|

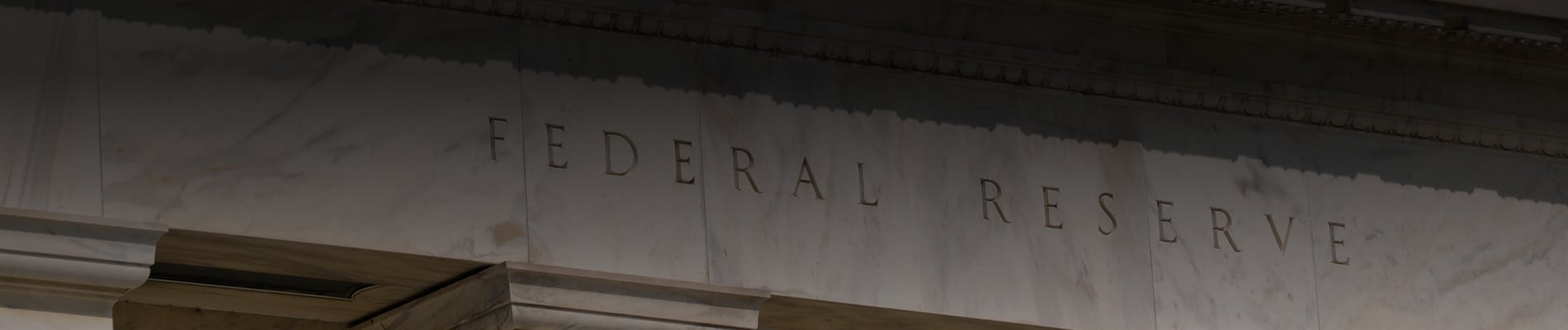

The average US rating is now AA+

Two of the three major ratings agencies now have the US at AA+ credit ratings. Previously, S&P downgraded the US in 2011 following a debt ceiling standoff (Figure 1).

Figure 1: The US has its second AA+ rating1

Source : Fitch, Moody’s S&P, Bloomberg, August 2023

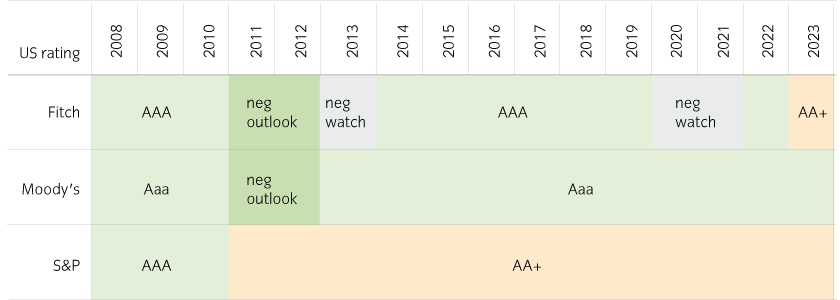

Fitch cited “expected fiscal deterioration over the next three years” and “growing general government debt burden”. It projects the US deficit will reach record levels in GDP terms (Figure 2), driven by weak economic growth and larger interest burdens along with wider state and local government deficits.

Figure 2: Fitch forecasts deteriorating federal debt metrics2

Source : Fitch, US Treasury, Bloomberg, August 2023

Despite this trajectory, Fitch returned its forward-looking outlook to “stable”. And we do not anticipate further activity in the foreseeable future.

Fitch’s forecasts notably involve a “mild recession” next year. In our view, recent economic data makes a recession less likely, meaning there may be room for US debt-to-GDP metrics to outperform the ratings agency’s expectations.

Fitch followed up by downgrading the US GSEs

Fitch has now also downgraded the government-sponsored entities (GSEs) Fannie Mae and Freddie Mac, given the “implicit government support”, with the action not related to “fundamental credit, capital or liquidity deterioration at the firms”.

Notably, Fitch has not changed the US’ “country ceiling”, which means other AAA US issuers (such as Microsoft or Johnson & Johnson[1]) will be allowed to maintain their ratings (absent credit deterioration) at Fitch given their lack of implicit or explicit government support.

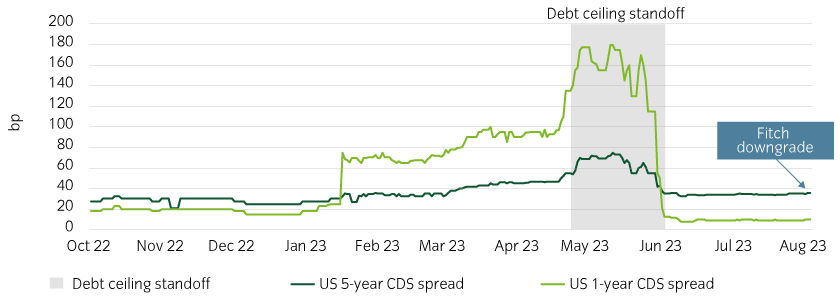

The market impact so far has been marginal

The debt dynamics of the US is not news to the market. Therefore, as we would expect, the market reaction has been marginal so far. We would even struggle to attribute the recent modest uptick in US yields to the ratings action.

To put things into perspective, US sovereign CDS spreads, which were volatile around the debt ceiling drama, have barely budged (Figure 3).

Figure 3: The market reaction has been marginal at best4

Source : US Treasury, Fitchratings, August 2023

Further, markets already have the experience of 2011 behind them, where there was little apparent forced selling following the downgrade. In our experience, given the US Treasury’s status as the ultimate “safe haven", regulatory regimes (such as banks’ risk weighting guidelines) as well as most investment and derivative documentation refer to US Treasuries specifically, as opposed to “AAA government debt”, removing the need for forced selling in the event of a downgrade.

The effect may be mostly felt in the halls of Congress

Fitch highlighted “repeated debt limit stand-offs” as another reason for the downgrade, a reminder of the political gridlock still present in Washington.

Although the 2023 debt ceiling episode is now behind us, Congress is now on a collision course for a government shutdown this fall. Both sides will need to agree on a spending “appropriations” bill for fiscal year 2024. We expect the Fitch downgrade may play into fiscal hawks’ political rhetoric, potentially making it harder to sign a deal.

Nonetheless, we believe the ratings action in isolation should not be a major concern for most investors.

United States

United States