatility

A quick reminder about the debt ceiling

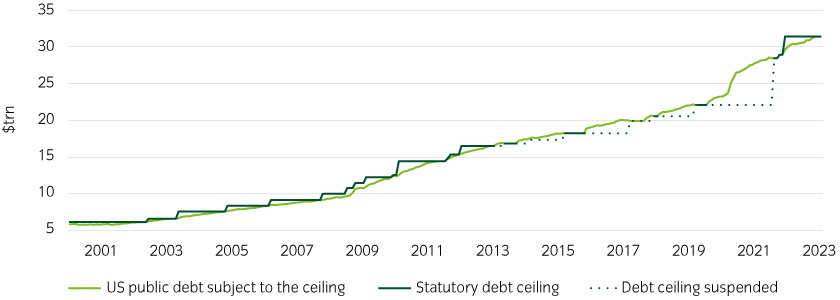

The US Constitution has always granted Congress authority over federal debt issuance. In 1917, due to wartime costs Congress implemented a ceiling to avoid approving every debt issue1. Since that time, Congress has had to continually raise the ceiling to fund agreed spending obligations, including repaying debt (Figure 1).

Figure 1: A recent history of raising the debt ceiling

Source: Bloomberg, April 2023

Today's impasse is similar to 2011

In 2011, the Republican Party (having won back the House of Representatives in the midterms) refused to agree to raise the debt ceiling without future spending concessions from President Obama’s administration. Talks repeatedly broke down until the 11th hour. Amid the market volatility and uncertainty, S&P downgraded the US credit rating from AAA to AA+, which has been unchanged since.

There are obvious parallels to today, with the Republicans having won the House in last year’s midterm elections. As before, a path forward could be a bipartisan deal, but it similarly may come at the expense of America’s remaining AAA credit ratings2.

The difference this time is the contentious position of House Speaker Kevin McCarthy, who was forced to grant significant concessions among factions of the Republican party, such as restoring the ability for any single House member to raise a “motion to vacate the chair”3 making a compromise bill complex.

A House bill that includes spending cuts will require support of the Democratic Party. Ratification in the Senate will necessitate enough Democrats agreeing to the cuts and voting with Republicans. This increases the potential for further gridlock.

Finally, President Joe Biden will have the option to veto any bill and has, at multiple times, stated that he is willing to do so.

Congress potentially only has until early June

The US reached the debt ceiling on January 19 according to Treasury Secretary Janet Yellen.

The Treasury’s next step has been to implement so-called “extraordinary measures” that involve suspending “special” forms of debt that also count against the debt limit4.

These include the Treasury’s issuance to state and local governments (known as "SLGS") and “special-issue Treasuries”, for investment from federal employee retirement and disability funds, savings funds and the dollar assets of the Treasury’s Exchange Stabilization Fund. Suspending these debt issues prevents those funds from earning interest but do not interfere with the Treasury’s day-to-day operations.

In January, Treasury Secretary Janet Yellen initially estimated these measures would hold the Treasury over until at least early June, with markets generally viewing the “X date” (the date the Treasury will run out of funds) would follow later in the summer.

However, On May 1, after reviewing federal tax receipts, Secretary Yellen revealed the Treasury’s estimated X-date at “early June and potentially as early as June 1” This is likely a conservative date with a large window but more urgent than original market estimates.

Insight's expected scenarios

1) Base case (90% propbability): Resolution

We see a “clean” debt ceiling lift (i.e. with no concessions) as unlikely, instead a fiscal spending deal that pairs a debt ceiling lift with immediate or future spending cuts is our most likely outcome.

2) "Messy" case (8% probability): No debt ceiling raise but no default

If there is no agreement ahead of the X date, the White House may look to unconventional and unprecedented measures, such as payment prioritization or invocation of the 14th Amendment to prevent a sovereign default.

3) Disaster case (2% probability): US sovereign default

The US defaults on its obligations and sends the US and global economies into a tailspin.

Base case (90% probability): Resolution

Ultimately, the prospect of a US default is severe and in the interests of neither political party. We believe that the compromise of some spending cuts attached to raising the debt ceiling is the mostly likely outcome.

At the same time, an early agreement will be hard to strike. As we approach the X date, Congress will face mounting pressure to get a deal over the line, even one that merely kicks the can down the road. Business leaders, ratings agencies, regulators and markets will apply mounting pressure to politicians as the deadline approaches.

What could go wrong: if the government is forced to enact steep spending cuts, it could lead to reduced economic growth and job losses.

"Messy" case (8% probability): No debt ceiling raise but no default

If Congress fails to raise the debt ceiling, the White House will likely pursue one or more of the following options. However, if we can contemplate these options, so can Congress, which may make a deal less likely than in 2011.

1) Payment prioritization: The Treasury pays obligations to bondholders first, deferring payment to other creditors. It has some experience doing this through government shutdowns where it meets “essential” payments only. However, payment prioritization reportedly faces technological hurdles, so this will be a challenge, but one we would expect the Treasury to overcome in a pinch.

Our take: The best of a bad menu of choices. This likely keeps Treasury investors comfortable that the timeliness of principal and interest is secure, although technical default may trigger CDS and other contractual obligations.

2) Fed intevernes to keep market functioning: The Fed can potentially purchase and resell Treasury securities at risk of imminent default through the standing repo facility, which was initially created to ensure dollar liquidity for the banking system.

Our take: Holders of delayed securities can earn the repo rate on these securities, but the idea is at least complicated by member banks only being eligible and current size limit.

3) Treasury mints $1trn coin: The Treasury is solely responsible for creating physical notes and coins, through the mint. Some have suggested creating a $1trn coin to deposit in its account at the at the Fed, thereby creating spending power without new debt.

Our take: Treasury Secretary Yellen and Fed officials have been strongly outspoken against this idea, questioning its legality. We believe this will lead to a significant inflationary and term premium impulse as it could be considered an extreme form of MMT (modern monetary theory), or unfettered printing money or debt monetization.

4) Invoke the 14th Amendment of the US Constitution: Section four of the 14th Amendment states, “The validity of the public debt of the United States… shall not be questioned.” Some argue this makes a US default unconstitutional, allowing the debt ceiling to be ignored, potentially through a Presidential executive order.

Our take: Many legal scholars disagree with this interpretation of the 14th Amendment. We believe it is highly uncertain how the Treasury would proceed.

What could go wrong: Payment prioritization, even if achievable, is only a temporary measure. It also implies severe fiscal retrenchment as the Fed will need to neglect non-debt spending until a deal is made.

Minting a coin or invoking the 14th Amendment would almost certainly face legal challenges, lead to a US sovereign credit rating downgrade, create prolonged global market volatility and undermine global financial stability. The involvement of the courts may even lead to a default by reversing or delaying decisions. It will also likely trigger a constitutional crisis which, among other things, will undermine national institutions and the principle of separation of powers between the executive and legislative branches.

A messy debt ceiling process could also severely damage the US government's credibility and reputation as a stable partner in international affairs and will damage the US dollar’s status as the world's reserve currency.

Disaster case (2% probability): US sovereign default

At a minimum, a default would likely:

- result in a run on money market funds, stablecoins, and even banking deposits as investors rush for cash;

- jeopardize contractual agreements and investment guidelines where the full faith and credit of the US government is used as collateral or stipulated

- result in all credit rating agencies downgrading the US from investment to speculative grade (BB or lower):

- dramatically increasing the cost of funding for future US debt obligations

- leading to widespread forced selling

- cause the US dollar value to plummet and lose its “exorbitant privilege”:

- potentially leading to the USD losing its reserve currency status

- resulting in American companies being asked to settle international transactions in other currencies.

- cause interbank lending to come to a sudden halt as the cascading effects of the default reverberate across the global banking system

- drive up the borrowing costs for other borrowers in the economy, including households, businesses, and state and local governments.

- raise a plethora of questions with no obvious answers, such as: “Would Treasuries still be accepted as collateral?” and “How will the system deal with delayed coupons or principal repayments?“

What could go wrong: The short answer… everything.

The US and the world will potentially experience a severe recession not dissimilar to 2008 and a near-complete credit market freeze. US Treasury debt is the global benchmark safe haven, and its interest rates are the foundation for pricing a vast range of financial products. A default would undermine the foundation of the modern global financial system.

Contingency planning for potential temproray missed treasury debt payments

We believe investors should consider the following:

Prepare for volatility: In the event of a missed payment by the Treasury, financial market and uncertainty volatility would almost certainly be high. This may have a material negative impact on financial asset risk premiums and liquidity. Clients should be prepared for a series of knock-on effects that might impact portfolio returns and access to funds.

Avoid the potential to become a forced seller: Investors should review outstanding portfolio guidelines in detail. Their current guidelines may restrict holding US Treasury securities in the event of a downgrade. Other debt may also be downgraded in line with the sovereign. Overall average quality restrictions, calculated on a weighted market value basis, could be triggered. The focus should be on acting now to prevent being a forced seller during what would likely be illiquid and volatile markets. Even if a missed payment is averted, the debt ceiling risk is ongoing. Investors should take the time to mitigate these guideline risks.

Maintain adequate liquidity: Investors that have known liquidity needs should prepare in advance to ensure access to necessary cash. As they raise liquidity, investors need to be mindful about where the cash resides to minimize the risk of the funds being encumbered in any way due to missed Treasury payments. As financial market volatility and uncertainty would likely rise, we believe clients in unfunded strategies should maintain adequate contingent liquidity to ensure their ability to satisfy any mark-to-market demands without being forced to close a position. Specifically, clients that require liquidity in the current potential X-date range (of the first two weeks of June) should consider holding short-term debt of US Agencies or Supranational issuers that are high quality, liquid and are expected to pay on time in the event of a temporary payment delay on US Treasury securities.

Volatility may create opportunity

We believe money market funds and liquidity investors will avoid Treasury investments around the summer, given the risk of a payment delay. We expect this to create opportunities for investors who do not have liquidity as a primary objective.

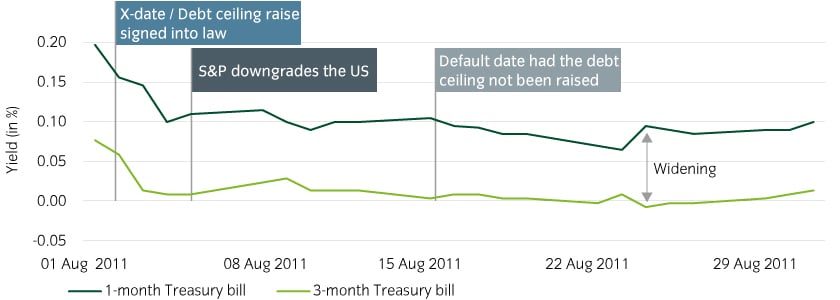

The 2011 experience is worth revisiting for potential clues. 1-month Treasury bills notably underperformed 3-month bills (Figure 2). In our experience, the 1-month bill was more volatile than the historical data suggests, and pricing of bills maturing just after the X date drove yields into negative territory.

Therefore, one line of thought is that pricing is a function of the probability of payment delay, the incremental yield on offer versus the rest of the market, and the opportunity cost for use of funds if a payment is delayed.

Figure 2: Treasury Bill yield spreads widening during the 2011 debt ceiling stand-off

Source: Bloomberg, Feburary 2023

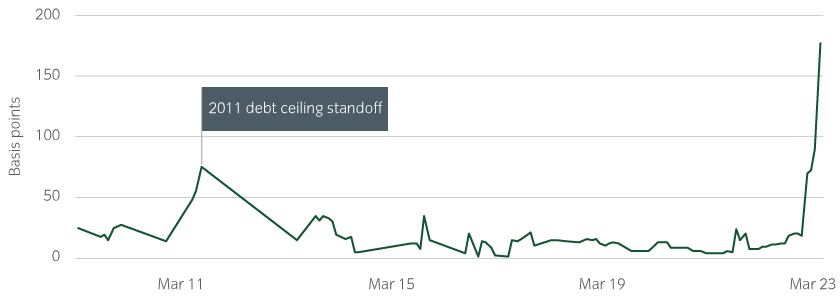

US sovereign credit default risk premiums also rose to unprecedented levels in 2011. Notably, they have recently returned to those heights (Figure 3). Selling default protection on the US now earns a premium in what should be considered the archetypal “risk free” asset, although this year’s experience may prove to be decidedly more complex.

Figure 3: US credit default swap premium, 5-year

Source: Bloomberg, Feburary 2023

Fiscal policy may tighten if our base case is correct

We believe that markets will also be affected in the medium-to-long-term by the outcome of the legislation if our base case comes to fruition. We expect the Republicans to succeed in achieving some spending cuts, which will temper the fiscal impulse to economic growth, and may come at a time when the economy is more sensitive to those spending cuts, given a higher Federal Funds rate environment. Sequestration from the 2011 debt ceiling compromise required $1.2trn in spending cuts over 10 years. The Congressional Budget Office estimated it reduced economic growth by 0.5% during its initial years5.

It is a reminder that, as inflation continues to run high, authorities will push for tighter policy, not just from a monetary perspective, but from a fiscal perspective too. We therefore believe investors should remain vigilant and seek compelling fundamental value, as the overall investment backdrop will likely be highly uncertain.

Prepare for uncertainty and volatility

In the base case of congressional compromise, it is likely that liquidity investors avoid affected securities while return-seeking investors again capitalize on a tactical opportunity. More relevant in the medium term is the severity of the spending compromise and the potential disinflationary fiscal impulse to the economy.

And while the risk to default is low, it is at least perceived to be rising, and thinking through potential alternative outcomes is prudent. Our list is not exhaustive and is highly uncertain, but the longer-term implications from this thought process implies an investment environment with structurally higher inflation and term premiums.

Ultimately, and as the X date approaches, we believe investment diversification remains the best strategy to manage the near-term volatility and highly uncertain outcomes from alternative scenarios.

United States

United States