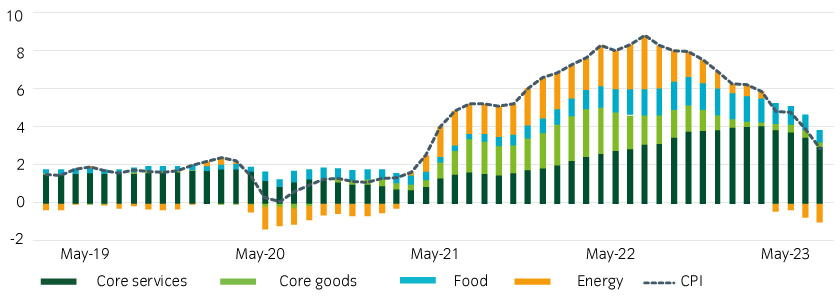

Headline CPI continued to make progress, reaching 3.0% year-on-year in June (as we had projected) down from 4.0% last month and within a striking distance of the federal reserve’s 2% target.

More importantly for the Fed, the stubborn core CPI measure, which had been stuck in the mid-5% range for most of the year, eased to 4.8%, the slowest growth rate since late 2021.

This is comforting for the central bank. However, fading base effects may slow further progress. We do not expect the result to dissuade the Fed from a further rate hike this month, but it may help shift expectations regarding the terminal rate.

Peak “base effects” help push CPI to 3%

Base effects were particularly favorable for headline CPI in June on a year-on-year basis, given that the headline inflation was ~9% last June.

Figure 1: Peak “base effects” helped all major headline CPI categories to fall

Source: Bureau of Labor Statistics, Insight calculations, July 2023

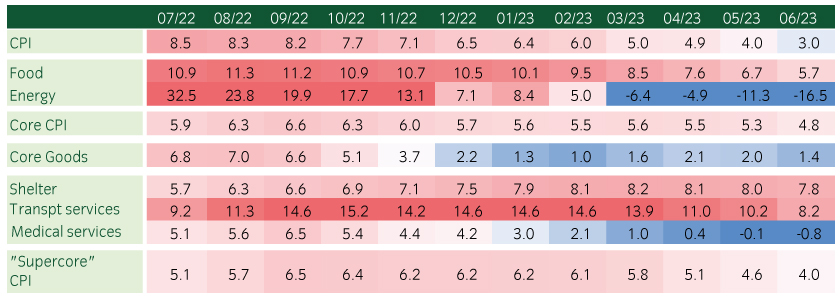

The Fed’s closely-watched “supercore” inflation level which focuses on the “sticky” core services excluding housing, reached its lowest level since the start of 2022. Elsewhere, the shelter component continued its slow decline, which is consistent with a moderation in rent prices seen in private data (Figure 2).

Figure 2: “Sticky” services sector CPI is moving in the right direction

Source: Bureau of Labor Statistics, Insight calculations, July 2023

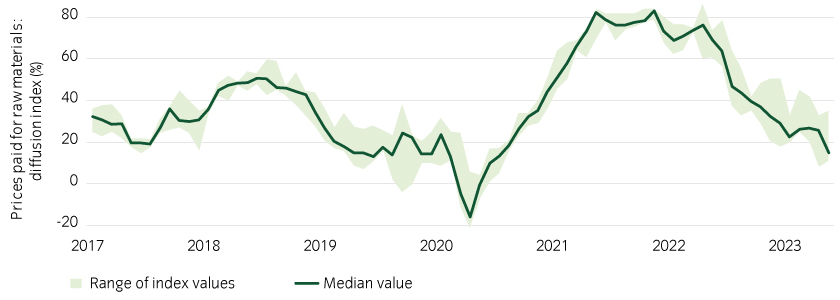

The rebound in core goods has ended

Core goods CPI had been rising over the last couple of months, but declined 0.1% month-on-month. Used vehicles prices declined 0.5% in June, partially reversing strong gains seen in the prior two months. Given a recent slowdown in the Mannheim Used Vehicle Index (which is a leading indicator), we expect used vehicle prices component of CPI to remain soft in the months ahead.

Outside of the CPI report, the regional Fed manufacturing surveys point to an ongoing disinflationary trend in other core goods prices, with domestic manufacturers reporting waning price pressures.

Figure 3: Fed regional manufacturing price inflation is falling

Source: Federal Reserve banks of New York, Dallas, Philadelphia and Kansas, July 2023

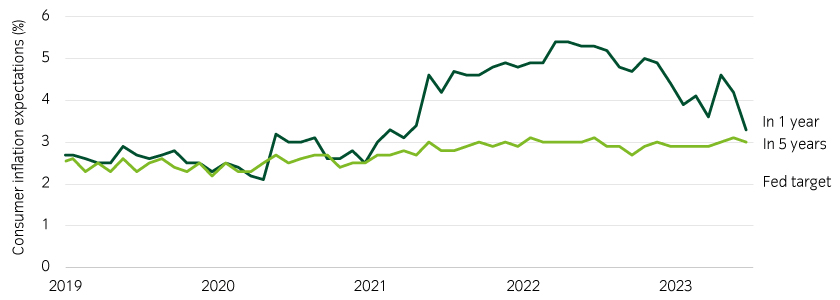

Falling inflation expectations reduce risk of spiralling inflation

Finally, easing consumer inflation expectations offer further good news for the Fed. According to a survey conducted by the University of Michigan, expectations for inflation 12 months from now are at the lowest level since early 2021 (Figure 4).

Figure 4: Inflation expectations are moderating

Source: University of Michigan, July 2023

A strong print for the Fed, but the “last mile” may be the toughest

Although the bulk of the Fed’s job is done, the path from 3% to 2% may be less straightforward than from 9% to 3%.

Positive “peak base effects” are for the most part behind us, and this has the potential to keep CPI at ~3% over the coming months. Encouragingly, core CPI may still benefit from some base effects over the summer.

Despite this generally positive CPI report, we believe the Fed will push ahead with another hike later this month, but odds are that it may prove to be the end of the hiking cycle.

United States

United States