By Harvey Bradley

|

Rate volatility should subside, but remain elevated

The world stands at an inflection point. After the largest inflation shock since the 1970s, we believe the neutral level of interest rates has shifted upwards. Governments now face fiscal discipline for the first time in over a decade. We’ve passed the peak in globalisation and the relationship between China and the Western world has changed dramatically. All of this suggests to us that the macro regime has changed, and as a consequence the volatility of rates has increased. In US Treasury markets, day-to-day volatility has been running at the highest levels since the 1980s.

With the end of the hiking cycle our base case is that volatility starts to subside, but that it remains above the levels seen in the decade after the global financial crisis. There is a risk that volatility rises even further, but we believe that would probably only come as a result of a policy mistake. If central banks start to ease policy in anticipation of achieving a soft landing but are then faced with a reacceleration in growth and inflation, they may be forced to restart the hiking cycle, which would leave markets scrambling to reprice.

The higher level of yields does provide some protection to fixed income investors however, with income able to offset any capital losses to a degree. Periods of volatility also increase the opportunities for active managers to add value in the macro and rates space.

Economic questions for 2024

In the macro space there are two key questions for 2024:

- Can we avoid recession?

- Where does inflation settle now that the more transitory rise in prices is behind us?

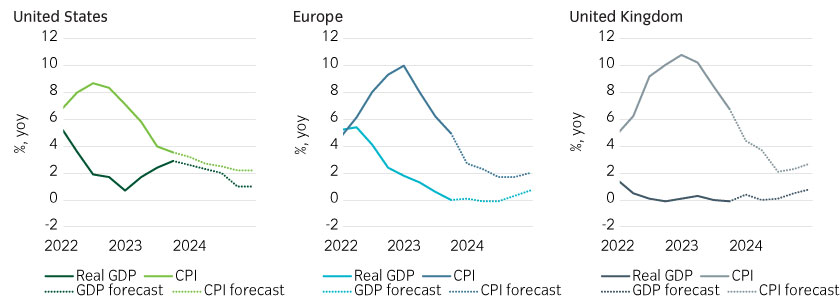

As we outline in Figure 1, we do believe that major economies can avoid recession, although in the case of the UK and eurozone only marginally so. The US economy should continue to outperform, but to a lesser degree than we’ve seen, and inflation should continue to moderate globally, at least in the short term.

Figure 1: Growth and inflation

Source: Insight and Bloomberg as at 31 December 2023.

Where inflation eventually settles is a trickier question to answer. It has been a considerable period of time since economies have had to deal with an inflation shock of the scale of recent years, and the structure of the global economy has meaningfully changed. Although headline inflation is moderating rapidly, core inflation tends to be stickier, and we may yet see second-round effects from the surprising resilience in labour markets. What is clear is that the period of stubbornly low inflation that occurred after the global financial crisis is now over. A more challenging period lies ahead for central banks, but markets are struggling to accept the new reality.

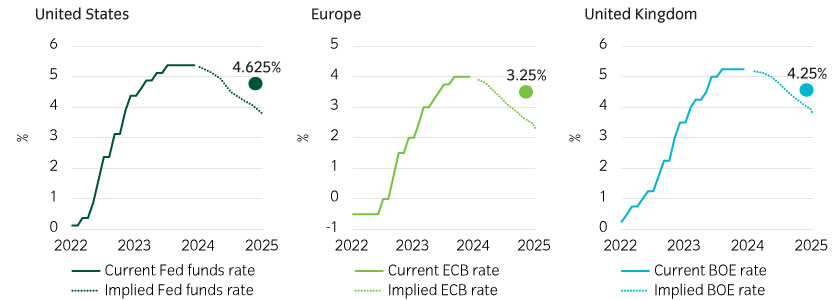

As outlined in Figure 2, as soon as it became clear that the hiking cycle was over, markets rushed to price in an aggressive easing cycle. We do believe that central banks will start to cut rates in the second half of the year, but we expect the easing cycle to be both slower and to start later than markets are currently pricing. Our expectation is shown by the small flags. We do accept though that market pricing is likely to remain skewed to the downside, as when economic growth is very slow, things can reach a biting point and activity can start to deteriorate more rapidly than expected if there is a shift into recession.

Figure 2: Central banks are at a turning point in the cycle

Source: Insight and Bloomberg as at 31 December 2023.

How we are positioned in government bond markets

The key change for government bond markets is that income is back. This should mean that government bonds should once again have diversification properties within investment portfolios, outperforming during risk-off periods.

In terms of duration positioning, we would typically expect yield curves to steepen at this stage of the cycle as a policy pivot point is reached. But the front end of the curve is already reflecting an aggressive expectation for policy easing, while longer-maturity yields appear pretty close to fair value. If we are correct and central banks ease later and more gradually than currently priced into markets, then positioning in shorter-duration issues would leave a portfolio exposed that repricing risk. This leaves us favouring steepening trades further along the curve. For example, between 10 and 30-year maturities most yield curves are relatively flat, with little term premium priced in. Wide fiscal deficits and central-bank balance-sheet reduction could increase upward pressure on longer-maturity yields over the medium term.

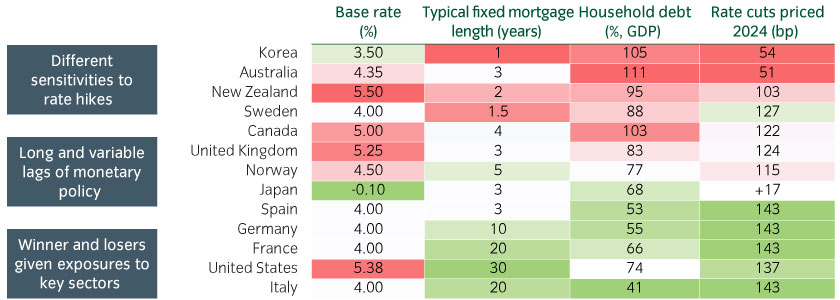

For those investors with broad international benchmarks or absolute-return approaches, we also believe that relative-value trades will offer attractive opportunities in 2024. When we focus on the household sector and particularly on the structure of mortgage markets, we can see stark differences across economies. In the US, mortgages often have fixed terms as long as 30 years, whereas in South Korea, mortgages are generally very short term. Household debt also varies markedly by economy.

So far, the interest-rate cycle has been relatively uniform across the developed world. Most central banks hiked at about the same time, hiked by a similar amount, and then paused at around the same time. But not all economies are built equally and there is likely to be greater divergence ahead. In Figure 3 we have ranked economies by interest-rate sensitivity – households in South Korea and Australia have far greater interest-rate sensitivity than Italy or the US, and as the long and variable lags that occur from changes in monetary policy fully impact these economies this is likely to become increasingly clear.

To take advantage of this, we can look for situations where markets appear to be under-pricing the variations in fundamentals. For example, one of our preferred trades in multi-currency portfolios is to be underweight Canada relative to Australia and New Zealand. We think these are pretty similar economies in terms of economic structure and in terms of sensitivity to rates, but they are pricing in a very different outcome for next year. As much as 120bp of cuts is expected in Canada, and only 50bp in Australia. We expect that to converge over time.

Figure 3: Not all economies are built equally, and greater divergence likely lies ahead

Source: IMF, Citi, Insight and Bloomberg as at 31 December 2023

Asia is the place to watch

We are carefully monitoring the outlook for two countries, as both could potentially impact broader bond markets in the years ahead.

The first is China, where in our view the pace of potential growth is in structural decline. Although there have been some announcements of measures to support growth, the challenges stemming from the property sector and leverage in general are going to be very difficult to overcome. China has been a key exporter of disinflation over the last 20 years and with the producer price index in negative territory, the question is whether we will see another disinflationary pulse coming from China. Our view is that China will likely continue to be a source of disinflationary pressure for the rest of the world, but that the impact of that exported disinflation is likely to be much smaller than in the past.

In Japan we are seeing an odd series of developments. Having refused to take part in the hiking cycle alongside other global central banks, the Bank of Japan is now preparing to hike rates just as they are being cut everywhere else. The mitigating factor is that even if the gap between rates in Japan and the rest of the developed world narrows, it is still likely to remain significant. In our view this should allow the Bank to return interest rates to positive territory later in 2024, and markets have done little to price this risk in so far. So, while we believe core rates markets are trading at close to fair value and would therefore want to be neutral duration for now, in Japan we are running underweight positions. If Japan does raise rates, and the yield curve steepens, it will be important to monitor the reaction amongst Japanese investors who have deployed considerable amounts of capital overseas in a search for yield. If that capital is returned home, it could have consequences for fixed income markets more broadly and could prove to be a key theme in 2024.

United Kingdom

United Kingdom