|

P&C earnings bring tax considerations into investment focus

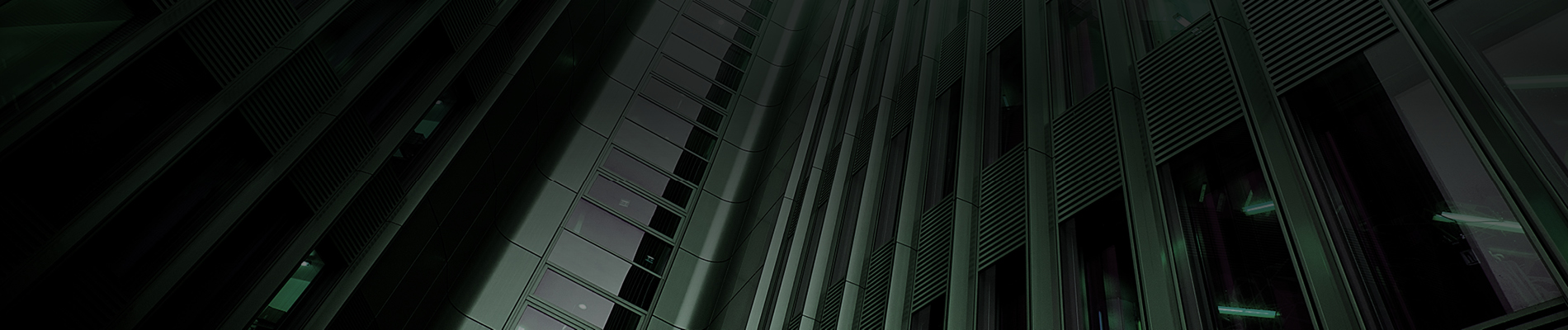

The post-pandemic environment continues to be challenging for insurance companies. Property & Casualty insurers likely experienced a second consecutive year of operating losses in 2023. The main causes continued to be persistent inflation, rising climate events (Figure 1), the impact of higher interest rates on investment portfolios and a fifth year of rising reinsurance rates.

Figure 1: Rising climate-related costs helped make for a challenging environment for insurers

Source: Macrobond, NOAA, February 2024

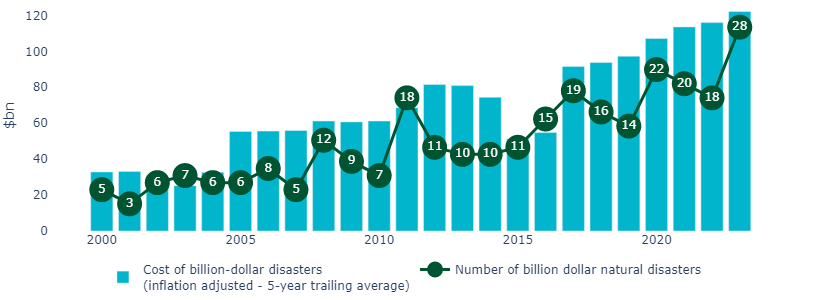

The industry’s combined ratio rose above 100 in 2022 for the first time since 2017 and S&P projections indicate the ratio stayed above 100 in 2023 (Figure 2).

Things are looking only modestly better for 2024. S&P Global Ratings and others project the metric will descend below the neutral 100 level, but only just, while remaining close to it for the next few years. We expect above-target inflation and reinsurance costs will be a risk to these forecasts.

Figure 2: Profitability may be challenged for some time

Source: S&P Global, June 2023

Time for insurers to take a more active approach in their pivot from tax-exempt assets?

P&C insurers have been taking a passive approach to reducing their tax-exempt bond exposure

The US insurance industry is one of the major institutional investors in the $4trn1 municipal bond market. Municipal bonds represent ~16%2 of the insurers’ total bond exposures, with P&C companies the largest holders within the industry.

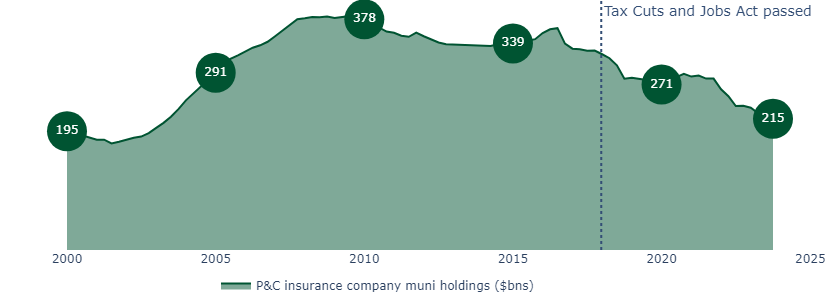

However, the tax benefits of owning tax exempt bonds have dwindled since 2017, when the Trump administration passed the Tax Cuts and Jobs Act (TCJA). The TCJA lowered the corporate tax rate from 35% to 21%, which reduced the tax benefit for insurers. The legislation also eliminated advanced refunding of municipal bonds, which significantly reduced new municipal bond issuance. This came just before federal aid, granted during the pandemic, reduced issuance needs further by shoring up the coffers of municipalities.

Lower supply has helped depress the ratio of tax-exempt yields to Treasury yields (a common measure of relative value) to an average of 73% over the past three years. However, P&C insurers generally favor the tax advantage of municipals over taxable bonds when the ratio is 83% or greater.

Since the TCJA’s passage, P&C companies have generally allowed their tax-exempt municipal holdings to passively fall from a collective peak of $380bn in 2010 to $207bn at the latest count, the lowest levels since the start of the millennium (Figure 3).

Figure 3: P&C insurance companies have been pivoting away from munis due to dwindling tax incentives

Source: Federal Reserve, February 2023

It could be time for active sales of tax-exempt bonds once deferred taxation is taken into account

Many have felt ‘stuck’ with their remaining tax-exempt holdings that are not set to imminently mature, as in many cases they would be forced to realize losses on the holdings if they were to sell them.

It is often true that selling will result in realizing losses, deferred tax benefits have changed the calculus on actively reducing municipal allocations. Insurers anticipating little to no tax liability in the coming years may be able to easily offset realized losses with the incremental income from switching into taxable bonds. We have found that the payback period (i.e. the time it takes to recover a crystallized loss from the yield benefit of switching into taxable bonds) can be less than 1-year if well-managed.

Taxable municipal bonds may be an attractive alternative

We believe municipal credit can still be an important allocation for fixed income investors; taxable municipal bonds generally offer higher yields than tax-exempt bonds while still providing the benefits of owning municipal bonds.

Municipal bonds are a high-quality asset class, offering diversification against investors’ riskier holdings. Since 1970, the US economy has endured seven official recessions and municipal bonds have been resilient through them all, recording an average 10-year default rate of 0.2% across the credit spectrum, compared to global corporates, at 10.4%3.

We think municipalities have even stronger credit fundamentals than corporate and consumer credit. Many municipalities have built up so-called “rainy-day” funds and have since been able to save much of the pandemic-era stimulus the federal government provided them and recently enjoyed better-than-expected tax collections.

Most have ample firepower to navigate potential surprises like revenue shortfalls or spending overruns. Of all credit issuers, we believe state and local governments are particularly well-positioned for an economic slowdown.

Insight has helped investors rebalance their investments for tax purposes

Insight has recently worked with several of our tax sensitive insurance clients to actively reduce their tax-exempt municipal bond holdings.

We focused on securing an attractive payback period on sales and have generally reduced each client’s tax-exempt exposure by 50%-80%, achieving payback periods (over which the incremental income gain offsets crystallized losses) between 6-months and 1-year4.

Depending on the needs of each client, we invested the proceeds pro-rata into their broad taxable bond allocation or taxable municipal bonds (to maintain the quality and diversification benefits of municipal bonds).

We achieved a yield-pickup of 2% to 3% on these sales, thus adding 40bp – 50bp of incremental yield on their aggregate fixed income portfolios4.

Insight and insurance companies

Our specialist insurance team has a breadth of experience constructing capital efficient investment solutions and provide ongoing reporting, analysis and technical support. We aim to be an extension of your in-house team, working in close partnership with clients and their advisors.

If you would like to discuss your tax management strategy, please do not hesitate to contact us.

About Insight

Insight is a global asset manager, responsible for $825.9bn in assets under management across fixed income, risk management strategies and absolute return capabilities. At the heart of our investment philosophy, is a desire to offer clients innovative yet practical solutions. At Insight we manage $32bn for over 50 insurers globally, providing investment solutions that utilize a range of multi-asset capabilities, tailored to the needs of the insurance company.

United States

United States