However, for some, high yield liquidity has never been better, via the ETF ecosystem through credit portfolio trading.

Contents

- Summary: Liquidity has never been better in high yield for some

- Liquidity challenges make it tough to extract the full potential of the high yield

- We have helped investors unlock 'hidden liquidity' within the ETF ecosystem

- The ETF ecosystem briefly explained

- Credit portfolio trading case studies

- Making use of credit portfolio trading in high yield allocations

- Managers need expertise within the ETF ecosystem to implement credit portfolio trades

Summary: Liquidity has never been better in high yield for some

- Credit portfolio trading is a more liquid and innovative way to trade high yield bonds than over-the-counter (OTC) trading for portfolio implementation. It aims to extract the full potential from less liquid markets such as high yield

- With the right technology, tools and relationships, managers can trade custom baskets of up to 1,000 bonds, within minutes, through the ETF ecosystem

- Credit portfolio trading can help investors source diversified beta, alpha opportunities that can be otherwise difficult to target. A highly diversified and liquid portfolio could also potentially act as a liquidity sleeve within a multi-manager allocation.

Liquidity challenges make it tough to extract the full potential of the high yield

High yield has become increasingly attractive for income generation and as an equity substitute, given a higher yield environment.

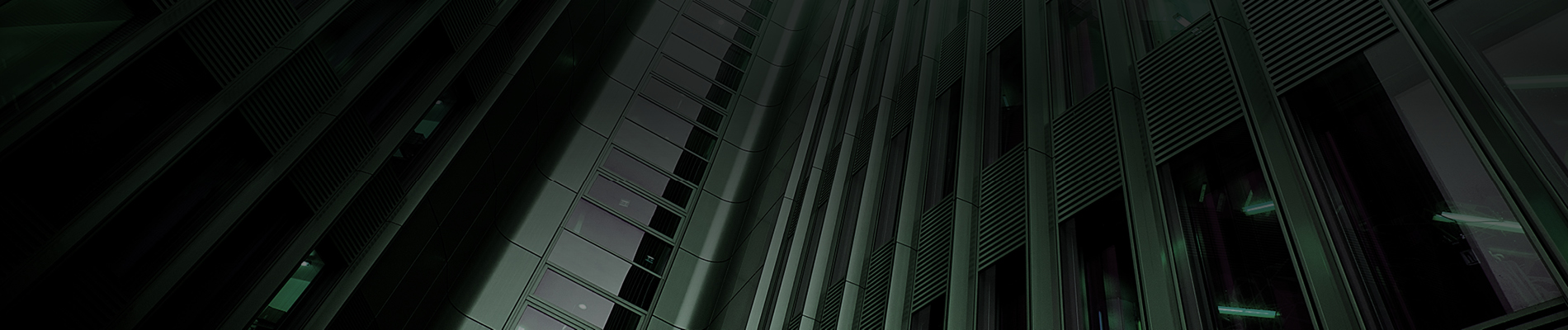

However, it is difficult to fully extract higher headline yields in practice. Bid-ask spreads are typically 60bp to 80bp per bond, so most active and passive strategies have underperformed the index over the medium and long term (Figure 1).

Figure 1: Most high yield strategies struggle to extract the potential of high yield

Source: eVestment Alliance, as of March 31, 2023. Past performance is no assurance of future returns.1

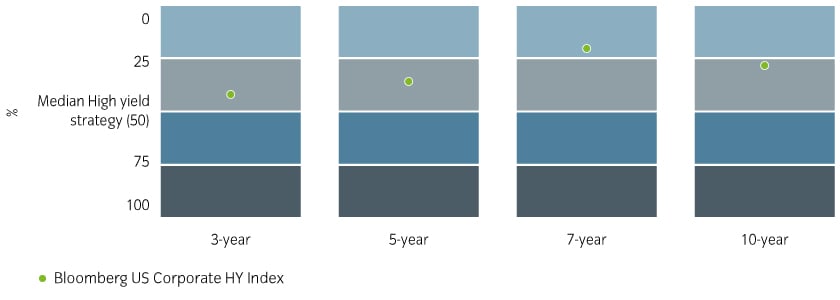

Traditional approaches to high yield bond trading results in lower liquidity

Investment managers traditionally trade bonds over-the-counter (OTC). This means trading one bond at a time, line item by line item, typically by calling brokers or through electronic trading (Figure 2).

Figure 2: OTC trading is line item by line item

Source: For illustrative purposes only

In the high yield market, it can take days or even weeks to complete an order. 2008-era banking regulations harmed liquidity by making it costlier for dealers to hold large bond inventories. Dealers can struggle to find the other side of a trade and have the challenging task of hedging idiosyncratic risk they hold. During stressed markets, two-way liquidity typically evaporates.

We have helped investors unlock 'hidden liquidity' within the ETF ecosystem

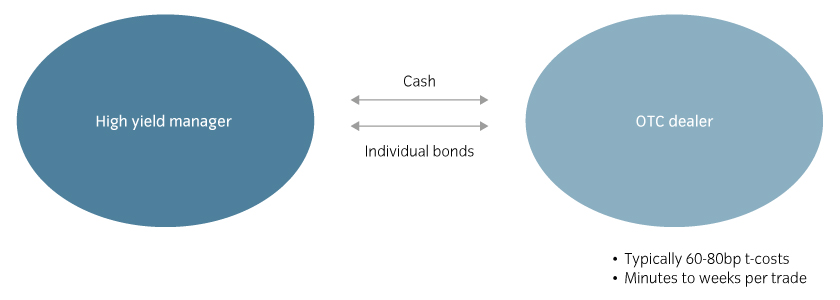

The fixed income ETF ecosystem has developed rapidly over the last few years

The fixed income ETF market has grown substantially in recent years, accounting for an ever-rising share of fixed income trading, particularly during stressed markets (Figure 3). This has resulted in an increasingly deep and robust ETF 'ecosystem'.

Figure 3: The share of high yield ETF trading is rising, particularly during stressed markets

Source: Goldman Sachs, March 2023

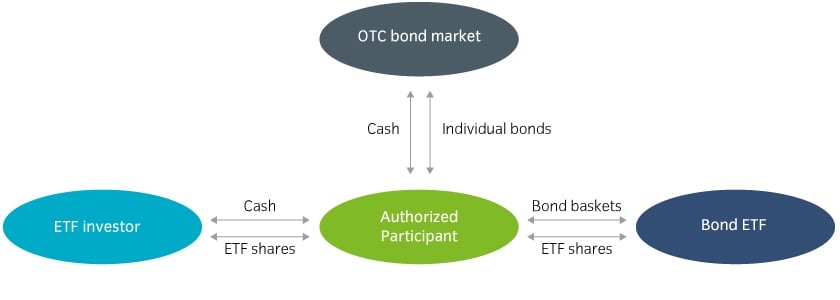

The ETF ecosystem briefly explainedETF issuers work with 'authorised participants' (APs – designated speciality brokers for ETFs) that act as middlemen between investors and the ETF issuers to transfer bonds in or out of the ETF (Figure 4). For example, when investors buy shares in an ETF, all else equal:

When investors sell ETF shares, the reverse happens. The AP takes the ETF shares from the investor and gives them back to the ETF issuer – which then redeems them for a bond basket. The AP liquidates the basket and returns the cash to the investor4. |

Figure 4: The basic ETF 'create and redeem' ecosystem

Source: Insight, June 2023. For illustrative purposes only

The process ensure liquidity as ETF shares can be created or redeemed in line with investor demand and APs compete away arbitrage opportunities if ETF prices deviate from the fair value of the underlying bonds.

We pioneered credit portfolio trading as a more liquid way to trade high yield bonds

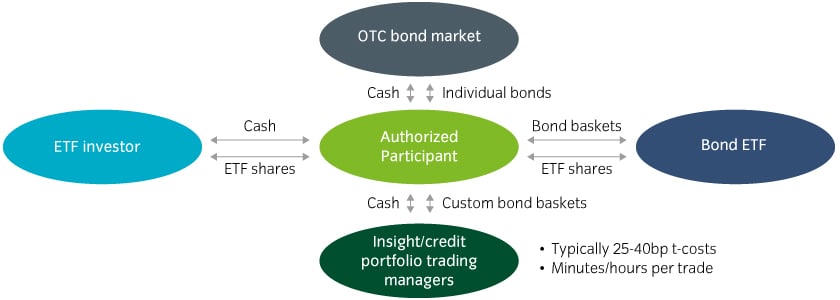

The ETF ecosystem provides a source of 'hidden liquidity' for managers with the expertise and know-how. We noticed this and pioneered 'credit portfolio trading' in fixed income to tap into it. APs are increasingly trafficking in bond baskets to meet growing ETF demand and to manage day-to-day flows. This is challenging them when trading OTC, as larger sized single bond line items that can take much longer to trade, may have idiosyncratic risk and may not have a natural buyer/seller.

Investors therefore can trade custom bond baskets (or credit portfolios) with APs instead of single bonds one at a time. In our experience, transaction costs for well-structured credit portfolio trades in the high yield market tend to be 50-75% lower than OTC trades5 (Figure 5).

Figure 5: Credit portfolio trading through the ETF ecosystem

Source: For illustrative purposes only

This better suits APs’ requirements for trading with ETFs, collecting commissions, chasing arbitrage opportunities, hedging (as hedging bond portfolios is easier than hedging single bonds), and managing inventories.

Our investment process allows us to trade up to 1,000 high yield bonds within hours if not minutes, even during stressed markets. Managers can customised these baskets, tilting them towards desired overweights and underweights.

Credit portfolio trading case studiesCredit portfolio trading has delivered benefits6 of relatively lower trading costs with two-way liquidity during stressed markets:

|

Making use of credit portfolio trading in high yield allocations

We believe that credit portfolio trading can open the door to a highly diversified high yield strategy that efficiently captures beta more effectively than a traditional active or passive high yield strategy. Further, within a wider high yield allocation, a strategy that uses credit portfolio trading can double up as a 'liquidity sleeve' for the entire allocation.

Standalone liquid broad-based high yield strategy

Credit portfolio trading can allow investors to build diversified high yield strategies holding up to 2000 high yield bonds, 10 or 20 times more than typical in traditional active or passive portfolios.

Further, managers can tilt strategies to reflect precise overweights and underweights relative to the index with a quantitative portfolio construction and trading platform.

A 'liquidity sleeve' within a multi-manager high yield framework

Investors can potentially benefit from a liquid high yield strategy within the rest of their high yield allocation as a 'liquidity sleeve'. Consider an allocation comprised of three high strategies, one of which uses credit portfolio trading (Table 1):

Table 1: A liquid high yield portfolio within a multi-manager framework

|

Low risk Satellite |

High yield portfolio using credit portfolio trading |

High risk Satellite |

|

|

Concentrated Defensive |

Core / Liquidity Sleeve |

Concentrated High risk |

|

| Allocation | 30% | 40% | 30% |

| Holdings | 200 | 1,700 | 99 |

| Tracking error | 2% | <0.50% | 5% |

| CCC exposure | 13% | 12% | 58% |

| Beta | 0.85 | 1.00 | 1.05 |

Source: Insight, June 2023. For illustrative purposes only

The presence of the more liquid high yield strategy can enable other, less liquid, strategies to work as intended without the potential drag of forced selling to meet cash flow obligations, rebalancing or strategic or tactical reallocations. Instead, a more liquid high yield portfolio can take on the liquidity burden more cost-effectively and efficiently through stressed or normal market conditions.

Further, investors allocating to deeply illiquid credit markets may wish to initially allocate into a credit portfolio trading-based high yield portfolio, rather than cash, as they wait for cash to be drawn down over months or years.

Managers need expertise within the ETF ecosystem to implement credit portfolio trades

Our Systematic fixed income team at Insight has 15 years of experience managing and sub-advising ETFs, cultivating in-depth knowledge of their inner workings.

For over two decades, we have also invested in developing proprietary technology to assess thousands of bonds along multiple risk dimensions to quickly generate diversified custom trade baskets for portfolio construction and liquidity management.

Further, over the past 15 years we have fostered strong relationships with APs, which has allowed us to work side-by-side with them to iterate and innovate credit portfolio trading processes with the aim of delivering further benefits to our clients.

We believe using this framework even within just one strategy can dramatically enhance an entire high yield allocation, by ensuring liquidity, diversification and allowing investors to collect a 'free' illiquidity premium.

Australia

Australia