By Francesca Fornasari

|

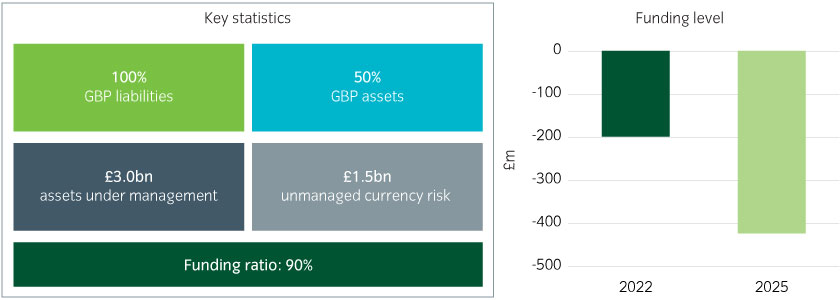

The remarkable rally in sterling

When we look back at 2023, one of the most surprising developments was the performance of sterling, especially versus the US dollar. Within the G10 universe, sterling was the second-best performing currency over the year (see Figure 1), with only the Swiss franc performing better. What is even more remarkable is that the franc’s performance was driven by the Swiss National Bank heavily selling its international currency reserves to drive the franc upwards as part of its efforts to control inflation. Sterling almost matched this performance without any central bank support whatsoever. This performance also occurred against a challenging backdrop in the UK – fairly sluggish growth, sticky inflation and a lot of political volatility.

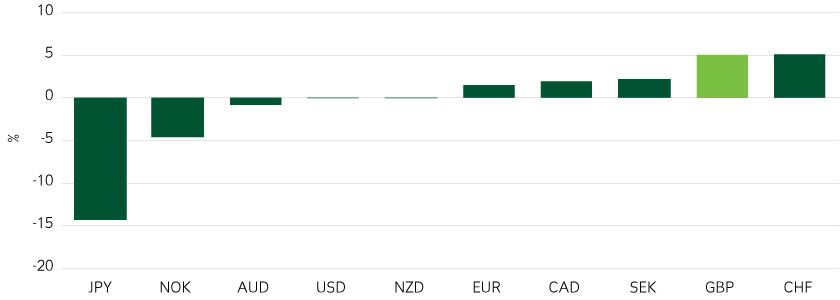

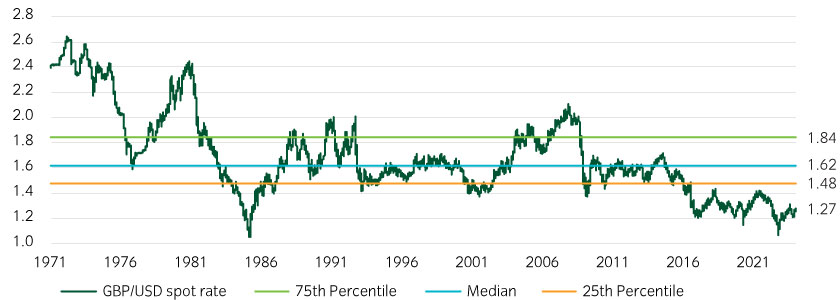

In our view a number of factors underpinned sterling’s rise. The UK’s current account position has improved significantly (see Figure 2). At its worst point, the UK was running a deficit of around 6% of GDP in 2016; since then, the deficit has contracted to just under 2% of GDP, and with it the amount of capital that the UK needs to attract to maintain currency stability. Carry has improved, with UK interest rates towards the top of the G10 range, and this is likely to remain the case for some time as we expect the Bank of England to cut rates at a more gradual pace than other major central banks. Then, although there is an election ahead, and polls suggest a change in government will occur, there is an expectation that political noise will lessen, and the tumultuous years of political noise are coming to an end. Last but not least, sterling started its rally from a position of being undervalued. Fair-value models suggest that even after the rally sterling remains around 15% undervalued relative to the US dollar and, looking back over the last 50 years, it has only been at this level of undervaluation for around 10% of the time.

Figure 1: 2023 USD returns versus major currencies

Source: Macrobond as at 9 January 2024.

Figure 2: UK current account (% of GDP)

Source: Macrobond as at 9 January 2024.

The sterling rally may just be starting

Looking out to 2024 our sense is that the risks for sterling are if anything to the upside. While 2023 was driven by sterling-specific factors, we believe the US side of the story will be the key driver over the next few years. There are three reasons we believe this:

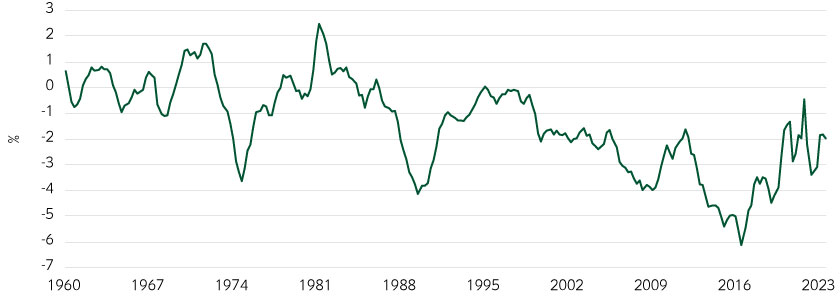

- The unsustainability of the fiscal situation in the US is generally underappreciated. When we look across a range of countries, we can see that the US has the second-worst fiscal balance on a structurally adjusted basis (see Figure 3). We look at the structural balance as this takes into account where economies are within the economic cycle. Only India is in a worse position than the US.

- Aggregate debt levels are also underappreciated. When you look at the level of debt in each country and take into account the net present value of liabilities stemming from healthcare and pensions, the debt of the US is second only to Japan. Regardless of who ends up in the White House post-election, the prospects for fiscal consolidation in the US are quite limited.

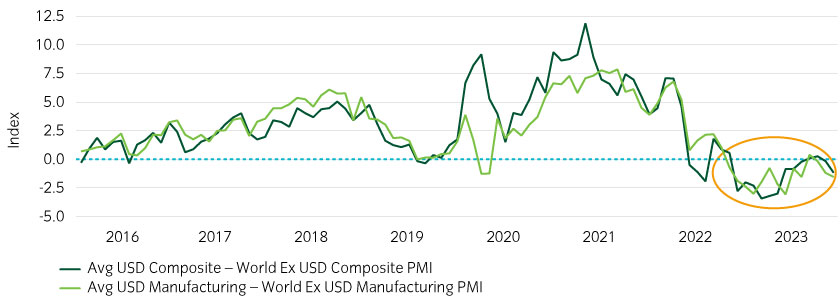

- US exceptionalism is past its peak. Although the structural problems facing the US aren’t new, markets have largely ignored these factors because the US economy has significantly outperformed most other economies. As we can see in Figure 4, when we look at purchasing managers index data, the US composite is now below the global ex US composite.

As the support from US exceptionalism fades, so we would expect other structural problems to come to the fore, and this should help to push the US dollar lower. The US election could exacerbate this move, with President Trump signalling a more protectionist position, with a 10% tariff on all foreign imports and a tariff of up to 60% on goods imported from China. This could have a significant impact on global trade and the global economy.

Figure 3: Structural balance as % of potential GDP (2023)

Source: Macrobond and IMF as at 9 January 2024. ‘US Government Obligations & Contingent Liabilities: A High and Rising Fiscal Risk’, Scope Rating 18 October 2017. * Advanced World.

Figure 4: The end of US ‘exceptionalism’?

Source: Macrobond as at 9 January 2024.

What could a sterling rally look like?

If our view proves to be correct, and the dollar depreciates over the next few years, it seems reasonable to expect sterling to at least return to fair value. That would see sterling rally by around 15% to a rate of 1.48 versus the US dollar. But if we look at historical moves in currency markets, we can see that once a trend is established it often continues for some time. This suggests that investors shouldn’t underestimate the possibility of significant further strength in the sterling/dollar rate over the years ahead. If this happens it is also likely to occur with some volatility. That should generate significant opportunity on the alpha side, but it also has the potential to meaningfully impact portfolios with foreign assets, particularly those that leave their foreign currency exposure unhedged.

Figure 5: Sterling versus the US dollar through history

UK investors with unhedged foreign assets may want to consider a hedging strategy

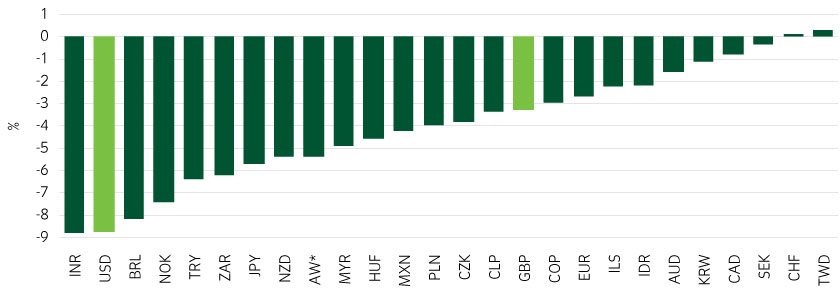

If we think about which investors might hold foreign assets without hedging currency exposure, particularly in the UK, we find that local government pension schemes (LGPS) might be most impacted if we are right about our view. In Figure 6 we show a representative LGPS account with £3bn under management, around 50% exposure to foreign currency assets, and a funding ratio of roughly 90%. As the foreign currency assets are typically unhedged, this account would have an unmanaged currency position of roughly £1.5bn.

If sterling appreciates by around 15%, which would take us back to fair value, then assuming that everything else is held constant, the funding level would decline from a deficit of around £200m to a deficit of over £400m – and that’s with only a 15% move.

So, it’s critical to assess the impact that a further rally in sterling could have not just on the portfolios of active strategies but also of those that have significant unhedged foreign assets. For those with unhedged currency risk, this may be a particularly good time to be thinking about those risks and engaging in ways to mitigate them.

Figure 6: Unhedged currency risk could result in a significant deterioration in funding

United Kingdom

United Kingdom