Is there a way of accessing the attractive yield of global investment grade credit with lower volatility? This is a question that we increasingly hear from risk-constrained investors as cash rates fall.

Since late 2022, global credit has attracted investors with relatively high yields, low default rates, and a constructive near-term outlook for corporates. However, as a risk asset, it remains vulnerable to market shocks – such as the abrupt reaction in early April to unexpectedly severe US tariffs. This has prompted investors to ask how best to access the credit market while mitigating volatility.

We look to achieve this by focusing on investment grade credit with maturities of five years or less. Shorter-duration bonds tend to be less sensitive to risk-off events and less exposed to fluctuations in government yields.

The volatility/opportunity trade off

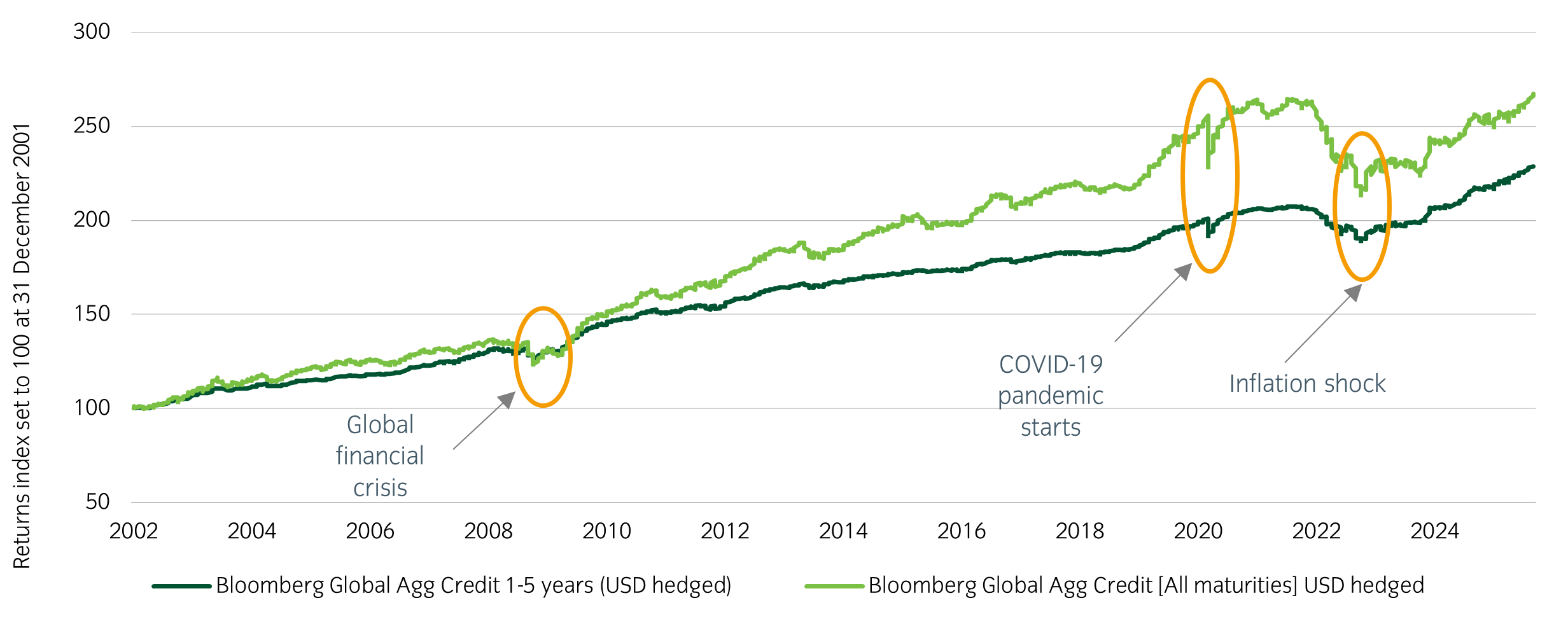

Restricting the global credit universe to securities with maturities no longer than five years can significantly smooth returns. Figure 1 shows the much-reduced drawdowns for the Bloomberg Global Agg Credit 1-5 years Index compared to the all-maturity index during the big market crises of the past 20 years. The trade-off for this benefit is sacrificing some of the extra yield that the longest dated securities offer.

Figure 1: Shorter duration credit experiences lower drawdown in market crises1

How would shorter-dated credit fare in these market scenarios?

It’s important to assess how all-maturity and short-term credit strategies might perform across a range of potential market scenarios in the near to medium term. We currently see three plausible scenarios:

- Inflation accelerates: If inflation starts to rise from already elevated levels – potentially driven by tariff-related cost pass-through – rate cuts may be delayed, and government yields could rise. This scenario is not currently priced into markets and would likely pressure global credit valuations. In such an environment, short-dated credit strategies would be more resilient, experiencing less downside than their all-maturity counterparts.

- Growth weakens: A backdrop of sluggish growth and rising unemployment could trigger risk-off sentiment, leading to wider credit spreads and lower government bond yields. This scenario presents mixed implications for credit: spread widening is a headwind, while falling yields offer support. The net impact on short-dated versus all-maturity strategies remains uncertain and would depend on the balance between these opposing forces.

- Interest rates decline: Should central banks resume or continue rate cuts, government bond yields are likely to fall. Global credit markets appear to be priced for this constructive scenario. An all-maturity credit portfolio would benefit most, as falling yields enhance the relative appeal of higher credit spreads and improve corporate financing conditions.

The role of short-dated credit in a portfolio

Short-dated global credit strategies offer a combination of relatively high income and low volatility, making them well-suited as a core allocation within fixed income portfolios. In this role, they can function effectively as cash-plus strategies – generating incremental spread through investment grade lending while active management has the potential to further enhance returns. Unlike government bonds, these strategies provide superior income potential by tapping into the creditworthiness of high-quality corporate issuers.

Enhancing consistency of return

As Insight we employ a disciplined process with careful risk controls designed to offer greater consistency of return. The controls include the landmine checklist, which screens securities for the likelihood of events that might cause a downgrade, a default or a sharp loss in investor confidence. We use a risk unit system to assess market conditions and adjust our exposure to market risk accordingly. Our platform is regionally balanced, ensuring unbiased idea generation across all geographies.

Insight’s global credit strategy, launched in 2011, manages over $13bn and has been led by the same management team since inception. These managers also oversee the short-dated strategy. Both approaches use the same process, platform and philosophy that generates the majority of alpha through security selection.

Conclusion

Global credit has seen strong inflows over the past three years, supported by attractive yields and solid fundamentals. But not all investors are able to weather the periodic bouts of volatility that longer-duration strategies can experience.

Short-dated strategies offer a way to capture much of the attractive risk-reward profile of global credit with limited volatility. By focusing on shorter maturities, these strategies provide a more stable return stream without sacrificing the core benefits of investment grade credit.