|

Absolute return bond strategies are designed to deliver a positive return in all environments. In an era characterised by high volatility they can be used by those seeking stable growth and capital preservation |

How do absolute return bond strategies smooth out volatility?

A fully flexible approach to portfolio construction is one of the first steps in seeking to reduce volatility. This means that whenever markets are overly fearful or exuberant, a manager has the broadest choice of mispriced securities to buy or sell. It also means the freedom to go long or short on any strongly held beliefs on valuations.

Overall, it can be seen as a way of seeking to improve risk adjusted returns from fixed income.

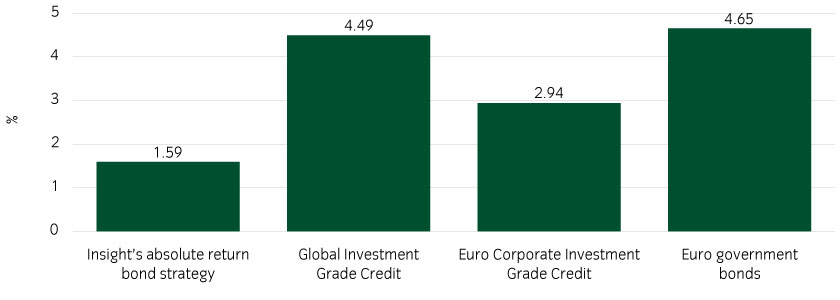

Over the past 12 months Insight’s absolute return bond strategy has experienced a small fraction of the volatility experienced in government bonds or investment grade credit (see Figure 1).

Figure 1: Volatility in fixed income 31/3/24-31/3/25

Source: Source Bloomberg 1 May 2025

How has performance been in 2025?

Our absolute return bond strategy made the vast majority of its alpha in Q1 2025 from government bond positioning. There has been far more volatility and dislocation in prices in rates (government bonds) than in credit over the year to date. This has meant better chances to buy bonds such as US Treasuries and UK gilts at what we see as cheap valuations.

Notable gains from the strategy have come from building long positions in US Treasuries and gilts when they sold off sharply in January. Gains have also come from holding shorter dated government bonds on the expectation of rate cuts, while another helpful position has been taking a view that UK inflation would fall where markets were less optimistic of such an outcome.

There has been far less volatility in investment grade credit where returns have been flat. Following the ‘Liberation Day’ US tariffs announcements on 2 April, investment grade credit yields moved 10-15bp wider, but they tightened again by the end of April. We used the correction to reduce our risk position in credit, as we think there is more risk to come from trade disruption. To protect on the downside our position is based more around relative value and sector positions than in reflecting market beta.

What assets do you own to generate attractive absolute returns?

Generally speaking, the most attractive returns in our strategy come from investment grade corporate bonds. To complement this, we have an allocation to asset-backed securities which pay a premium above yields of corporate credit of the same risk rating. At the riskier end of the credit spectrum, we invest selectively in a few high yield securities and leveraged loans, where we are confident in our abilities to pick issuers with resilient non-cyclical businesses and improving credit scores.

How important are derivatives to an absolute return bond strategy?

Derivatives can enable us to be nimble during periods of high volatility. When investors are fearful it becomes harder and more expensive to trade physical bonds, so expressing a view on markets through derivatives offers an alternative approach.

Derivatives also play a role shortly before or after a big event or announcement. Here again, it can be too cumbersome to sell a large number of bonds to express a view on markets.

A more nuanced job is to buy downside protection through an option that enables a portfolio to more confidently take on extra risk to boost returns.

We would go so far as to say that an absolute return bond strategy that does not make full use of derivatives has less ability to protect investors from drawdowns.

How much extra risk do derivatives pose?

We treat derivatives with the same level of risk controls we would with a physical asset. As such derivatives should be no more risky than a physical asset if the risks taken are understood.

Outlook

Both 2025 and 2026 appear to hold elevated levels of uncertainty for global growth and security. The US is redefining itself on trade, geopolitics, defence and tax, but the jury is out on whether these changes will be positive for the US. There may be some positive news for companies and GDP if corporate taxes and regulation are reduced; however, these are balanced by concerns that higher tariffs will overall prove a negative for the US economy due to reduced trade and higher prices. Only hard economic data over the rest of the year will make this picture clear.

United Kingdom

United Kingdom