A better economic environment ahead?

At Insight we utilise a regime-based asset allocation framework, which helps us assess likely asset class behaviours in different growth, inflation, and real rate environments. From a growth perspective we look at a range of data to guide our current thinking, but our long-term analysis uses PMIs (purchasing managers indices) given the timeliness of the releases of comparable data across a wide range of countries.

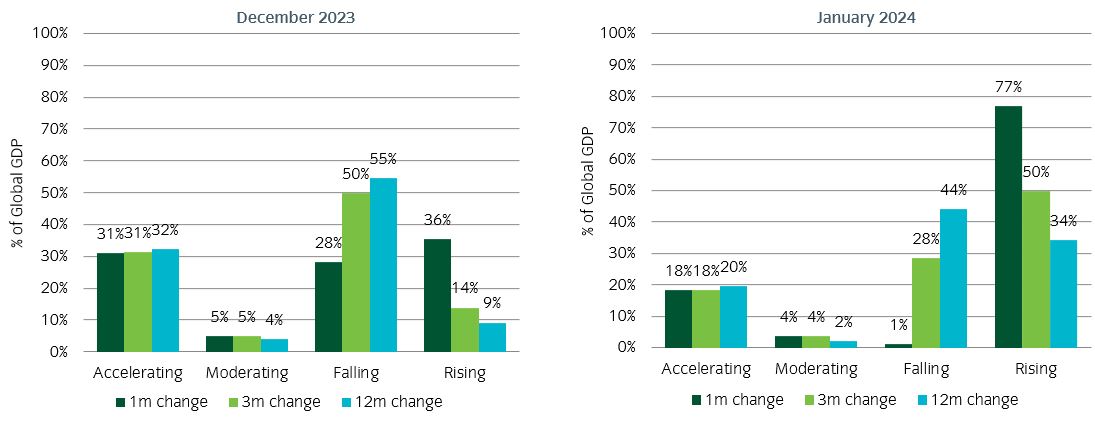

Since October last year we saw tentative evidence that the broader growth dynamic in a range of key countries may be stabilising. As Figure 1 shows, using the January PMI data releases, some 77% of countries currently sit in a ‘rising regime’ (or 50%, depending on whether we view the data through a 1-month or 3-month change lens). This still implies a difficult environment (where growth is still in contractionary territory – in PMI ‘speak, they are below 50 – and in the case of the US ISM that has remained the case for 14 consecutive months now), but the rate of change is starting to improve.

Historical data since the early 1970s suggests that once an economy enters a rising regime the likelihood of then moving into an improving one is very high (92% probability). We describe this as an accelerating regime – in PMI speak, this is consistent with readings in excess of 50 and moving higher.

The recent falls in market expectations of interest rates should feed through to lower borrowing costs, while lower inflation and reduced energy costs should make household balance sheets feel a little heathier. Should this continue the soft-landing or mid-cycle slowdown narrative would gain further credence and, with inflation at lower levels, there is an increased acknowledgement that central banks are in a position to ease policy, if growth considerations required. These factors, in turn, should improve confidence.

Figure 1: January manufacturing PMIs support rising regime thesis

Source: Insight and Bloomberg as at 31 January 2024.

Time to add exposure to laggard markets?

If the future does appear brighter, that obviously begs the question of how much of this improving macro narrative is already priced into risk assets. The latest earnings season offers some bottom-up insight into how corporates are viewing the economic backdrop. In the US, headline earnings growth masked some wide sector divergences. Most notably an extremely positive season for the technology sector where earnings grew by +40% year on year, and an extremely negative one for the more cyclical energy and materials sectors which saw -20% year on year growth.

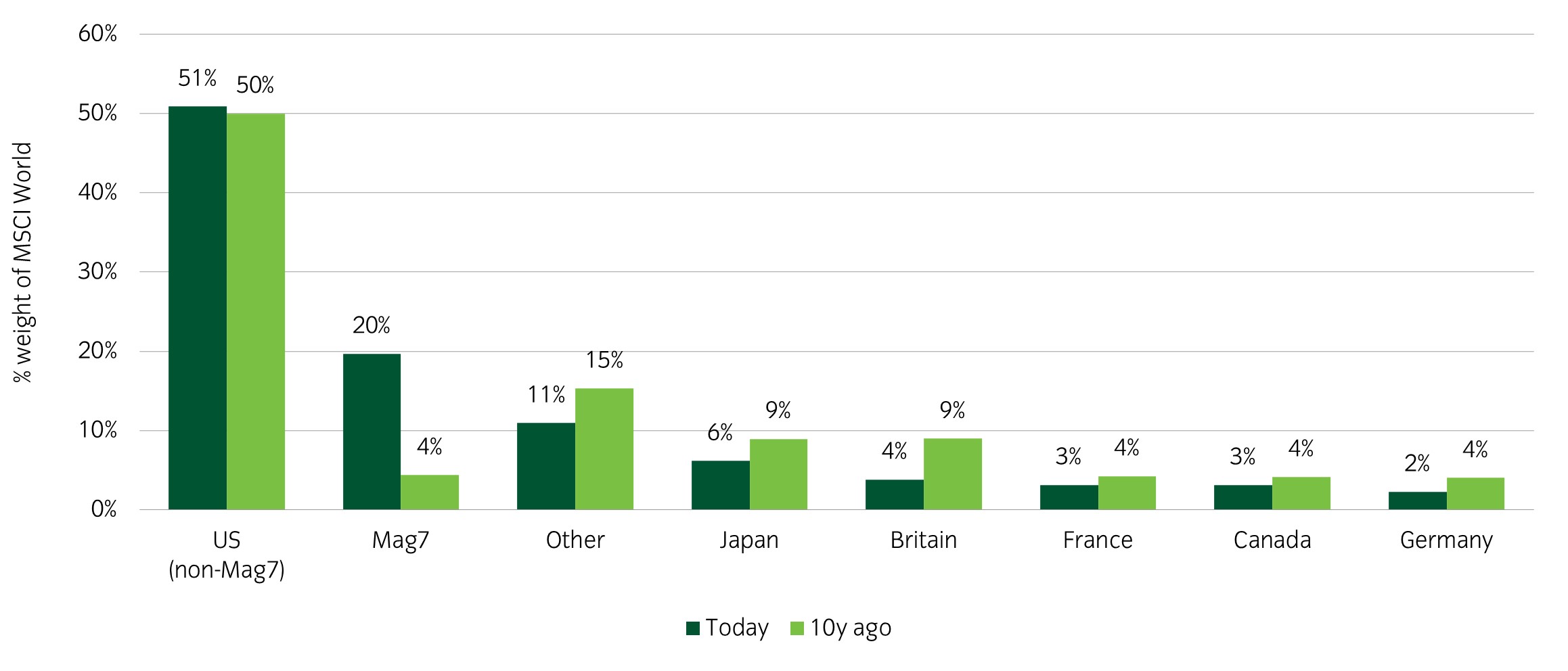

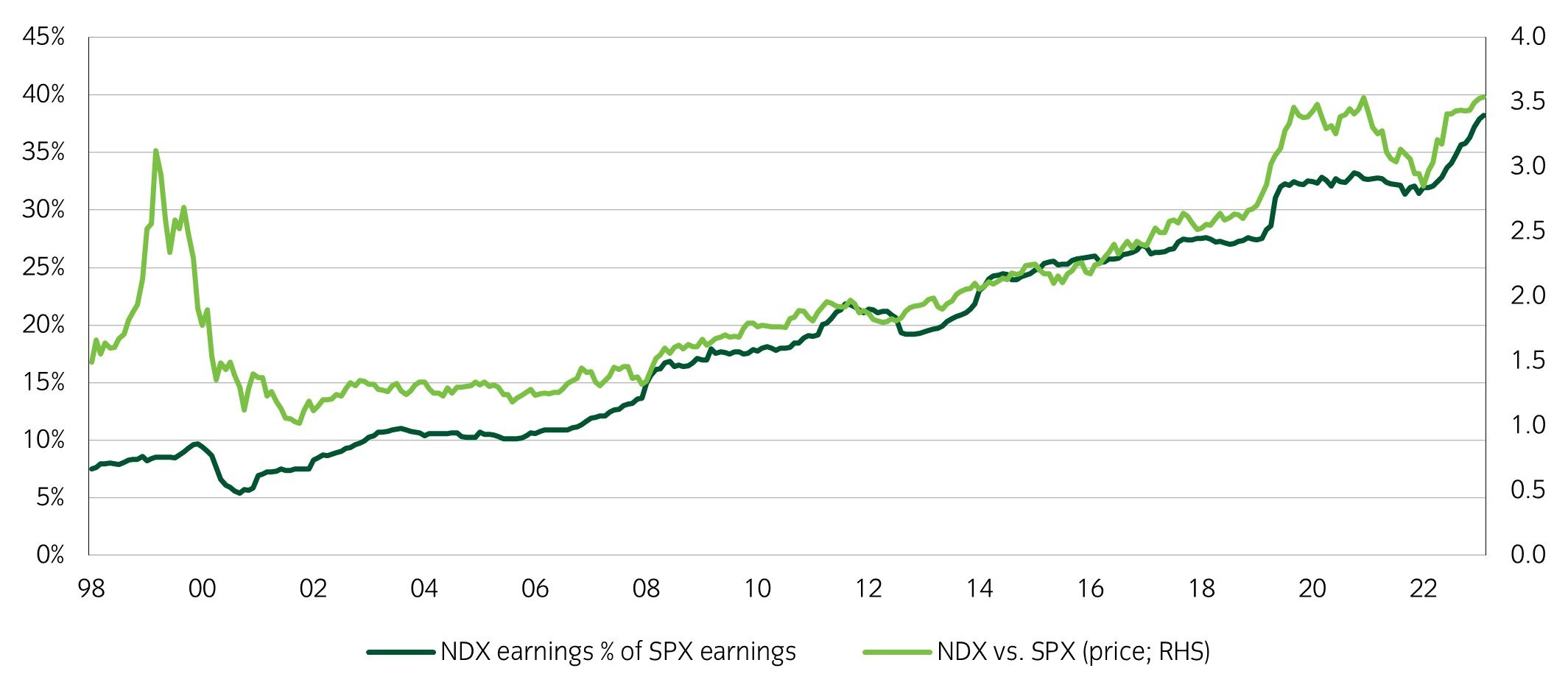

So, although aggregate earnings appear to be tentatively picking up, the tech megacaps continue to be the big beneficiaries. The dominance of the Magnificent-Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) has been well documented and increasingly their market cap and global reach transcend the characteristics of normal stock market constituents. Ten years ago, the US constituted 54% of the MSCI World Index, and that had risen to just over 70% by the end of 2023 (see Figure 2). Almost all of this increase is due to the Magnificent-Seven. The growth of these companies has, however, largely reflected the rapid earnings growth of the tech sector which they dominate (see Figure 3).

Figure 2: Magnificent Seven’s increasing market share in MSCI World

Source: Bank of America Merrill Lynch. Data as at 31 January 2024.

Figure 3: Rally in tech has been supported by earnings

Source: Bank of America Merrill Lynch. Data as at 31 January 2024.

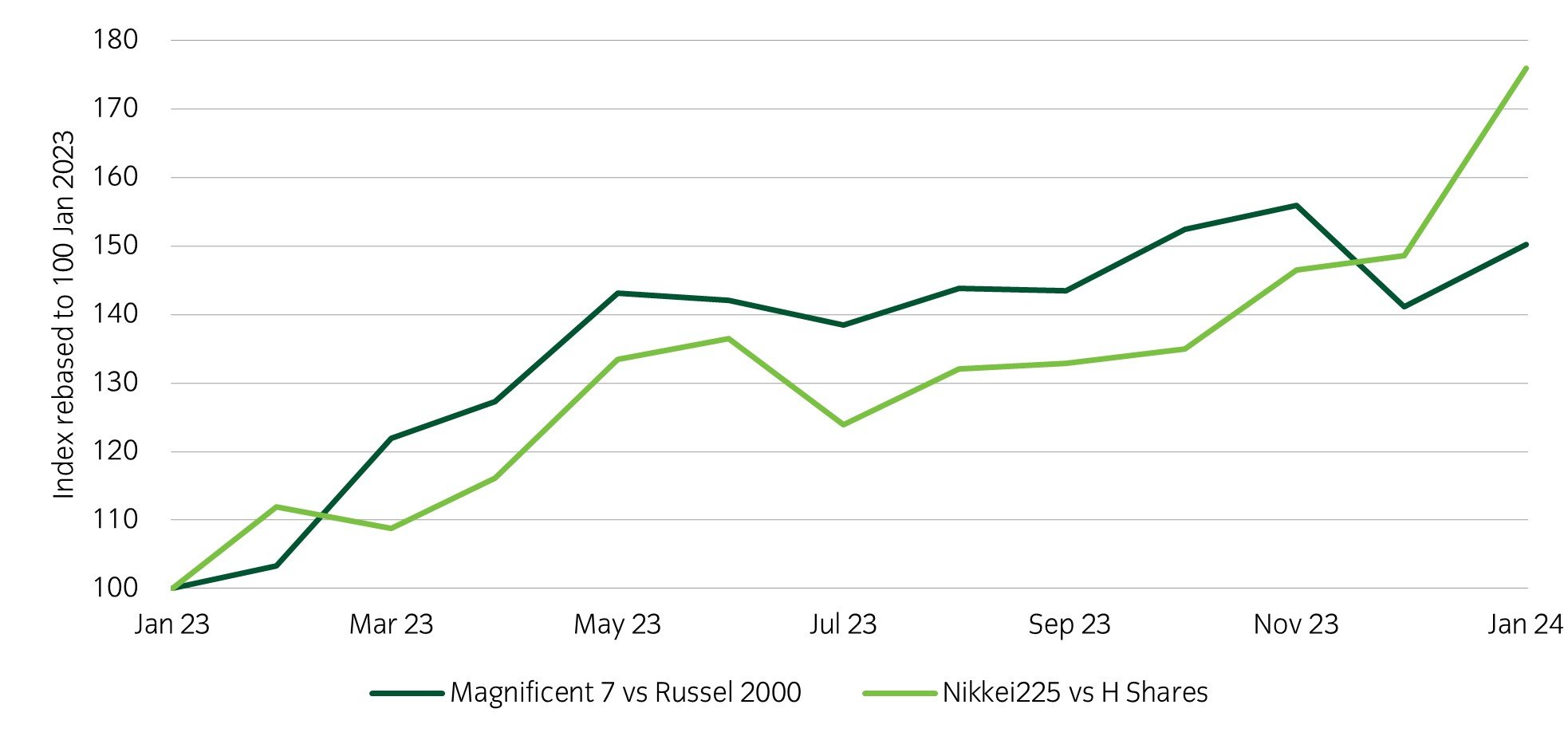

If markets can look through to the end of the current economic slowdown to a renewed growth phase, the case for at least some rotation into laggards, both within and outside the US, would become much stronger. Some of these market divergences have become stark (see Figure 4), even over relatively short periods of time. In the US, the small cap Russell 2000 Index has been dominated by the Magnificent-Seven, while in Asia, Japan has now significantly outperformed China. Although we believe some of these moves are justified to a degree, based on earnings growth or in the case of Japan, corporate reforms, some of these laggard markets are at levels that may now offer attractive entry points.

Figure 4:Market divergences have become stark

Source: Bank of America Merrill Lynch. Data as at 31 January 2024.

For more thoughts from our multi-asset team click here.

United Kingdom

United Kingdom