The Fed hiked the Fed Funds Rate by 25bp, as expected. However, it stopped short of overtly signalling a “pause”, as many had expected.

Chair Powell indicated the committee’s views have not changed materially since last month (meaning the door is open for at least one more hike this year). But Powell stated the central bank will go “meeting by meeting” in determining if any further hikes will be needed.

Market pricing is now in line with the Fed

The market may no longer be underestimating the Fed’s willingness to keep rates at restrictive levels.

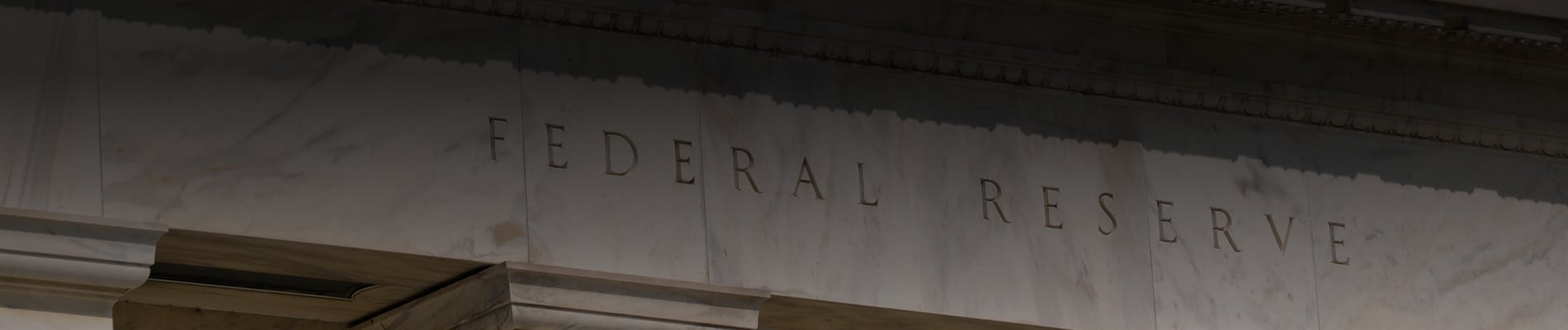

Earlier in the year, Fed Funds futures markets were projecting rate cuts before the end of 2023, despite Fed guidance only moving higher over time (Figure 1).

Figure 1: Markets have stopped pricing rate cuts this year

Source: Federal Reserve, Bloomberg, July 2023

However, the markets have changed their tune and are now more in sync with the Fed’s “dot plot”. This is encouraging for the Fed, implying its policy is having the desired impact on financial conditions, and we expect the Fed to continue to lean hawkish to help guide monetary policy.

The good news is the risk of a wage-price spiral is falling

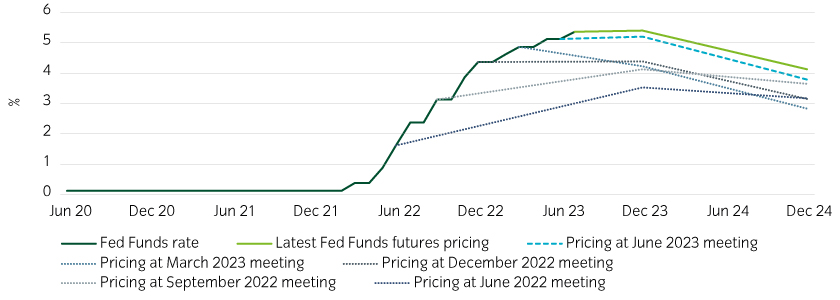

Although the Fed’s policy statement continues to point to “robust” job gains, Chair Powell did acknowledge that job gains are slowing, as is wage growth (Figure 2).

Figure 2: Cooling wage growth makes a wage-price spiral less likely

Source: Atlanta Fed, July 2023

According to the Atlanta Fed’s wage growth tracker, nominal wage growth has moderated markedly over the past several months. Notably, wage growth for job switchers, which had been running particularly hot (given rising competition for workers), has moderated the most. This lowers the threat of a dreaded 1970s’-style wage-price spiral.

The US may be first developed economy to end its hiking cycle

Although the Fed will keep markets guessing as to when rate hikes will end, we expect the Fed to be done before its European peers.

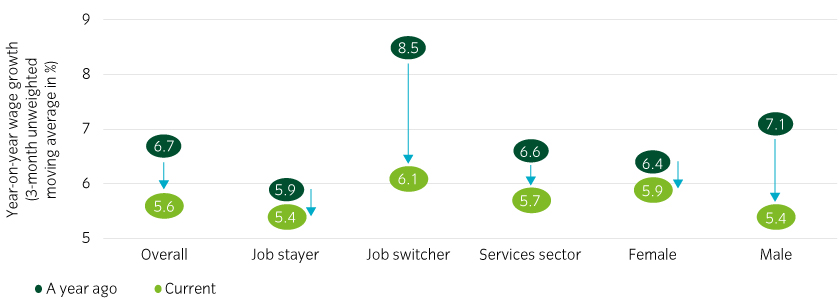

At the start of the Fed’s hiking cycle, US inflation was higher than in Europe and the UK, prompting series of aggressive rate hikes. Fast forward to today, and headline CPI inflation is cooler in the US (Figure 3).

Figure 3: The US is closer to the end of the hiking cycle than its peers

Source: Federal Reserve, European Central Bank, Bank of England, US Bureau of Labor Statistics, July 2023

A dovish pivot from the Fed will likely exert a downward pressure on the US dollar in the medium term.

Core inflation will steer the Fed

With the next FOMC meeting scheduled for September, the Fed will have ample opportunity to evaluate the state of the economy in line with its desire to be “data dependent”. As such, Chair Powell avoided being drawn on whether the Fed will “pause” next time.

We believe that the path of core inflation will be critical in determining the Fed’s path. Another hike over the coming months is possible but we would also not rule out today’s meeting marking the end of the hiking cycle.

Further, we expect the Fed will be keen to keep financial conditions tight, through its market communications, to avoid another upswing in inflation pressures.

United States

United States