The Federal Reserve kept rates on hold for the first time since February 2022. However, it signaled more than one hike could come this year, delivering a decidedly hawkish message despite the pause.

The Fed signals it has not finished hiking

Fed Chair Jerome Powell stated “nearly all” committee members believe “some” further rate hikes will be needed to meet the Fed’s 2% inflation target. He also stated he expects July to be a “lively meeting”.

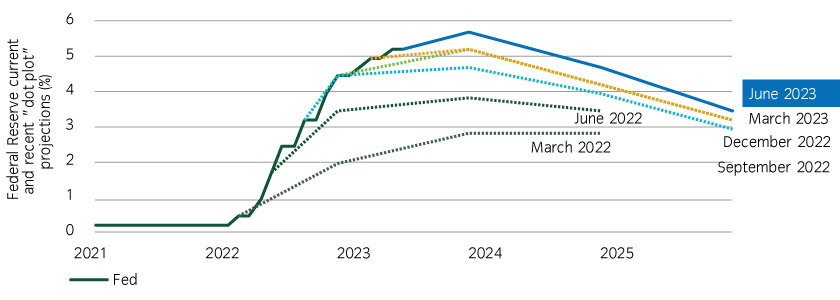

Additionally, after keeping its quarterly median “dot plot” projections relatively static over the previous two quarters, the Fed increased its projections (Figure 1), now reflecting two additional 25bp hikes to come in 2023 when many had only expected a maximum of one.

Figure 1: The Fed modestly increased its “dot plot projections”

Source: Federal Reserve, June 2023: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230614.pdf

Notably, nine out of the 18 voting committee members projected two further rate hikes this year, similar to the consensus at the last meeting, indicating dissent is not yet building as the Fed reaches peak rates. Elsewhere, the Fed did keep its long-term “neutral rate” projection unchanged at 2.5%

This is in line with our view that rates will be elevated for some time.

The Fed ‘s revised economic projections acknowledge robust economic data

The central bank’s revised quarterly economic projections highlighted the recent resilience of the US economy despite over 5% in rate hikes over two years.

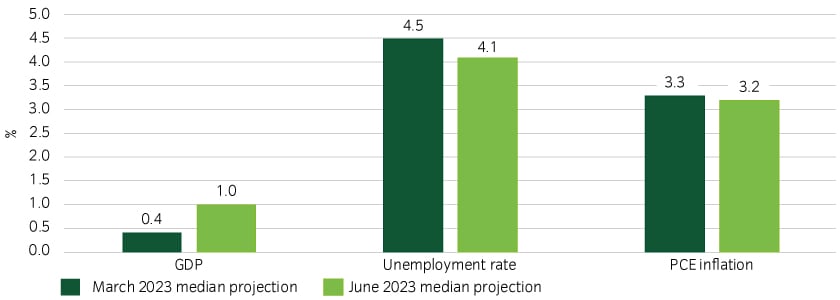

Although the Fed largely kept its economic projections unchanged for 2024 and beyond, it changed them significantly for end-2023. The Fed raised its economic growth projection from 0.4% to 1% and reduced its unemployment rate projection from 4.5% to 4.1% (Figure 2), acknowledging the continued strength of the labor market.

Figure 2: The Fed reduced its near-term unemployment projections and increased its growth projections

Source: Federal Reserve, June 2023: https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230614.pdf

Real rates are turning positive, justifying “peak rates”

In justifying a pause rather than a rate hike this month, Powell continued to cite the lagged effect of monetary policy on the real economy, and headwinds from credit tightening, given recent stress in the regional banking sector. Powell also stated that speed is less important as the central bank reaches peak rates.

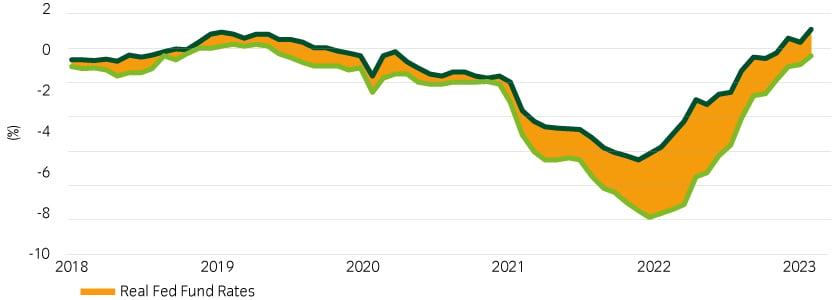

In our view, this is justified. We believe that rates will continue to be restrictive at current levels. It is worth noting that in real terms, the Fed Funds rate is finally entering positive territory by almost all inflation metrics (Figure 3).

Figure 3: Real Fed Funds Rates are turning positive

Source: Bureau of Labor Statistics, Bureau of Economic Analysis, Federal Reserve, Insight calculations. Real rates determined by CPI, Core CPI, PCE and Core PCE

Even without a hike yesterday (or even another hike at a later date), we expect rates to continue to move into positive territory due to falling inflation. This is a sign that the existing hikes are working as intended and may continue to be increasingly restrictive on economic activity.

If a further hike is not needed later, the Fed would have reduced the risk of overtightening as it attempts to engineer a “soft landing” for the economy.

The Fed will continue to focus on inflation

This week's inflation print was encouraging for the Fed. However, Chair Powell does not yet consider the job to be done on inflation and is focused on keeping financial conditions from loosening. Although the Fed is close to the end of its hiking cycle, it will likely hike further without more decisive progress on inflation and the labor market. Ultimately, rates are set to be elevated for at least the near future.

United States

United States