The growing importance of longevity risk

Defined-benefit pension schemes are typically exposed to three liability-related risks:

- Interest rate risk

- Inflation risk

- Longevity risk

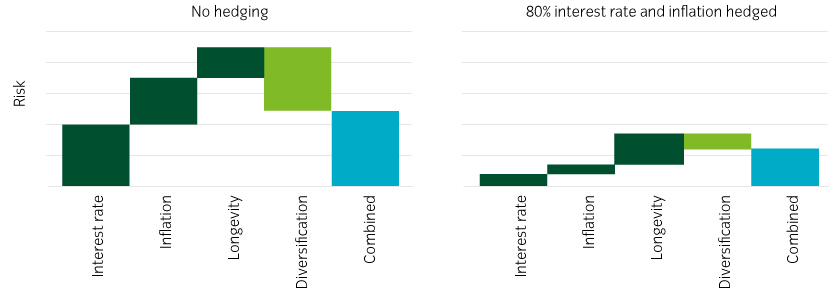

Many pension schemes have managed their liability risks by hedging interest rate and inflation risks through a liability-driven investment (LDI) approach. As a result, longevity risk has grown in significance for many schemes (see Figure 1).

Figure 1: Longevity risk grows in significance as other risks are hedged

Source: For illustrative purposes only. Three-quarters of the liabilities are linked to inflation and longevity risk is assumed to be equal to 50% of interest rate risk. We use a correlation of -0.5 between interest rates and inflation and 0.25 between longevity and both of the market risks.

Extending the LDI toolkit

As pension schemes are now seeking to hedge longevity risk, we have extended the LDI toolkit for our clients by providing a platform through which they and their consultants can efficiently transfer longevity risk to the reinsurance market.

Our longevity-hedging platform, when combined with our existing LDI and fixed income solutions, provides our clients with the key building blocks needed to manage all of their liability-related risks, helping to generate the cashflows required to meet pension payments.

In the longer term, we hope to encourage standardisation in the longevity market, enabling more pension schemes to access a cost-effective longevity hedge.

Insight’s longevity-hedging platform

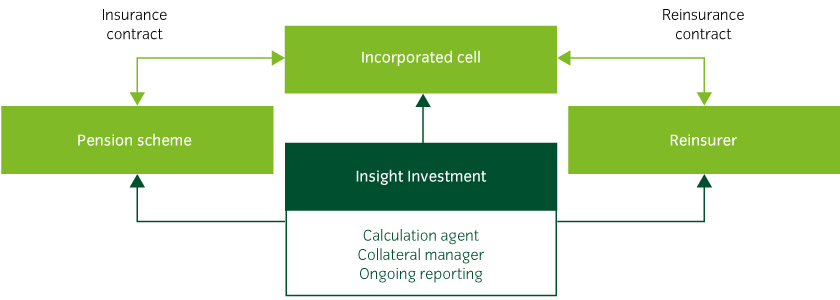

The appetite for taking on pension schemes’ longevity risk comes primarily from reinsurers, who view it as a natural offset to their mortality risk exposure.

This means that practically all longevity-hedging solutions involve the risk being passed from a pension scheme to a reinsurer. Typically, this involves a scheme making a series of agreed payments to the reinsurer over 35 to 40 years. In return, it receives payments equal to the pensions payable to a defined group of scheme members.

However, under current regulations, as reinsurers can only transact with insurers, any pension scheme wishing to hedge longevity risk must do so via an insurer.

Under the Insight longevity platform the role of the insurer is played by a Guernsey-domiciled incorporated cell (IC), an entity that sits within an incorporated cell company (ICC) owned by a third party (see Figure 2). There exist a number of suitable Guernsey-domiciled ICCs under which a pension scheme could establish an IC. Insight can help with this process.

The role of Insight is to provide all of the services needed to support the transaction on an ongoing basis, including calculation agent, collateral management and ongoing reporting.

Figure 2: How Insight’s longevity platform works

Benefits of incorporated cells

In recent years it has become increasingly common for pension schemes to transact longevity swaps via a Guernsey-domiciled IC, with the primary benefits of this approach being:

- Security: Each IC is a separate incorporated entity containing only a single pension scheme transaction, meaning that its solvency is not impacted by any other elements of the ICC.

- Efficiency: As the IC does not retain any of the longevity risk, Guernsey legislation allows the pension scheme to provide only a minimal level of capital to the IC.

- Flexibility: An IC-based transaction arguably offers the most flexibility should the scheme subsequently wish to transfer the longevity hedge to an insurer through a buy-in or buy-out.

By creating the IC under an existing ICC we enable the scheme to benefit from the existing governance and infrastructure of the ICC, rather than having to set everything up from scratch. This means that an existing ICC can typically set up a new IC within a period of two months.

Under a pre-existing ICC, the IC would typically be governed by the ICC’s board of directors. However, recent changes in regulation mean that representatives of the pension scheme may now sit on the board of the IC, giving the scheme more control over the running of the IC. In any case, as sole shareholder of the IC the pension scheme would retain sufficient powers to limit the board’s freedom to act in a way that would not be in the best interests of the scheme. In extreme cases, the scheme could opt to move the IC to an alternative ICC.

Alternatively, a pension scheme could ask a UK-domiciled insurer to provide a longevity hedge. However, this could make it more difficult to novate the longevity hedge if the scheme wants to implement a buy-in or buy-out in the future. Using an IC means the pension scheme retains the flexibility to decide how to proceed over the long term.

Benefits of Insight’s platform

In addition to the benefits of using a Guernsey- domiciled IC, the Insight longevity platform offers the following advantages:

- Transaction documentation: We have worked with a leading law firm to develop a suite of legal documents that cover all key aspects of a longevity transaction, allowing transactions to be implemented with maximum efficiency.

- Efficient use of LDI assets: Managing the longevity swap alongside other LDI exposures enables schemes to set up a unique pool of collateral to support all their hedges.

- LDI systems and infrastructure: The ongoing management and collateralisation of the longevity swap can benefit from Insight’s robust operational processes and systems.

- Ongoing reporting: By playing the role of calculation agent, Insight can provide detailed reporting on the ongoing performance of the longevity hedge.

- Experienced team: Schemes would benefit from our experience of working with external advisors to implement complex transactions.

How do you implement a longevity hedge?

Should a pension scheme implement a longevity hedge using the Insight platform, the key steps will typically be as follows:

- Appoint advisers and conduct a feasibility study

- Cleanse the scheme’s in-force and historical membership data

- Run a competitive quotation process to select the reinsurer

- Select the platform, including the insurer/ICC that will intermediate the transaction

- Negotiate all required legal documentation

- Execute the transaction

United Kingdom

United Kingdom