|

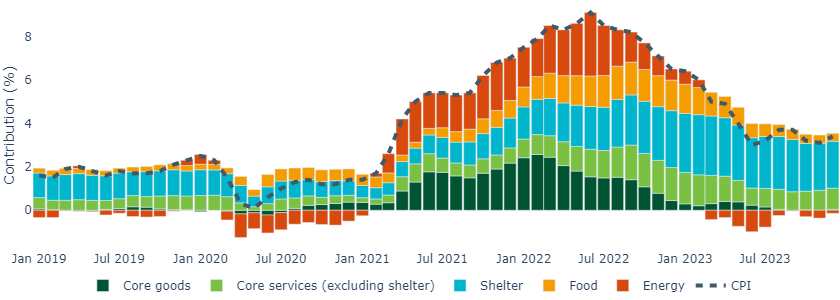

Headline CPI accelerated slightly more than the market expected, by 0.3% in December, taking the year-on-year rate from 3.1% to 3.4%.

Core CPI continued to make steady progress. It remained at 0.3% month-on-month, and on a year-over-year basis, dipped below 4% to 3.9%.

We expect CPI to continue to make steady, if bumpy, progress towards the Fed’s 2% target over the course of the year.

The “last mile” proves bumpy as CPI trends sideways

Energy prices rebounded slightly on a month-on-month basis, particularly in areas such as electricity and energy services, despite an unseasonably warm winter. However, the other non-core category, food prices, continued to moderate on a year-on-year basis.

Figure 1: Prices generally rose slightly across the major CPI categories

Source: Bureau of Labor Statistics, FRED, Bloomberg, January 2024

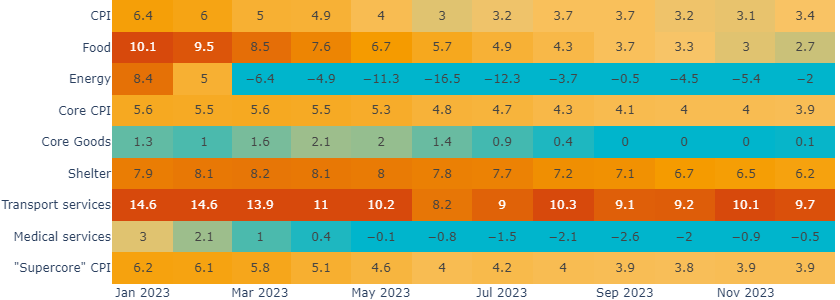

The “stickier” components of inflation remained relatively stubborn. Nonetheless, shelter (the largest component of the index) continued to make steady progress (Figure 2), in line with our projections. Meanwhile, non-shelter services inflation (known as “supercore”), remained fairly elevated.

Figure 2: Shelter inflation is improving but “supercore” (non-shelter services) remains stubborn

Source: Bureau of Labor Statistics, FRED, Bloomberg, Insight, January 2024

Our current base case is for geopolitical tensions to have a muted impact on US inflation

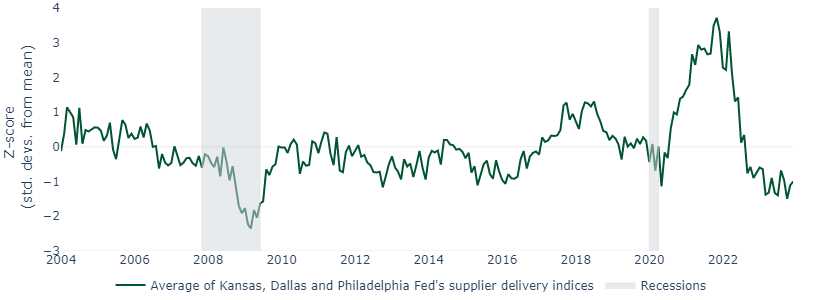

Pandemic-era supply chain bottlenecks have long dissipated (Figure 3).

However, geopolitical tensions may potentially reignite inflationary pressures in goods. Attacks on container ships in the Red Sea are diverting transit from the Suez Canal (where 11% of global maritime trade traverses1) to the Cape of Good Hope (at the Southern tip of Africa – which has seen a 76% year-on-year increase in traffic over the last week). This adds ~10 days or 3,300 miles to a one-way trip. Container freight prices have doubled since November2, but remain far lower than during the pandemic.

Figure 3: Supply-chain pressures have dissipated, but we are watching shipping activity closely

Source: Federal Reserve Bank of Kansas, Federal Reserve Bank of Dallas, Federal Reserve Bank of Philadelphia, Macrobond, Insight, January 2024

For now, our base case is that the impact on US inflation will be muted, but we are watching developments closely.

It will be bumpy ride to 2% inflation

We expect to see headline CPI close to or at 2% by the middle of the year, but this print is another reminder that it will be a bumpy ride.

We think the ongoing progress on inflation sets the stage for Fed rate cuts from the summer. However, we believe markets are significantly overestimating the probability of any cuts before then. As a result, we believe investors will find many opportunities to lock in compelling yields from fixed income assets ahead of the cutting cycle.

United States

United States