"Rising stars" present potential opportunity through market disruption. Investing in a portfolio of fallen angels may be an efficient way to capture future rising stars.

Executive Summary

- Current economic conditions could provide opportunities for ‘rising stars’ – the term for companies that get upgraded from high yield (HY) to investment grade (IG). 2022 was a record year for the supply of rising stars at $108bn (versus the average of $47bn)1

- Historically, rising stars are almost twice as likely to come from the fallen angel market than the broader HY market.

- A dedicated fallen angels strategy may offer the most efficient path for capturing rising stars, while offering historically equity-like returns for bond-like volatility.

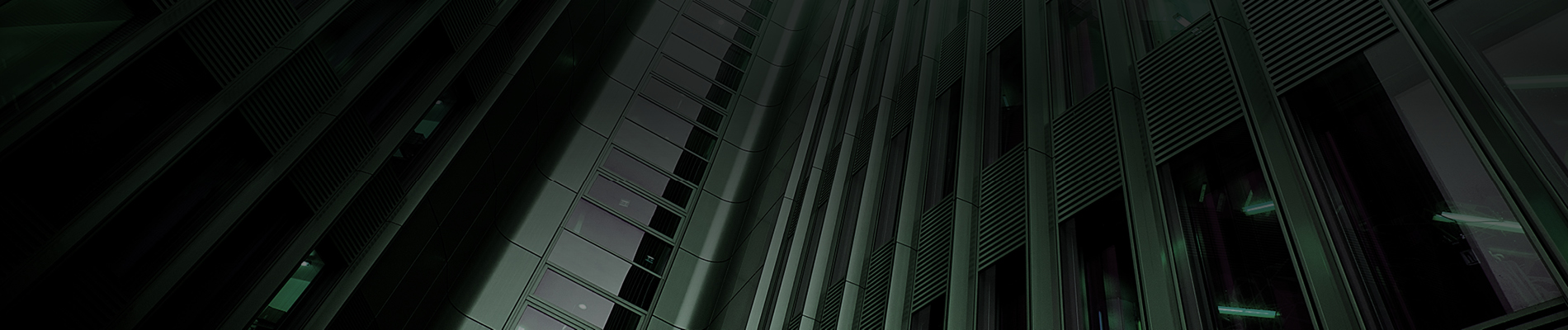

Rising stars are common in rising growth environments

Rising stars saw a record year in 2022, with $108bn of high yield bonds upgraded to investment grade.

During 2023 we expect a lower supply, but still a healthy $30bn. Rising stars tend to be most common during periods of modest economic growth (Figure 1).

Figure 1: A rising tide potentially launches rising stars

Source: Bloomberg, Barclays, December 2022

As the US economy recovers, it is progressing into the ‘mid cycle’ phase of the expansion, driven by consumer spending and public and private investment. We anticipate ~$100bn of rising stars to emerge from the high yield market now until the end of 2022, up from $20bn in H1 2021 and $20bn in 2020.

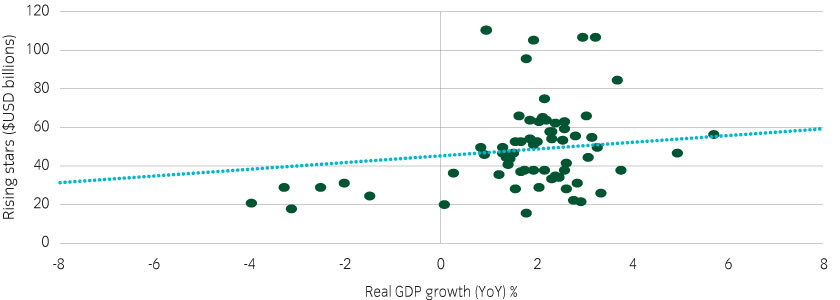

Three stages of rising star outperformance

A rising star's outperformance tends to occur in multiple stages as ratings agencies can lag market pricing.

Stage 1: Journey begins

Up to three years or more before an upgrade, a future rising star begins deleveraging. Bottom-up investors take note, resulting in narrower spreads. Eventually, over this time period, the issuer becomes a clear candidate for an upgrade and spreads outperform versus peers.

Stage 2: Upgrade announced

The rating agencies announce the upgrade, the market reacts positively and spreads tighten in anticipation of future buying from a larger IG asset base.

Stage 3: "Forced" buying

Once upgraded, at month end, passive funds and ETFs will rebalance their portfolios and become forced buyers to minimize tracking error. In anticipation of this buying activity, volumes pick up in these names and spreads tighten further.

Figure 2: The stages of rising star performance

Source: Bloomberg, December 2022

Challenges with traditional approaches

There are three key challenges to traditional concentrated approaches:

-

Concentration risks: The pool of potential rising stars has historically been ~5% of the broader HY market on average. Traditional approaches to specifically targeting just this opportunity set means high concentration risks, and thus a high impact from volatility

-

Timing challenges: Pin-pointing early-stage rising stars can be tricky, and the penalty for getting it wrong can be severe. Rating agencies each have specific methodologies and two agencies typically need to upgrade a bond before passive accounts start buying them.

-

High transaction costs: The HY market offers relatively low two-way liquidity in single bonds, particularly within smaller issuers (which could be early-stage rising star candidates). High transaction costs would potentially limit active trading.

'Fallen angels" could hold the key to capturing rising stars

In our view, a diversified "fallen angels" portfolio could be a compelling way to catch rising stars early and reliably.

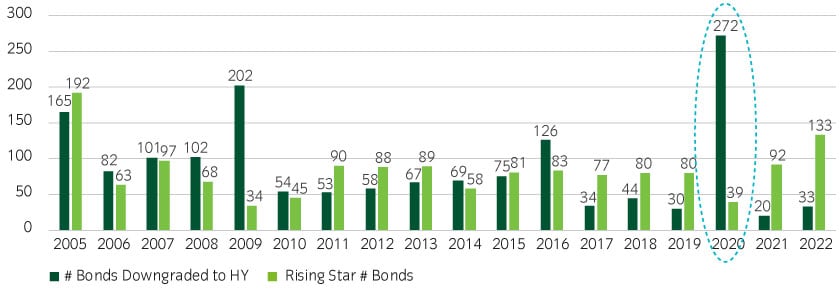

Historically, rising stars are almost twice as likely to come from the fallen angel market than the broader HY market (Figure 3).

Figure 3: Rising stars make up a higher proportion of the fallen angels market than HY

Source: Bloomberg, December 2022

It may surprise you that, despite the financial market downturn in 2022, it was actually a banner year for rising stars. In 2023 so far, there have already been close to $15bn of upgrades, as companies used the low rate period to lock in low cost debt for longer. Although the supply of fallen angels did not markedly accelerate in 2022 (Figure 5), we expect to see a moderate pick-up in downgrades in 2023 (Figure 4). We expect to see $40bn to $60bn of fallen angels this year, closer to historically averages given economic headwinds and the potential for a (in our view) shallow recesstion.

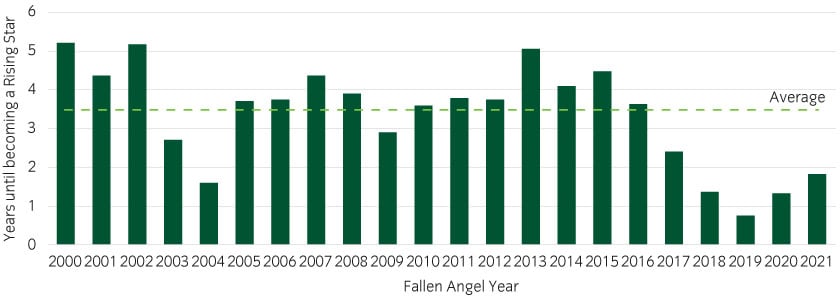

Figure 4: 2022 was a strong year for rising stars

Source: Bloomberg, December 2022

Barclays estimates $70bn of fallen angels in 2023 and an equal volume of rising stars2.

Fallen angels have also been upgraded at an accelerating pace in recent years, indicating that now is potentially an ideal time to consider a fallen angels strategy.

Figure 5: Former fallen angels have been returning to IG at an improving pace

Source: Bloomberg, Barclays. Only contains bonds that were originally downgraded to high yield.

Fallen angel strategies may also offer additional tailwinds

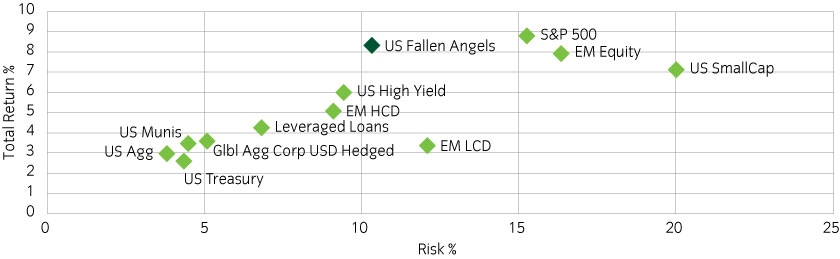

Fallen angels have historically delivered returns in line with equity markets despite volatility in line with bond markets (Figure 6).

Figure 6: Fallen angels have delivered equity-like returns for bond-like volatility11

Source: Bloomberg, December 2004 to December 2022.

Fallen angels are often large multi-nationals with large capital structures, whereas traditional high yield companies tend to be smaller businesses with less access to capital markets. For example, the larger fallen angels in the index are household names such as Ford, Delta Airlines and Vodafone3. Fallen angels were once investment grade rated and had access to capital at lower funding rates. Upon downgrade, many of these fallen angel corporations are incentivized to repair their fundamentals to get access to that cheaper capital again. As such, intuitively and empirically, we believe angels are potentially stronger rising star candidates on average.

Playing rising stars: fallen angels could be the key

In our view, casting the net wide in a diversified, fully dedicated fallen angels strategy may be a compelling solution for a wide range of investors looking to access rising stars.

The asset class may help fit multiple needs for pension plans, such as compelling yield and income streams to cover future pension obligations and well as the growth potential to help close funding deficits and participate in the economic recovery.

Insurance investors may also benefit from the income streams of the fallen angels market, particularly if they can receive favorable capital treatment on BB rated corporate bonds given fallen angels are mainly BB rated.

We believe that investors need to consider managers with the ability to overcome the liquidity challenges of reliably delivering the performance of the fallen angels market, such as managers able to unlock the ‘hidden liquidity’ within the fixed income ETF infrastructure.

United States

United States