|

|

In 2019, Insight helped the trustee of the Affinity Water Pension Plan to adopt a state-of-the-art risk management framework for pension schemes. Michael Calabrese, chair of the plan, shares his view on the trustee experience. |

Michael Calabrese

Chair, Affinity Water Pension Plan

- What concerns led you to consider a new approach to investing?

- Why did you opt for Insight’s Integrated Solutions in 2019?

- How has your integrated approach fared since adoption in 2019?

- Were there any non-investment benefits of your approach?

- How would you summarise your experience of Integrated Solutions?

What concerns led you to consider a new approach to investing?

As Trustee of the Affinity Water Pension Plan (The Plan) our primary objective is to pay the pensions promised to all our members. Specifically, the Plan’s objective is to be fully funded on a gilts-flat funding basis by 2028. Over the expected time horizon of the Plan, the unpredictability of mortality rates, interest rates, inflation and investment returns all pose a threat to meeting this objective. As such, we were keen to find ways to increase the certainty of meeting our objective and doing so with maximum efficiency.

The focus of a traditional asset allocation strategy or cashflow-driven investment (CDI) strategy would be to minimise risk to the Plan’s funding level on an ongoing basis – effectively limiting short-term mark-to-market funding risk. Our desire, however, was to focus on minimising the risk relative to our specific funding objective, thereby increasing the certainty of achieving this outcome.

In 2018, we explored a range of long-term options open to us in conjunction with our advisers Hymans Robertson and with our LDI manager Insight Investment. Among the options we considered were a buy-in, adviser-driven asset allocation based on value at risk and more integrated risk approaches, including Insight’s Integrated Solutions framework.

Why did you opt for Insight’s Integrated Solutions in 2019?

Not only does the Integrated Solutions approach give the Trustee more certainty of achieving the target goal, in our view, we believe it is also better aligned with The Pension Regulator's guidance.

Increased resilience

Specifically, we judged that a more integrated approach could increase the Plan's resilience to extreme market events. Insight's solution gains efficiencies from more closely integrating the management of our LDI programme with our fixed income assets and some of our growth assets (20% of the Plan’s assets remain managed by investment managers other than Insight) – removing siloed thinking and siloed action. The proposal enabled the delegation of key day-to-day risk management decisions to Insight to allow quick decision-making during extreme market conditions, while we retained strategic oversight.

When a single manager has oversight over LDI and fixed income, it removes potential inefficiencies and provides flexibility to respond to market events (within a pre-agreed risk-management framework) without the need for decisions by and intervention from the Trustee.

This means the Plan can deal with investment risks more rapidly and has increased its ability to evolve the investment strategy, either in the face of extreme market circumstances or as the Plan matures.

Simple, more transparent governance

Another way the approach has reduced risk for us was by creating a simple, transparent governance model with user-friendly monitoring.

Under this approach, investment risks are identified at the outset, and the Insight team can either:

- identify and pre-agree the corrective actions that will be taken in response, should those risks be realised; or

- budget for those risks by assigning a target for a risk reserve buffer above what is needed to achieve the specified long-term objective.

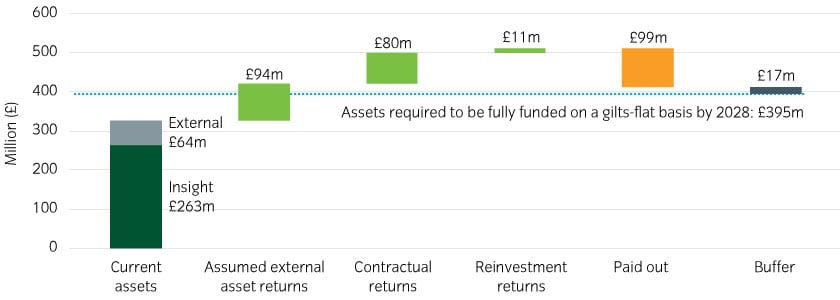

Further, Insight’s reporting provides us with regular updates showing the Plan’s projected outcome relative to its objective (See Figure 1 as an example). Insight provides an enhanced set of monitoring tools and risk metrics to measure progress against our ‘future value’ funding outcomes, rather than focusing on 'present value' funding risk.

With regard to the latter approach, we have found that monitoring funding-level progression versus expectations and looking at short-term risk metrics, such as value-at-risk, are less helpful for judging our progress related to our outcome-oriented objectives.

Figure 1: The median projection to 20281

1For illustrative purposes only. Projection as at 31 March 2023. Projection gross of fees. Assumed external asset returns as agreed with the Plan’s investment consultant. Contractual returns net of 50th percentile defaults. Reinvestment returns assume 50th percentile credit spreads.

How has your integrated approach fared since adoption in 2019?

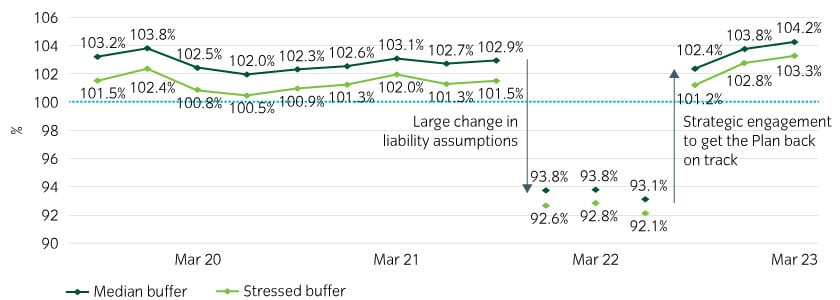

An early indication of the worth of the Integrated Solutions approach was how the projected funding level of the Plan remained very stable and above 100% during the volatile period of the March 2020 COVID crisis (see Figure 2, which shows the projected funding level under expected and stressed conditions).

Greater transparency of our projected funding level following an unexpected increase to our liabilities helped us get back on track

In October 2021, some changes were made to actuarial assumptions resulting from the reform of RPI, which led to an increase in value of the Plan’s liabilities and a significant impairment to the Plan’s projected funding level.

Following close collaboration between the Trustee, Hymans Robertson and Insight, we configured the investment strategy 2022 (before the crisis) to get our projected funding level back on track without changing the investment objective or timeframe. For example, we:

- Increased the contractual investment returns via an allocation to secured finance investments, and

- Revisited the allocation to external growth generative assets

To gauge the most appropriate strategy, we used Insight’s forward-looking cashflow analysis to assess the Plan’s projected outcome relative to our long-term objective. We also used their analytics to assess the specific risks that could challenge the Plan’s achievement of this objective; it helped us to assess the stressed scenarios that might affect cashflow delivery (e.g. defaults of debt issuers) as well as the impact of worse-than-expected market conditions that could affect our plans for reinvestment or lead to the forced sale of assets.

Figure 2: The evolution of the Plan’s projected funding level2

2Source: Insight as at 31 March 2023. Median/stressed scenario assumes 50th/80th percentile historic default based on the Moody’s default study, and 50th/80th percentile historic credit spreads sourced by BAML.

Exceptional action and performance in the 2022 crisis

The full worth of our new approach was felt in 2022 during the peak of the gilts crisis where activity and performance were exceptional – enhancements made to the strategy in anticipation of liquidity challenges provided vital additional protection.

In September and October, the need to rapidly top up collateral to support our liability hedges could have been compromised by poor or inefficient decision-making. However, our approach allowed Insight to assess and choose the most appropriate source of liquidity on a daily basis dependent on market conditions at the time.

This measure of control and management of risk meant that we were able to maintain our liability hedge at a tolerable level and remain on track for our long-term objective. This contrasts to the position of pension schemes that either were forced to cut hedges or were in the fortuitous position of already having a low hedge. We take assurance that this framework will also enable us to better prepare against other future high volatility scenarios.

Key actions that helped the Plan deal with the crisis at that time revolved around liquidity, integration and governance:

Available liquidity

A combination of prudent collateral buffers and a collateral waterfall structure ensured our strategy could withstand the sharp interest rate rises going into the crisis.

| A collateral waterfall consists of allocating eligible capital such as cash and gilts for collateral calls, and then having a second tier of liquid assets that can be readily called up on in extreme market conditions to be converted into cash for use in a collateral call. |

Integration of assets

During the worst days of the crisis, having a single manager with oversight of the core risk management components of the strategy (LDI, fixed income, asset-backed securities and secured finance assets) enabled significantly greater efficiencies than the sum of the individual siloes.

Insight provided the Plan with:

- the implementation of corporate bond repo to top up collateral without the need to sell assets;

- the ability to choose and sell the most appropriate assets under the flexible collateral waterfall structure to top up collateral; and

- the ability to withhold income from reinvestment to top up collateral.

Each of these tools were employed to good effect during the crisis.

Fast and considered governance actions in the crisis

Insight, as our integrated manager, had a holistic view of the Plan’s position on a daily basis. This access to information provided a clear impact assessment and so enabled quick and well-informed decision-making.

In particular, we believe we began selling small amounts of credit to top up collateral pools much sooner than otherwise possible, which meant we sold before the credit spreads blew out. In addition, given the wider discretionary remit we gave to Insight, they were able to sell attractive corporate bonds (USD rather than GBP) which meant that when markets reverted and they began to buy back credit, they bought back at better prices than at which they sold.

Such decisions were made daily to help manage risk as and when required with a view to keeping the Plan on track to deliver the Trustee’s funding objectives.

A daily ability to reassess decisions meant that ‘whip-saw risk’ (selling assets for liquidity, only to replenish them later at detrimental prices) was also minimised.

| The integrated nature of the investment solution the Trustee of the Affinity Water Pension Plan adopted with Insight gave them considerable comfort throughout the gilt crisis.” – David Yao, Senior Investment Consultant, Hymans Robertson |

Were there any non-investment benefits of your approach?

In November 2022, the Trustee put a notice on the member website that provided assurance that the Plan and its use of LDI were healthy and that we were on track to meet our liabilities. We believe this communication will have reduced enquiries to the administrator and the Trustee.

How would you summarise your experience of Integrated Solutions?

The Plan’s resilience and governance is now significantly enhanced – the Trustee believes members, the sponsor and other stakeholders can sleep better at night

Our risk-management evolution, together with the real-life performance under stress of the strategy in the 2022 gilt crisis, provide us with high levels of confidence for the future.

We believe what we have in place reduces investment market risk, liquidity risk and keeps all other risks to a minimum. The governance arrangements allow the Trustee to focus on member needs and strategic issues. Key implementation decisions are taken on a timely and expert basis, under the delegated arrangement we have with Insight as our risk management partner.

In years to come we expect all pension schemes will be managed in such a similar way.

FIND OUT MORE ABOUT INTEGRATED SOLUTIONS |

United Kingdom

United Kingdom