Executive summary: It's not easy being green

Green protectionism refers to government policies explicitly designed to do two things at once: expedite decarbonization efforts while incentivizing domestic manufacturing.

|

The rise of green protectionism

The US is spearheading green protectionism

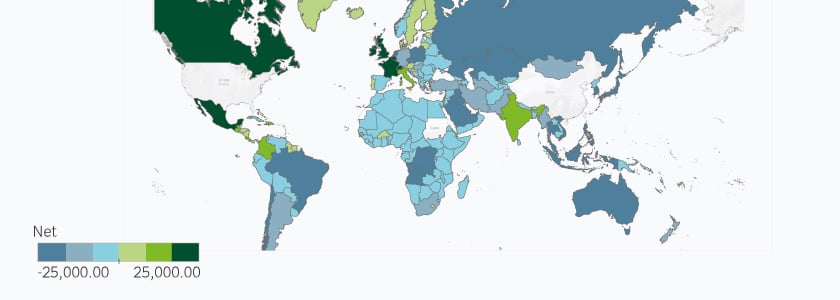

Before 2001, the US was the undisputed leader of global trade, with greater than 80% of countries globally trading more with the US than with China. However, China’s accession to the WTO in 2001 was a major turning point, and by 2022, only 28% of countries traded with the US more than with China.

Although the US spearheaded globalization and free trade, the soaring US-China trade gap has become an increasingly contentious political issue, culminating in the Trump administration’s trade war with China, and now the Biden administration’s export controls and investment flow restrictions.

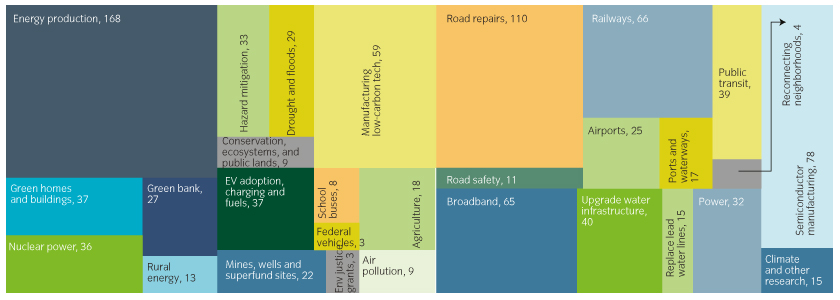

Today, the Biden administration is wrapping protectionism with climate-focused spending. To date it has passed $1trn worth of fiscal stimulus policies, including the Inflation Reduction Act (IRA), the CHIPS and Science Act and the Bipartisan Infrastructure Law (Figure 1). All are designed to boost domestic investment and manufacturing and bolster national security.

Figure 1: President Biden's trillion-dollar fiscal stimulus by sector (enacted spending in $bn)

Source: "See Everything the House Wanted, and Everything It Got," The New York Times, October 20, 2022, Insight Investment

We believe this has the potential to usher in a new CAPEX Supercycle in the US.

Figure 2: Is this is the beginning of a new capex supercycle (new investments in $bn)?

Source: The White House, as of July 5, 2023

Click to read the full whitepaper below