Contents

- Our final verdict on our 2022 calls

- Our key macro call for 2023: US exceptionalism but persistent high rates

- Our key investment call for 2023: High rates will make this a fixed income era

- Insight's 2023 calls summarized

Our final verdict on our 2022 calls

Macro calls

We underestimated inflation last year, in terms of severity and persistence as “sticky” services sectors like rents accelerated. The Ukraine war also played a part, but to a lesser extent than for inflation abroad. It forced the Federal Reserve and other central banks to be more inflation-focused than we had expected, taking away the “easy policy” punchbowl.

Table 1: Inflation figures were higher than we expected

| Insight's 2022 Macro Calls | Verdict | Why? |

|---|---|---|

| Real GDP Growth will be 3.5-4% | x | Inflation eroded real GDP, although nominal GDP was above 7%. |

| Inflation will moderate to ~3% by very end of the year | x | Inflation ended above 7%, only moderating toward the end of the year. |

| Interest rates will rise manageably | ~x | We did not anticipate the steepest hiking cycle since the 1980s. Nonetheless, the rate rise was not unmanageable, largely a result of relatively robust consumer health. |

| Volatility will increase | ✓ | All asset classes deflated as the Fed removed the punchbowl. |

Source: Bloomberg US High Yield Corporate Index, ICE US Convertibles Index, JP Morgan Corporate EMBI Global Index, JP Morgan EMBI Global Sovereign Index. Bloomberg EM Hard Currency Index, December 2022.

Investment calls

Nonetheless, many of our investment calls were accurate. We expected equities to struggle as financial conditions tightened. We also expected to find compelling opportunities to lock in income opportunities, such as in high yield (albeit entering in early 2022 would have been too early). Emerging markets, however faced a far tougher year, with a strong dollar, the Ukraine war and Chinese lockdowns having a marked effect.

Table 2: Our investment calls nonetheless fared well as we anticipated tighter financial conditions

| Insight’s 2022 Investment calls | Verdict | Why? |

|---|---|---|

| Overweight high yield (particularly fallen angels and short duration high yield) | × | High yield underperformed as risk assets sold off, but compelling entry points arrived for locking in income |

| Allocate to structured credit | ✓ | Structured credit outperformed corporate credit as floating rate debt performed well and consumer credit remained solid |

| Hedge downside equity risks | ✓ | The S&P 500 entered a bear market for the first time since 2008 excluding the pandemic |

| Overweight BBB corporate credit vs A or higher | ✓ | BBB corporate credit outperformed A rated credit on a beta-adjusted excess return basis |

| Allocate to hard currency EM | x | EM underperformed, largely to due to geopolitics as Russia invaded Ukraine and China went into strict lockdowns and the US dollar appreciated |

| Credit outperforms equities | ✓ | Equities underperformed all credit sectors |

Source: Insight, January 2023. Opinions expressed herein are as of the date of this presentation, and are subject to change without notice. Insight assumes no responsibility to update such information or to notify a client of any changes.

Our key macro call for 2023: US exceptionalism but persistent high rates

The US looks attractive versus the rest of the world

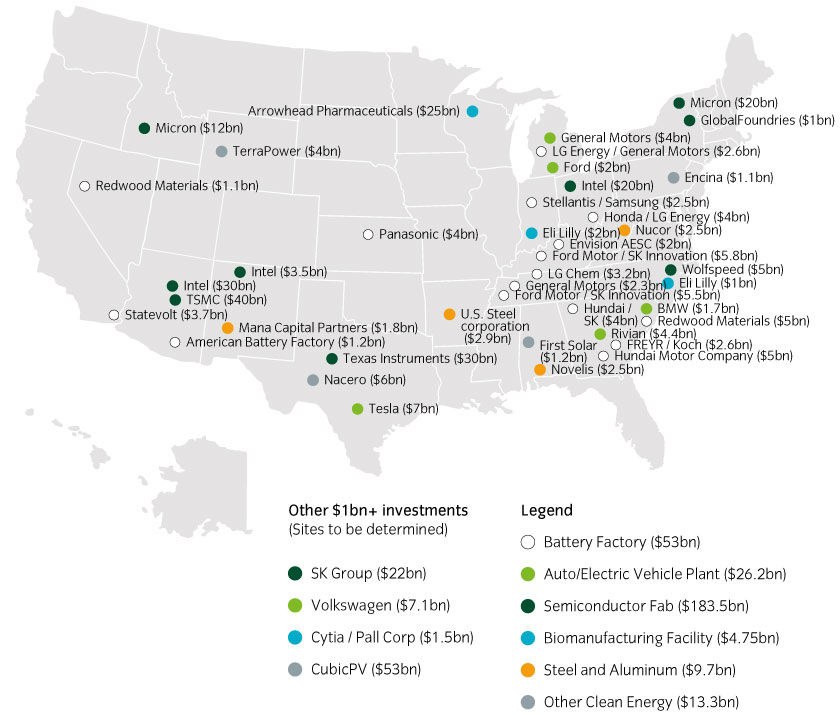

We believe the United States is potentially about to see a resurgence of global industrial production over the next decade. Any New Yorker taking a road trip along the Eastern Seaboard would have noticed miles of factory construction sites along the North Carolina to West Virginia corridor.

Figure 1: US manufacturing is on the rise

Source: Reshoring initiative, ZETA, SIA and Alliance for Automotive Innovation. Note: Initial snapshot of some of the companies announcing major investments in the US since 2021. The mention of a specific security is not a recommendation to buy or sell such security. The specific securities identified are not representative of all the securities purchased, sold or recommended for advisory clients. It should not be assumed that an investment in the securities identified will be profitable. Actual holdings will vary for each client and there is no guarantee that a particular client’s account will hold any or all of the securities listed.

Multinational corporates are responding to political uncertainty in China, where expanding production has become less workable. The US has emerged as a compelling alternative, partly due to fiscal incentives relating to the administration’s Inflation Reduction Act and Chips and Science Act. Further, the relative stability of energy prices compared to Europe, which has large exposure to Russian supplies, is more appealing to heavy industrials. The West Virginia corridor appears to offer the best combination of resource, weather exposure, educated workforce and labor cost.

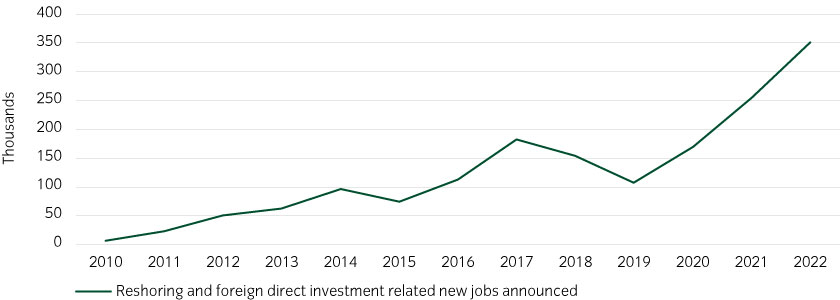

Figure 2: Reshoring of corporate supply chains to the US is accelerating

Source: Reshoring Initiative, Q3 2022: https://reshorenow.org/content/pdf/2022_Q3_data_report.pdf

We expect this to boost US GDP and help cushion the US through the upcoming global downturn. This supports our wider view that the US may avoid a recession over the next two years. If not, we believe any recession will be shallow.

It will also complicate the Fed’s attempt to bring inflation back down to target.

We believe markets are wrong about rate cuts coming this year

The Fed’s attempt to slow the economy will not be helped by an influx of industrial production and a US consumer than still has ~$1trn of $2trn of excess savings (amassed during the height of the pandemic) left over1.

It is well understood that the Fed intends to raise rates to a peak above 5%. However, markets are subsequently pricing in rate cuts later in 2023 after the peak is in. We believe markets are wrong here. We expect rates to remain at the peak levels for the rest of the year, and potentially even all of 2024.

Our key investment call for 2023: High rates will make this a fixed income era

With peak Fed rates arriving and becoming entrenched this year, equity markets will have to wait even longer for the “Fed put” to return as central banks focus on keeping financial conditions tight.

While high rates will make life difficult for equities, it potentially creates a sweetspot for fixed income.

Compelling yields are now achievable on lower and higher risk credit assets. TINA (“there is no alternative”) was an equity story for the last few years, but if anything, it may well be a fixed income story now. At least, TARA (“there are reasonable alternatives” to equities) should be the new watchword.

Investment grade credit looks attractive – particularly the front end: Investment grade credit now offers 4.5% yields, compared to ~2% in 20212. We believe an active approach can push this up to north of 6%. The inverted yield curve offers value at the front end. Floating rate notes also offer an, in our view, outsized premium given forward curve expectations of falling rates later this year.

High yield offers yields in line with growth asset returns: Investors can lock in yields over 8.5% (since 2000, the S&P has averaged a 7.6% pa total return). We estimate that even if index defaults were to rise to 2008 levels, this would still leave the high yield index3 with a comparable yield to BBB credit4.

Interest coverage ratios actually improved over 2022 given anaemic supply. ~55% of the bonds in the high yield index were issued in 2020 or 2022 during the era of record low rates, with no significant maturity wall until 2025.

Fallen angels could be a compelling high yield “overweight”. Ratings migration may raise the supply of fresh downgrades to high yield, which become subject to forced selling from investment grade accounts and offer value. We believe investors need access to a strategy than can enhance liquidity in these less liquid markets.

Convertible bonds could be attractive if we are wrong about equities

Our view is that credit will outperform equities, particularly on risk-adjusted basis. However, in case we are wrong, we believe a long-only convertible bond strategy can be a compelling way of playing both sides.

Convertible bonds offer the optionality to convert the debt to equity if stock markets do rally strongly.

On the debt side, convertible bonds yields have gone from close to 0% to ~3%5, offering genuine income for the first time in years. If equity markets rally, investors can convert their bonds into equities and participate on the upside. Convertibles have tended to be issued by higher-beta companies from innovative industries that have significant capital needs for investment. As such, when equity markets rally, the equity of the companies that raise convertible debt has historically performed well.

Further, certain issuers may look to refinance their maturing high yield debt in the convertibles market given the lower cost (a result of selling the equity call option to the investor) which may lead to some compelling deals.

Structured credit may also be an option for corporate refinancing

The other way for corporate and other borrowers to refinance maturing debt more cheaply is to offer investors security. This makes structured credit a potential avenue for refinancing.

We continue to see structured credit as attractive, partly given diverse collateral types, structural protections and enhanced spreads, particularly further up the capital structure where we believe distress would be unlikely to inflict losses on investors.

Lastly we continue to see value in private structured credit market segments, particularly esoterics. Given idiosyncratic factors, rigorous credit selection remains critical in this space and we do expect the market to cheapen further from here, making it a potential area for flexible investors to watch.

Table 3: Implications for pension allocations: Flip equity and bond assumptions

| Pension plan strategy consideration | Insight's recommended strategy |

|---|---|

| Rates allocation | Increase precision of liability hedge and consider cashflow matching a measure of near-term liabilities. |

| Credit allocation | Allocate linearly to investment grade throughout the year, particularly BBB credit. Consider tactical exposure to the front end. Consider selective complementary exposure to high yield and structured credit. |

| Growth allocation | De-emphasize equity exposure over high yield, fallen angels and convertible bonds. |

| Inflation risks | Capture positive real income as inflation moderates but remains above-target. |

| End state | Given market moves, update end state objective and plan to reach it. |

Insight's 2023 calls summarized

| Insight's 2023 Macro Calls | Why? |

|---|---|

| The US will avoid a deep recession | A strong consumer and attraction of the US for industrial expansion. |

| Core inflation will not trend below ~3% by year-end | A strong consumer and sticky non-shelter services will keep CPI above target. |

| No interest rate cuts | The Fed will reach a terminal rate above 5%, and will keep rates there longer than markets expect. |

| Equity volatility will remain elevated | The Fed needs to keep financial conditions tight, eliminating the Fed put while inflation remains above target. However, if markets do not turn by the summer, equity volatility will likely be lower overall than 2022, but above the norms of recent years. |

| Insight's 2023 investment calls | Why? |

|---|---|

| Credit outperforms equity | High yield environment offers compelling entry points for fixed income. We see contractual yield as more attractive than hoping for capital gains in equities. |

| High yield and fallen angels offer growth-level income returns | Those able to lock in high yields may be able to achieve what are traditionally considered equity-like returns in 2023. |

| Convertible bonds offer a hedge against "regret risk" | In case equities do rally, convertibles can participate on the upside while protecting the downside and locking in yield. |

| Structured credit can offer potential stability and yield through the downturn | Investors have an opportunity to diversify collateral within their credit allocations. Higher up the capital structure, we believe structured credit offers protection against a downturn. Lower down the capital structure it may offer a premium above corporate credit. |

United States

United States