Summary

A continued reduction in trade uncertainty and increased expectations for interest rate cuts has given a surprising resilience to the global outlook over the past three months. However, the likely terminal rate for tariffs is at the higher end of expectations and we expect global growth to slow.

The outlook for US interest rates is not clear; while the disinflationary process has stalled, there is increasing government pressure for a cut. More broadly, we see the US dollar still faces the headwinds of a stretched valuation and unsustainable fiscal outlook. We retain a short US dollar exposure.

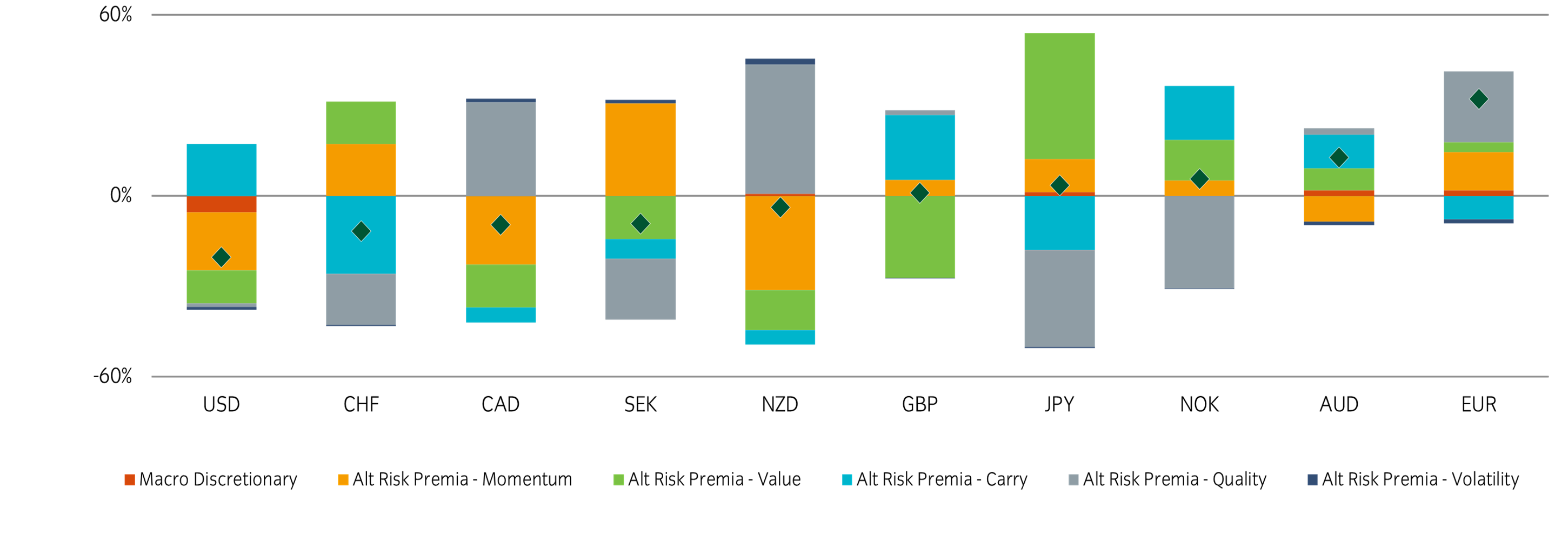

Our Alt Risk Premia model also holds a short USD exposure driven by Momentum and Value – Carry is only partially offsetting the positive USD exposure. Elsewhere, our model favours longs in EUR and AUD versus shorts in CHF, CAD, and SEK.

The alpha view

Given the uncertainty around the policy outlook and extended USD short positioning, our macro exposure is limited. We have a modest USD short, with a bias to add to this on rallies.

The Alt Risk Premia model also holds a short USD exposure driven by the Momentum and Value – Carry is only partially offsetting the positive USD exposure. Elsewhere, our model favours longs in EUR, and AUD versus shorts in CHF, CAD, and SEK.

The overall portfolio seen in Figure 1 (see page 1), is short USD, but with only a moderate beta.

Our approach to generating returns in currency markets uses a diversified set of factors that cover key short and medium-term currency drivers. These latter include macro themes, as well as an additional five risk premia – namely Carry, Momentum, Volatility, Value, and Quality.

Figure 1: Insight currency absolute return exposure

Source: Insight. Data as of 3 October 2025. Note: dark green dot shows aggregate position.

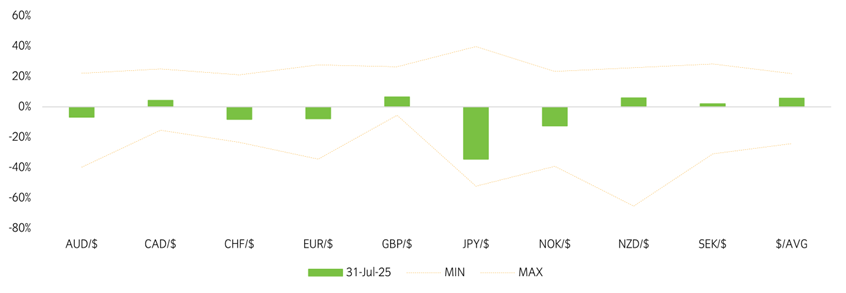

Longer-term valuation overview

For less agile longer-term investors whose investment decisions lean more heavily on valuation metrics, a few points can be made.

• USD, CAD, GBP, NZD are expensive;

• JPY and NOK look very cheap

• While EUR, CHF and AUD are only moderately cheap;

• SEK looks close to fair value.

Figure 2: Local currency overvaluation (+) and undervaluation (-) versus USD

Source: Insight. Data as of 30 September 2025.

Insight’s Richard Turner leads FXPA’s push for transparency in FX internalisation

In July 2025, the Foreign Exchange Professionals Association (FXPA) released a landmark guidance paper aimed at standardising the definitions and practices surrounding FX internalisation in algorithmic execution. The development of the paper was led by Richard Turner, Senior Trader at Insight Investment and Chair of FXPA’s Buy Side Working Group.

After months of cross-industry dialogue, the paper seeks to address growing concerns around transparency and execution quality in FX markets, particularly where internalisation practices vary widely and lack consistent definitions.

“Internalisation plays a critical role in today’s FX landscape,” said Turner, “but without clear definitions and standards, its application can raise concerns around transparency and execution quality. This guidance offers a practical framework that supports market integrity while enabling continued innovation and efficiency in FX trading.”

To read the full guidance paper click here.

Most read

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro, Fixed income

October 2023

Global Macro Research: Yield-curve inversion – an unreliable recession signal?

Fixed income

December 2025

Latest fixed income review and outlook

Responsible investment, Fixed income

June 2022