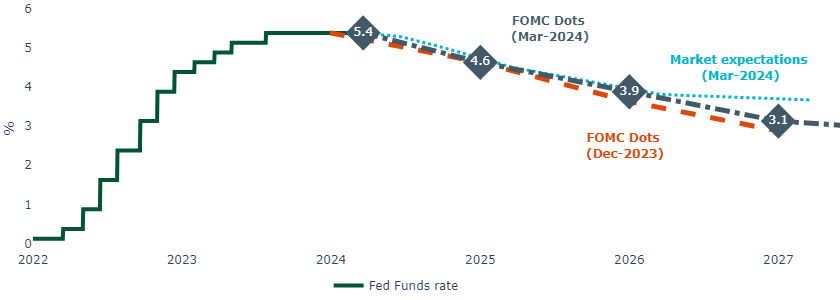

The Fed left its “dot plot” largely unchanged from its December meeting. It continues to reflect three rate cuts by the end of the year, albeit it reflected one less cut over 2025 and 2026. Some members raised their estimate of the “neutral” or longer run equilibrium rate, although this only nudged the median estimate up slightly from 2.5% to 2.6%.

Figure 1: The Fed’s median rate projections remained largely unchanged from December

Source: Federal Reserve, Bloomberg, Insight, March 2024

The Fed also left its official statement almost unchanged (having revised it significantly last month) For now, the Fed kept its quantitative tightening (QT) operations unchanged. However, Chair Powell stated that the Committee discussed “tapering” the pace of QT to ensure “ample reserves” in the system. The committee made no decision at this meeting, but the committee believes it “…will be appropriate to slow the pace of run-off fairly soon”.

Currently the Fed is allowing up to $60bn of Treasuries and $35bn of mortgage-backed securities to roll off its balance sheet per month, and we expect these figures will fall over the coming months, with QT potentially halting altogether around the summer.

The committee raised its growth forecasts for 2024 significantly, from 1.4% to 2.1% and slightly raised its core inflation forecast for 2024 from 2.4% to 2.6%. It otherwise left its projections largely unchanged.

Unemployment and home affordability will add to the case to cut rates

In the press conference Powell highlighted how the Fed’s restrictive monetary policy has put “downward pressure on economic activity and inflation” and “labor market tightness has eased”. Albeit he continued to stress that it needs greater confidence that “inflation is moving sustainably toward 2%” before cutting rates.

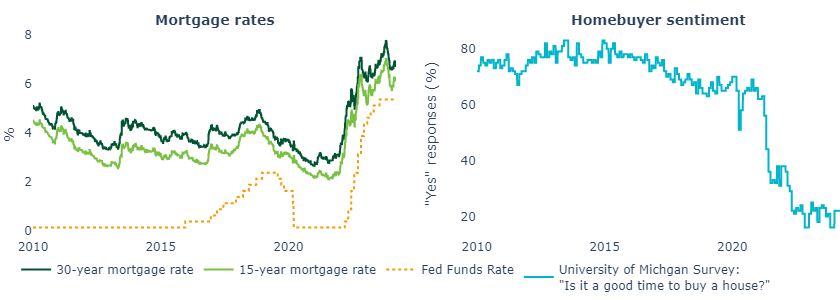

Powell also mentioned that the housing market was “subdued”, reflecting “high mortgage rates”. We believe the housing market will continue to be a consideration for the committee, given how directly mortgage rates have caused housing market affordability to deteriorate (Figure 2).

Figure 2: Rising rates have made housing far less affordable for prospective buyers

Source: Freddie Mac, Federal Reserve, University of Michigan, Macrobond, March 2024.

Time to prepare for the rate cutting cycle

Market pricing regarding the path of US rate cuts is now generally consistent with the Fed’s latest “dot plot” projections and aligns with our own base case. We expect the first rate cut around the summer, and up to two more will follow into the end of the year.

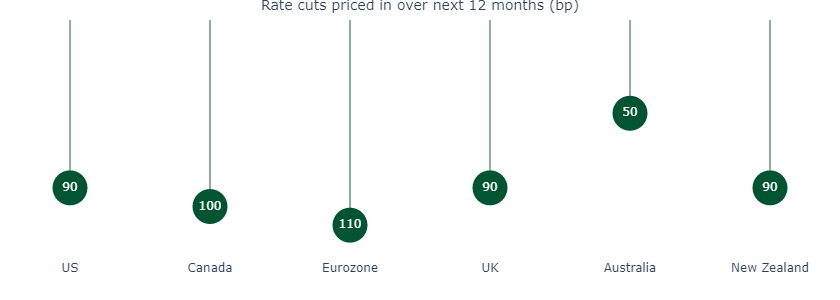

We don’t think the Fed will be alone in cutting rates. Markets expect a similar pace of rate cuts in other advanced economies over the next 12 months (Figure 3). Some emerging markets (such as in LATAM, Eastern Europe and Africa) have already begun cutting rates, which we expect to continue.

Figure 3: A rate cutting cycle is in the cards outside the US as well

Source: Bloomberg, March 2024

We believe investors should prepare for the upcoming rate cutting cycle. In our view, investing at the top of the rate cycle before rate cuts take effect could potentially set investors up for what could be the latest fixed income golden age, both in the US and globally.

United States

United States