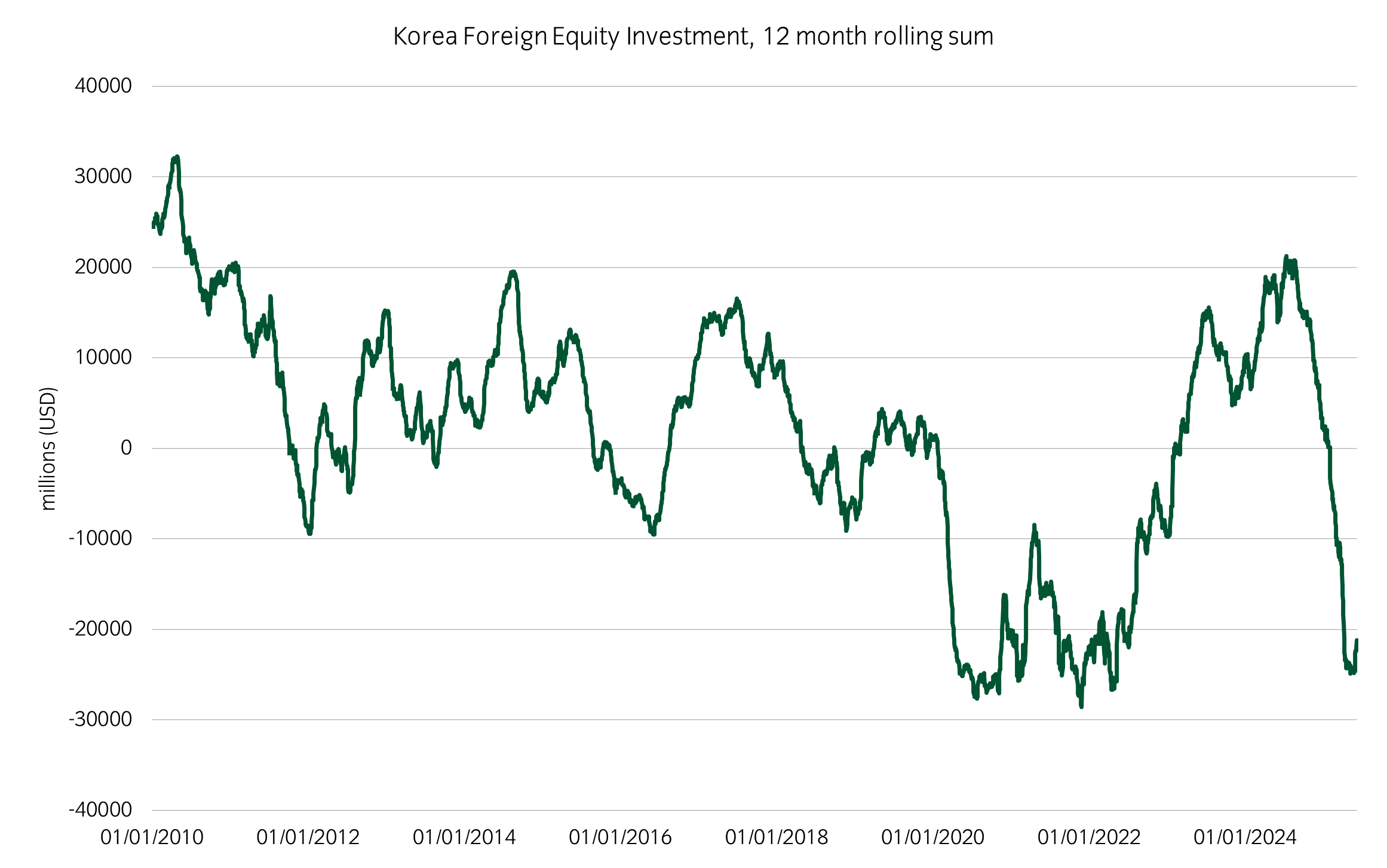

Chart of the week

Inflows to emerging market equities may return

Source: Bloomberg and Insight Investment as at 05 June 2025.

- Outflows from emerging market equities had increased over the past year and in some cases (for example, Korea) the outflows had reached extremes relative to the past 15 years.

- The outflows may have been due, in part, to investors chasing the “US exceptionalism” theme. The US’ healthy macroeconomic backdrop, and its dominance of the technology sector, helped to drive flows toward US assets.

- Given the current economic and policy uncertainty in the US, global investors may on the margin be reallocating toward other markets. Emerging markets such as Korea, Taiwan, or India might be beneficiaries of this, especially as current positioning in these markets is quite low relative to history.

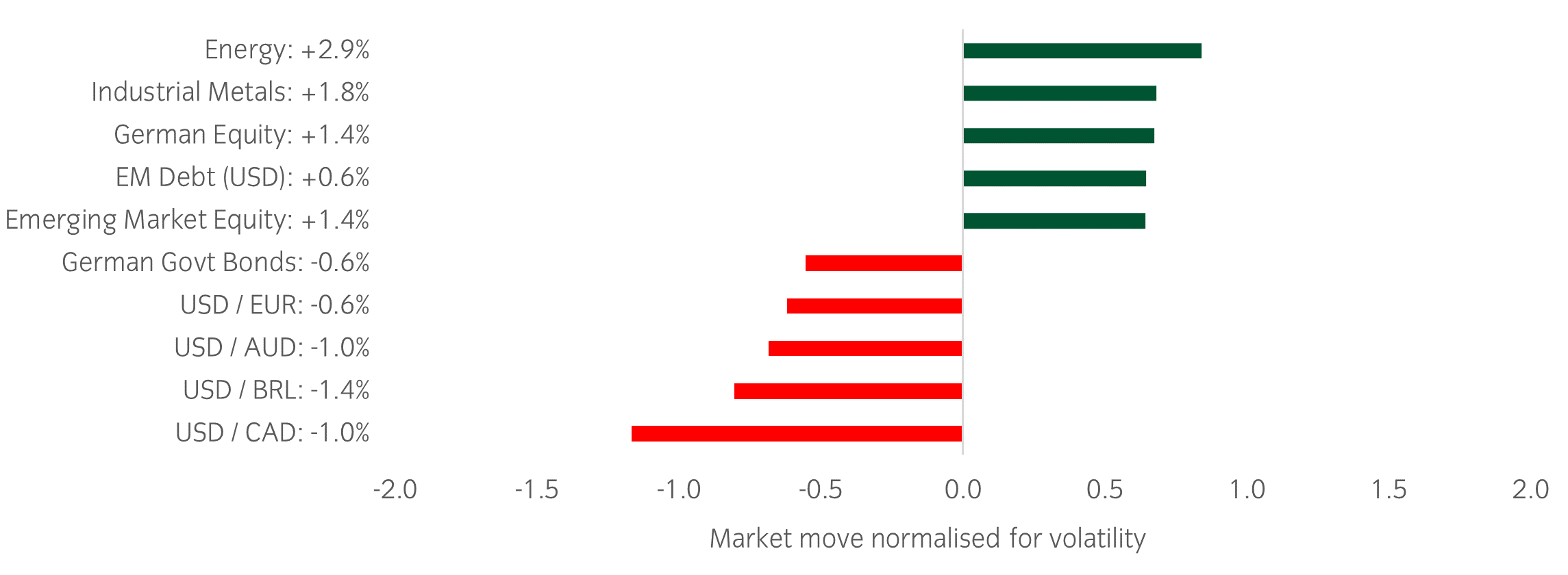

Significant market moves this week

Source: Bloomberg and Insight as at 05 June 2025. The price movement of each asset is shown next to its name. The data used by the bar chart divides the price movement by the annualised historical volatility of each asset.

Winners & losers: Commodities such as energy and industrial metals produced outsized positive risk-adjusted returns, whereas the US dollar weakened versus developed and emerging market currencies.

Over the past week, several things caught our eye:

- US President Trump and Chinese President Xi had a phone call discussing the ongoing trade negotiations. While this seems like a positive development, the details of the final trade deal and the size of any remaining tariffs remain uncertain.

- US nonfarm payrolls surprised to the upside (139 thousand actual versus 126 thousand expected). This data print helped to keep equity markets buoyant over the week

- The eurozone composite PMI surprised to the upside, with a release of 50.2 versus expectations of 49.5. A release above 50 indicates expanding private sector activity, while a release below 50 signifies contraction.

- South Korea held its presidential election, with the opposition Democratic Party candidate Lee Jae-myung emerging as the victor. Market participants are expecting the new administration to commit to larger fiscal stimulus to boost growth. The results were followed by a sharp rally in Korean equities and the Korean won.

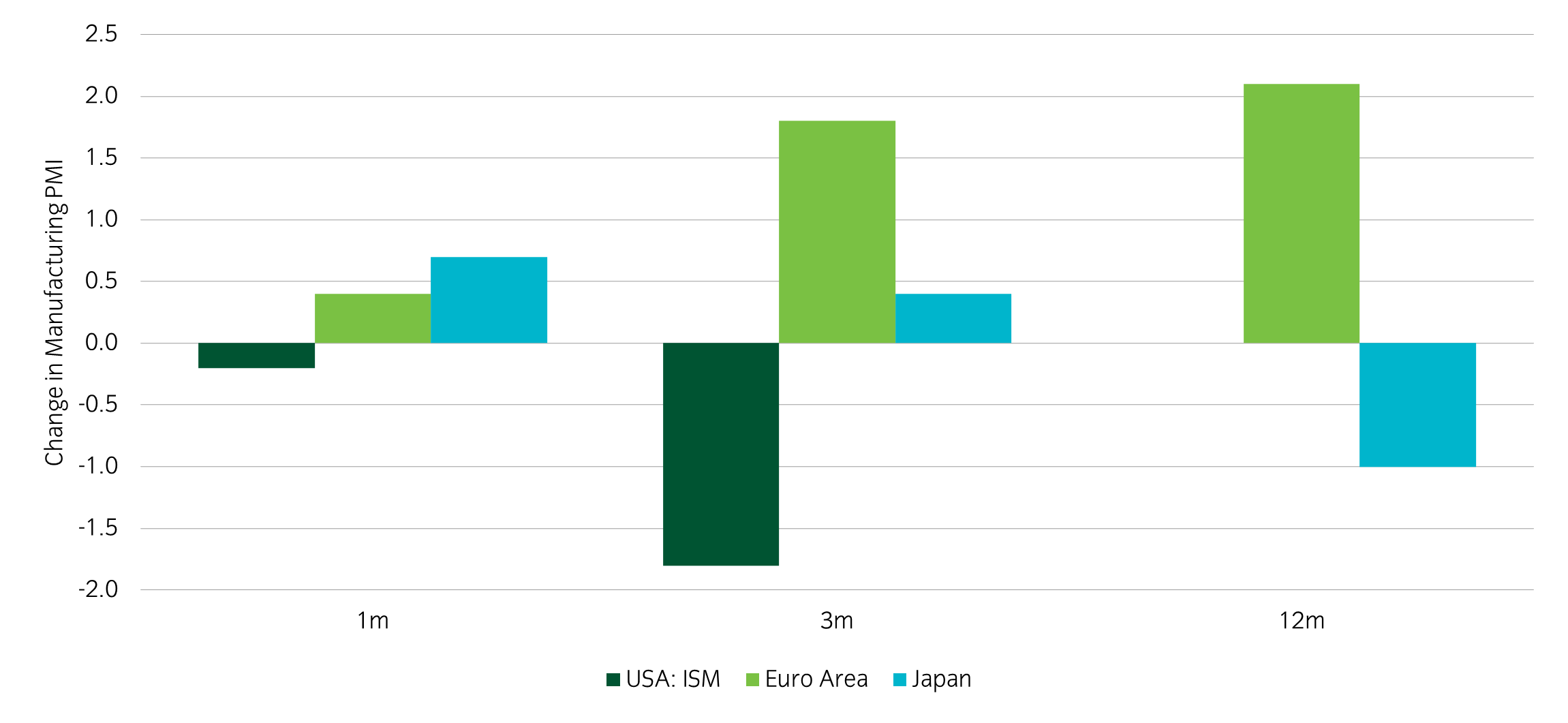

Asset allocation observation

Manufacturing PMI: divergence between US and other developed markets

Source: Insight and Bloomberg as at 05 June 2025.

- The latest release of PMI data showed a continuing divergence between manufacturing PMI in Europe and Japan compared to the US.

- Global allocations may continue to shift out of the US into other regions like Europe, Japan, and emerging markets, due to both 'push' factors and 'pull' factors. Push factors from the US include the high degree of policy and economic uncertainty and a slowing growth environment, whereas pull factors from the rest of the world include potentially new fiscal stimulus and stable or improving growth environments.

- Within our portfolios, we have relative value positions across equities and FX which would benefit if Europe and emerging markets continue to outperform the US.

Most read

Multi-asset

June 2025

Multi asset chart of the week

Global macro, Currency

June 2023

Global Macro Research: 30 years in currency markets

Global macro

January 2022

Global Macro Research: Asset allocation, growth and inflation cycles

Global macro, Fixed income

October 2023

Australia

Australia