Summary

- High yield markets have repriced — yields are worth considering

- Corporate balance sheets are starting from a position of strength

- High yield has historically weathered financial crises better than equities

- High yield is unfairly ignored as a strategic allocation

- Buy while spreads last — but carefully

High yield markets have repriced — yields are worth considering

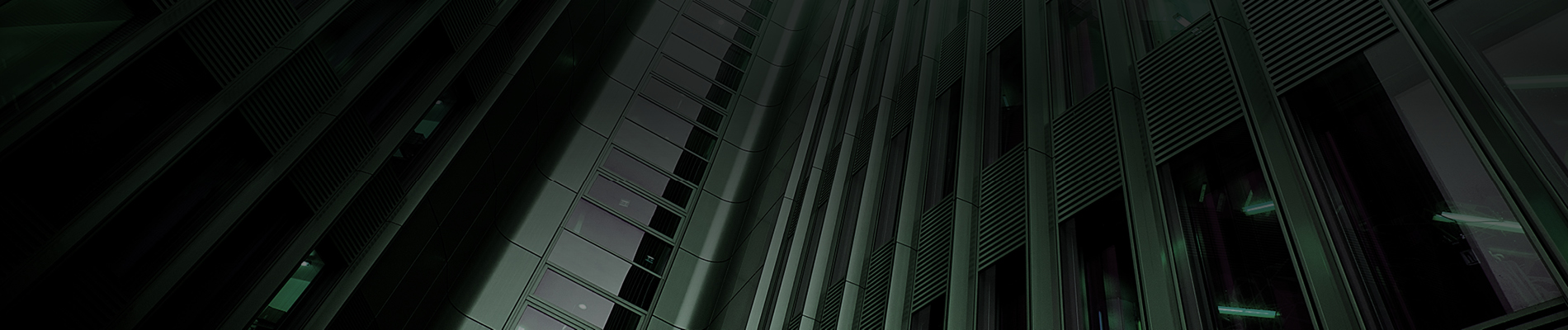

Yields reached as high as 8.8% at the end of June 2022, the highest level since 2016 (excluding the start of the pandemic) with credit spreads close 6% (Figure 1).

Figure 1: Yields on the US high yield index have reached compelling levels for income-oriented investors1

High yield has an average duration of just over 4-years, compared to investment grade at over 7.5, implying relative resiliency in the case that rates continue to rise.

Corporate balance sheets are starting from a position of strength

As economic storm clouds gather, metrics indicating corporate credit strength have room to deteriorate before distress sets in.

Companies’ costs are potentially rising slower than their revenues

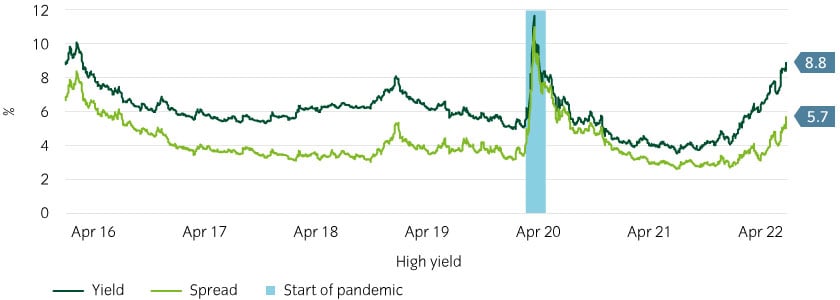

Almost 60% of bonds in the high yield index were issued in 2020 and 2021 (Figure 2). This was at the height of the pandemic; companies rushed to raise liquidity and term out debt (to lock in lower fixed rates for longer) to ride out uncertainty. This has dramatically reduced and delayed corporate refinancing needs. High yield issuance is down ~70% year-to-date in 2022, indicating that the corporates have less need to come to market.

Figure 2: High yield supply has been low, improving supply and demand dynamics2

With inflation running high, the result is that real interest costs and debt burdens are falling (as most corporate debt is fixed rate and floating rate debt is generally hedged).

Other costs are also falling in real terms. Wage growth is running at ~5%, while CPI is ~9%3. Further, capex grew 25% pa in Q2 2021, the fastest level since the mid-1980s4 and has since tapered off with corporate borrowing. If the peak in capex is in, costs from depreciation and amortization of new plant, property and equipment over the next few years will also fall in real terms, as they will be fixed.

By contrast, corporate revenues in aggregate do appear to be rising with inflation. Producer price inflation (PPI) for goods is matching CPI at ~9%5, indicating many corporates are successfully passing costs on to consumers.

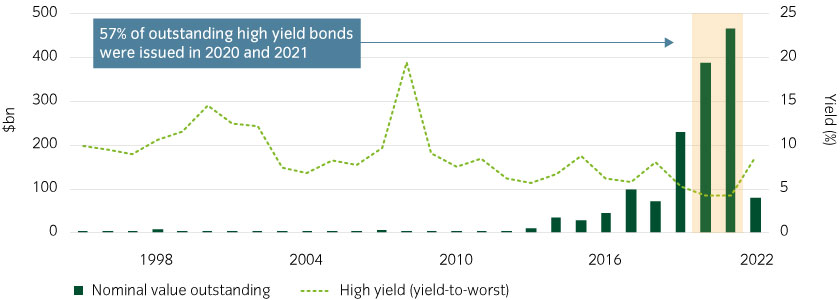

Leverage metrics are historically low

Corporate leverage and interest coverage ratios are historically strong (Figure 3).

Figure 3: Interest coverage and leverage ratios are at historical highs6

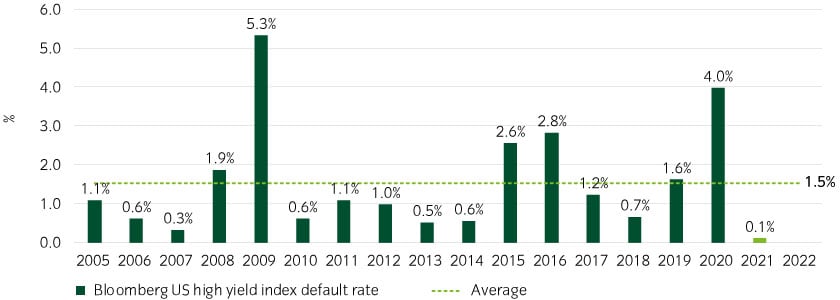

Similarly, defaults are starting from historic lows, and have to revert a fair bit before even reaching the historic 15-year average of~1.5% over the last 17 years (Figure 4).

Figure 4: Default rates are set to rise, but from historic lows7

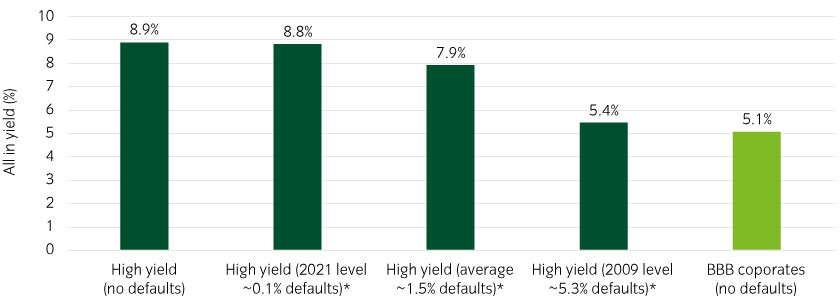

Even once default rates rise to historical averages, we believe high yield would still be expected to deliver a higher net yield than BBB credit (assuming a conservative 35% recovery rate on average). This would even be the case if high yield defaults rose to 2009’s extreme levels of 5.3% (Figure 5).

Figure 5: Even if defaults rise, yields will potentially exceed those on BBB credit8

High yield has historically weathered financial crises better than equities

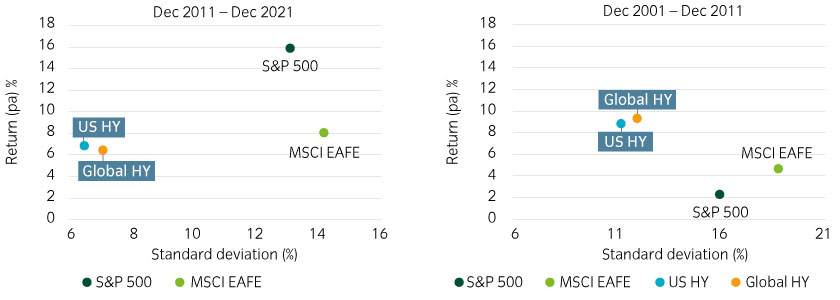

The last decade has been an “easy” one for most asset classes, as central bank liquidity (i.e. aggressive QE asset purchases, particularly as the pandemic started) lifted all boats. (Figure 6 left chart).

However, the previous decade was less easy, with far less (although high for the time) central bank support, given the aftermath of the dotcom bust and the 2008 global financial crisis. Nonetheless, during both decades, high yield returns were very similar, but equity returns were radically different (Figure 6 right chart).

Figure 6: High yield returns in the last two decades have been consistent, but equity returns have not9

We believe this is because the bulk of high yield returns come from contractual coupon income, rather than price appreciation like equities (assuming bonds are held to maturity or call event) (Figure 7).

Figure 7: The bulk of long-term returns on high yield has always been driven by coupons rather than price moves10

Therefore, as we move to a world where central bank liquidity potentially looks more like 2001 to 2011, we believe high yield markets may have less to fear than equities.

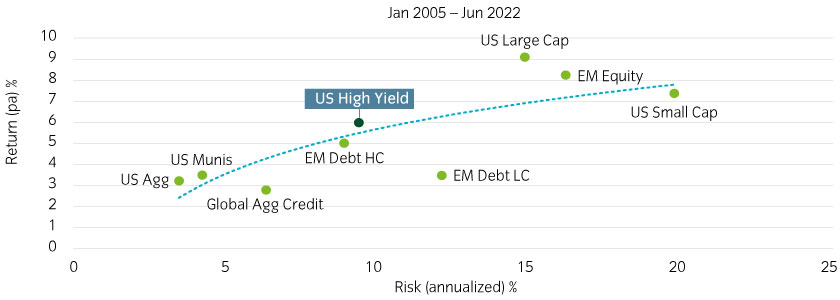

High yield is unfairly ignored as a strategic allocation

Investors, such as pension plans, often bifurcate their strategic investments between equities and investment grade bond strategies. However, we believe ignoring high yield can mean unnecessarily missing out of the “belly” of the efficient frontier, and miss the diversification against equities (Figure 8).

Figure 8: Many investors do not include high yield in their asset allocation mix, potentially ignoring the “belly” of the efficient frontier11

Buy while spreads last — but carefully

Although the odds of recession are material as the Fed pushes ahead with its hiking cycle to fight inflation, we believe investors need to keep a close eye on compensation for risk.

However, market repricing has potentially provided opportunities to enter the asset class, particularly for long-term income focused investors.

We believe that a diversified efficient beta approach to high yield is worth considering, provided managers can take a highly diversified approach and have the quantitative tools to pinpoint the more robust issuers. Active approaches that include high yield within the opportunity set are also worth considering, providing managers can prioritize value investing and therefore rigorous security selection.

With great care, comes potentially compelling reward.

United States

United States