|

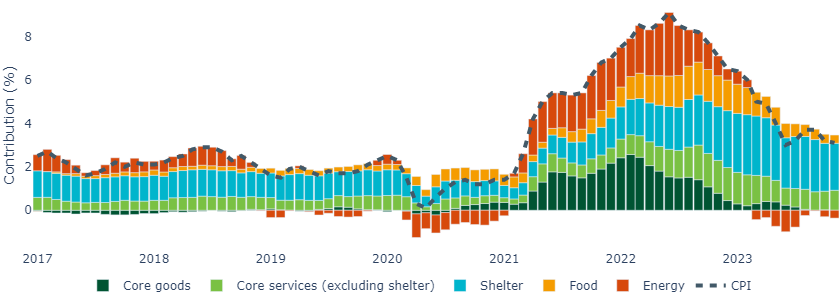

Headline consumer prices rose 0.1% in November, bringing CPI down from 3.2% to 3.1% on a year-over-year basis. Core CPI accelerated slightly from 0.2% to 0.3% month-on-month, remaining at 4% year-on-year.

On a 3-month annualized basis, headline CPI is running close to 2% which is encouraging momentum into the New Year as the Fed enters the “last mile” of its inflation battle.

Falling energy prices help keep inflation low

Energy prices, and related categories such as gasoline, energy goods and private transportation were the largest negative contributors to the index.

This is no surprise, as global oil prices have fallen to $71 from their recent peak of $94 in September and gasoline prices have fallen from $3.9 per gallon to $3.1 over the same period.

Figure 1: Energy prices are retreating, reducing inflation expectations

Source: Bureau of Labor Statistics, FRED, Insight, December 2023

Shelter categories offset the impact of energy prices

Shelter had the largest weighted contribution to the index. Excluding shelter, CPI actually fell 0.1% in November and is running at 1.4% year-on-year.

Shelter prices accelerated slightly from 0.3% to 0.4% month-on-month. However, the segment remains in a disinflationary trend and is still cooling on a year-on-year basis (Figure 2).

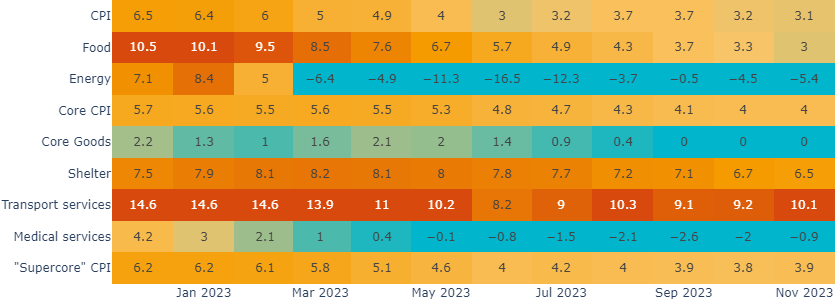

Figure 2: The services “hot spots” are gradually cooling

Source: Bureau of Labor Statistics, FRED, Bloomberg, Insight, December 2023

The Fed also closely watches the so-called “supercore” inflation, which comprises core services less the shelter component.

The measure remained relatively “sticky” this month, almost entirely due to transportation services (which remains our only bright red “hot spot” in Figure 2) and medical care services (partly related to last month’s calculation reset in health insurance). However, elsewhere, cooling labor costs are keeping other “supercore” categories contained.

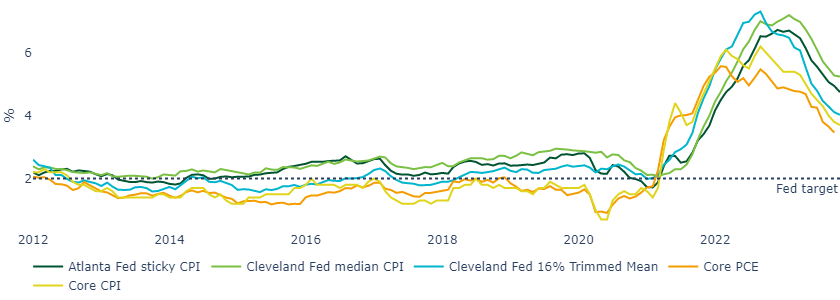

Other measures of inflation are unanimously improving, albeit none have reached the Fed’s target

The Fed and other market participants closely follow a range of metrics outside of CPI and core CPI. These include the Fed’s preferred inflation gauge, core PCE, and various “trimmed mean” and “median” measures maintained by regional central banks.

The good news is that all show substantial improvement since inflation peaked last summer. By the same token, however, none has quite reached the Fed’s 2% inflation target, which means that the job of taming inflation isn’t quite done yet.

Figure 3: Most inflation measures are significantly improved

Source: Bureau of Labor Statistics, Bureau of Economic Analysis, Atlanta Fed, Cleveland Fed, Macrobond, December 2023. Median and mean CPI based on the one-month inflation rate of the component whose expenditure weight is in the 50th percentile of price changes. 16% trimmed-mean CPI is a weighted average of one-month inflation rates of components whose expenditure weights fall below the 92nd percentile and above the 8th percentile of price changes.

All eyes are on potential rate cuts in 2024

Overall, we expect CPI and core CPI to continue easing into 2024, with headline inflation trending closer to 2.5% by mid-next year.

All eyes are now on the Fed’s December 13 meeting for clues on future rate cuts. We expect to see the first “dovish” dot plot revision since the Fed began hiking rates in 2021.

Although the market will focus on the timing of rate cuts, we suspect chair Powell will be keen to strike notes of caution to avoid financial conditions easing too much further to ensure the Fed continues to see encouraging progress on inflation.

United States

United States